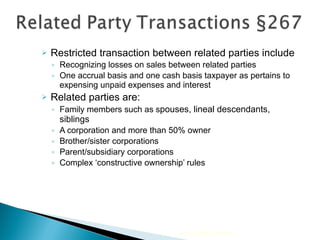

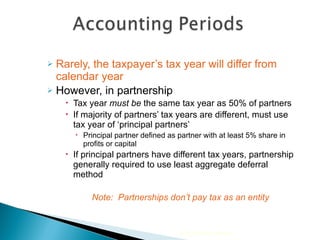

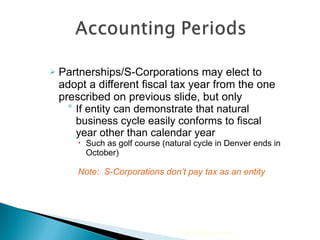

- Partnerships and S-corporations can elect a fiscal tax year other than the calendar year if they can demonstrate their natural business cycle aligns with the alternative year. However, they must still make estimated tax payments to cover taxes on income earned during the deferral period between the fiscal year-end and December 31.

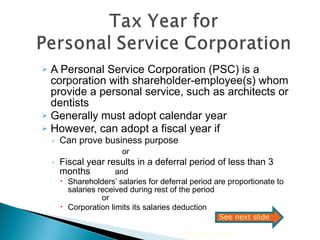

- Personal service corporations, whose shareholders provide personal services like dentists or architects, generally must use a calendar year but can use a fiscal year if certain conditions are met to prevent improper deferral of shareholder compensation.

