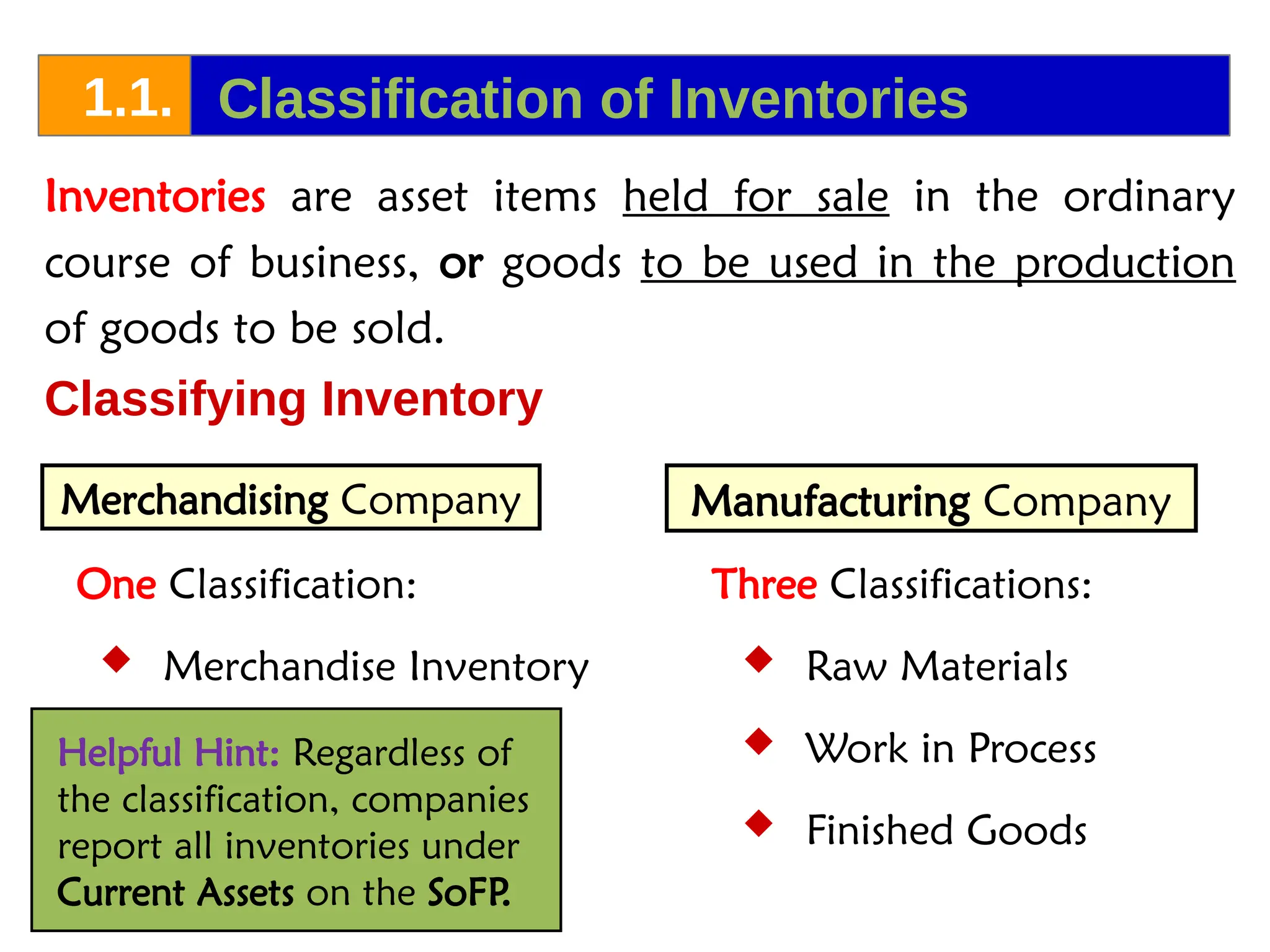

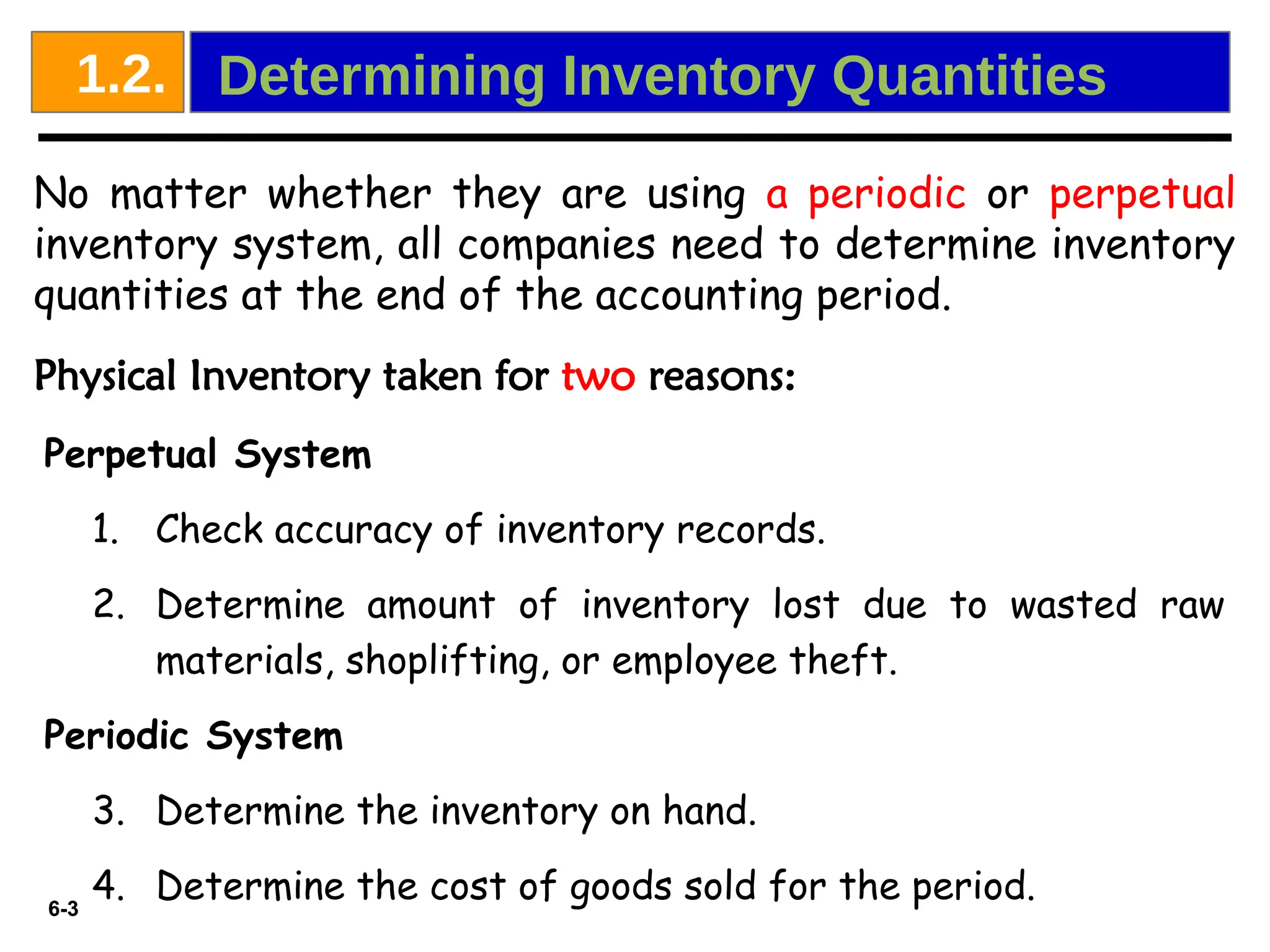

