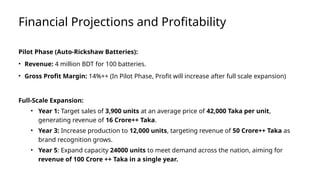

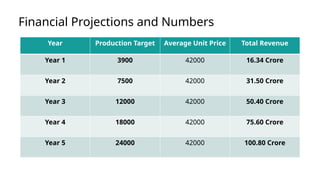

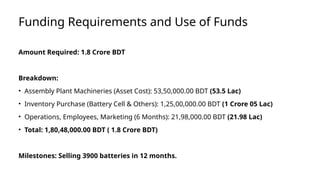

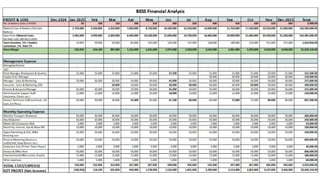

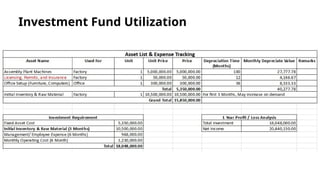

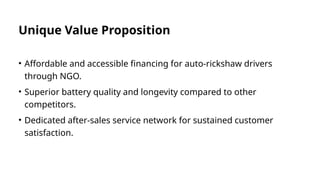

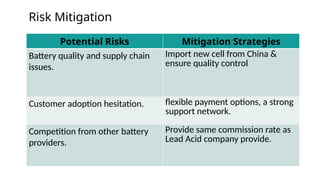

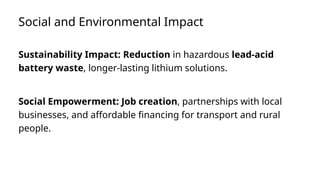

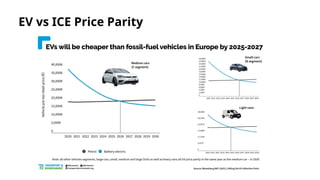

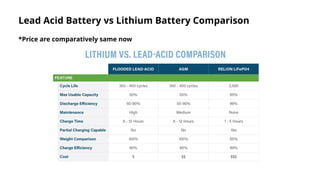

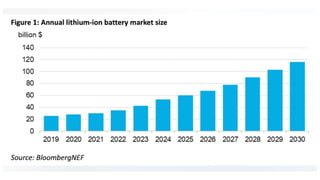

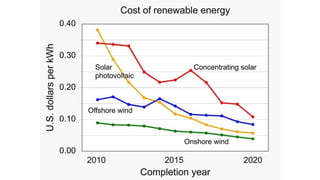

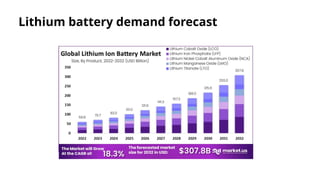

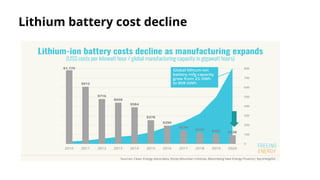

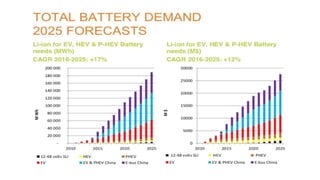

The document outlines a plan for launching and expanding lithium-ion battery solutions for auto-rickshaws in Bangladesh, highlighting significant growth potential and market demand. Key features of the proposed batteries include longer lifespan and faster charging, addressing current challenges faced by drivers using lead-acid batteries. The business intends to establish a local assembly plant, achieve notable revenue targets, and promote sustainability while overcoming competition and supply chain risks.