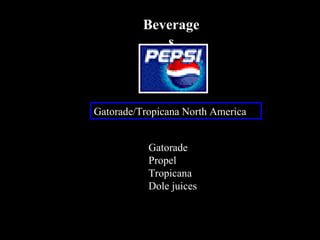

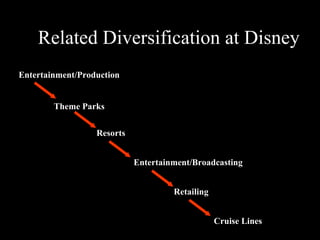

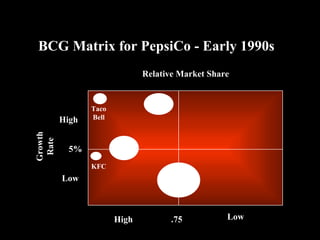

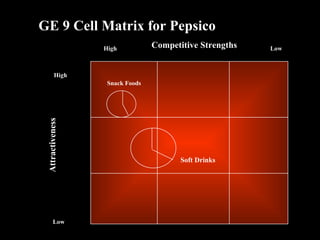

This document discusses various corporate level strategies including diversification, vertical integration, and outsourcing. It discusses the benefits and risks of these strategies. It also provides examples of PepsiCo's business unit structure and product offerings within their snack foods, beverages, and foods divisions on a global level.