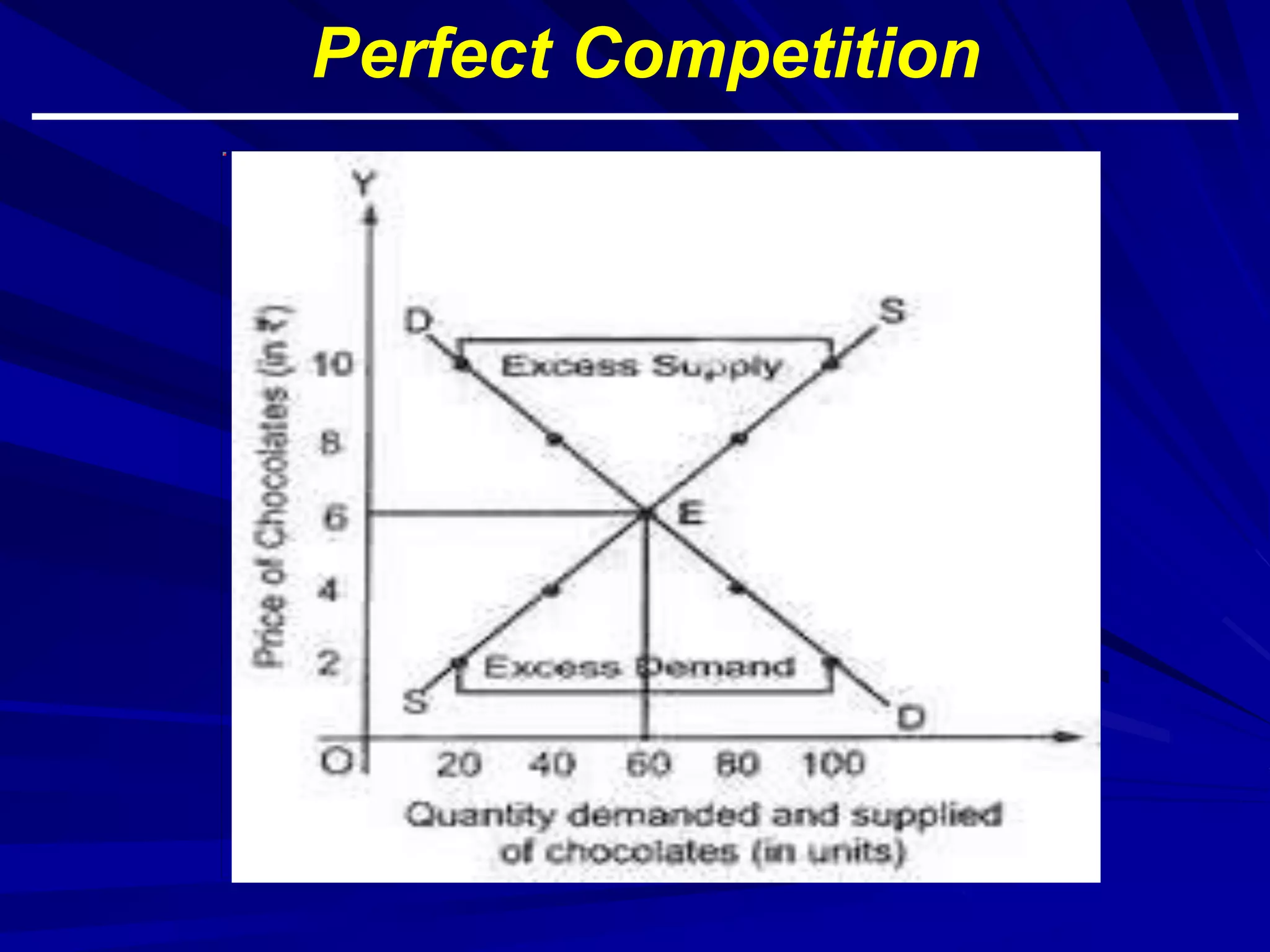

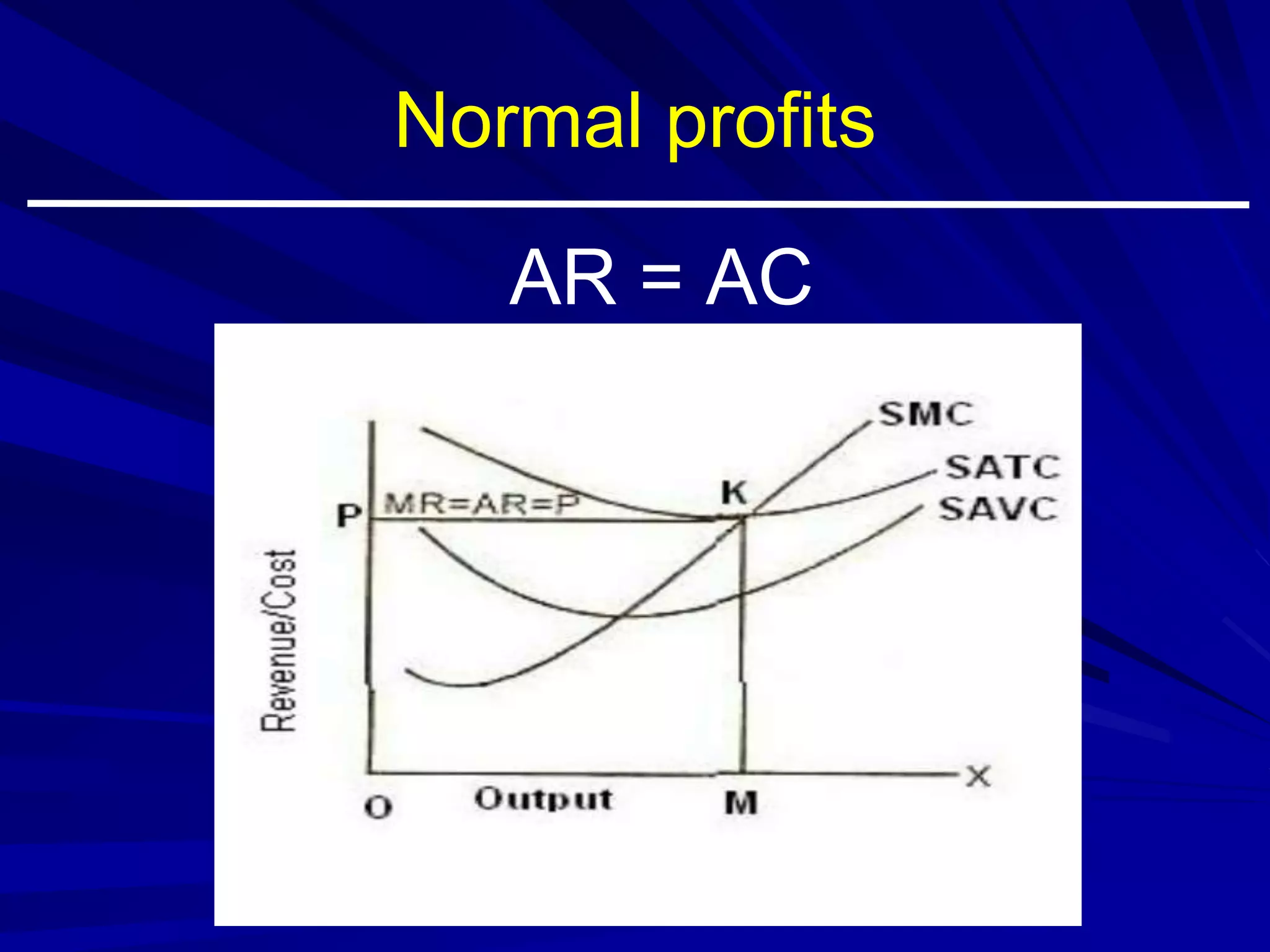

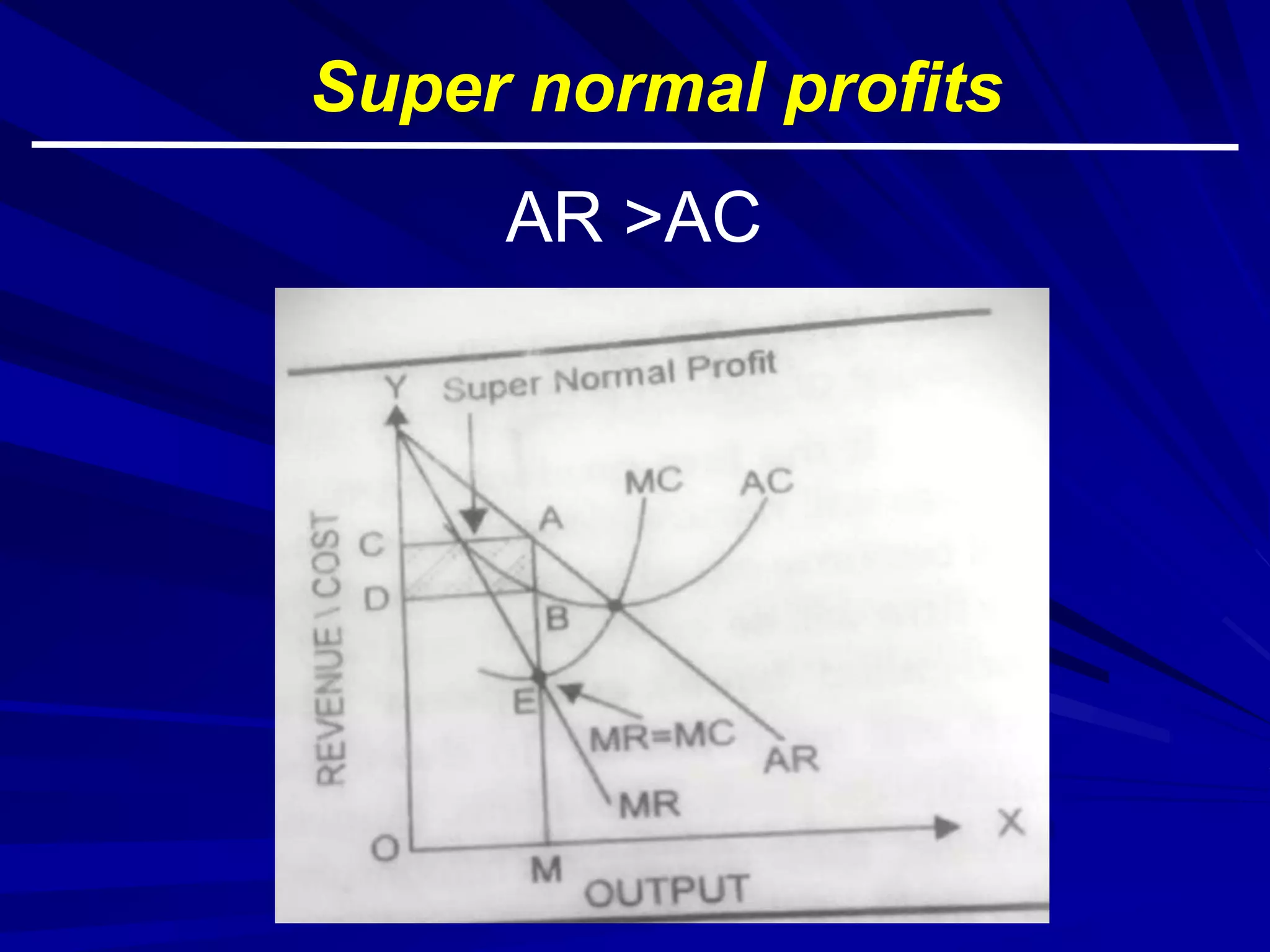

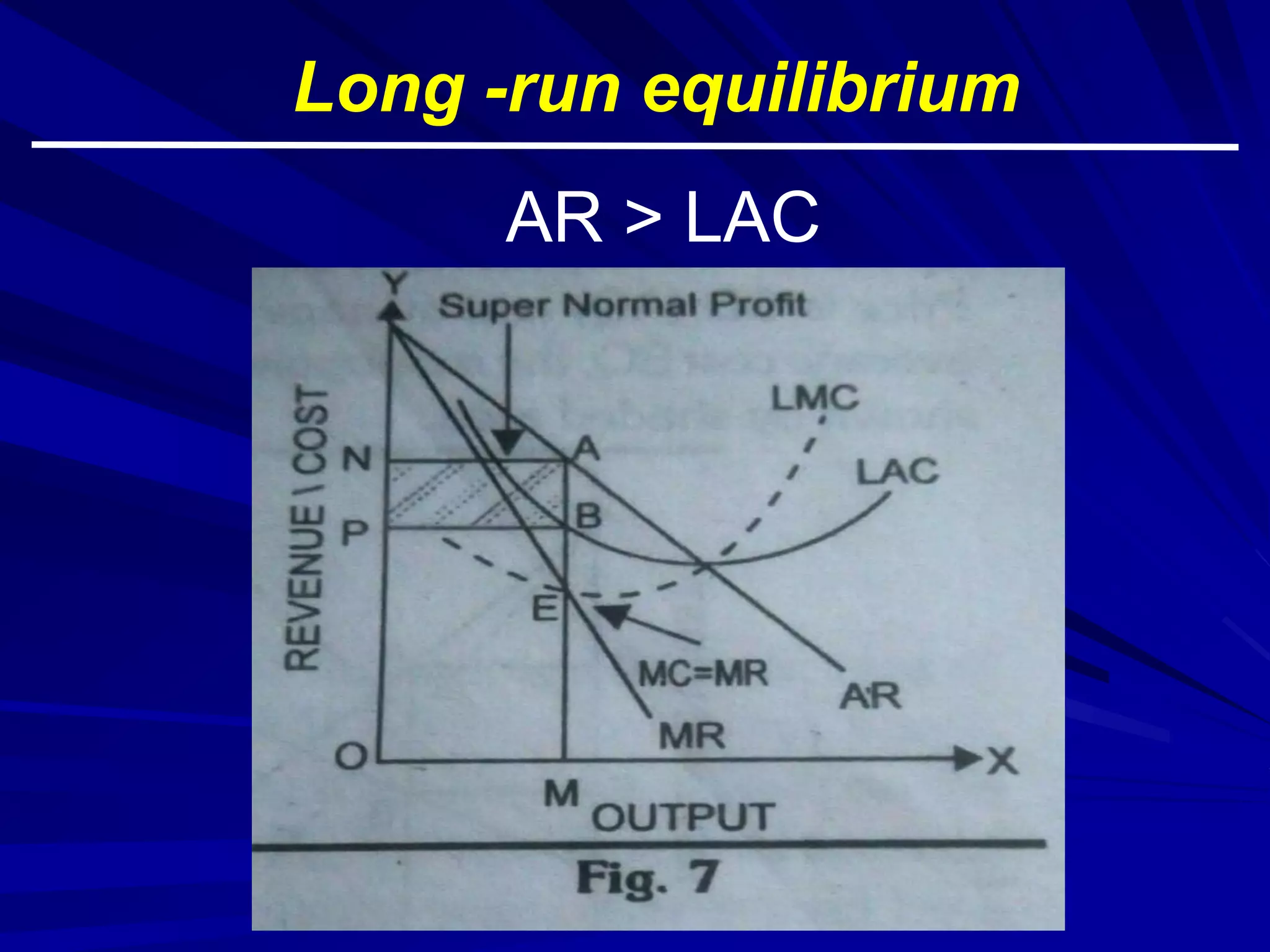

This document discusses different market structures: pure competition, monopolistic competition, oligopoly, and monopoly. It provides details on the key features of each structure, including the number of buyers and sellers, level of product differentiation, barriers to entry, and how price is determined. Perfect competition is characterized by many small buyers and sellers, no barriers to entry, perfect information, and price taking behavior. Monopoly is a single seller with barriers to entry and control over price. Oligopoly has a few large sellers that can influence price through cooperation. Monopolistic competition features many differentiated products with some control over price.