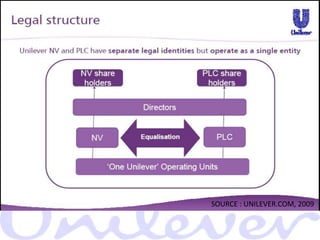

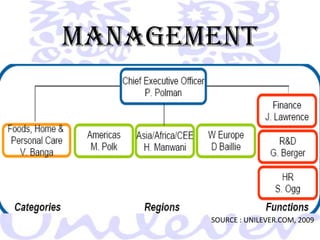

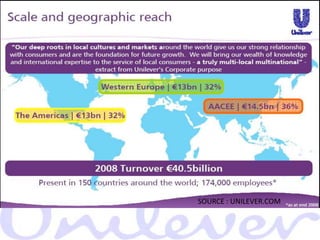

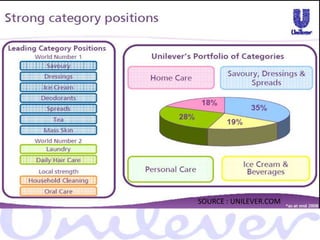

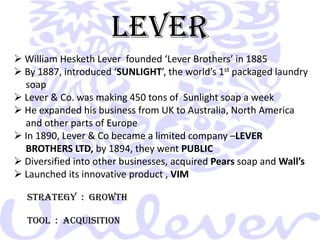

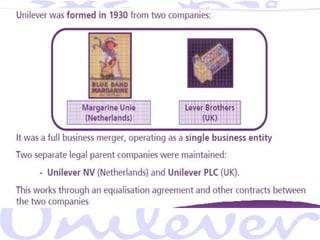

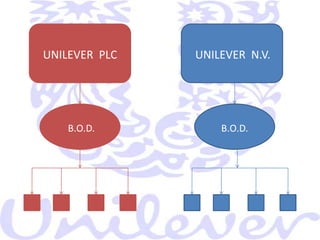

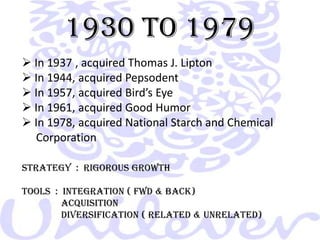

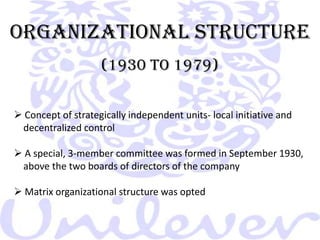

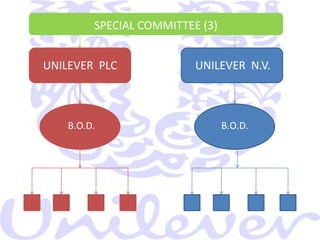

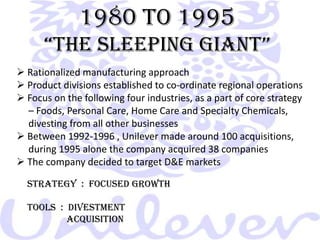

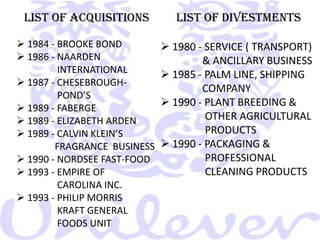

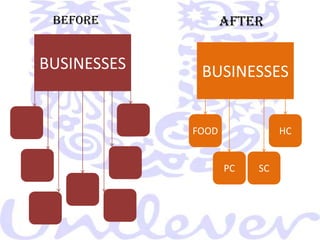

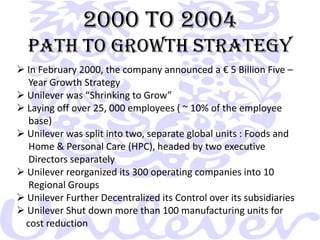

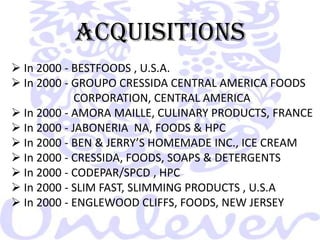

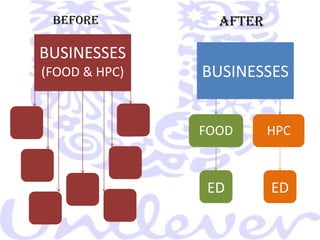

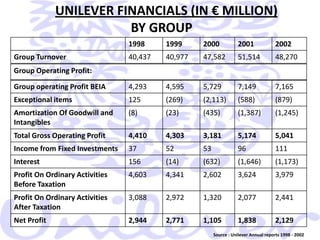

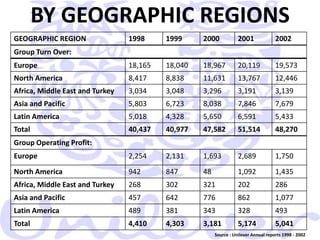

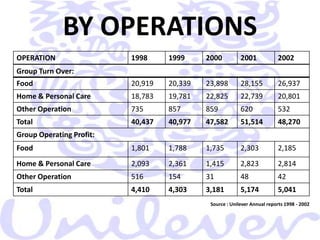

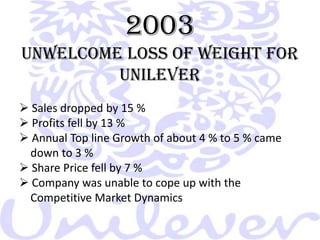

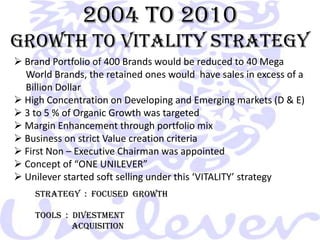

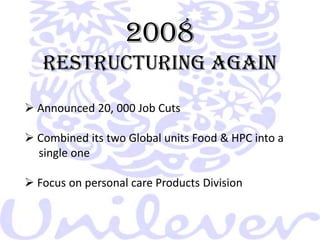

The document outlines the history and evolution of Unilever, detailing its strategic decisions, mergers, acquisitions, and restructuring efforts from its inception in 1872 to 2009. It highlights various problems faced by Unilever due to complex organizational structures and frequent restructuring, ultimately leading to significant layoffs and a renewed focus on core brands and markets. The company's shift towards a 'path to growth' strategy emphasizes consolidation and efficiency, aiming to strengthen its market position amid competitive dynamics.