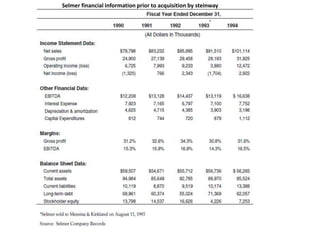

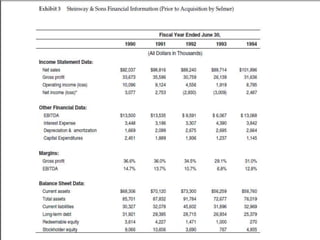

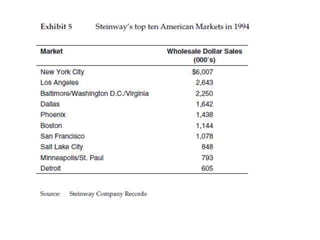

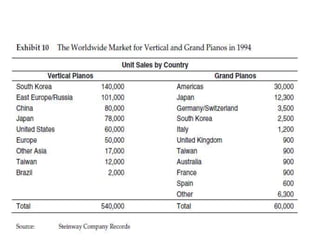

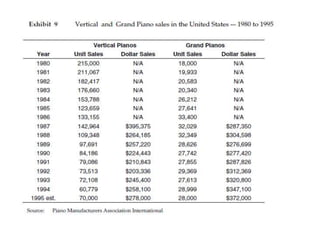

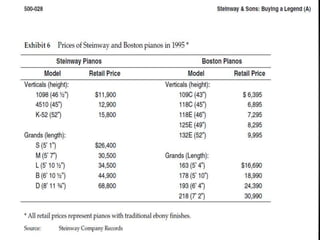

Steinway & Sons, a leader in high-quality grand pianos since 1853, has undergone multiple ownership changes due to financial difficulties, including sales to CBS, the Birmingham brothers, and Selmer. The company faced challenges such as declining product quality, loss of dealer and worker confidence, and increased competition, particularly during a downturn in the piano industry. Despite these issues, there are future opportunities for Steinway, particularly in improved economic conditions and potential growth in the Asian market.