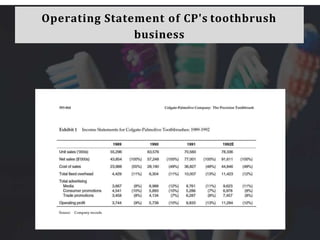

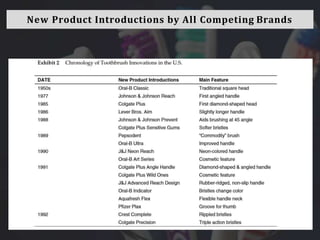

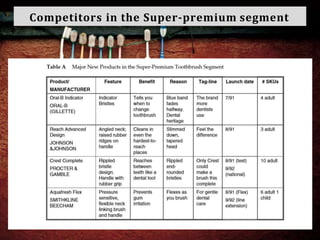

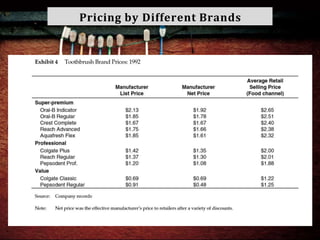

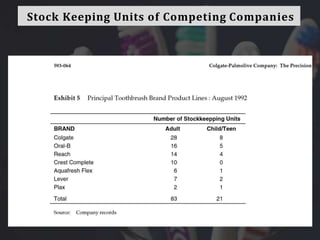

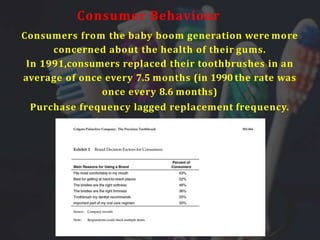

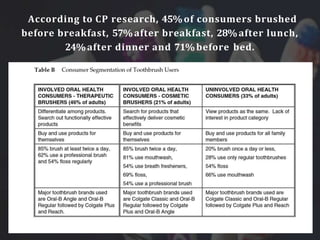

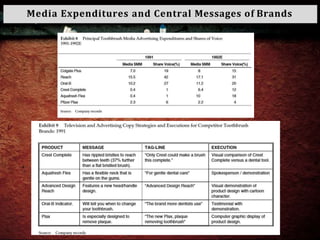

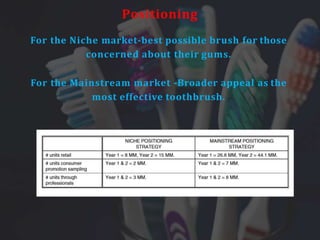

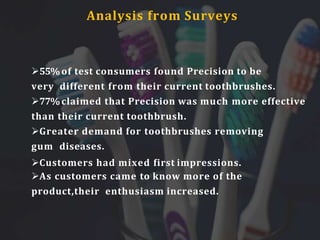

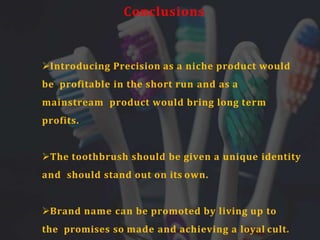

In August 1992, Colgate-Palmolive was set to launch its Precision toothbrush in a competitive U.S. market. Product manager Susan Steinberg needed to recommend strategies for positioning, branding, and communication as the company faced challenges from competitors like Henkel and Kao. Market analysis indicated significant consumer concern for gum health and highlighted both niche and mainstream strategies for product launch that could yield short- and long-term profits.