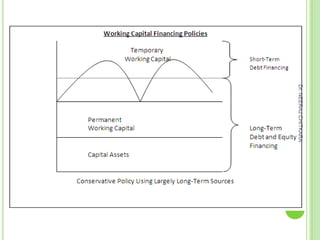

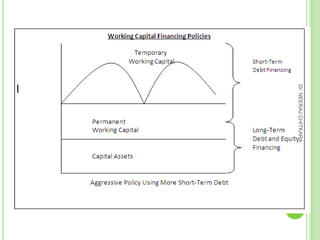

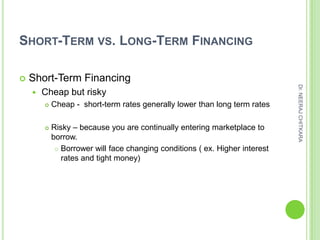

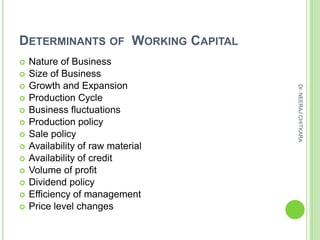

The document discusses liquidity versus profitability in financing working capital. It covers short-term financing versus long-term financing, with short-term being cheaper but riskier due to changing market conditions, while long-term is safer but more expensive. It also discusses determinants of working capital like nature of business, growth, production cycles, and importance of maximizing shareholder wealth and profit. Working capital management is defined as planning and controlling current assets and financing them at satisfactory levels.