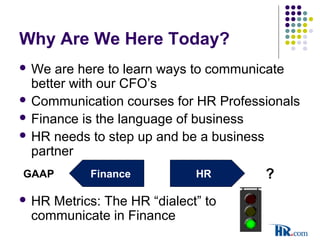

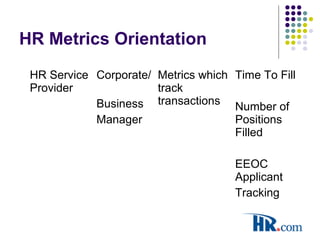

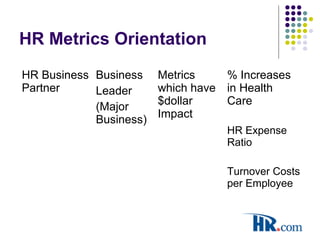

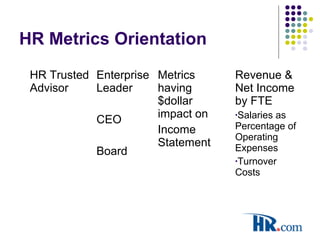

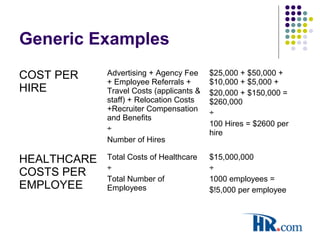

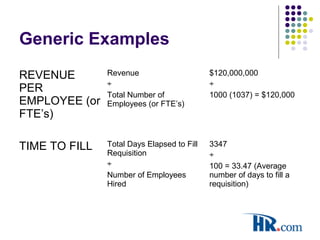

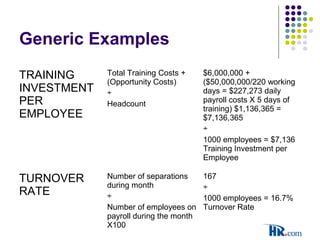

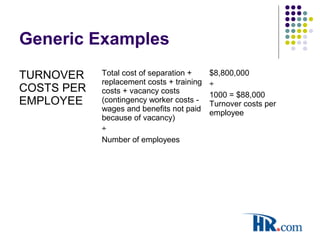

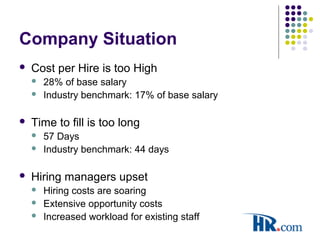

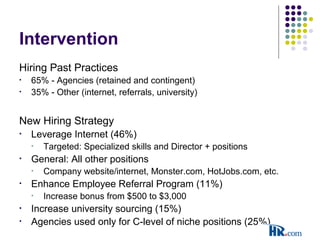

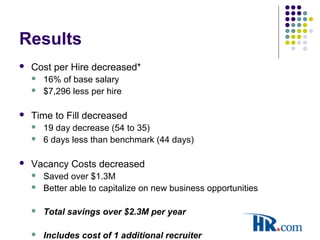

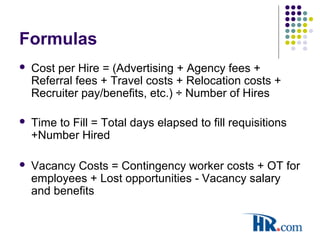

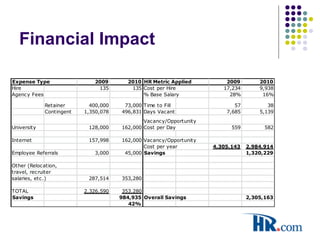

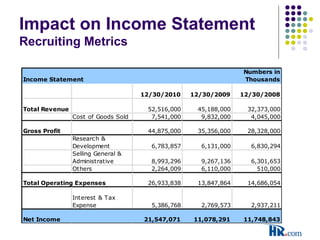

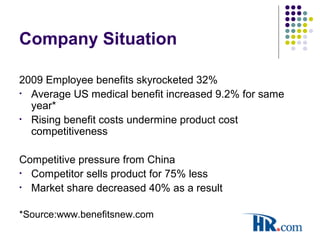

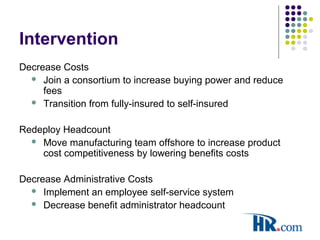

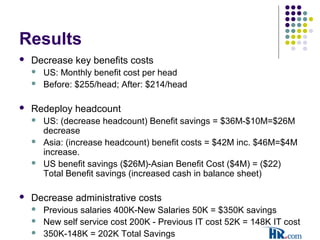

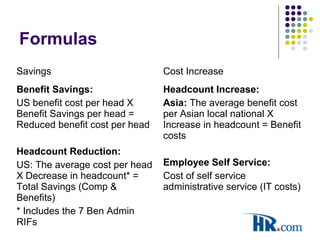

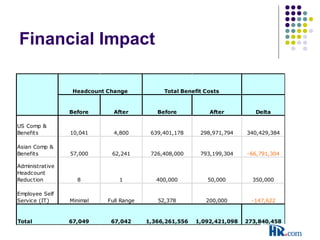

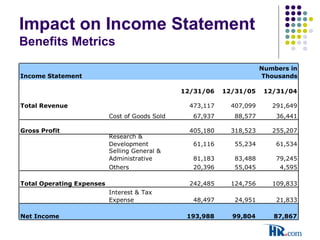

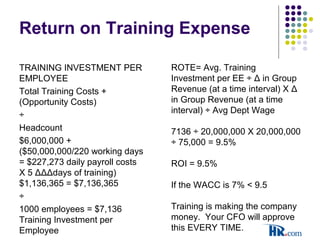

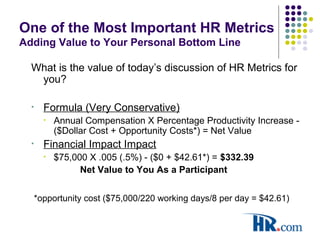

This document summarizes a presentation about using HR metrics to communicate effectively with CFOs. The presentation discusses characteristics of high-quality HR metrics, provides generic examples of common metrics like cost per hire and turnover rate, and presents two case studies showing how companies improved metrics related to recruiting and benefits to realize significant cost savings. It concludes by discussing how HR metrics are increasingly being incorporated into business intelligence dashboards used by executives.