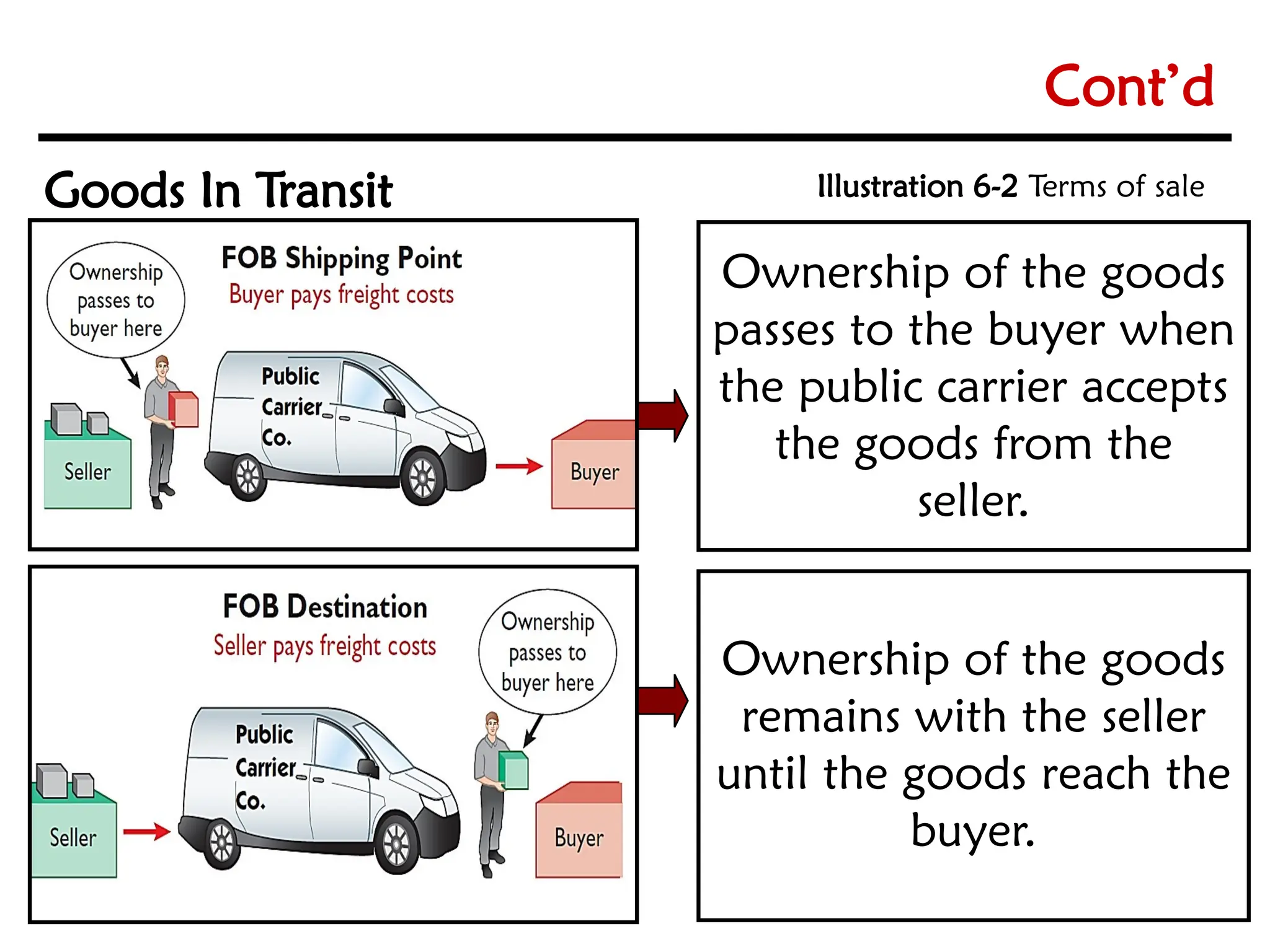

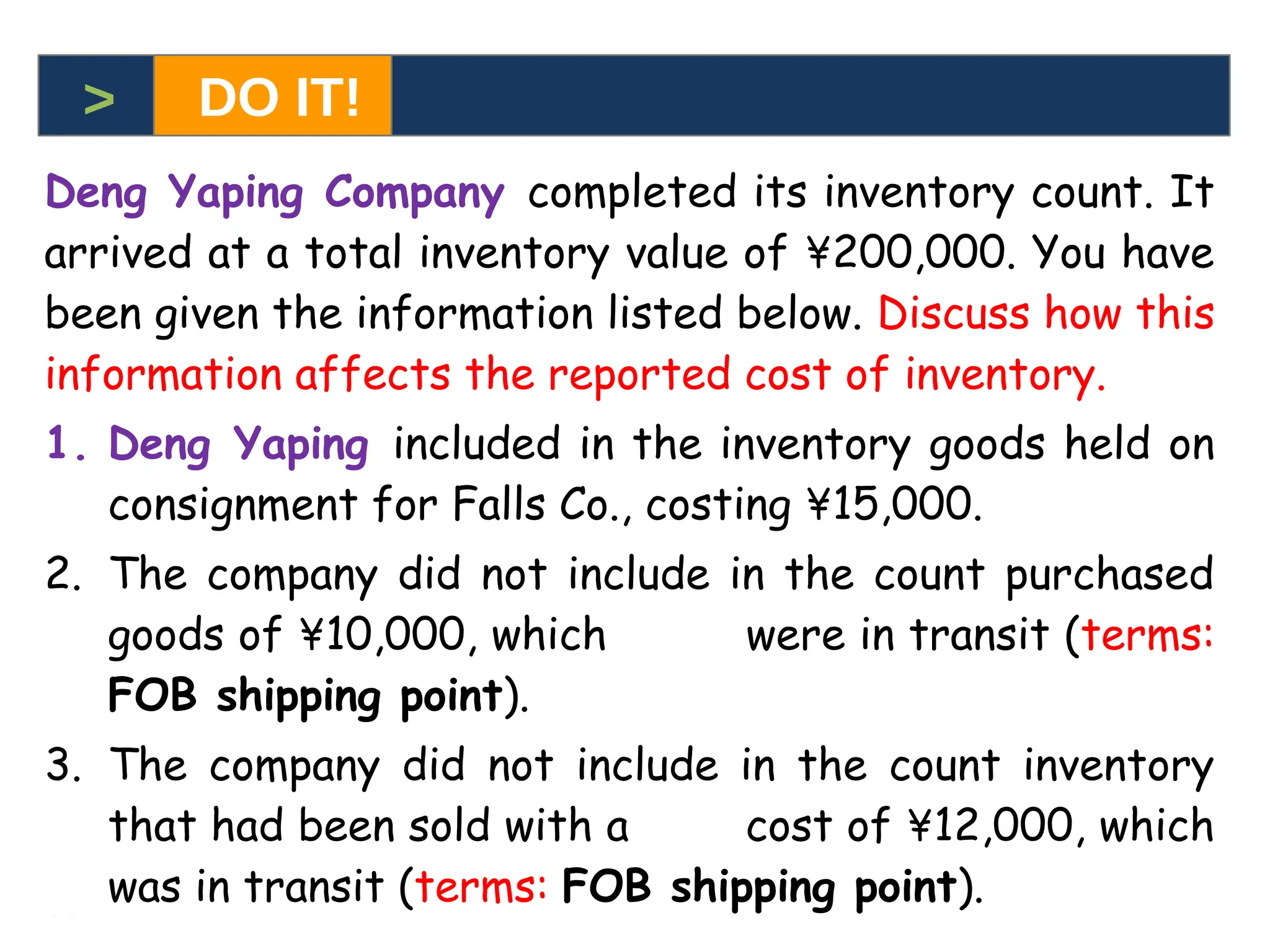

