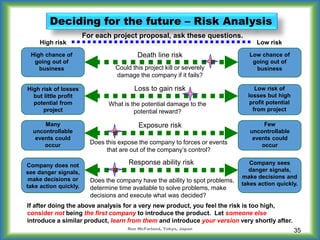

The document outlines various global strategies for business expansion, highlighting methods such as direct export, licensing, and foreign direct investment, along with their associated advantages and disadvantages. It examines vertical integration strategies, emphasizing the benefits of improved trust and communication against the risks of increased fixed costs and decreased flexibility. Additionally, it discusses market entry techniques and competitive dynamics, stressing the importance of assessing competitors' behavior and future demand when expanding or entering new markets.