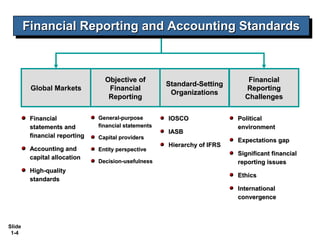

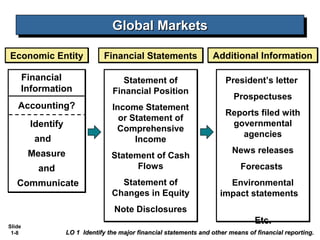

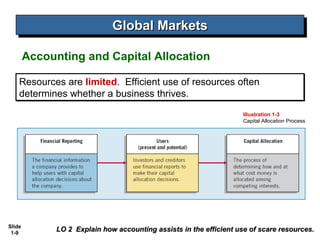

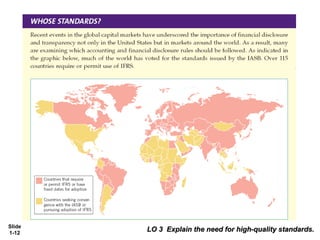

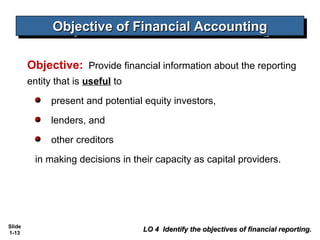

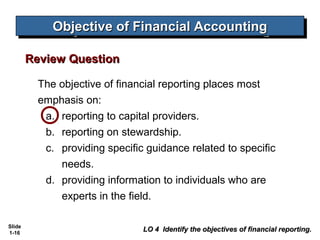

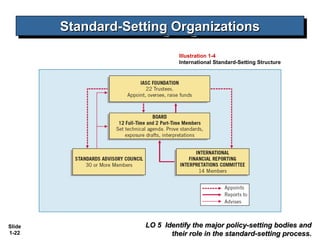

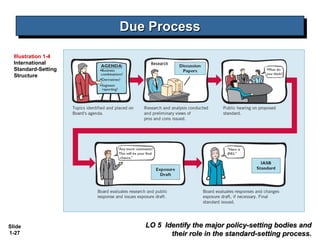

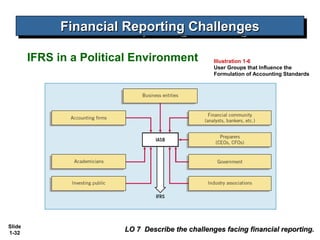

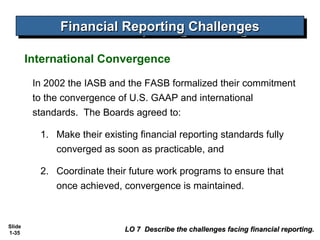

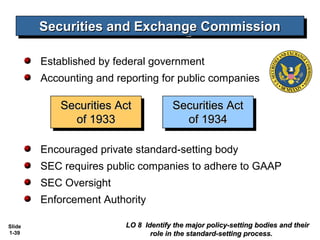

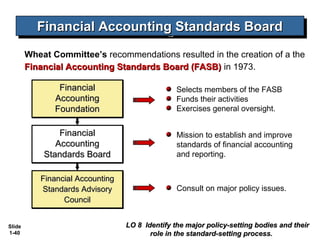

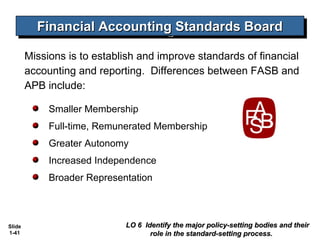

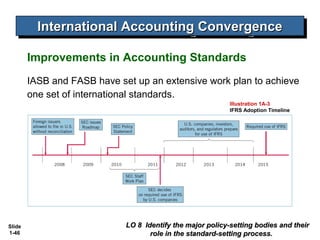

This document provides an overview of financial reporting and accounting standards. It discusses the objectives of financial reporting which is to provide useful information to present and potential equity investors and creditors. It also outlines the major financial statements and additional financial reports companies provide. Furthermore, it explains the need for high-quality standards due to globalization and identifies the International Accounting Standards Board and IOSCO as the two major standard-setting organizations.