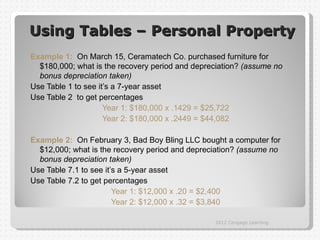

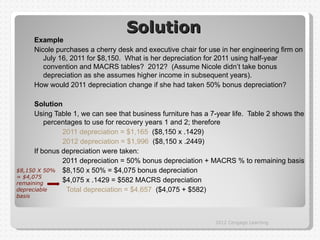

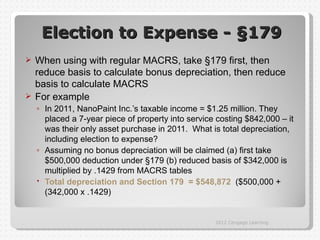

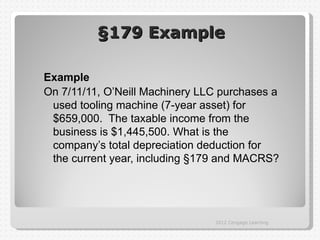

Here are the steps to solve this example:

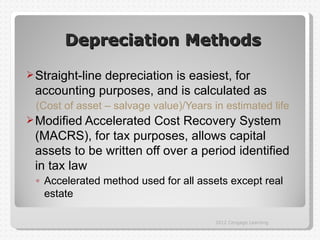

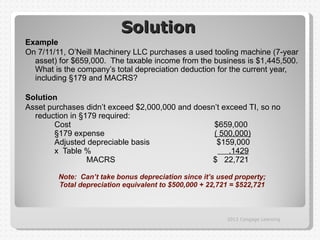

1. O'Neill Machinery's taxable income is $1,445,500 which is greater than the $659,000 cost of the asset, so the full $500,000 Section 179 deduction can be taken.

2. The Section 179 deduction reduces the asset basis to $159,000 ($659,000 original cost - $500,000 Section 179 deduction).

3. The MACRS depreciation on the remaining $159,000 basis is 14.29% of $159,000 = $22,701 (using the MACRS table for a 7-year asset).

4. The total depreciation deduction for the current year is

![Solution

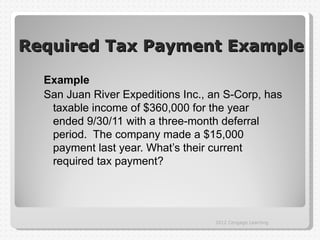

Example

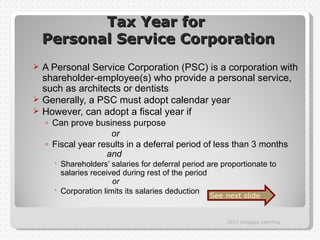

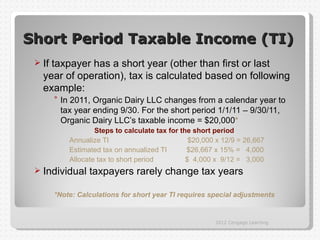

San Juan River Expeditions Inc., an S-Corp, has taxable income of

$360,000 for the year ended 9/30/11 with a three-month deferral period.

The company made a $15,000 payment last year. What’s their current

required tax payment?

Solution

The required tax payment =

(Estimated taxable income in deferral period x 36%) - prior year’s tax payment

Deferral period is 3 months (October – December)

[($360,000/12) x 3 months] = $90,000 ($90,000 x 36%) = $32,400

($32,400 - 15,000) = $17,400 estimated tax payment due in current year

2012 Cengage Learning](https://image.slidesharecdn.com/itfippch072012final-120420092945-phpapp02/85/Itf-ipp-ch07_2012_final-7-320.jpg)