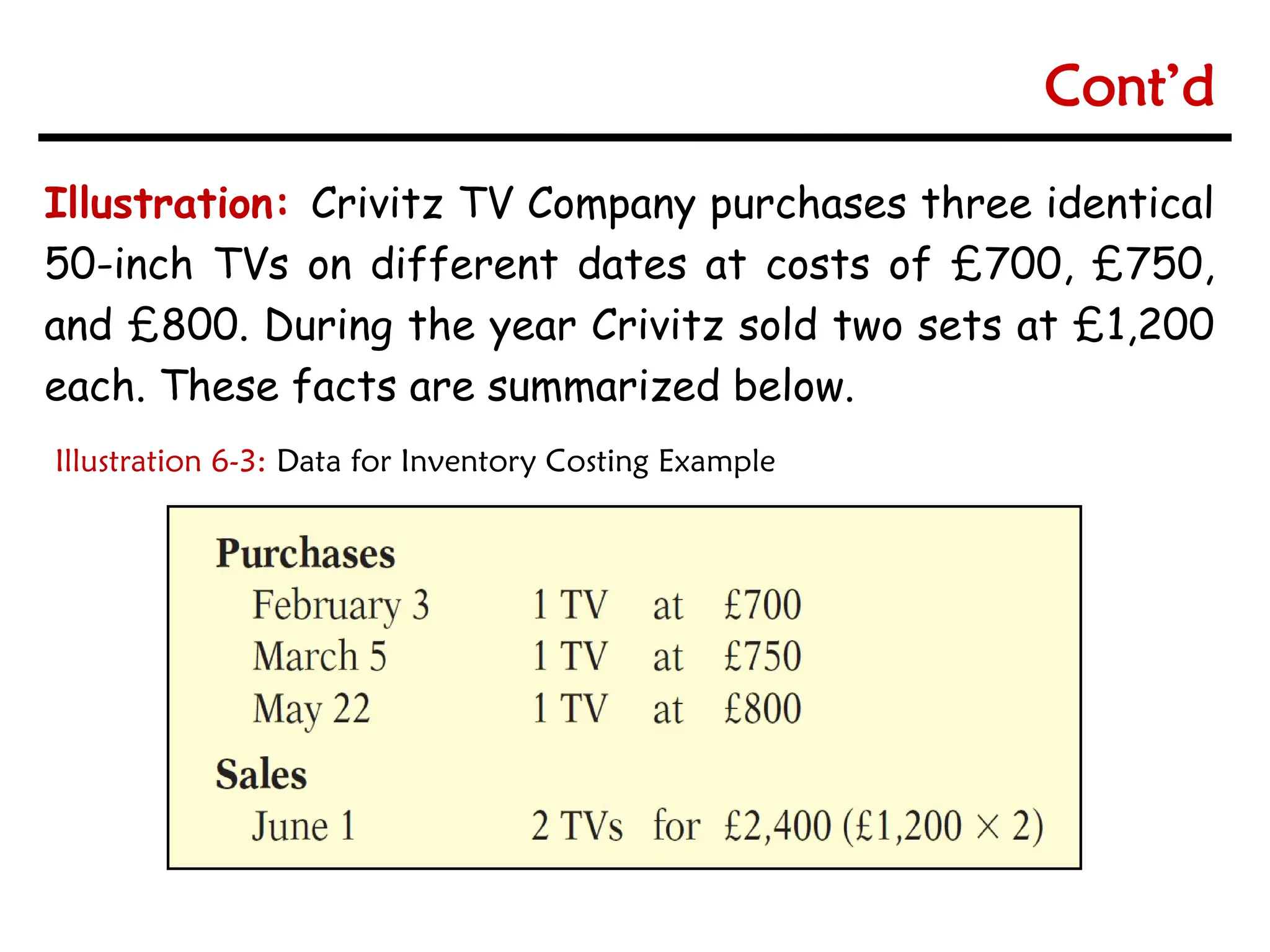

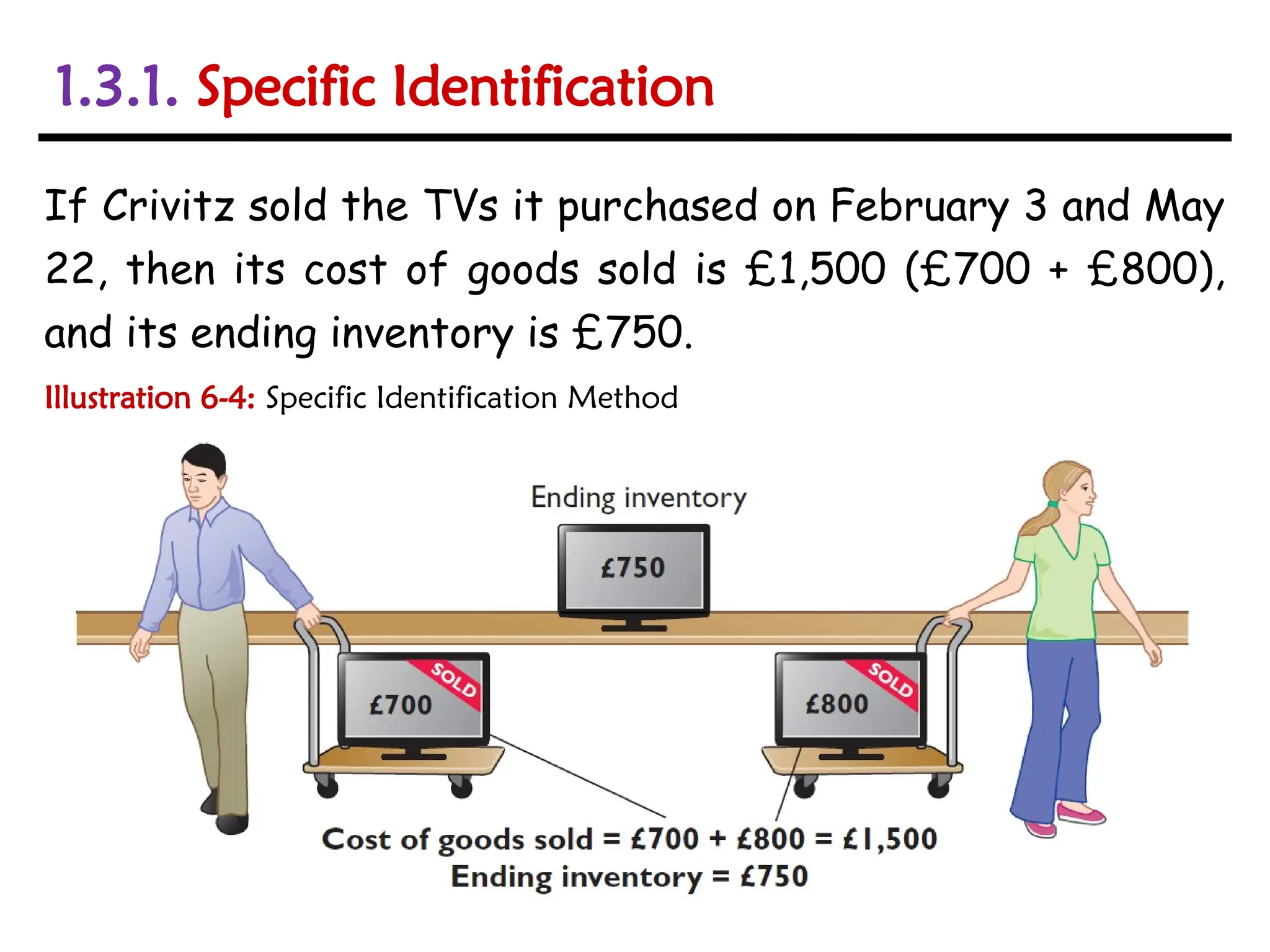

