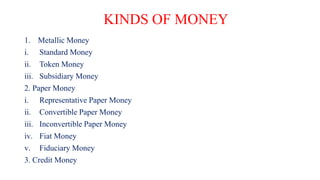

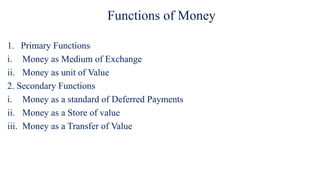

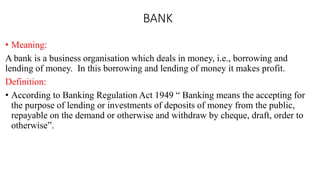

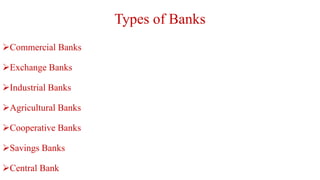

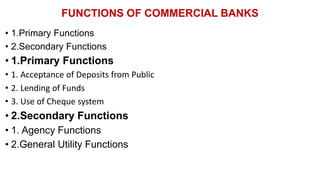

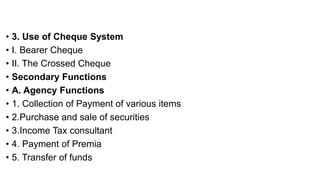

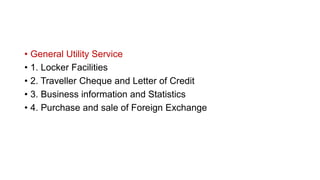

The document provides an extensive overview of money, including its definitions, types (metallic, paper, and credit money), and primary and secondary functions. It also discusses banking, defining banks as organizations involved in accepting deposits and lending money, with various types of banks and their functions outlined. Finally, it details the role and functions of the central bank, specifically the Reserve Bank of India, emphasizing its importance in controlling the economy and promoting financial stability.