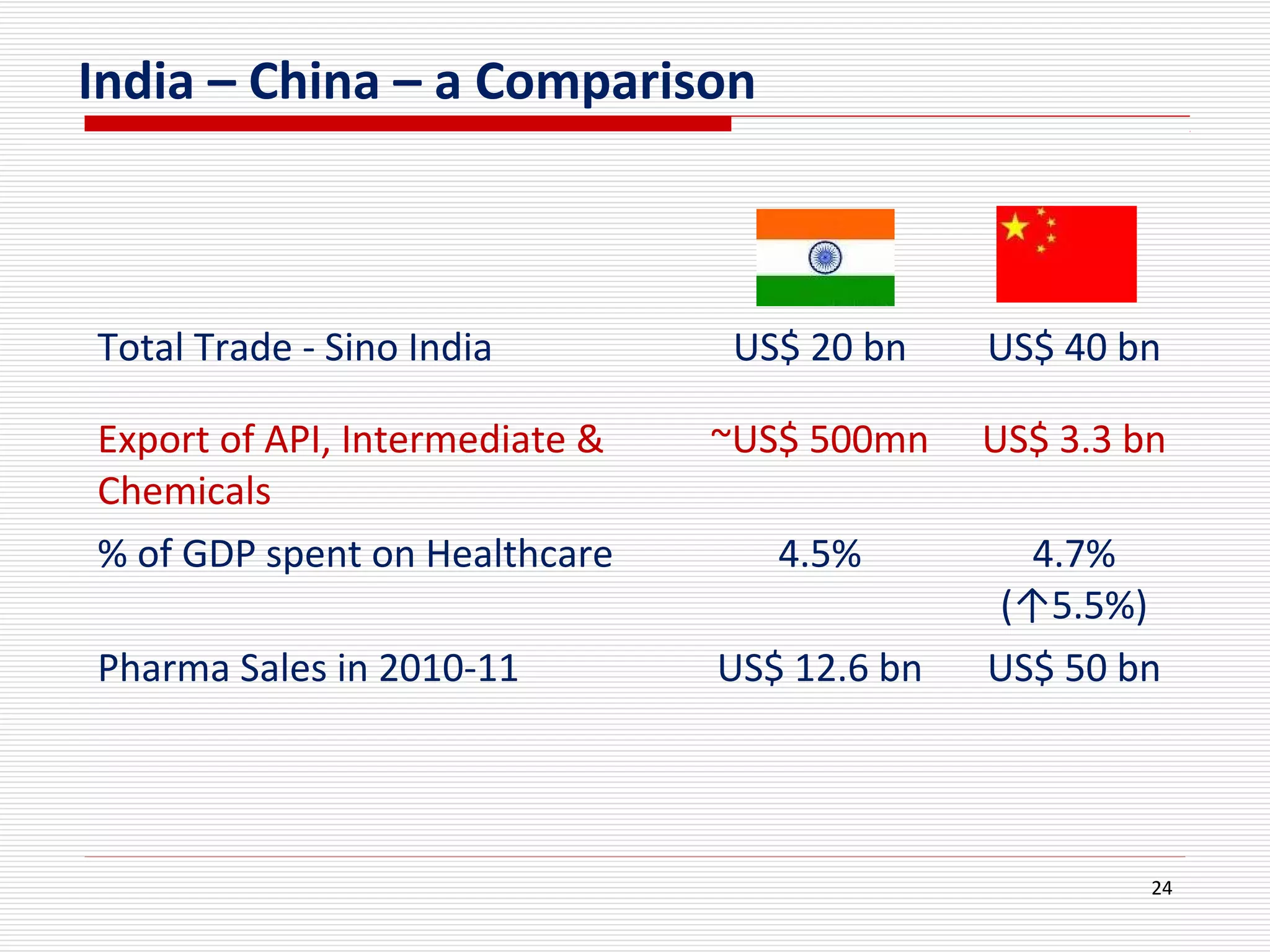

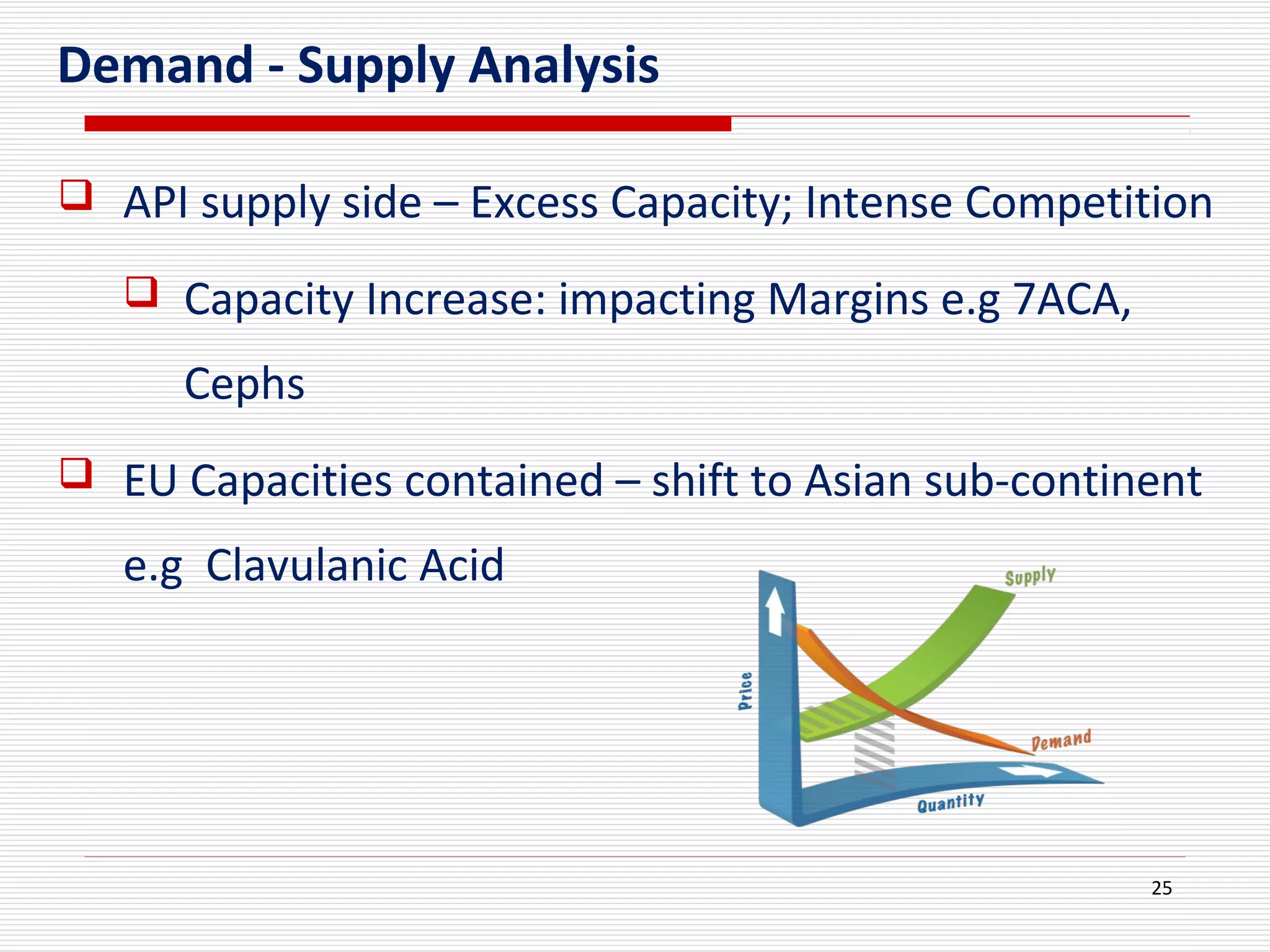

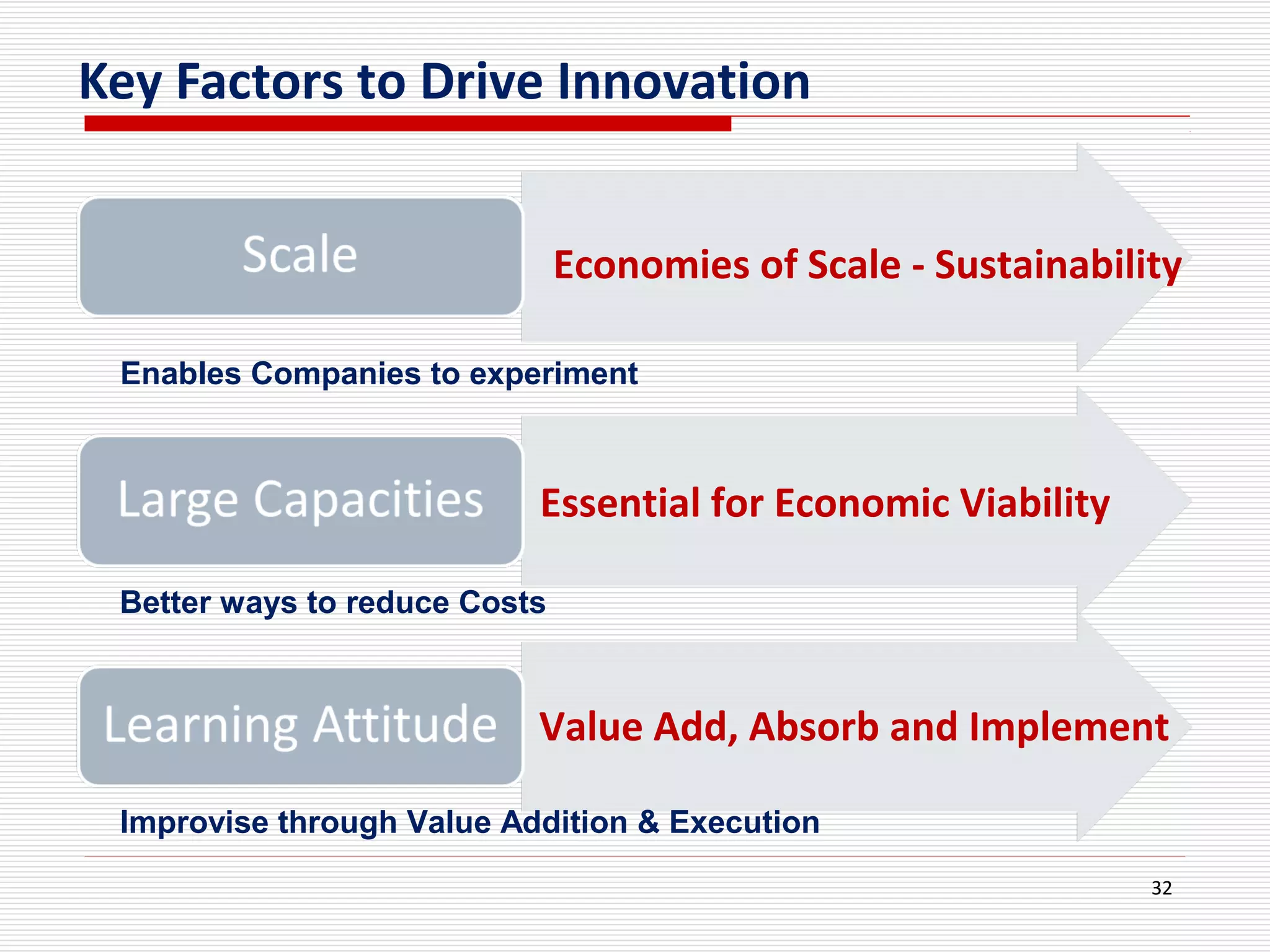