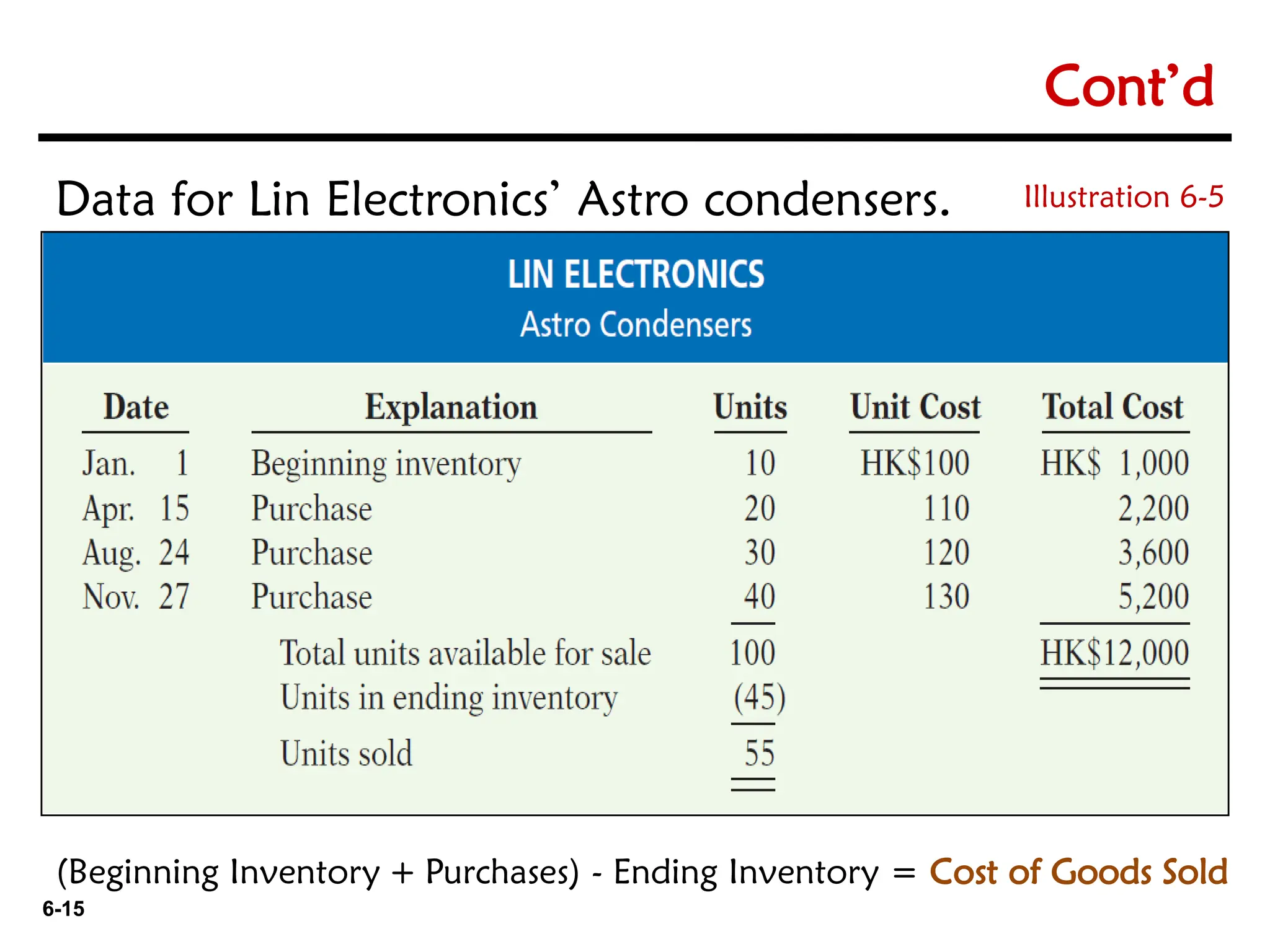

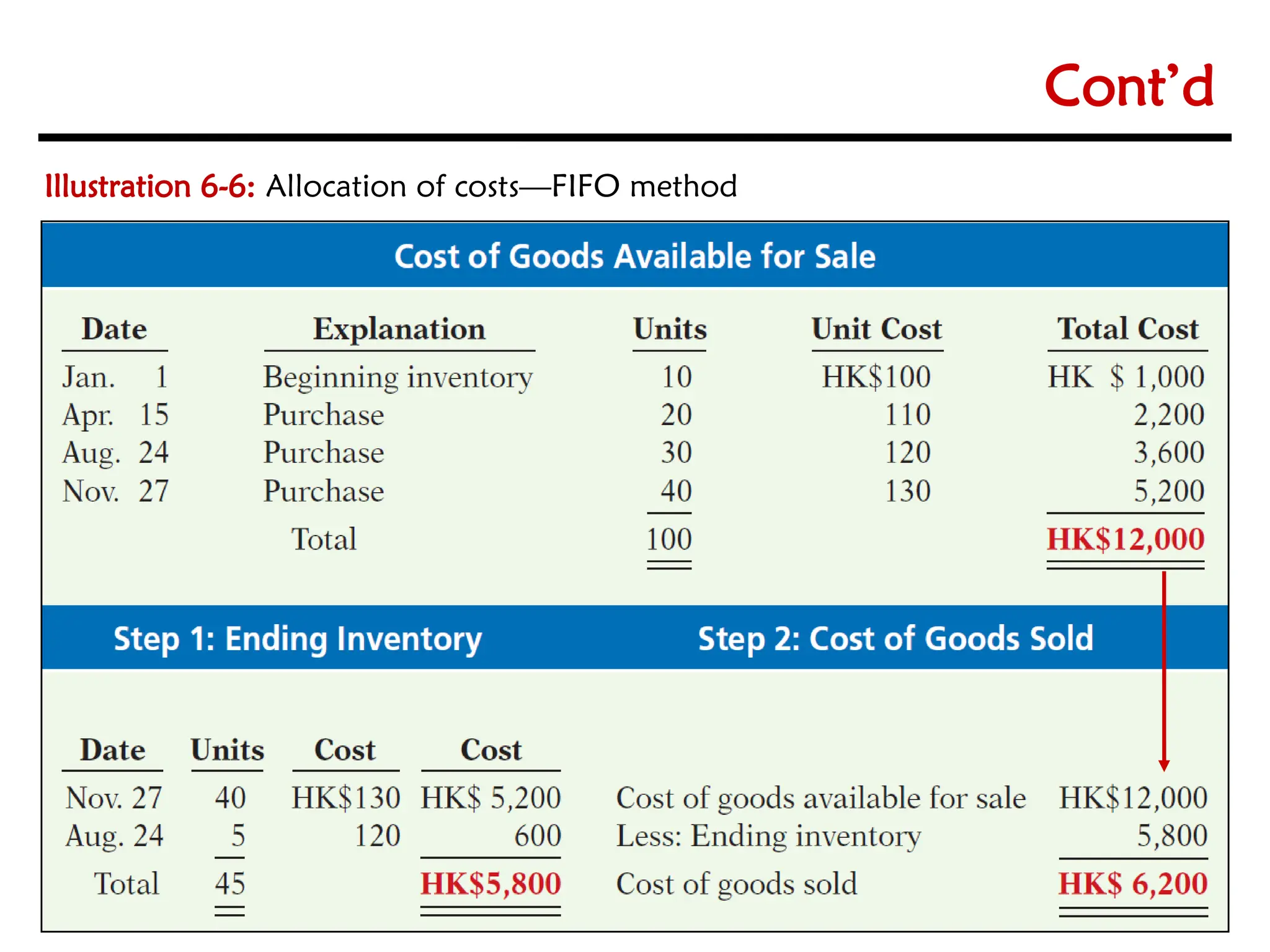

