This document provides an overview of management accounting. It defines management accounting as the process of analyzing business costs and operations to prepare internal financial reports and records to aid managerial decision making. Some key points:

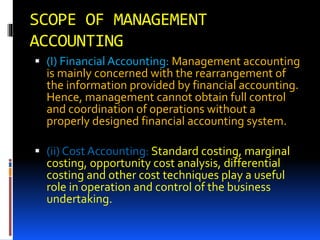

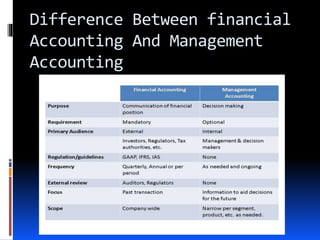

- Management accounting focuses on internal reporting for managers, while financial accounting focuses on external reporting.

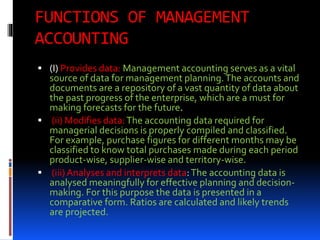

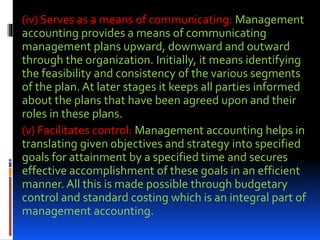

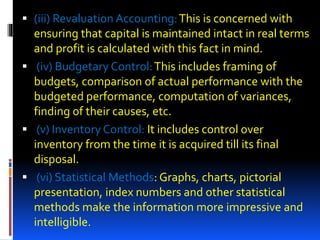

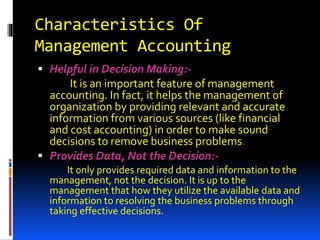

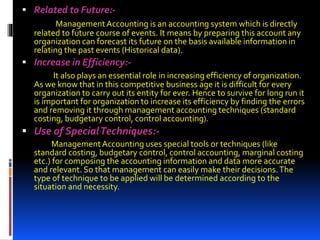

- Management accounting helps managers with budgeting, decision making, planning, and controlling costs. It provides modified and analyzed financial data to managers.

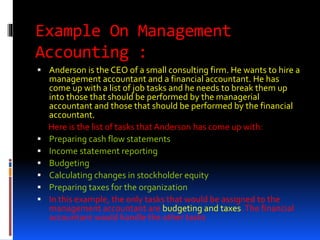

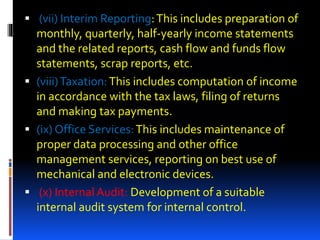

- An example is given of tasks that would be assigned to a management accountant (budgeting, taxes) vs. a financial accountant (preparing financial statements, cash flows, stockholder equity changes).

- The functions of management accounting include providing data,