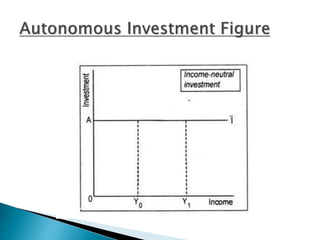

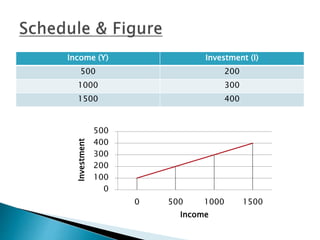

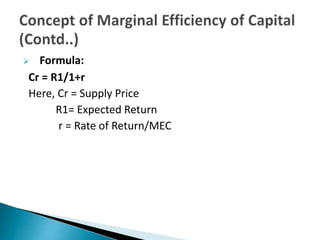

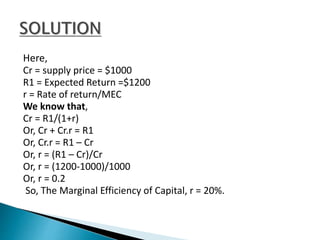

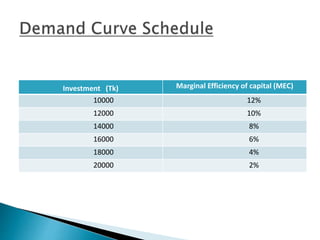

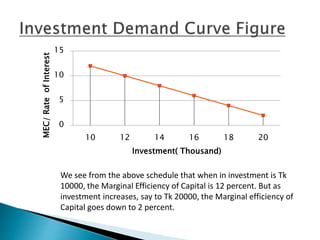

Investment refers to the purchase of assets like factories, machinery and equipment to generate future income and wealth. There are different types of investment including autonomous investment which remains constant irrespective of income levels, and induced investment which varies with national income changes. Gross investment is total spending on new capital assets, while net investment is gross investment minus depreciation. Investment can also be private, from individuals seeking profit, or public from governments. Marginal efficiency of capital refers to the expected rate of return of a project and determines whether an investment is undertaken. As more investment is made, the marginal efficiency of capital declines.