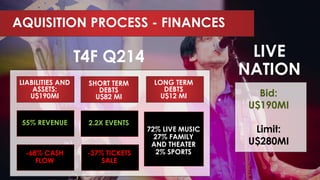

Live Nation plans to expand into South America by acquiring T4F, Brazil and Chile's largest entertainment company. T4F owns 5 venues in Brazil and 1 in Argentina and has a network of over 2.3 million fans. However, T4F is struggling financially and their stock has dropped 85% since going public. Live Nation's acquisition of T4F for $190 million would allow them to gain a foothold in South America and leverage T4F's expertise and infrastructure to grow live entertainment in the region over the next 4-6 years.