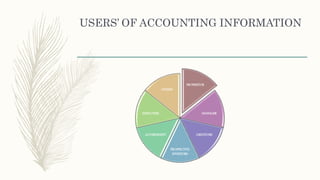

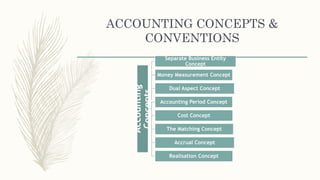

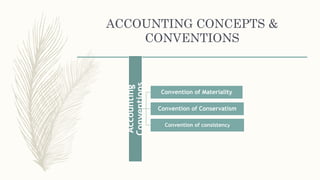

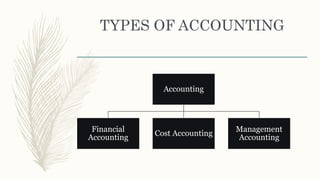

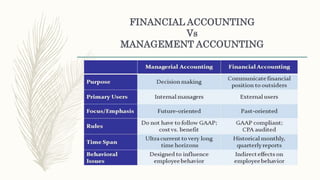

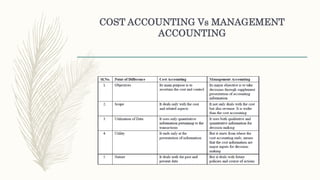

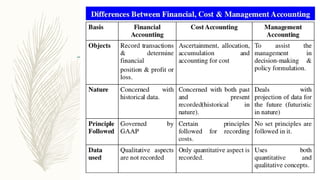

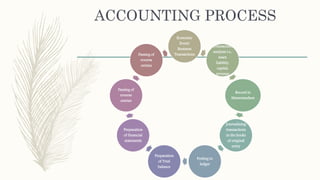

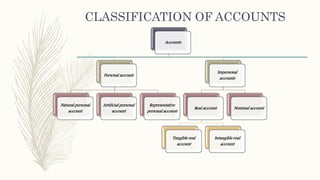

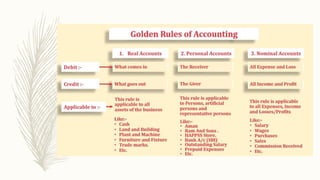

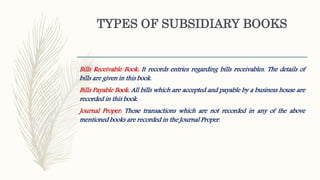

This document provides an overview of accounting concepts and processes. It defines accounting as the process of recording, classifying, and summarizing financial transactions, and communicating the results to interested parties. The key concepts discussed include the accounting equation, money measurement, accrual accounting, and matching principle. It also describes the accounting process, from recording transactions to preparing financial statements. Finally, it discusses the different types of accounts, books, and accounting systems used such as journals, ledgers, cash books, and subsidiary records.