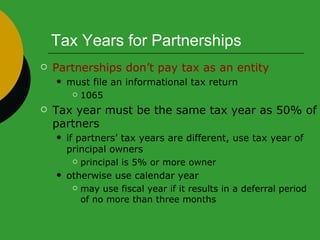

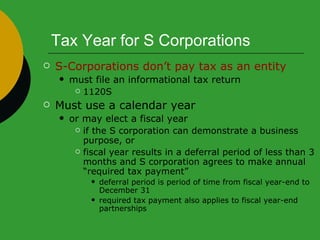

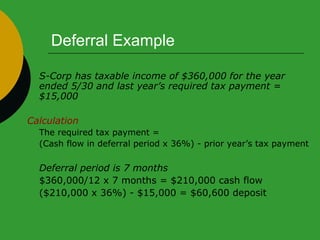

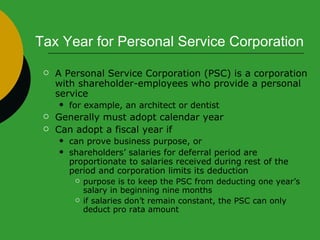

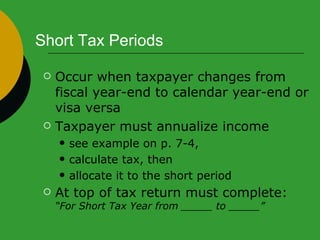

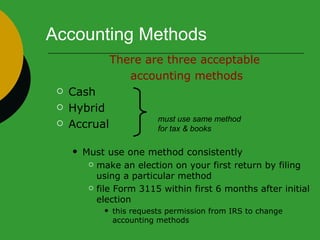

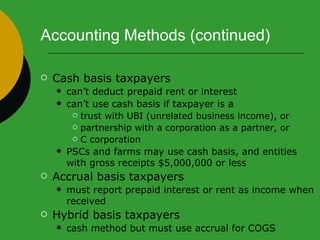

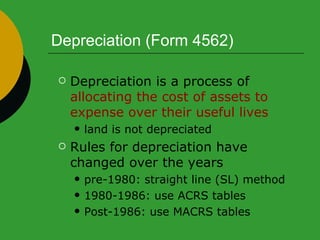

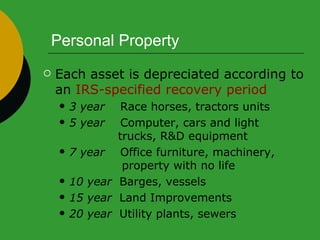

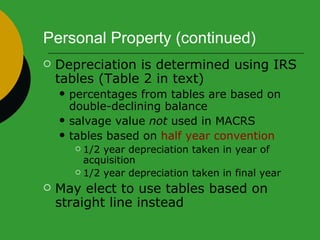

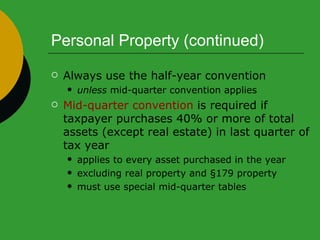

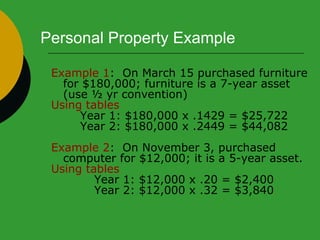

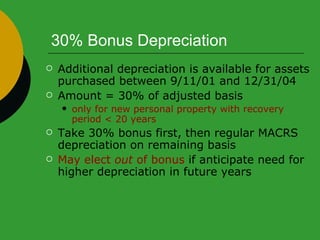

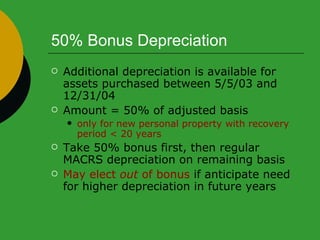

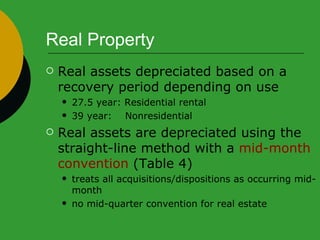

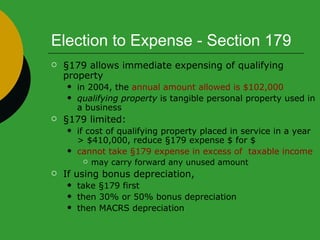

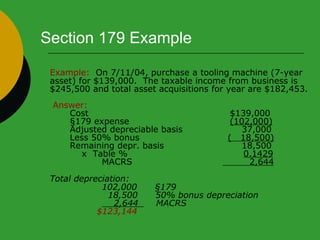

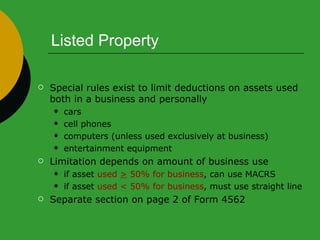

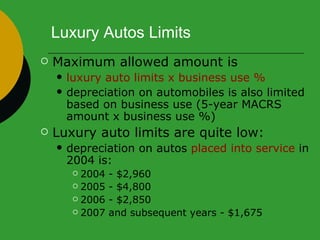

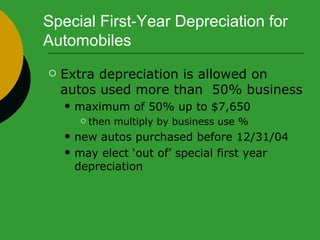

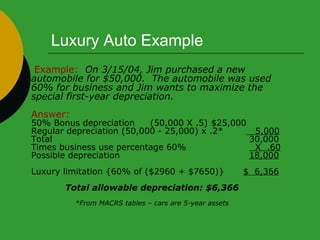

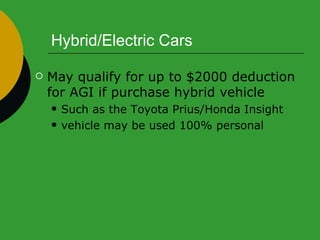

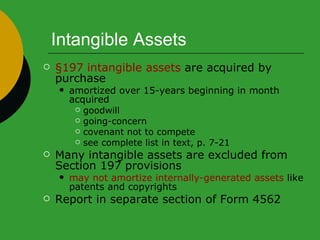

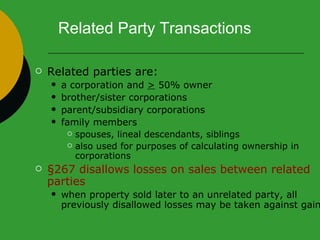

The document discusses various tax accounting periods and methods, depreciation accounting, and special rules for certain assets. It covers topics like tax years for individuals, partnerships, S corporations and personal service corporations. It also discusses accounting methods, depreciation methods, bonus depreciation, section 179 expensing, listed property, luxury vehicles and related party transactions.