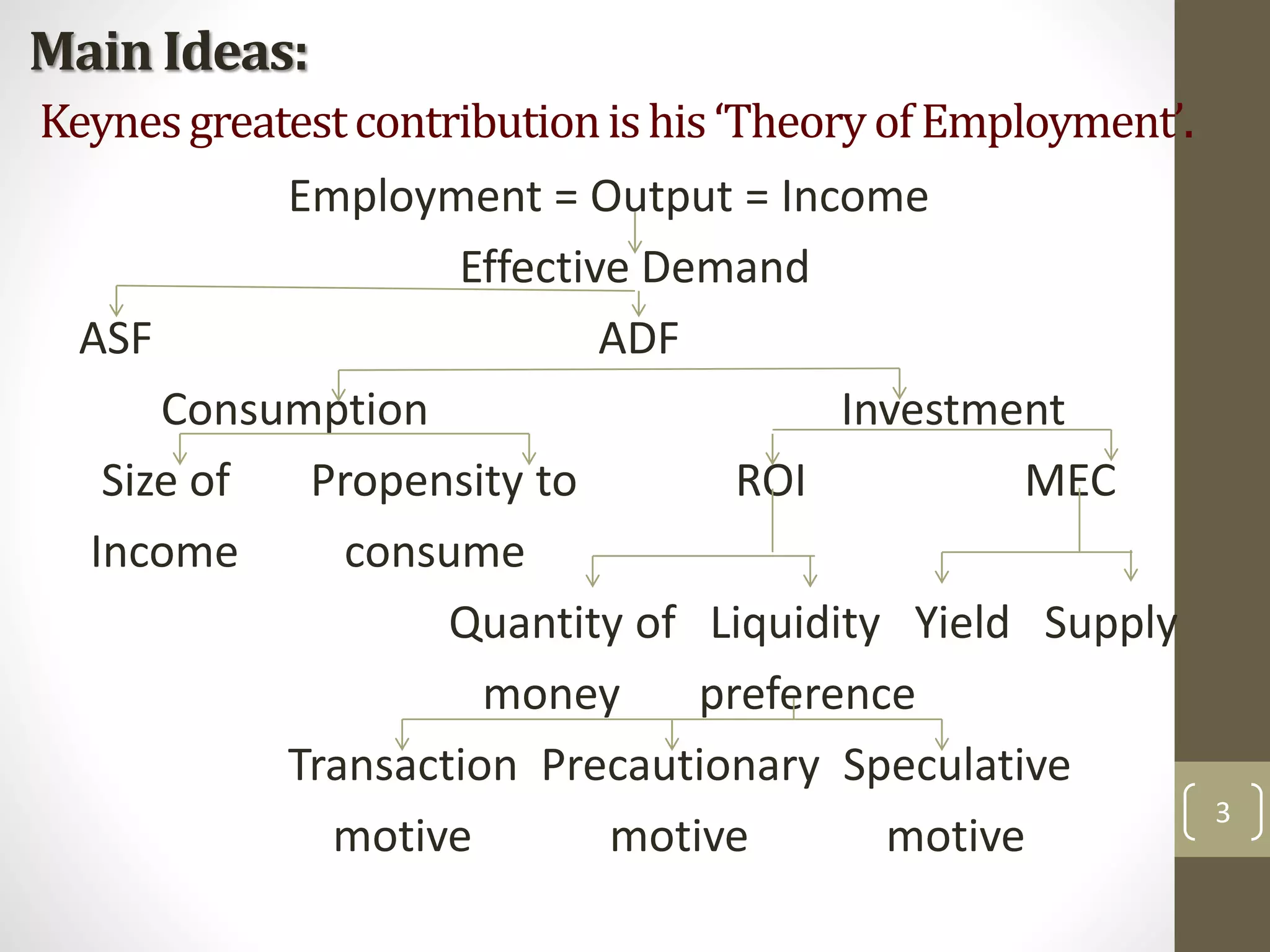

John Maynard Keynes was an influential 20th century English economist known for developing Keynesian economics. Some of his key ideas included that employment is determined by effective demand, which depends on aggregate supply and demand. Consumption and investment determine aggregate demand, with consumption depending on income and propensity to consume. The multiplier effect means that a change in investment leads to a proportional change in national income and output. Interest rates are determined by the supply of money and liquidity preference. Keynes argued governments could fight unemployment through fiscal policy like taxation and public investment.