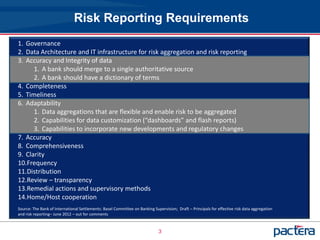

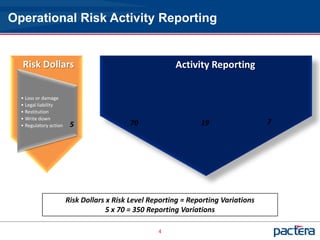

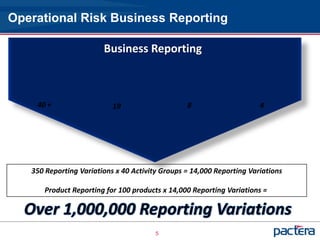

This document discusses Basel III compliance and operational risk measurement and reporting requirements for banks. It summarizes the key principles for effective risk data aggregation and reporting established by the Basel Committee on Banking Supervision. These include governance, data accuracy and integrity, completeness, timeliness, and adaptability of risk reporting. The document also provides examples of operational risk activity and business reporting, highlighting the largest losses come from retail banking and external fraud. It concludes with best practices for a pragmatic approach to risk detection and transparent, understandable reporting to improve risk management.