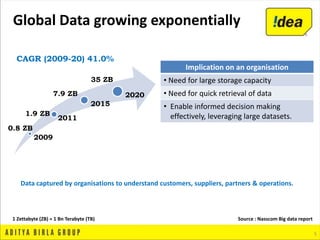

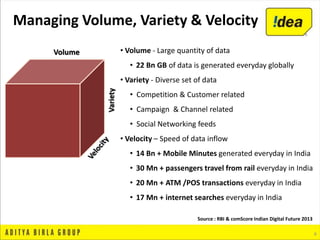

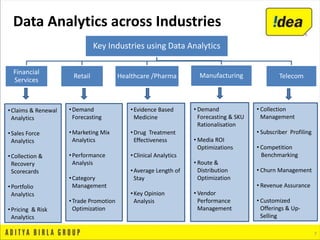

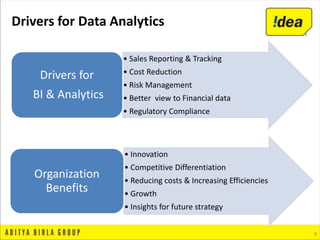

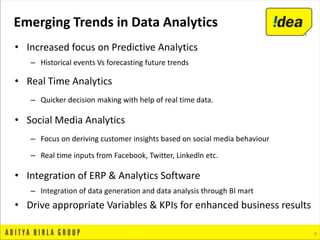

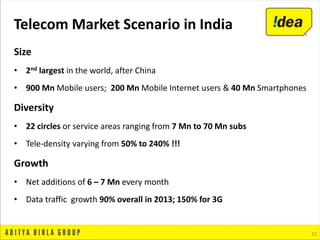

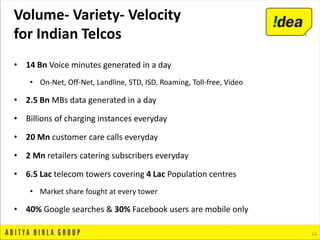

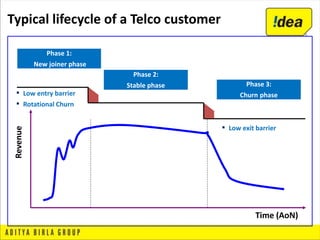

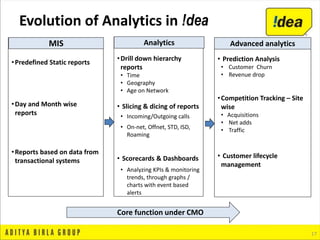

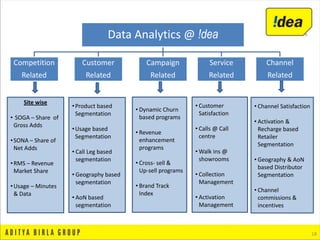

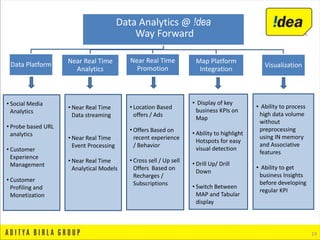

This document discusses business analytics and its strategic importance for telecommunications companies in India. It provides an overview of Idea Cellular, the challenges facing Indian telcos, and how Idea is using data analytics and customer lifecycle management. Specifically:

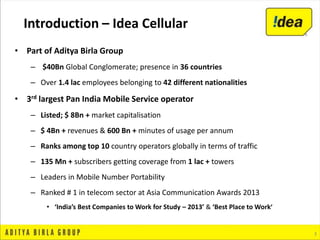

1) Idea Cellular is the 3rd largest mobile operator in India that uses data analytics to gain insights into customers, competition, campaigns and more.

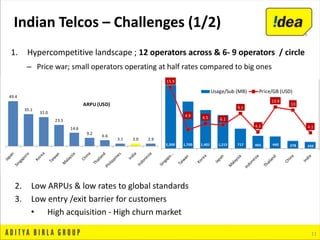

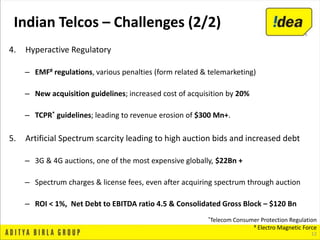

2) Indian telcos face challenges like low ARPUs, regulatory issues, and spectrum scarcity that increase costs.

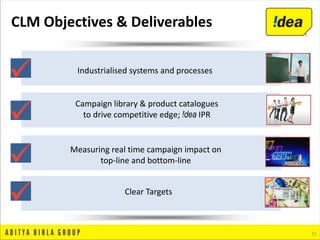

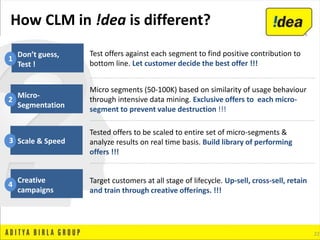

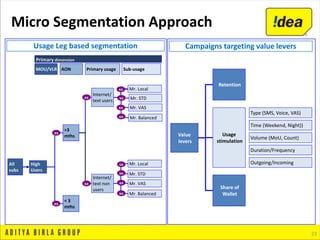

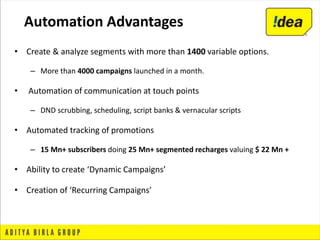

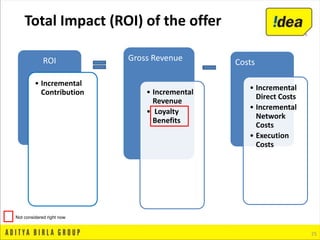

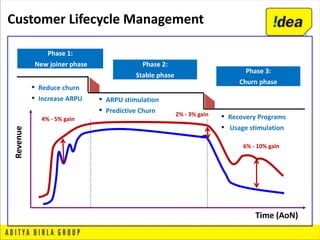

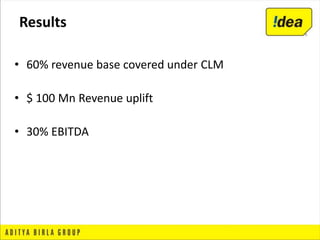

3) Idea uses advanced analytics to segment customers, create targeted campaigns, and optimize the customer lifecycle to increase revenue, retention and ARPU. Their approach has provided $100 million in revenue upl