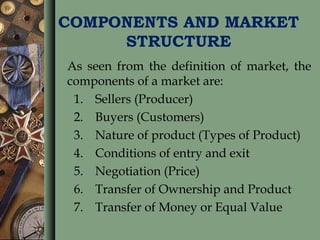

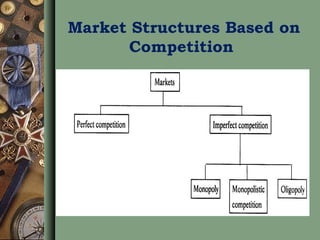

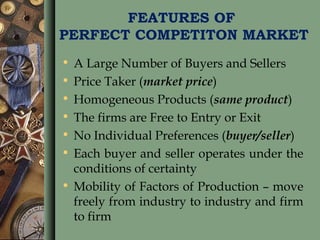

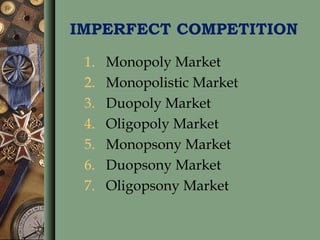

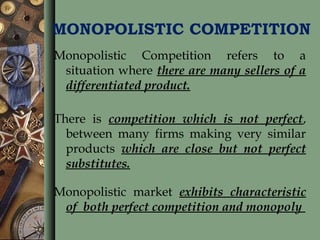

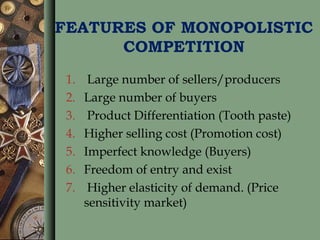

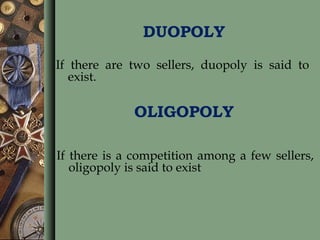

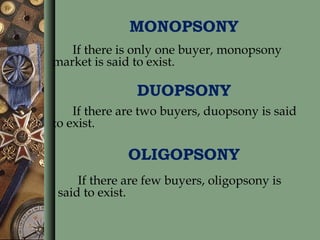

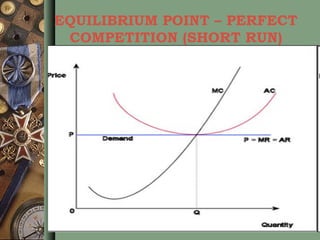

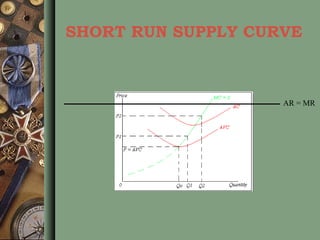

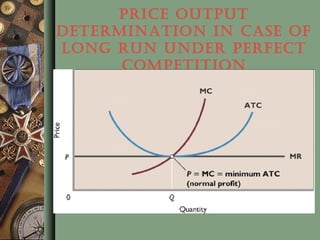

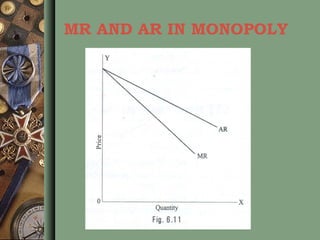

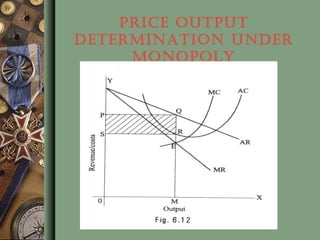

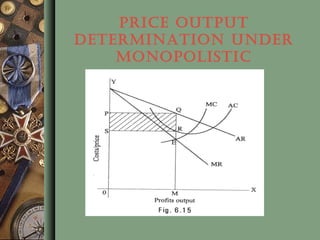

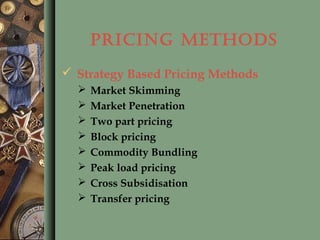

This document provides an overview of market structures and pricing policies. It defines key terms like market, competition, and market structures. It then describes different market structures in more detail like perfect competition, monopoly, monopolistic competition, oligopoly, and their features. It also discusses equilibrium points for different market structures and how price and output are determined. Pricing methods and objectives are introduced along with strategies for pricing in competitive markets.