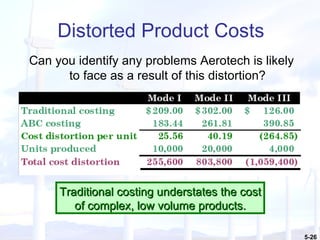

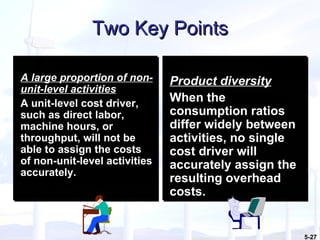

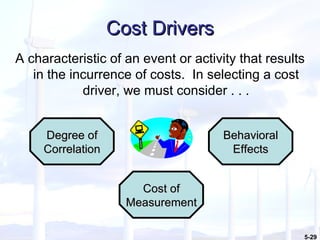

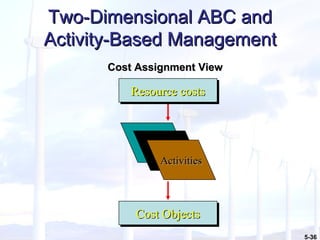

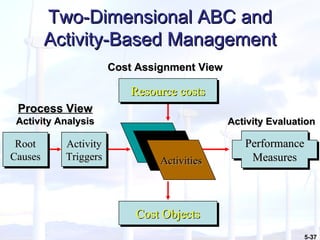

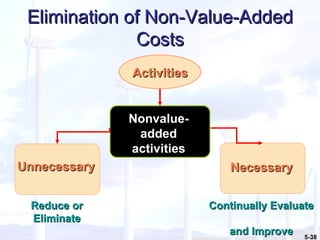

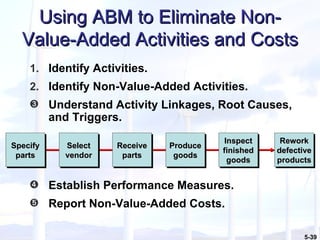

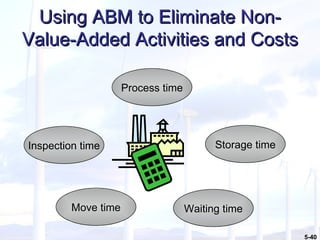

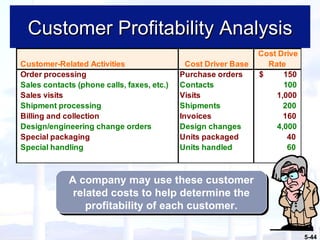

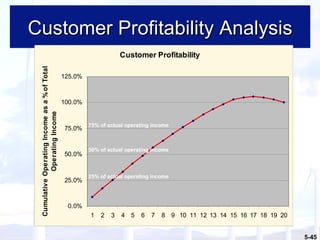

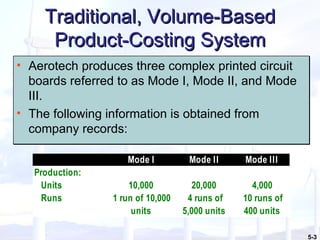

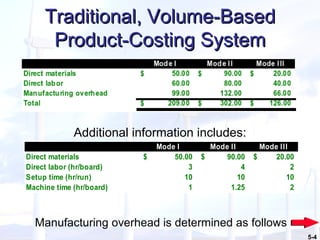

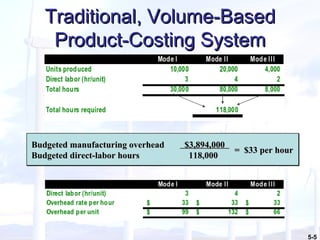

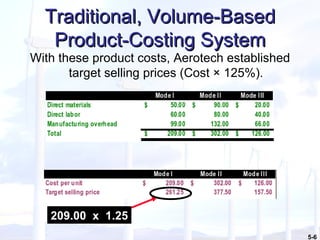

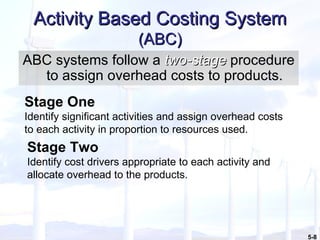

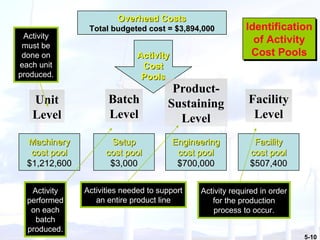

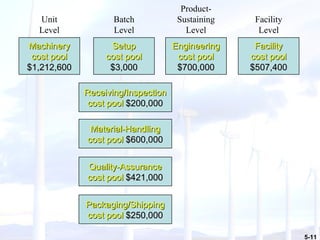

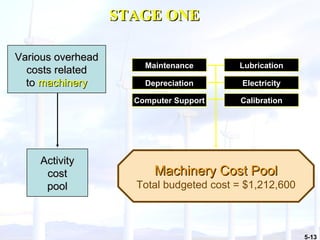

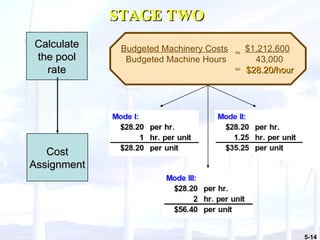

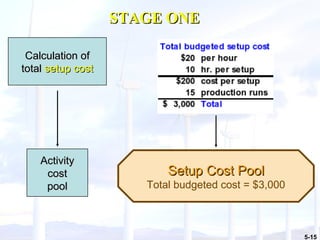

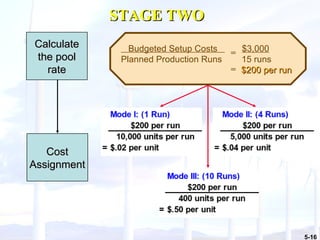

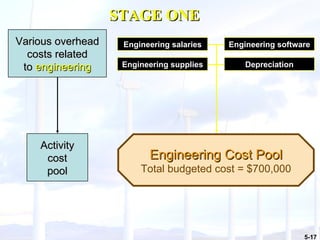

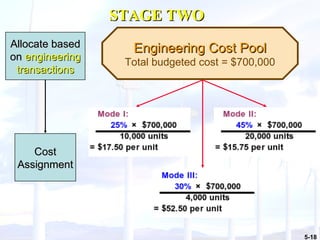

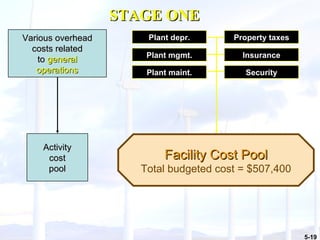

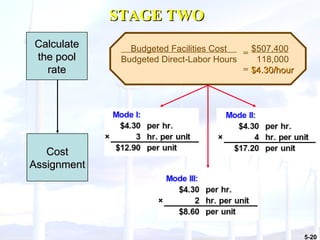

