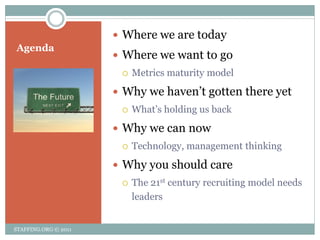

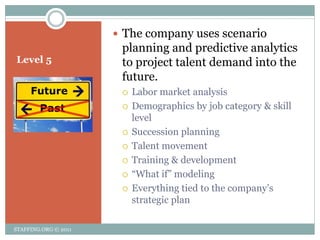

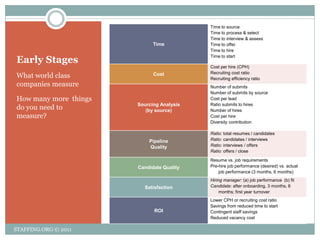

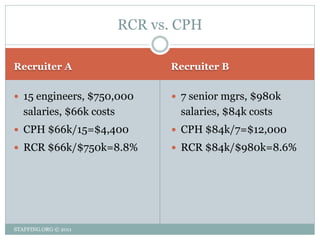

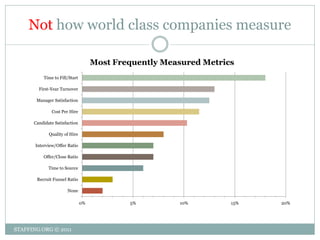

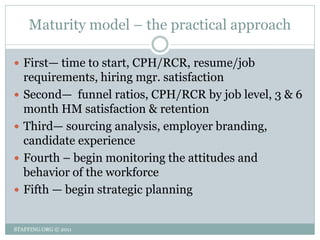

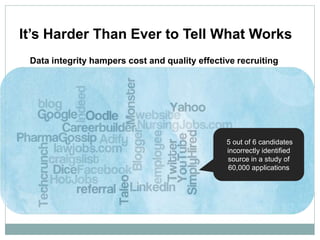

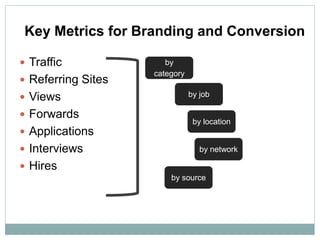

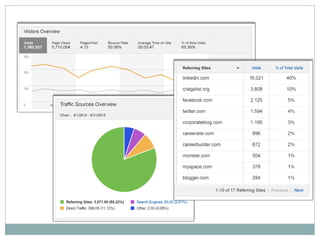

The document discusses the evolution of recruiting analytics from a 20th-century model focused on efficiency to a 21st-century model emphasizing value and metrics. It highlights the need for organizations to adopt modern technology and metrics to improve talent acquisition processes and suggests implementing a metrics maturity model. The text outlines various key performance indicators that can guide organizations toward better recruiting effectiveness and efficiency.