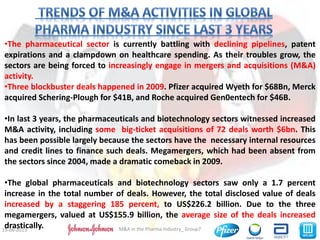

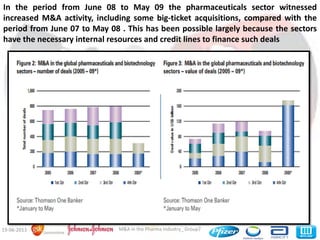

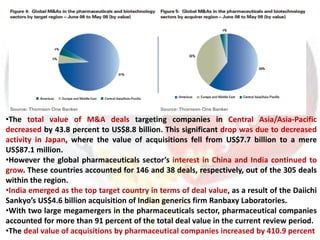

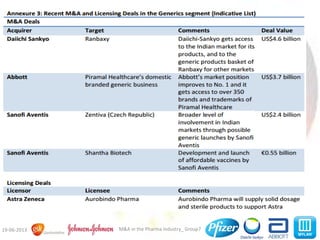

The document discusses mergers and acquisitions (M&A) in the pharmaceutical industry. It outlines problems faced by Indian pharmaceutical companies like pricing controls and fragmented markets. It also discusses trends in M&A activity, with multinational companies acquiring Indian firms for access to generic drugs and manufacturing. Reasons for M&A include expanding into new markets, cutting costs, and gaining access to biologics with longer commercial lifespans. The document also lists other inorganic growth strategies used in the industry like strategic alliances, outsourcing, and co-marketing agreements.