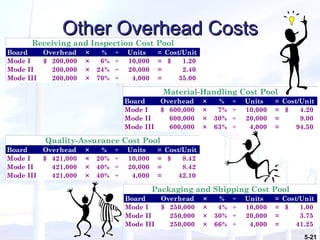

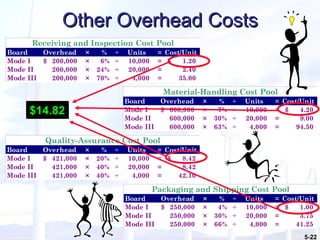

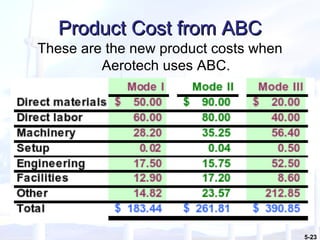

The document discusses activity-based costing (ABC) and activity-based management (ABM). It provides details on how Aerotech, a company that produces circuit boards, implemented ABC to more accurately assign overhead costs. ABC identified multiple cost pools associated with different activities. This revealed that the traditional costing system understated the costs of complex, low volume products. ABM focuses on managing activities to reduce costs by eliminating non-value added activities. Customer profitability analysis and just-in-time inventory systems are also discussed.

![Distorted Product Costs Both original and ABC target selling prices are based on (Cost × 125%). [$209.00 × 1.25] [$183.44 × 1.25] The selling price of Mode I and II are reduced and the selling price for Mode III is increased.](https://image.slidesharecdn.com/chap005abc-120227092222-phpapp02/85/Chap005-abc-25-320.jpg)