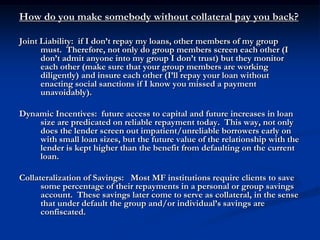

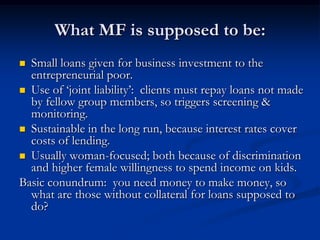

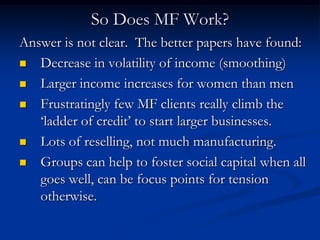

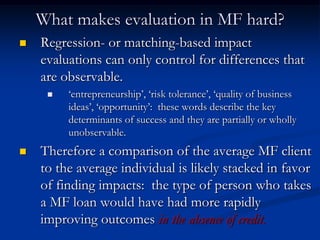

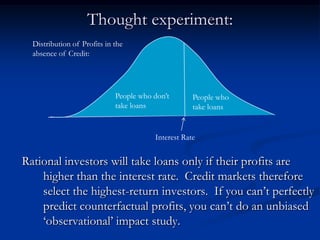

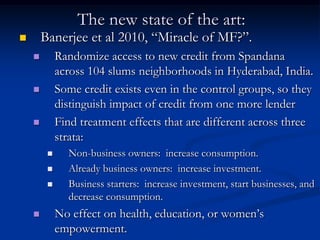

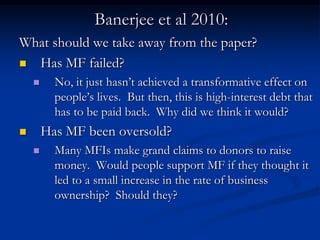

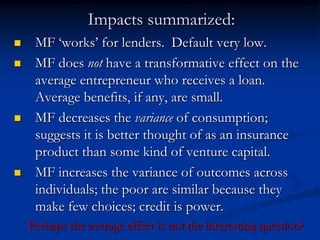

Microfinance aims to provide credit to the poor without collateral by using group lending and dynamic incentives. Evaluating its impact is challenging due to selection bias. A recent randomized study in India found:

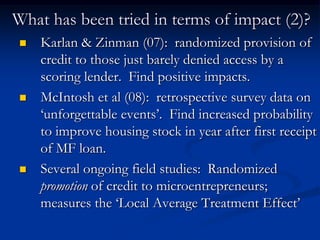

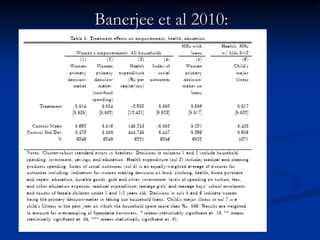

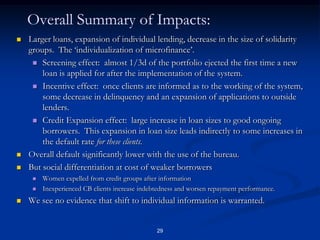

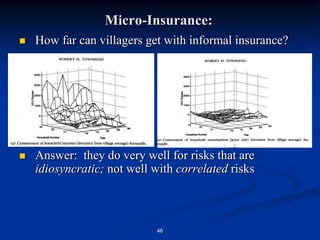

1. Microfinance decreased consumption variance, suggesting it functions more as insurance.

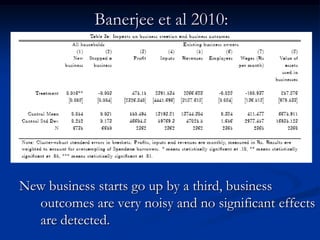

2. It increased business ownership rates by 1/3 but average benefits were small and impacts varied individually.

3. It did not have transformative effects on average but did increase some individuals' ability to take economic risks.