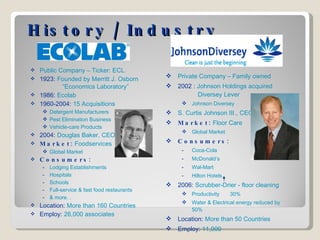

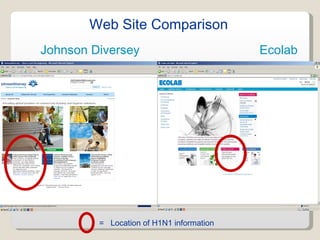

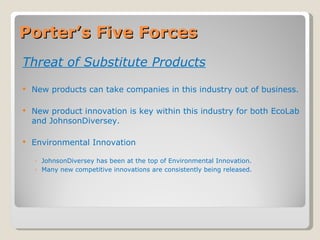

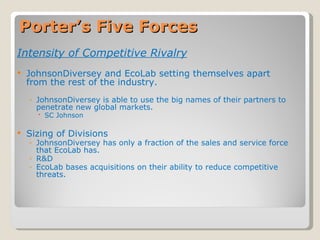

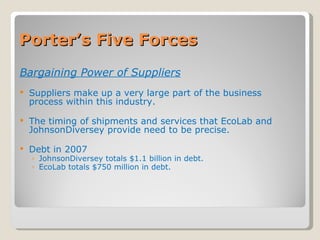

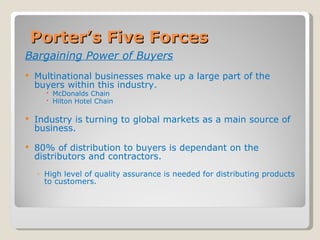

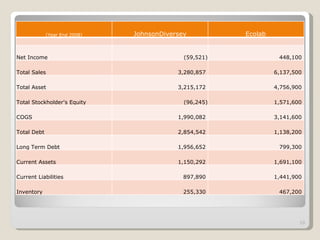

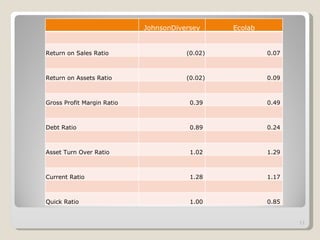

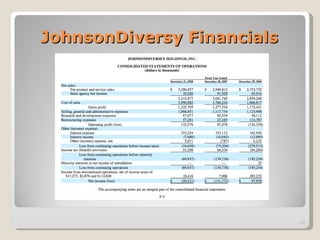

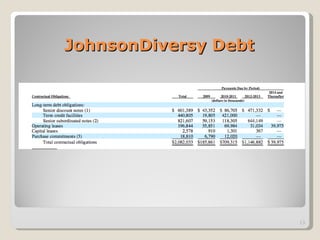

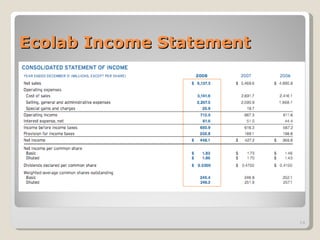

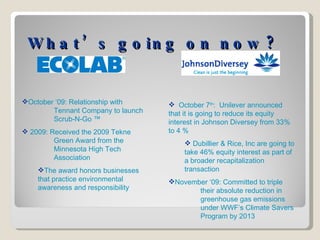

The document provides an analysis of the institutional and industrial cleaning industry, focusing on two major companies: Ecolab and JohnsonDiversey. It discusses the history and operations of both companies, compares their financial performance in 2008, and analyzes their competitive environment using Porter's Five Forces model. The document concludes by recommending various strategic options for each company, including potential mergers or partnerships.