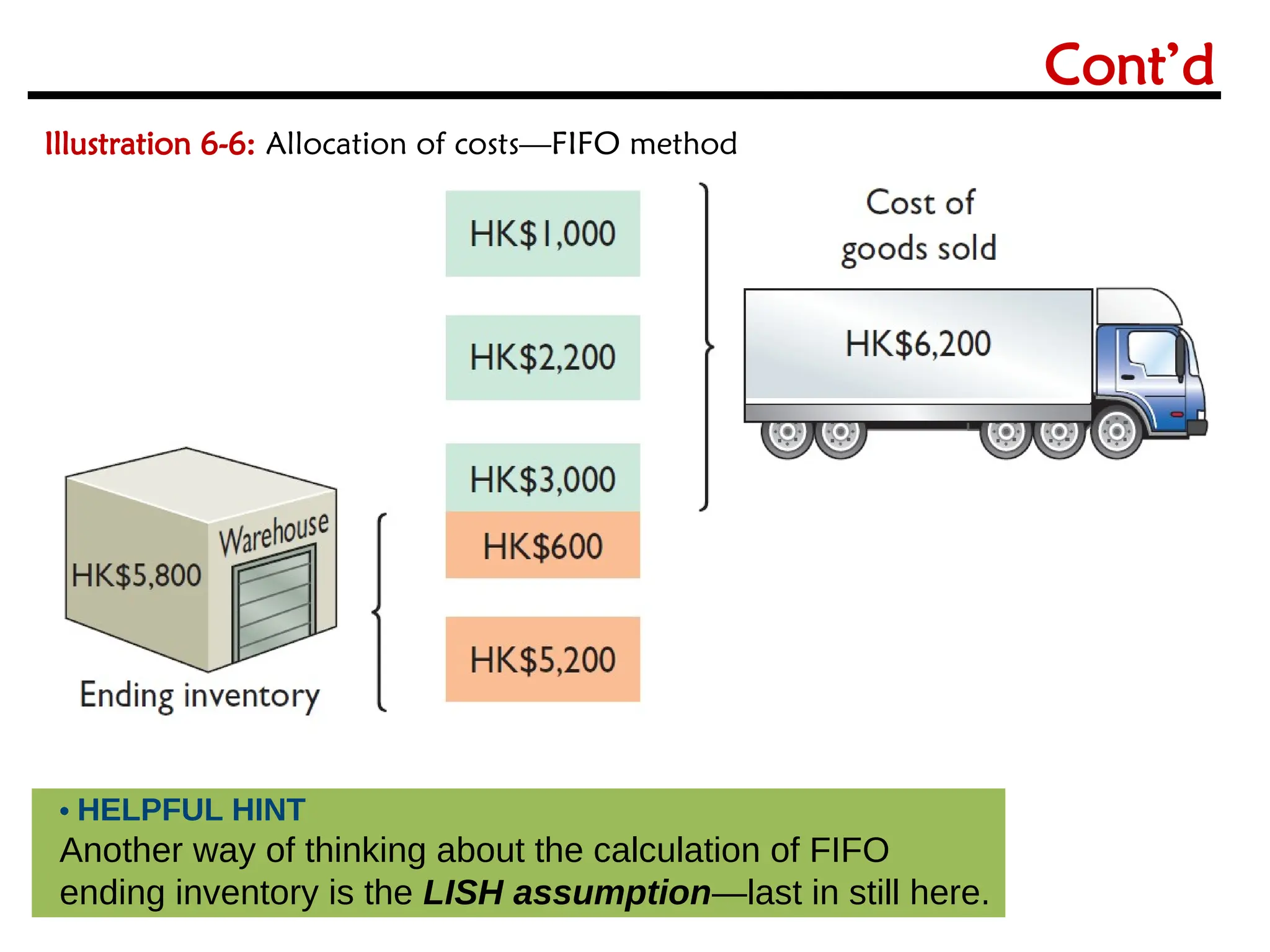

