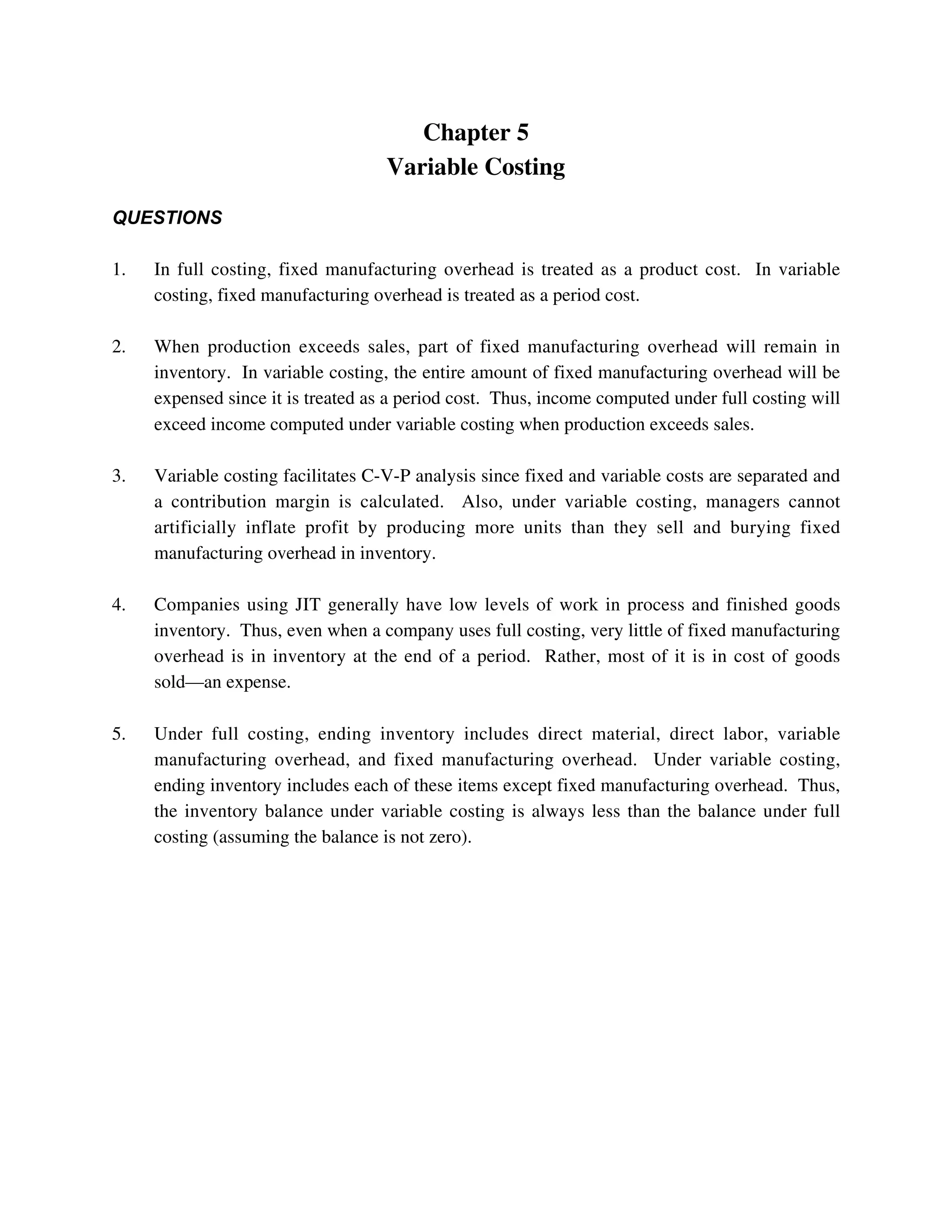

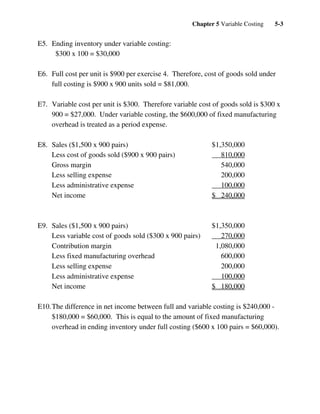

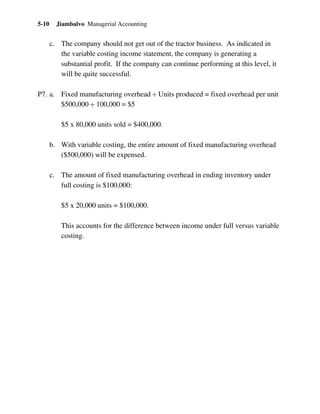

1. The document discusses the key differences between variable costing and full costing. Under variable costing, fixed manufacturing overhead is treated as a period cost rather than a product cost.

2. When production exceeds sales, variable costing expenses all fixed manufacturing overhead in the period rather than including some in inventory. This means income under variable costing will be lower than under full costing when production is greater than sales.

3. Variable costing facilitates contribution margin analysis and managers cannot artificially inflate profits by overproducing to bury fixed costs in inventory. Inventory balances are also always lower under variable costing compared to full costing.