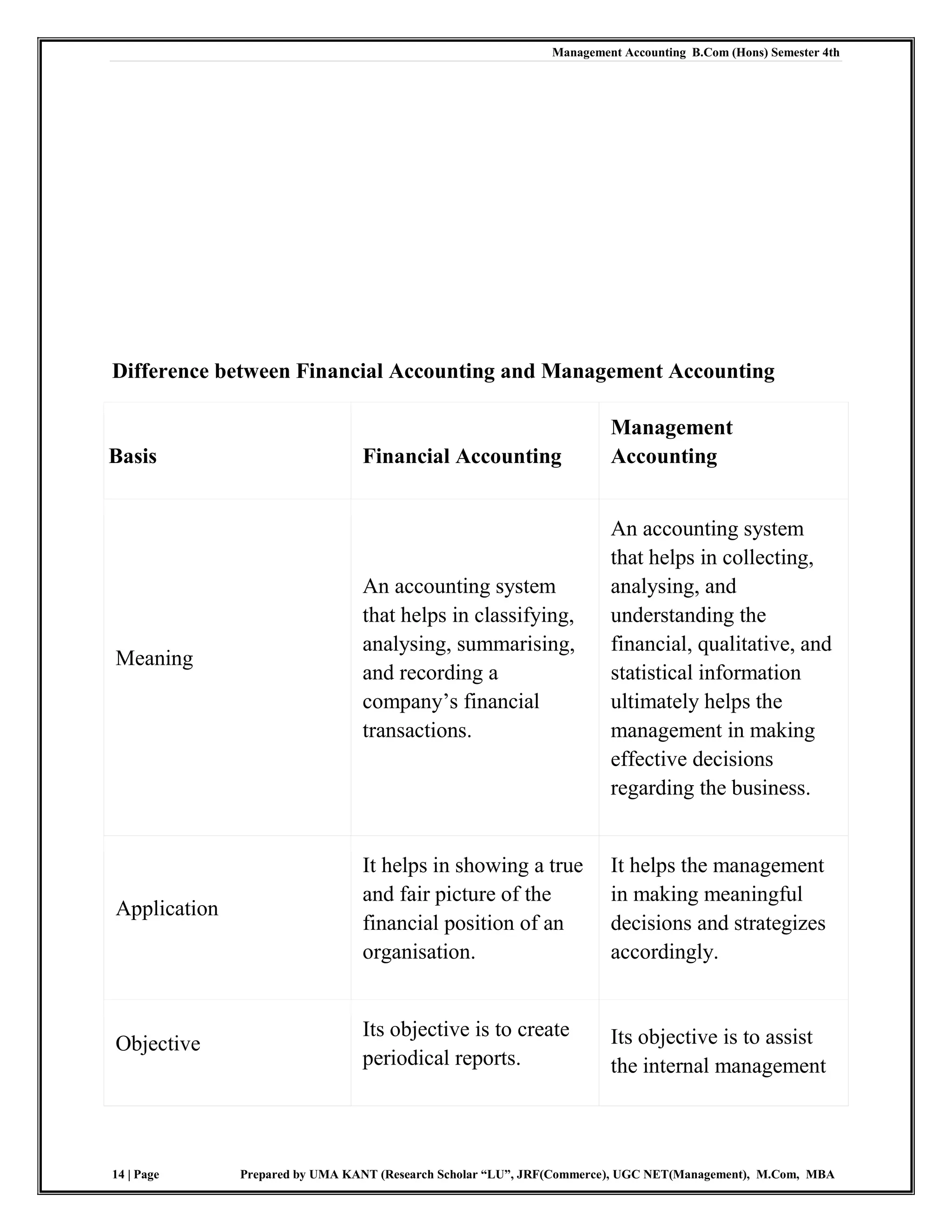

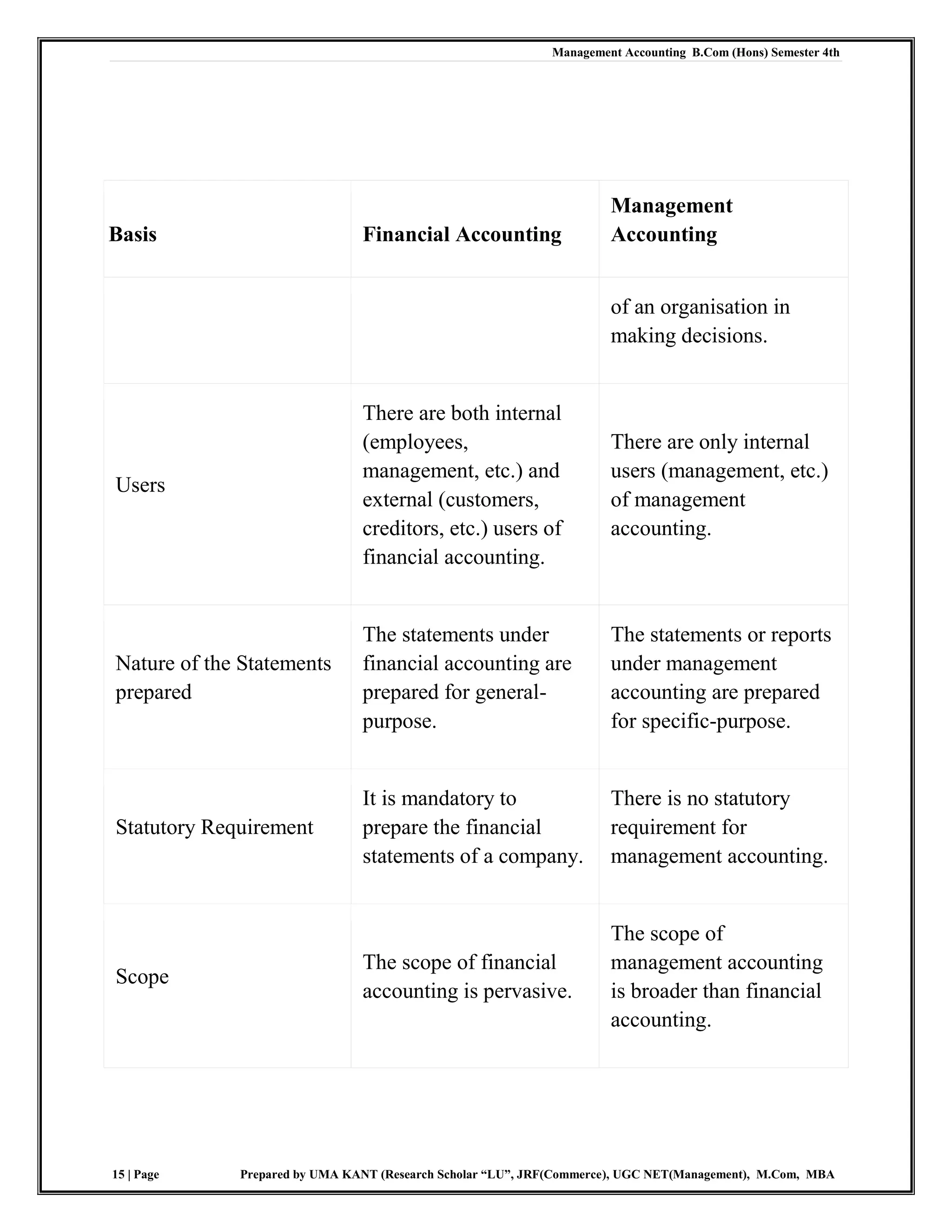

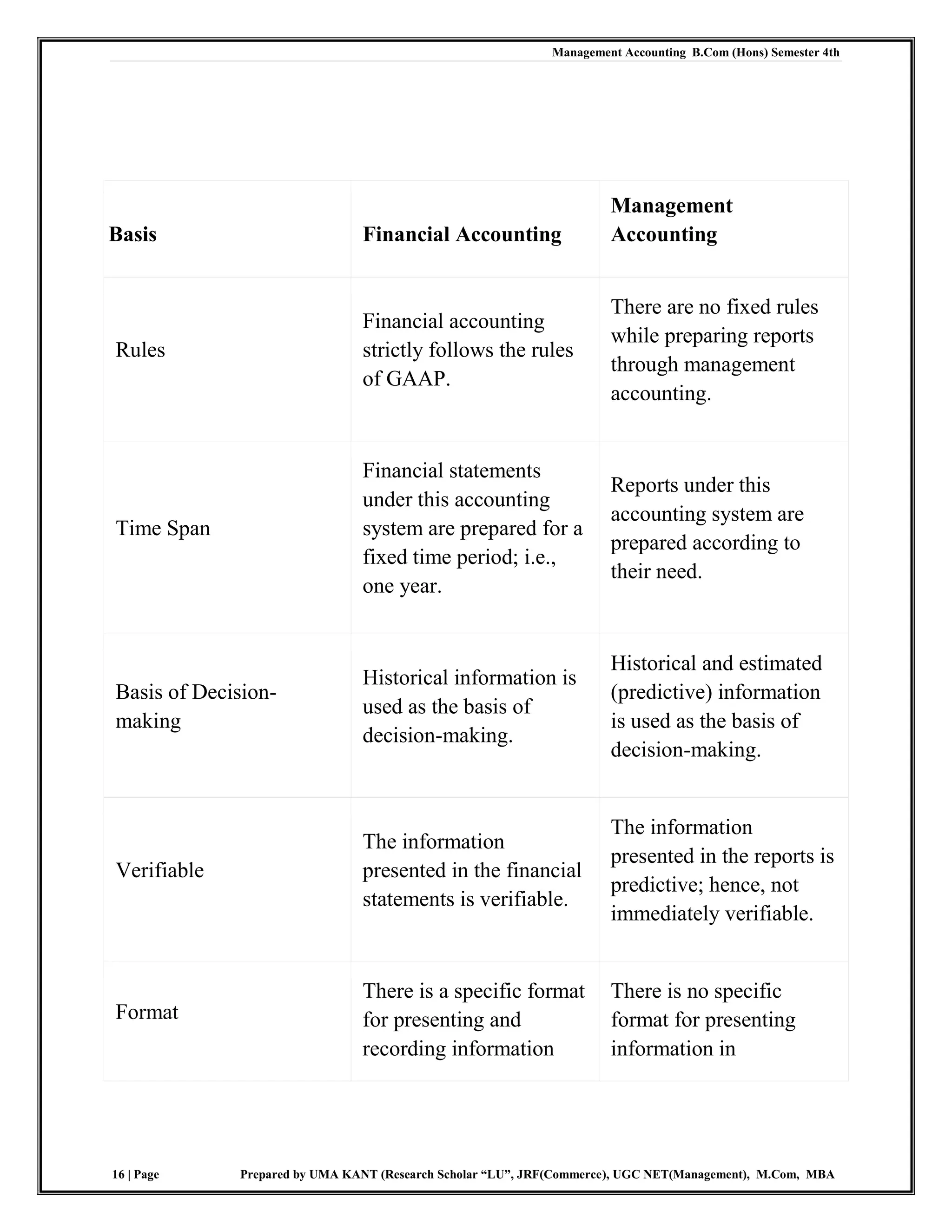

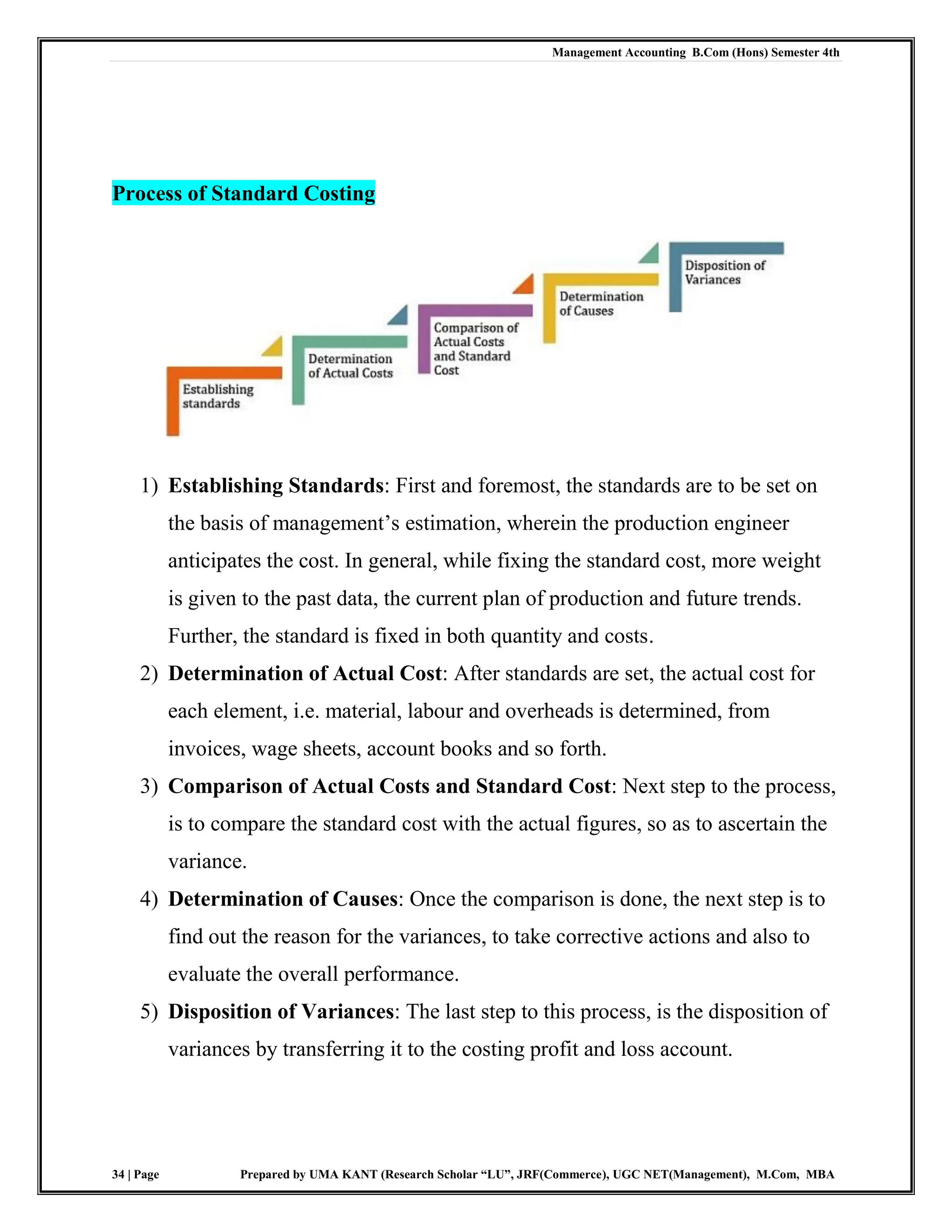

