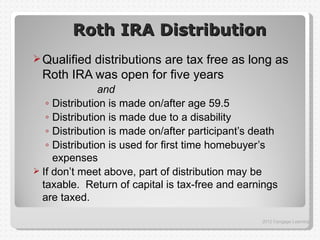

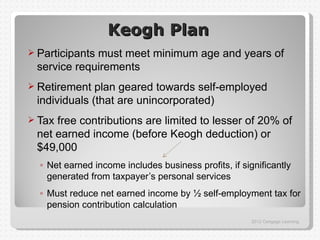

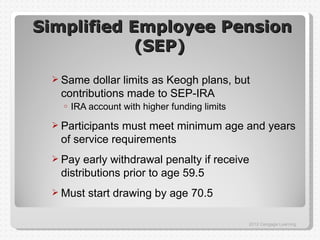

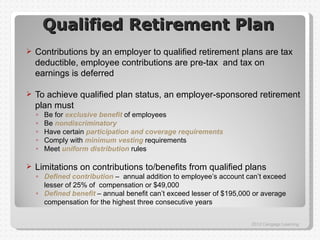

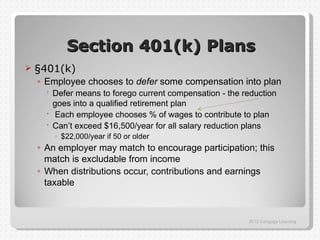

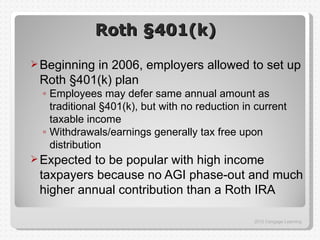

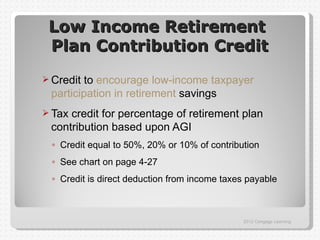

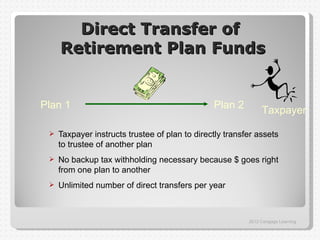

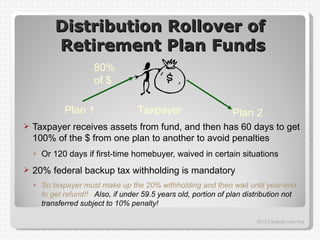

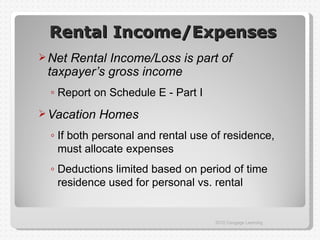

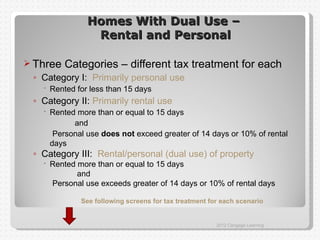

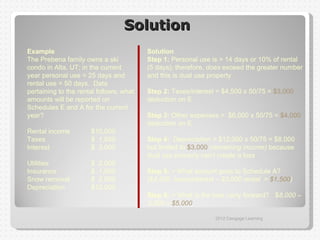

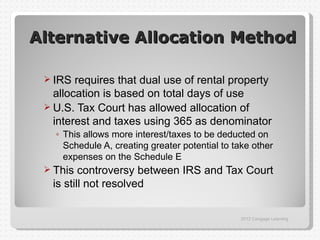

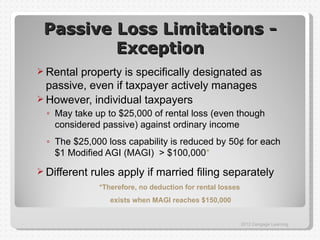

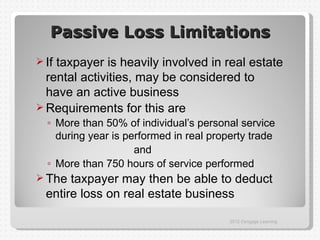

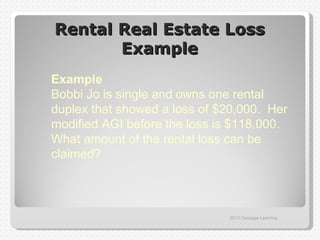

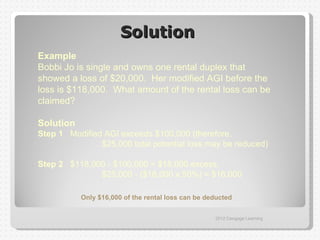

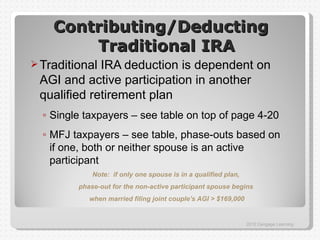

This document discusses various tax rules related to business income and expenses, including rental properties, passive income/losses, retirement plans, and itemized deductions. It provides learning objectives and then covers topics like rental income treatment, the dual use of vacation homes for personal and rental purposes, passive loss limitations, self-employed health insurance