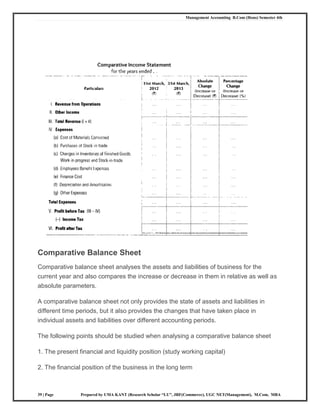

The document discusses financial statement analysis, a process for evaluating the financial position and performance of a firm through its financial statements. It outlines the objectives, importance, limitations, and key tools such as comparative statements, cash flow analysis, and ratio analysis used in this analysis. Additionally, it contrasts funds flow and cash flow statements, detailing their purposes and methods of preparation.