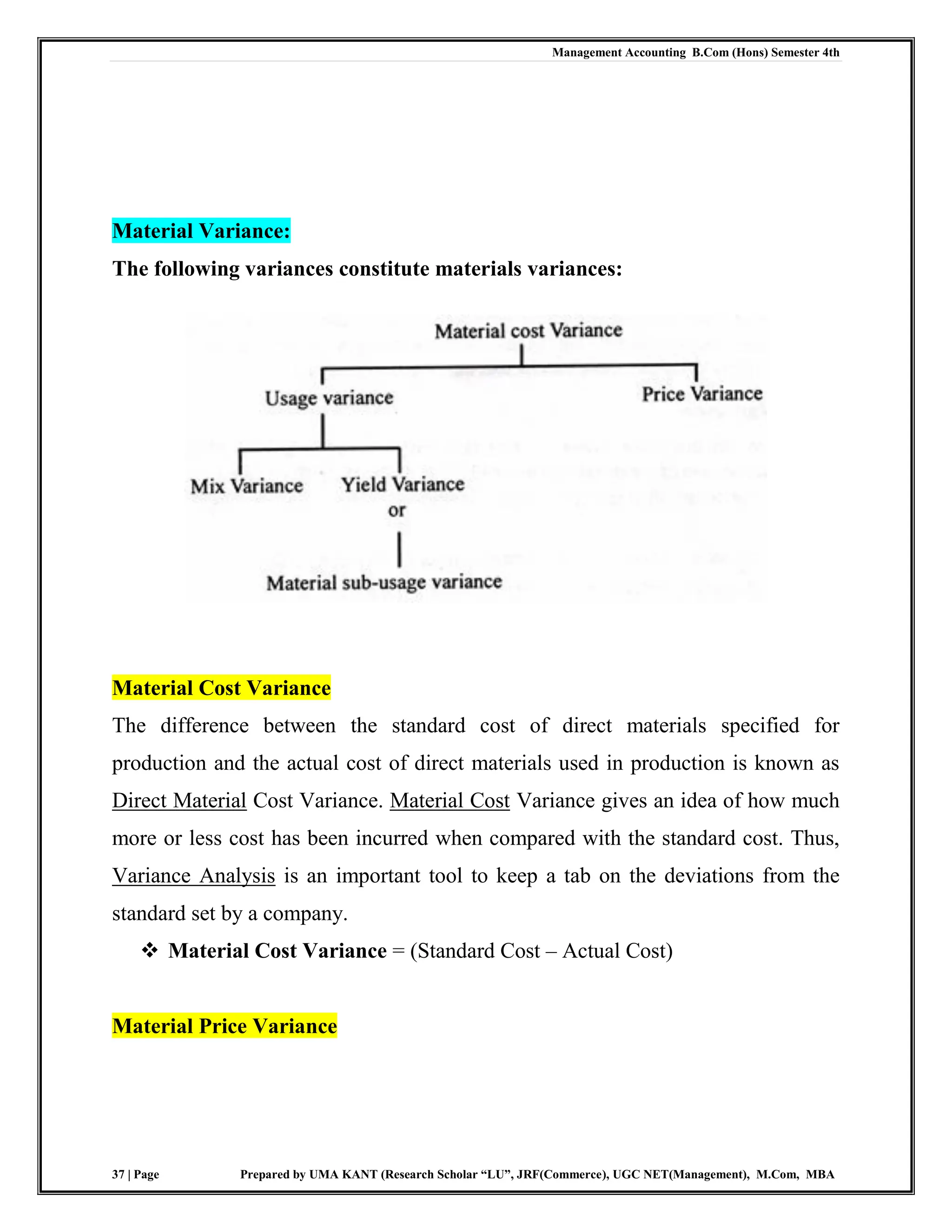

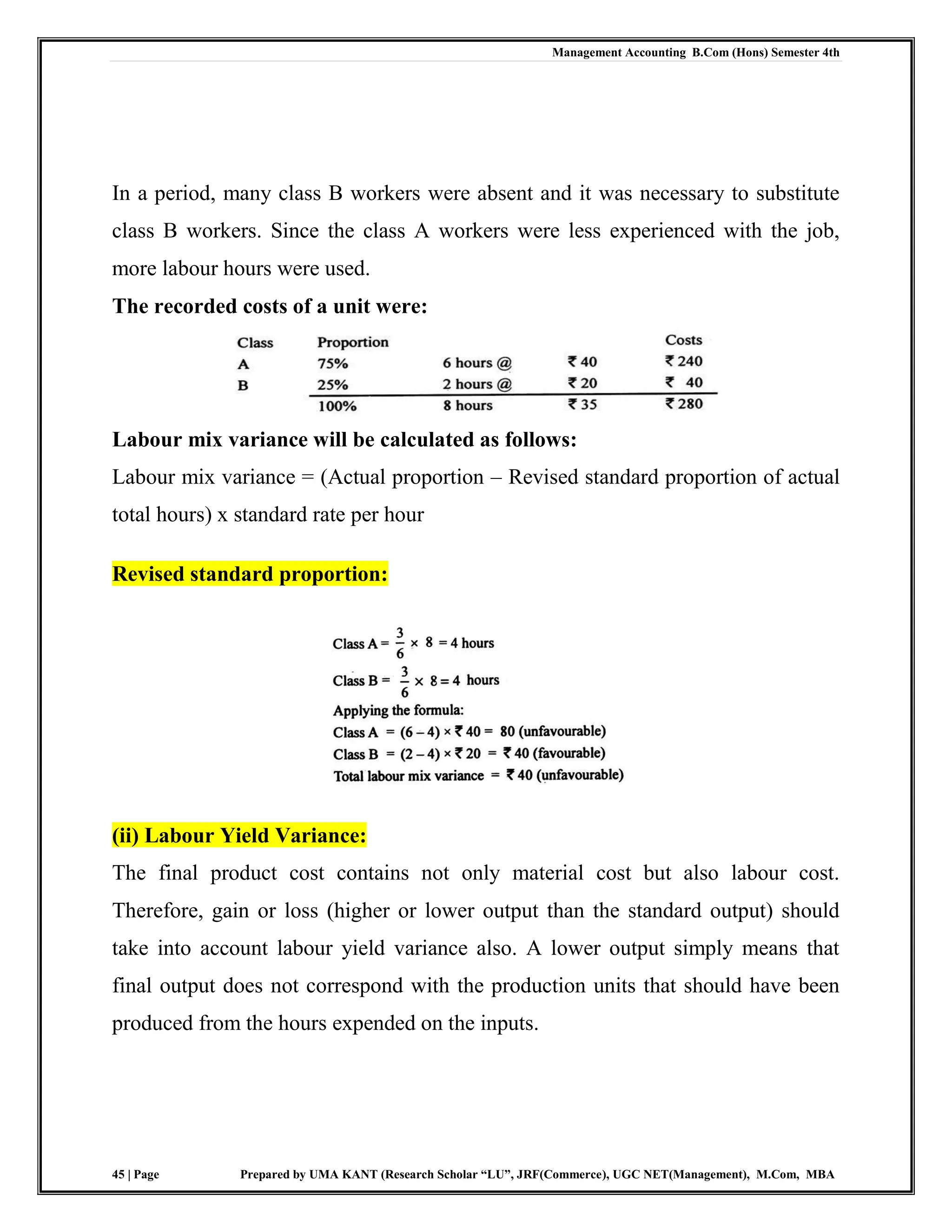

Management accounting is the study of managerial aspects of accounting, primarily focusing on providing financial information to assist management in decision-making, planning, and control. It employs various techniques, such as budgeting and standard costing, to analyze financial data and enhance efficiency within an organization. Despite its benefits, management accounting has limitations, including dependence on accurate financial data and potential personal bias in interpretation.