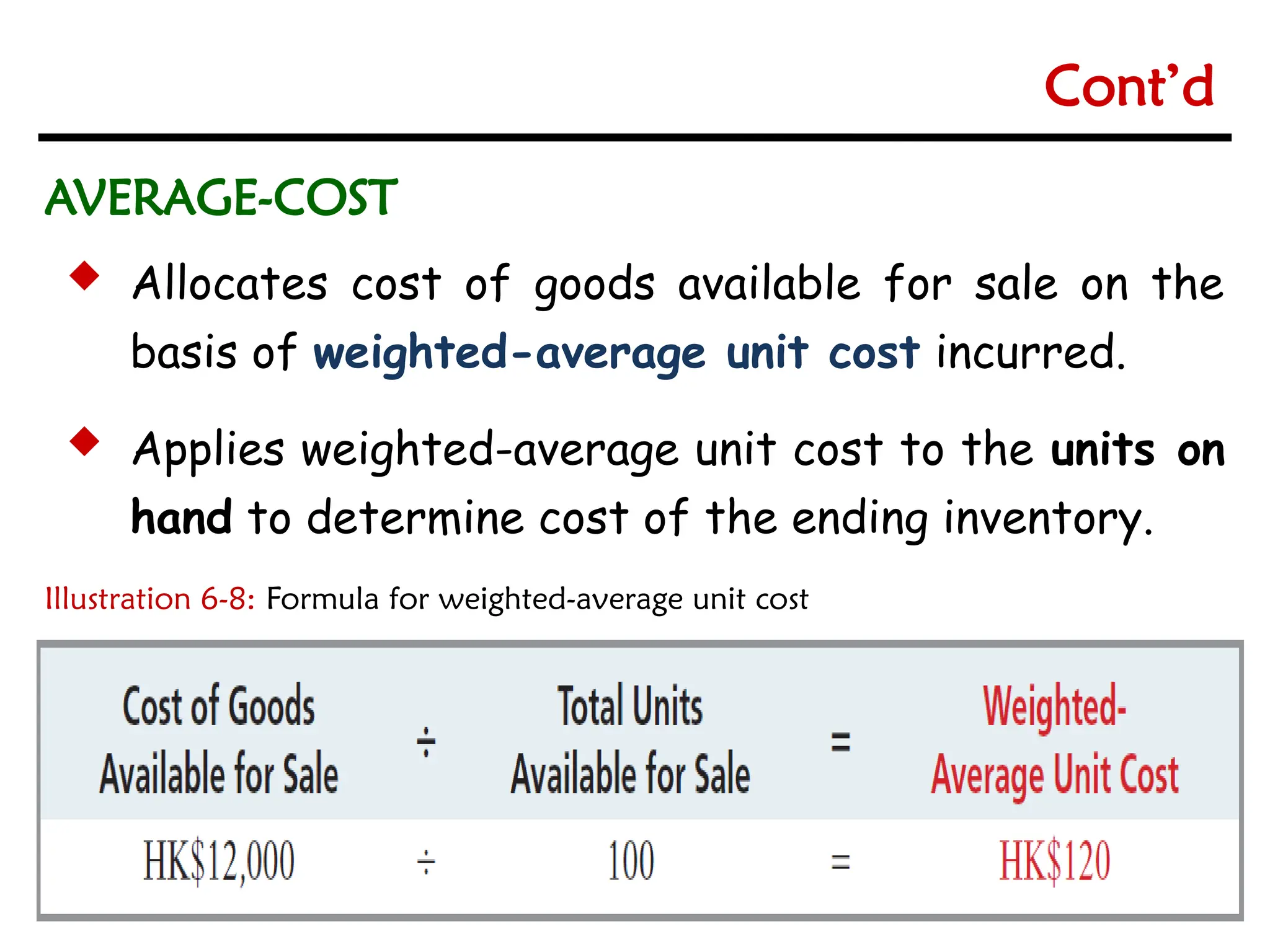

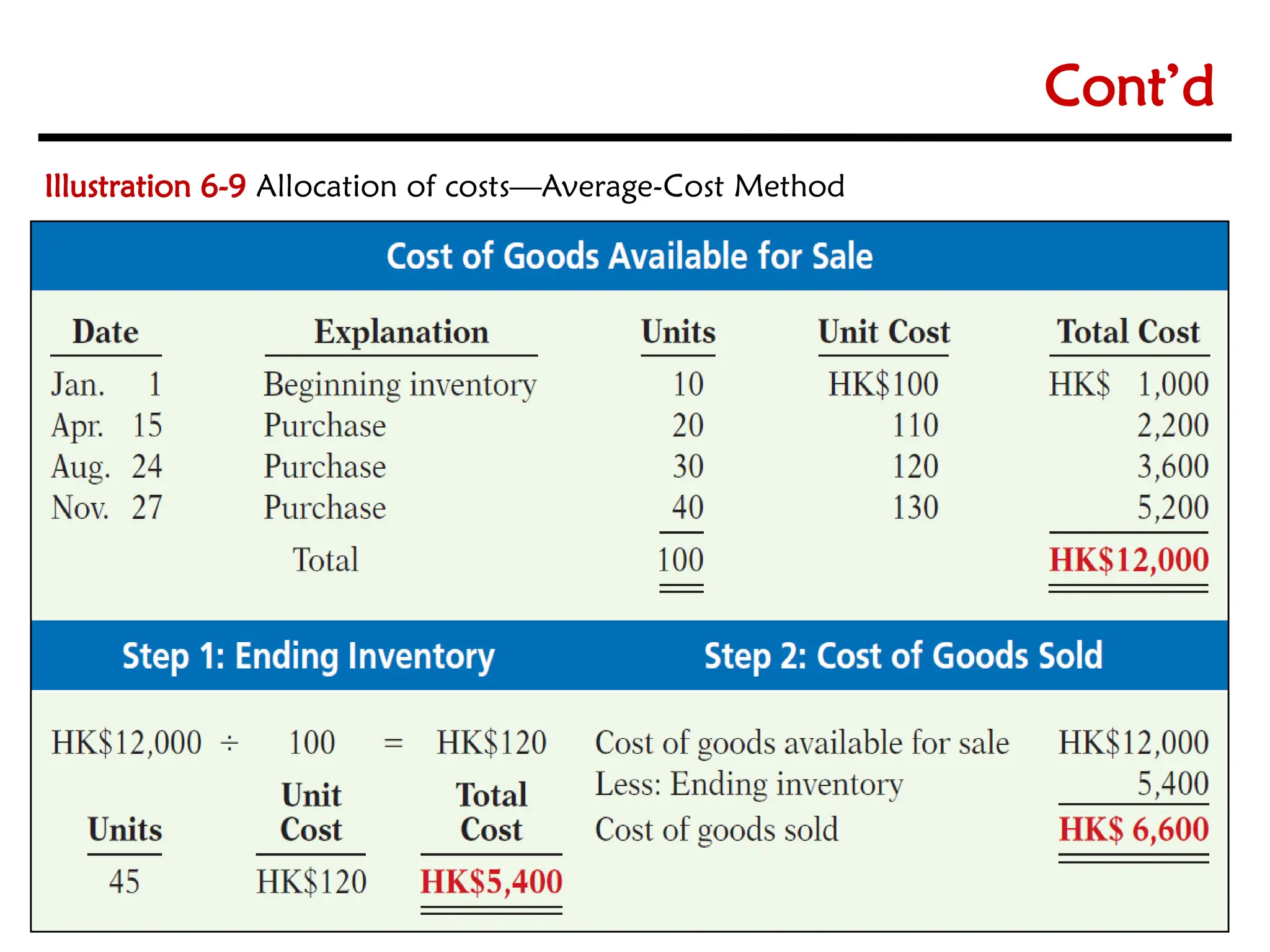

