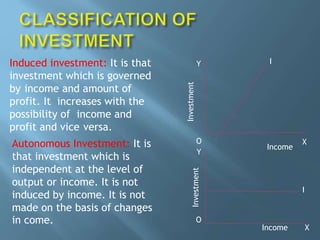

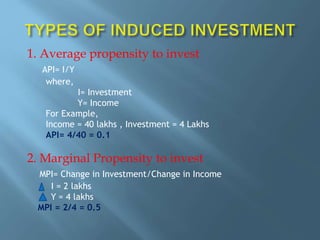

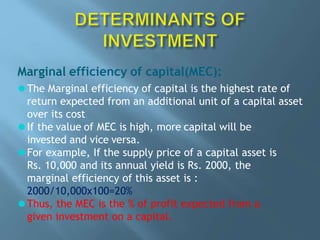

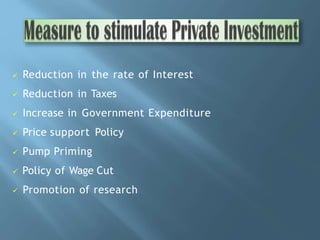

The document discusses the meaning and classification of investment, the determinants that influence investment including income level, interest rates, and demand forecasts, and the sources of investment such as private individuals seeking profit and government investment aimed at economic development and public welfare. Key factors that impact investment are discussed like the marginal efficiency of capital, interest rates, availability of financing, and government policies aimed at stimulating investment.