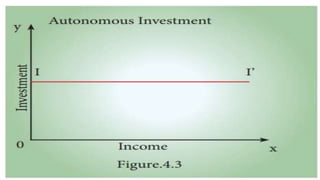

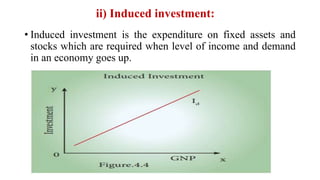

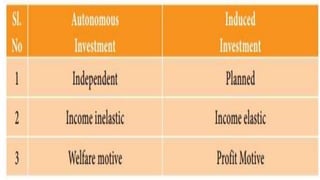

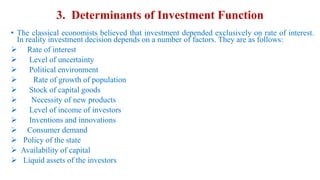

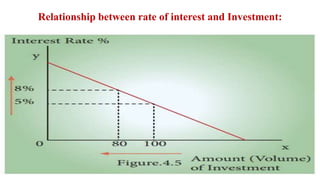

The investment function describes the inverse relationship between interest rates and investment, with investment dependent on various factors including expected returns, business confidence, and national income. Types of investment include autonomous investment, which is not influenced by national income, and induced investment, which occurs when income and demand rise. Important concepts include the marginal efficiency of capital (MEC), which measures the expected profitability of capital assets influenced by both short-term and long-term factors.