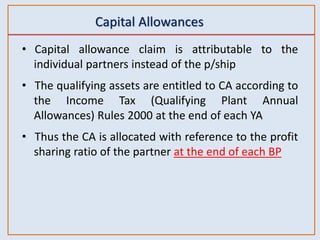

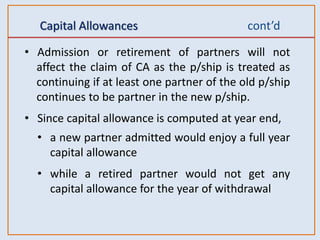

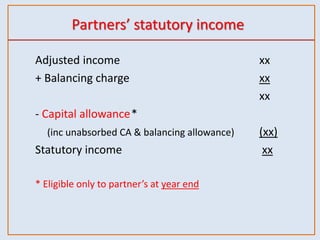

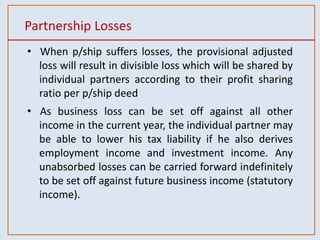

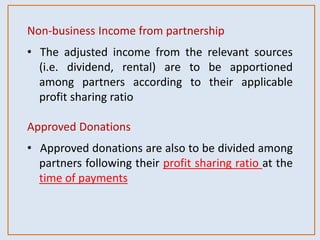

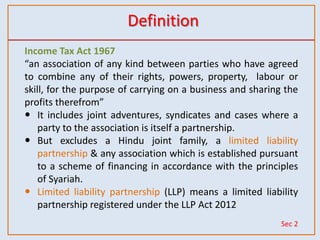

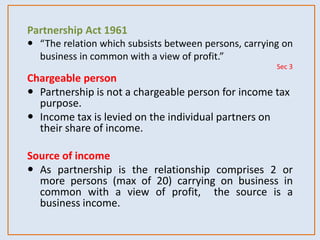

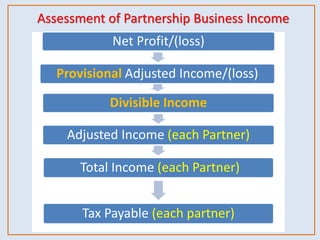

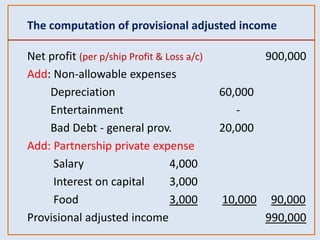

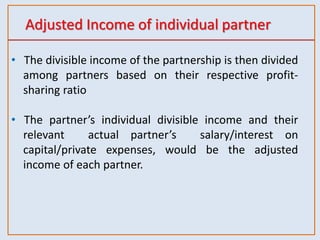

Partnerships are associations between two or more persons carrying on business together with a view to profit. A partnership is not a chargeable person for tax purposes - instead, tax is levied on individual partners based on their share of partnership income. To determine a partner's tax liability, the partnership income is first calculated as provisional adjusted income or loss, then divided among partners according to profit sharing ratios to arrive at each partner's adjusted income or loss. Capital allowances are also allocated to partners individually.

![Basis Period (BP)

• BP for a partnership = BP for business

• Where there is a change in the partnership

[admission of new partner(s) / withdrawal of

existing partner(s)], the BP will be divided into

two period:

1. old partnership (before change in the partnership)

2. new partnership (after change in the partnership)

In this case, the partnership’s income also need to

be distributed into those two periods](https://image.slidesharecdn.com/chapter8partnership-230113194515-499b1477/85/Chapter-8-Partnership-ppt-5-320.jpg)

![Return form by Partnership

The return (Form P) must declare:

• The divisible income or divisible loss

[sec.86(2)(a)]

• All information to determine the statutory income from

all sources

[(sec.86(2)(b)]

• Other information as required

[(sec.86(2)(c)]](https://image.slidesharecdn.com/chapter8partnership-230113194515-499b1477/85/Chapter-8-Partnership-ppt-6-320.jpg)

![Provisional Adjusted Income [Sec.55(2)]

• A partnership is postulated as a sole proprietorship

for the purposes of computing partnership adjusted

income

• For partnership, this adjusted income is known as

provisional adjusted income

• The normal rules of allowable, non-allowable,

double deduction are employed to determine the

gross income & deductions

» See chapter 7 on business Income](https://image.slidesharecdn.com/chapter8partnership-230113194515-499b1477/85/Chapter-8-Partnership-ppt-8-320.jpg)

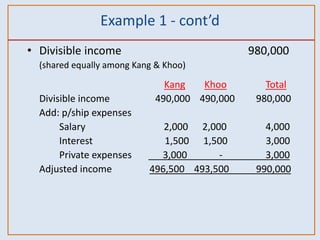

![Divisible Income [Sec.55(3)]

From the provisional adjusted income the following are

deducted to arrive at the divisible income:

• Remuneration of partners

• Interest to any partner on capital paid or advanced

• Private and domestic expenses, if any, of a partner

(including reimbursement by the partner)

The basis to allocate the partnership income to

individual partners is based on the ratio as stipulated

in a partnership agreement](https://image.slidesharecdn.com/chapter8partnership-230113194515-499b1477/85/Chapter-8-Partnership-ppt-11-320.jpg)

![Admitting a new partner

• In the case of a new partner admitted into an existing

partnership which continues to prepare its accounts

to its usual year end, the basis period will start on the

day one becomes a partner to the end of the

accounting period [S21(5)]

• Example:

If C is admitted on 1 October 2018 as a partner in the firm

of EBICO, which continues to prepare its accounts to 31

Dec annually, the basis period for C would be as follows:

Y/A Basis period

2018 1/10/2018 – 31/12/2018

2019 1/ 1/2019 – 31/12/2019](https://image.slidesharecdn.com/chapter8partnership-230113194515-499b1477/85/Chapter-8-Partnership-ppt-26-320.jpg)