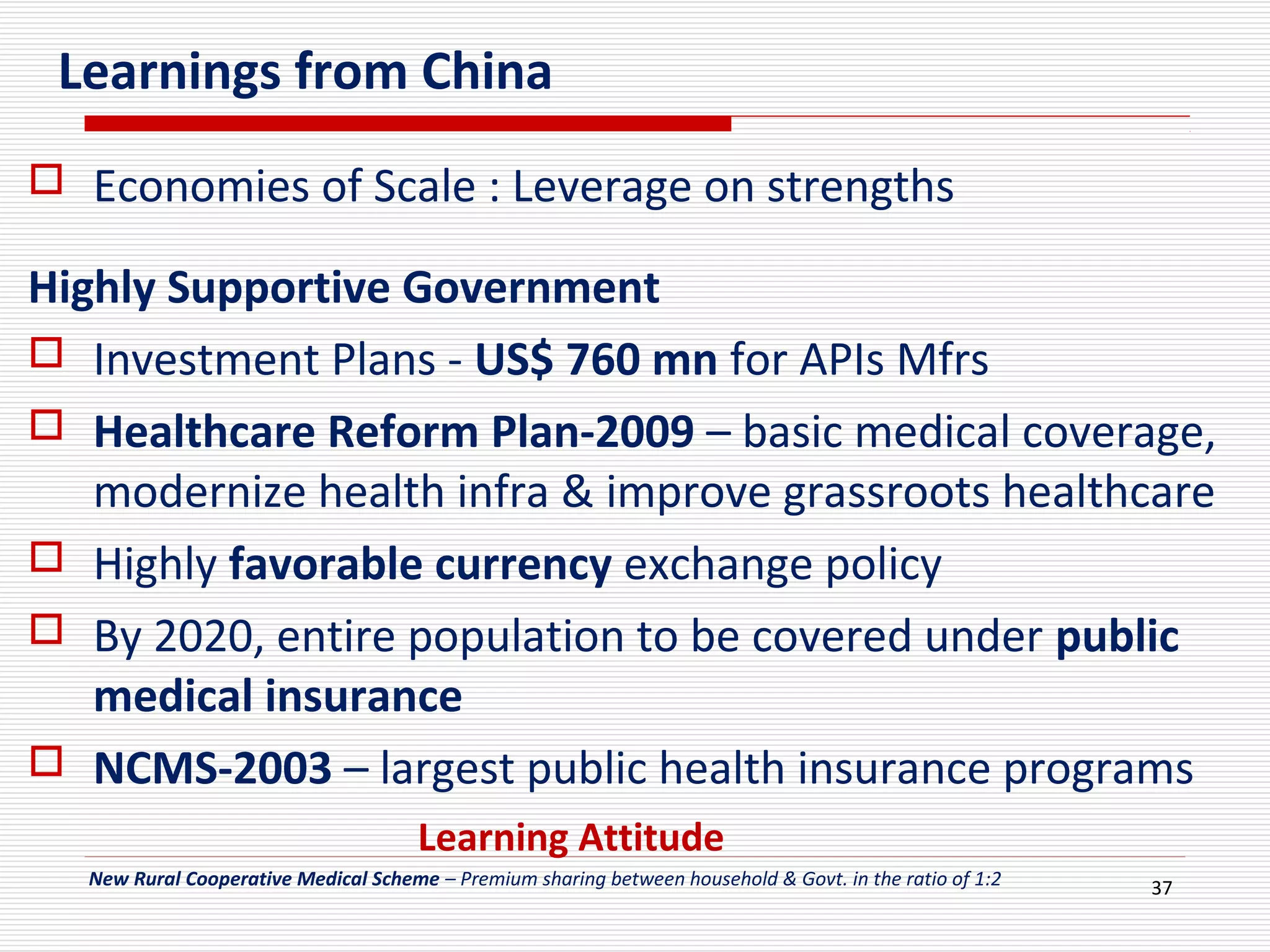

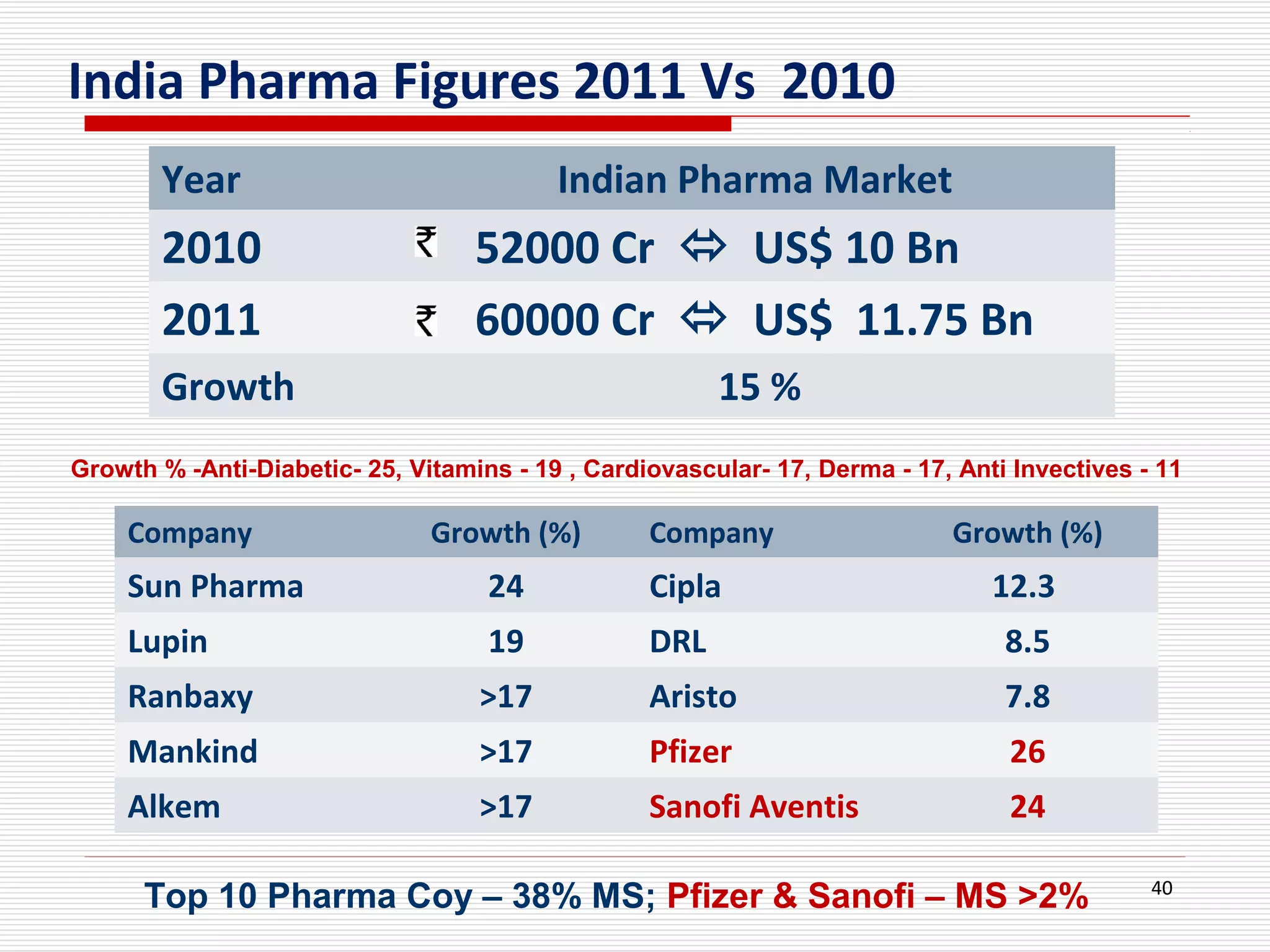

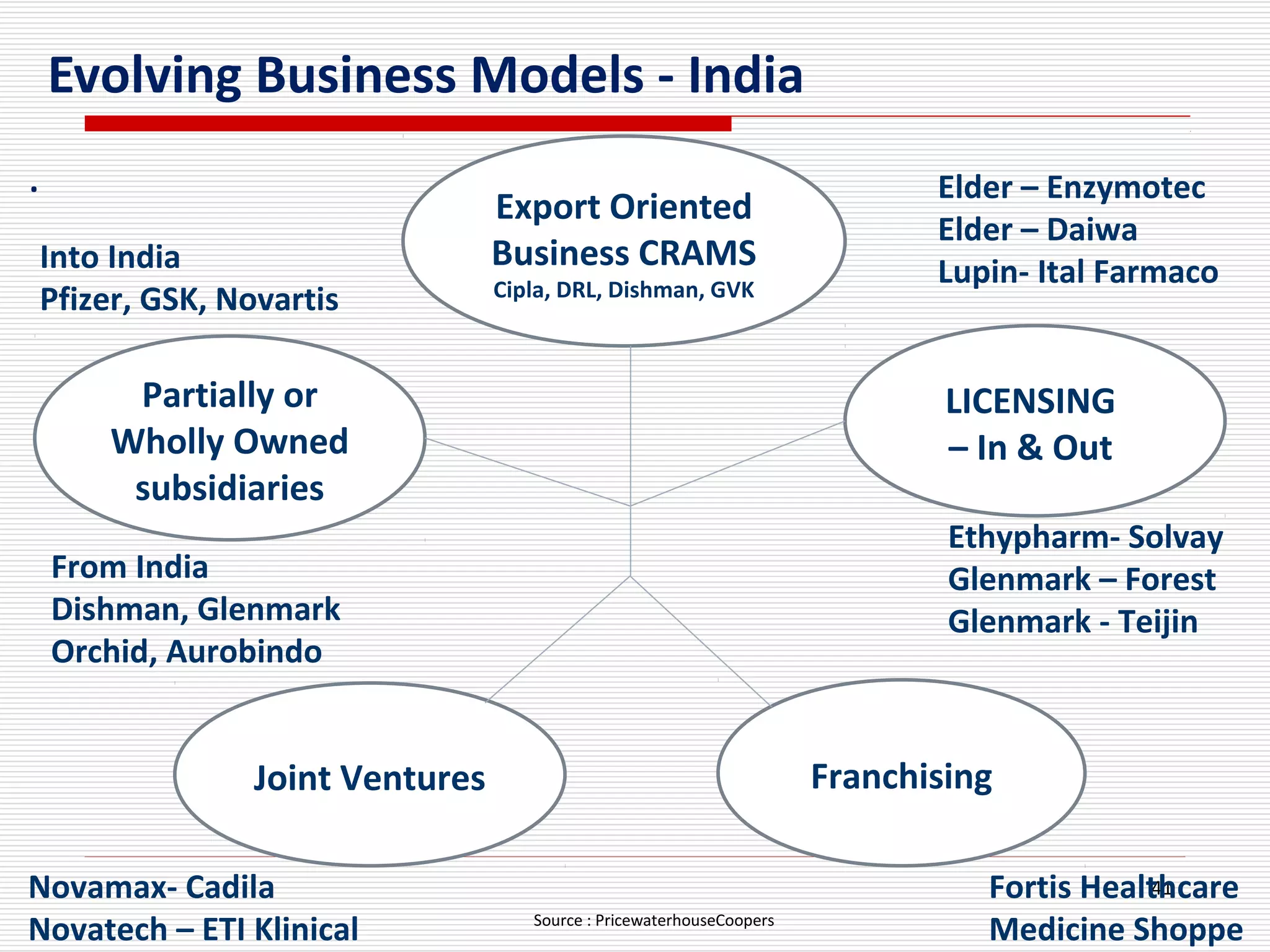

The document discusses the challenges and changes in the pharmaceutical industry, particularly focusing on the dynamics of global sourcing and the implications of the 'patent cliff'. It highlights the need for innovation, collaboration, and strategic partnerships, especially in emerging markets like India and China, to compete effectively in an evolving landscape. The future of the industry will depend on adapting to new economic realities and ensuring the sustainability of healthcare provisions amid an ageing population.