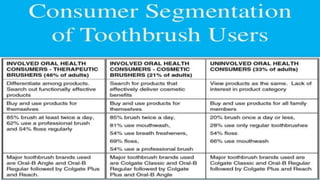

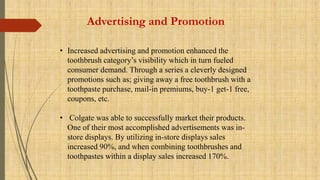

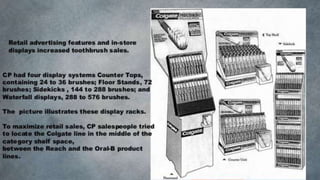

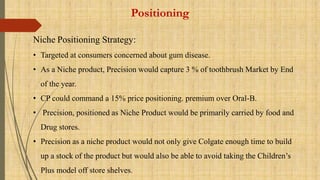

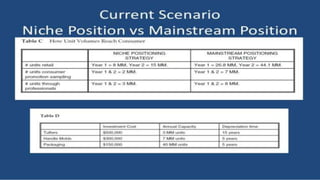

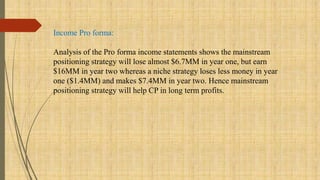

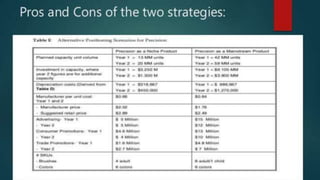

Colgate Palmolive was considering launching a new precision toothbrush. They could position it as either a niche product targeting gum health or a mainstream product. As a niche product it would capture less of the market more slowly but with less risk, while mainstream would capture more of the market faster but with greater risk. They analyzed test marketing and financial projections. In the end, they recommended initially positioning it as a niche product to appeal to consumers concerned with gum health, then potentially expanding it mainstream later.