deductions, and contribution and distribution rules for IRAs and retirement plans. Examples are provided to illustrate concepts like calculating the deductible portion of rental real estate losses.

![Solution

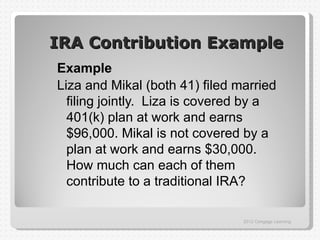

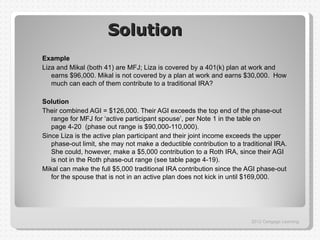

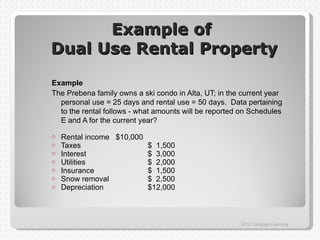

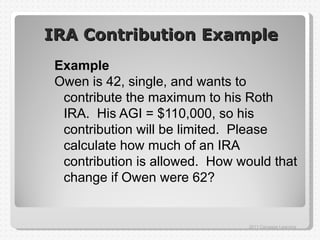

Example

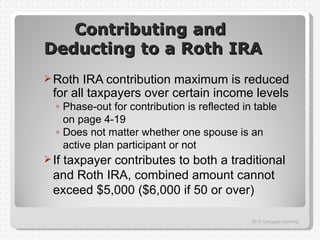

Owen is 42, single, and wants to contribute the maximum to his

Roth IRA. His AGI = $110,000, so his contribution will be

limited. How much of an IRA contribution is allowed? How

would that change if Owen were 62?

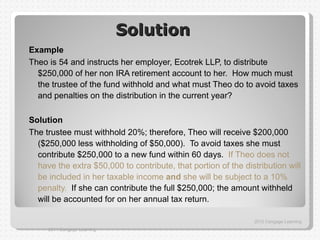

Solution

Look at the phase-out chart on p. 4-19. The denominator to the

calculation is the range of the phase-out amounts*

* $122,000 - $107,000

[($122,000 – $110,000)/$15,000] x $5,000 = $4,000 Roth IRA

contribution

If he were 62:

[($122,000 – $110,000)/$15,000] x $6,000 = $4,800 Roth IRA

contribution

2012 Cengage Learning](https://image.slidesharecdn.com/itfippch042012final-120420001503-phpapp01/85/Itf-ipp-ch04_2012_final-27-320.jpg)