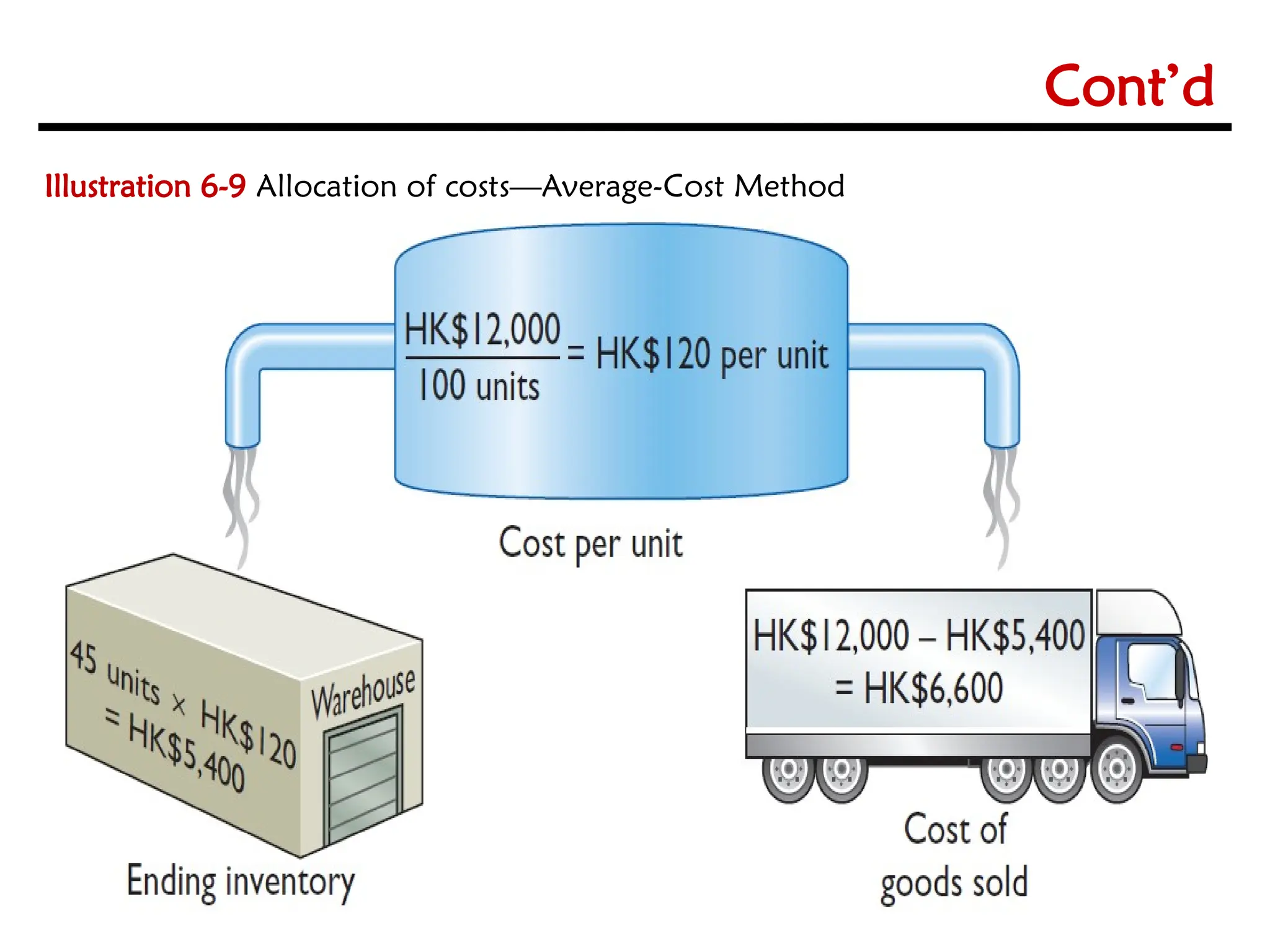

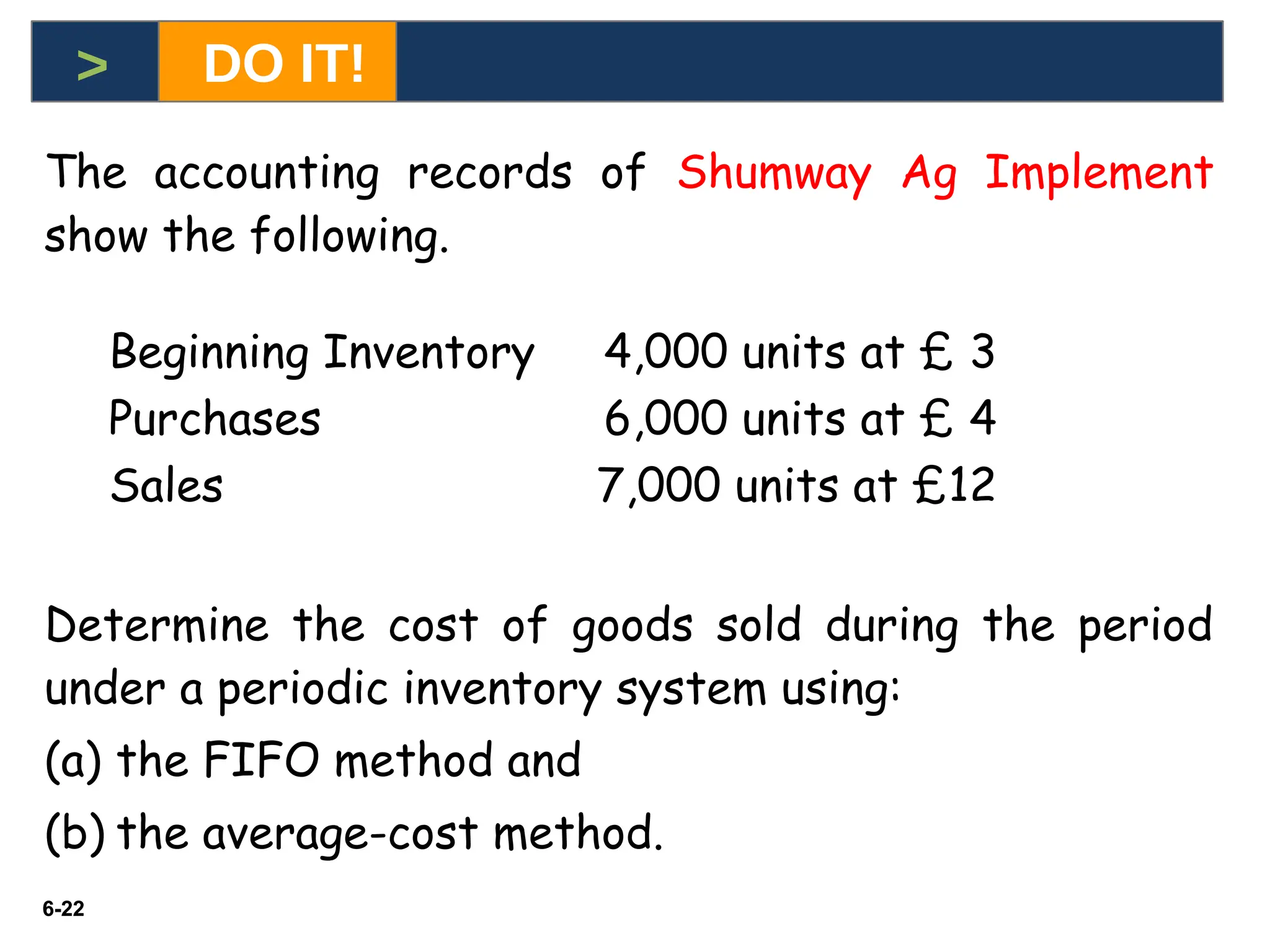

