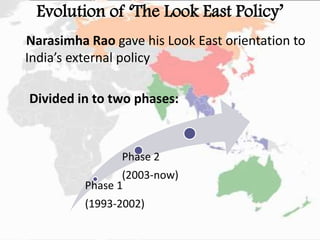

This document summarizes an Indian student group's presentation on India's Look East policy. It provides an introduction to the policy, outlines its evolution and objectives. Key points discussed include:

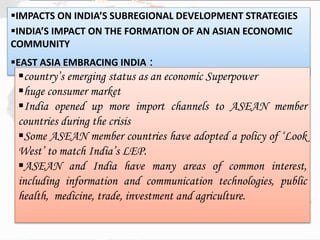

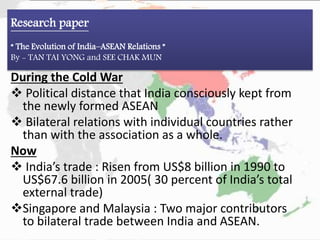

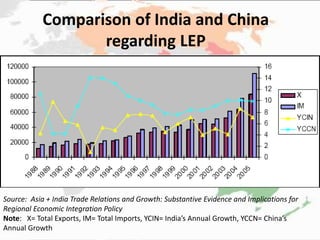

- The policy aims to strengthen India's economic and strategic ties with East/Southeast Asian countries.

- It has evolved from a focus on ASEAN countries to broader cooperation across the region.

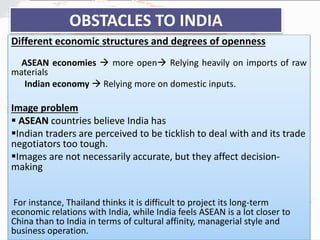

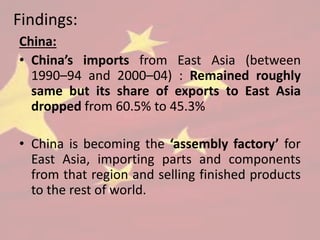

- Factors driving the policy include countering China's influence, tapping emerging Asian markets, and addressing regional security concerns.

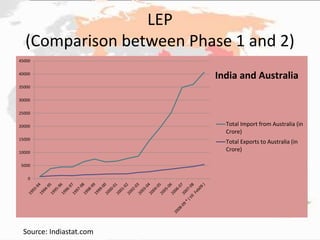

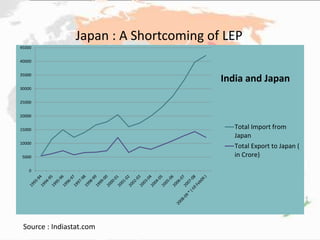

- India's economic relationships with countries like Singapore, Australia and Thailand have deepened under the policy, but ties with Japan remain a shortcoming.