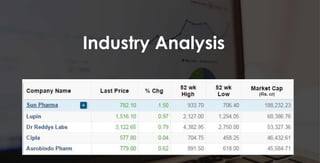

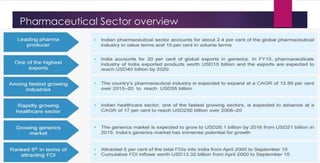

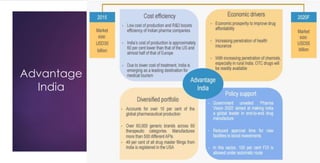

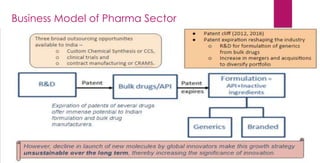

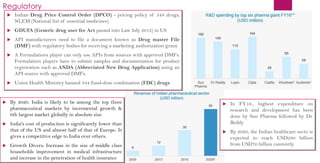

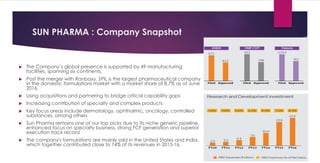

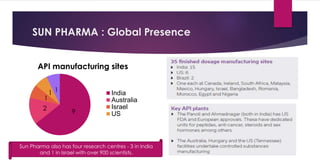

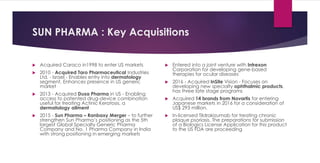

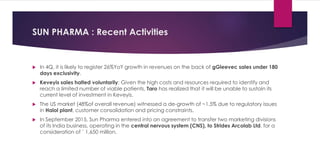

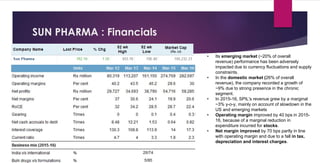

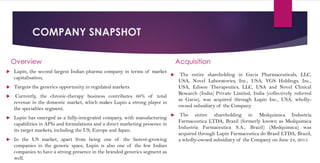

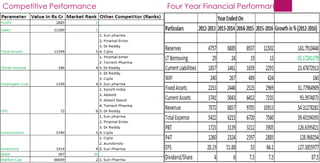

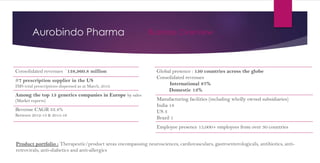

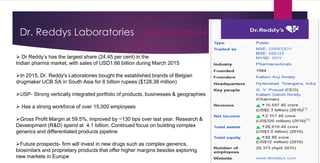

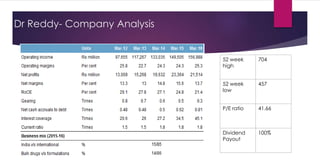

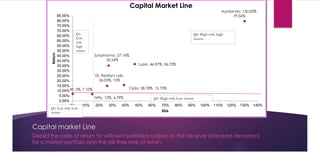

The document provides an overview of the pharmaceutical industry in India and details regarding Sun Pharma and Lupin, two major Indian pharmaceutical companies. It discusses the regulatory environment, business models, financial performance, acquisitions, and growth strategies of Sun Pharma and Lupin. The summary highlights both companies' focus on expanding their global footprint and specialty product portfolios through acquisitions and internal research and development.