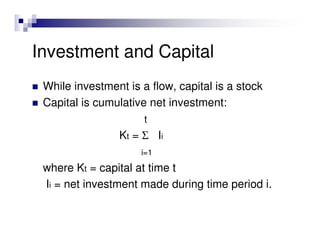

1. Investment refers to the net addition to existing capital assets like machines, factories, and plants that create additional employment. It does not include purchases of existing assets.

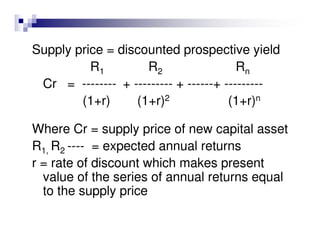

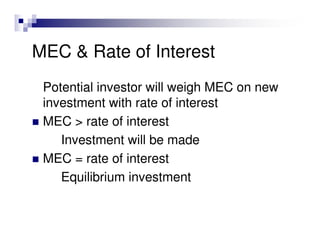

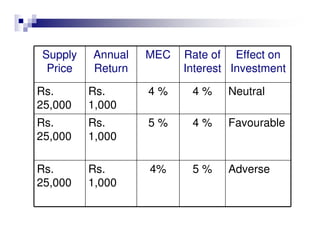

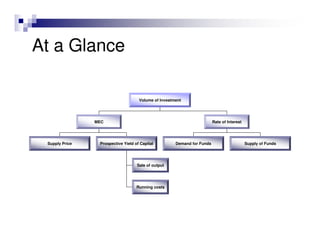

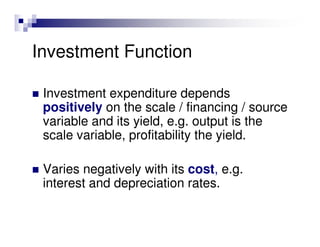

2. The level of investment is determined by the marginal efficiency of capital (MEC), which depends on the prospective yield of a capital asset and its supply price. Investment will occur when the MEC is higher than the prevailing interest rate.

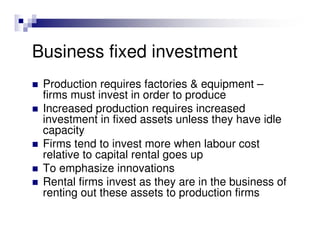

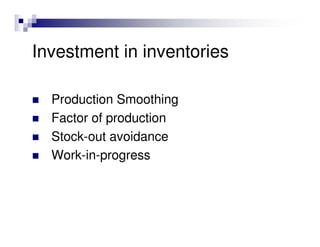

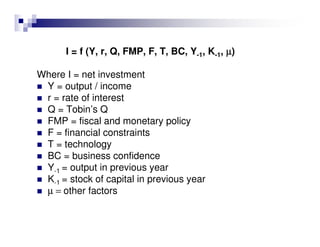

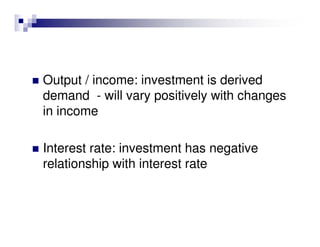

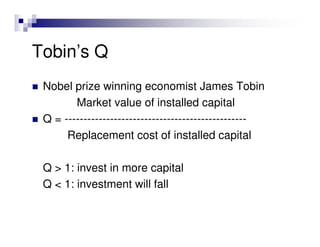

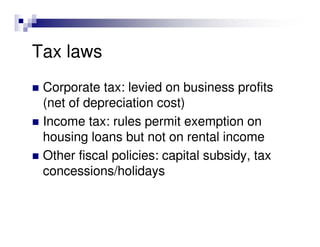

3. Factors like expected demand, costs, interest rates, tax policies, financing constraints, technology, and business confidence influence the MEC and the volume of investment in both the short-run and long-run.