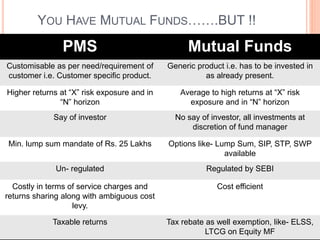

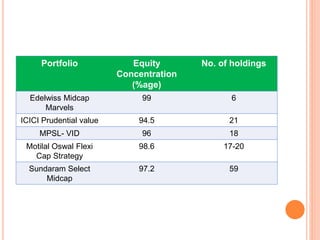

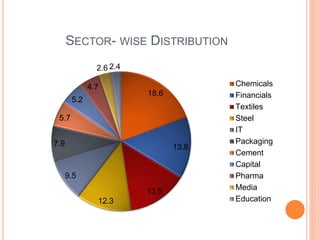

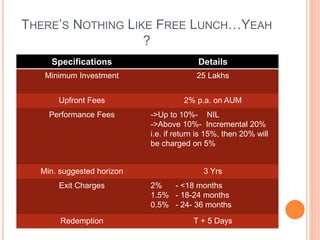

Portfolio management services are meant for high net worth individuals who want a personalized and professional management of their finances by a team of experts. PMS provides custom investment solutions and strategies through extensive research to achieve clients' investment objectives. It offers higher returns than mutual funds through concentrated portfolios of 18-25 stocks that are closely monitored and rebalanced regularly. Fees for PMS include upfront fees of 2% of assets and performance fees of up to 20% of returns above 10%. The minimum investment amount is 25 lakhs for a minimum suggested holding period of 3 years.