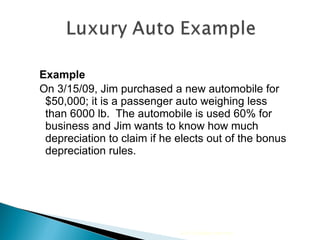

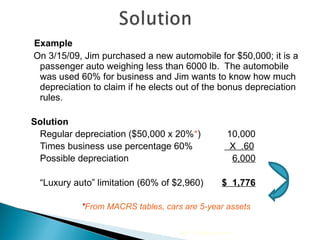

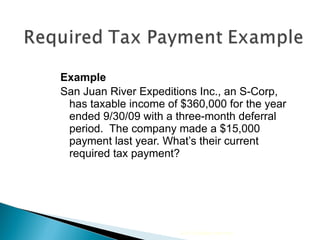

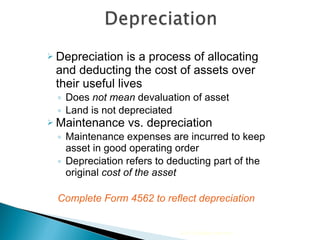

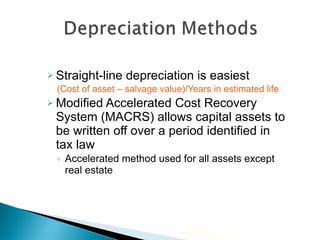

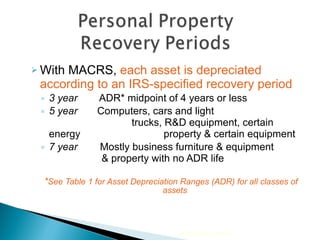

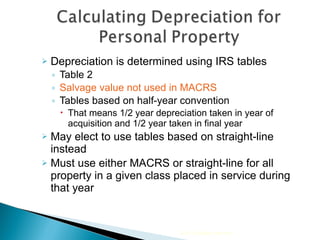

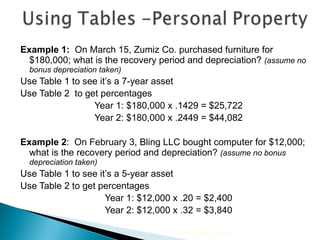

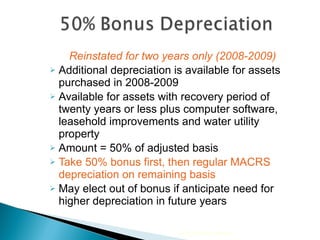

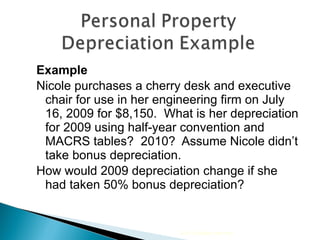

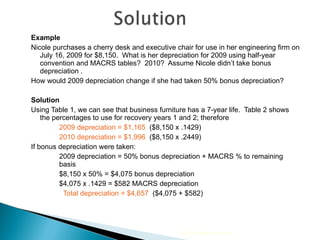

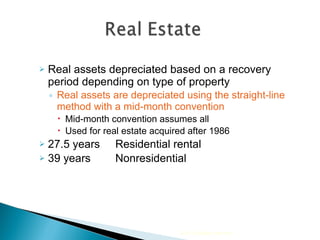

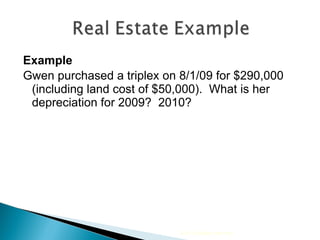

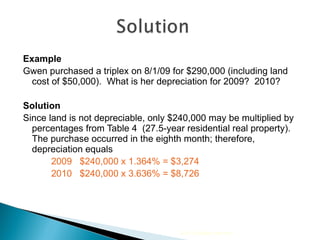

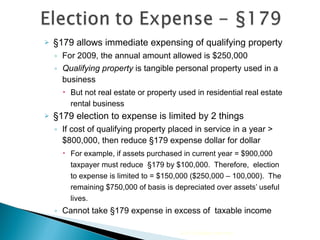

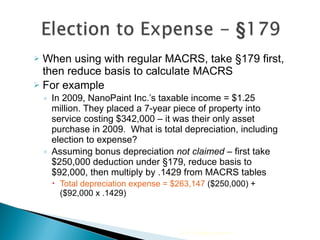

- Depreciation allows taxpayers to allocate the cost of assets over their useful lives using methods like straight-line or MACRS, which provides accelerated depreciation schedules. Additional bonus

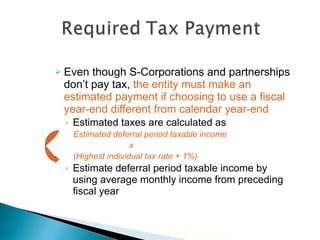

![Example San Juan River Expeditions Inc., an S-Corp, has taxable income of $360,000 for the year ended 9/30/09 with a three-month deferral period. The company made a $15,000 payment last year. What’s their current required tax payment? Solution The required tax payment = (Estimated taxable income in deferral period x 36%) - prior year’s tax payment Deferral period is 3 months (October – December) [($360,000/12) x 3 months] = $90,000 ($90,000 x 36%) = $32,400 ($32,400 - 15,000) = $17,400 estimated tax payment due in current year 2010 Cengage Learning](https://image.slidesharecdn.com/chapter7-100628220041-phpapp02/85/Chapter-7-6-320.jpg)

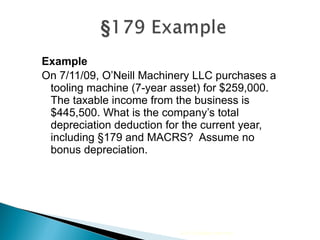

![Example On 7/11/09, O’Neill Machinery LLC purchases a tooling machine (7-year asset) for $259,000. The taxable income from the business is $445,500. What is the company’s total depreciation deduction for the current year, including §179 and MACRS? Assume no bonus depreciation. Solution Asset purchases didn’t exceed $800,000, so no reduction in §179 availability: Cost $259,000 §179 expense ( 250,000) Adjusted depreciable basis 9,000 x Table % 14.29% MACRS $1,286 Total depreciation= $251,286 $250,000 [§179] + $1,286 [MACRS] 2010 Cengage Learning](https://image.slidesharecdn.com/chapter7-100628220041-phpapp02/85/Chapter-7-28-320.jpg)