1. A bank is a business organization that deals in borrowing and lending money and makes a profit through interest charged on loans. The Central Bank, also known as the Reserve Bank of India, controls the country's money supply and promotes financial stability.

2. The Central Bank regulates other banks, acts as a lender of last resort, clears checks, and manages foreign exchange rates and monetary policy. Commercial banks accept deposits, lend funds, use checks, and provide other services like agency functions.

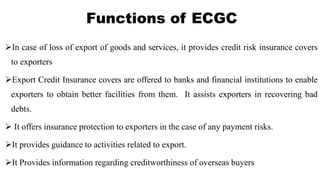

3. Export credit agencies provide insurance to exporters against payment risks and help recover bad debts. The Export Import Bank finances imports/exports and provides related services, while the IMF promotes exchange rate stability and balance of payments adjustments between