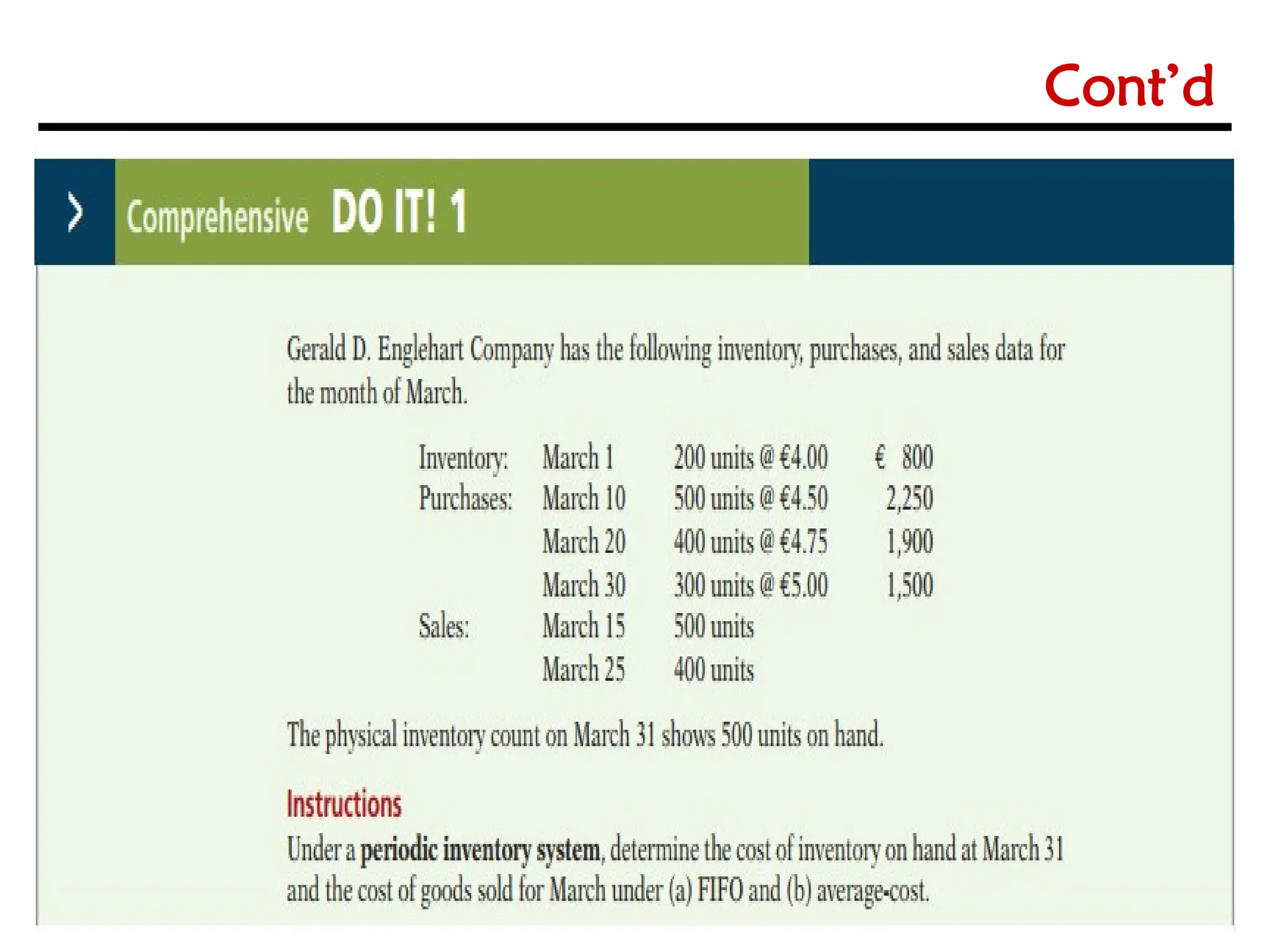

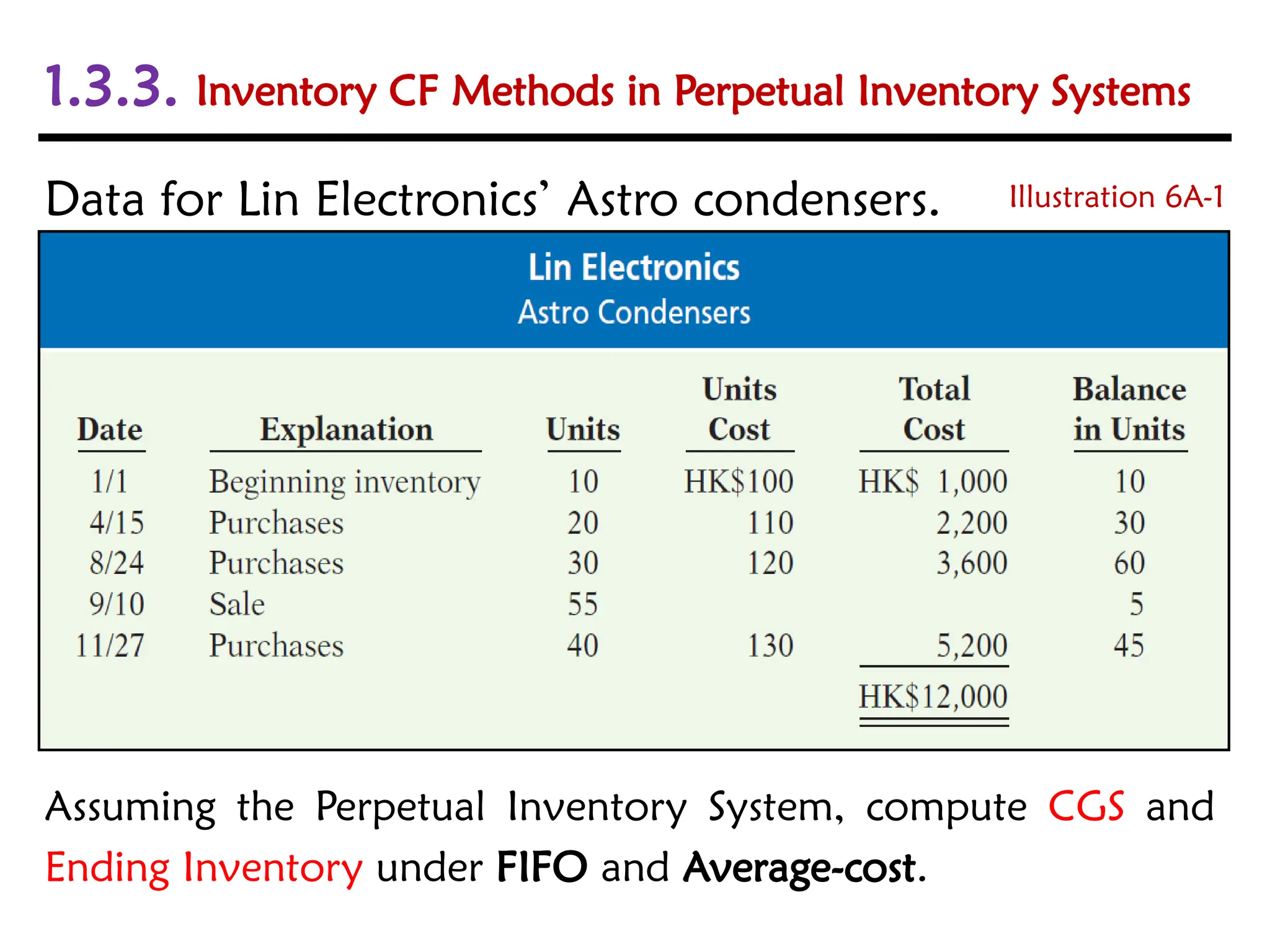

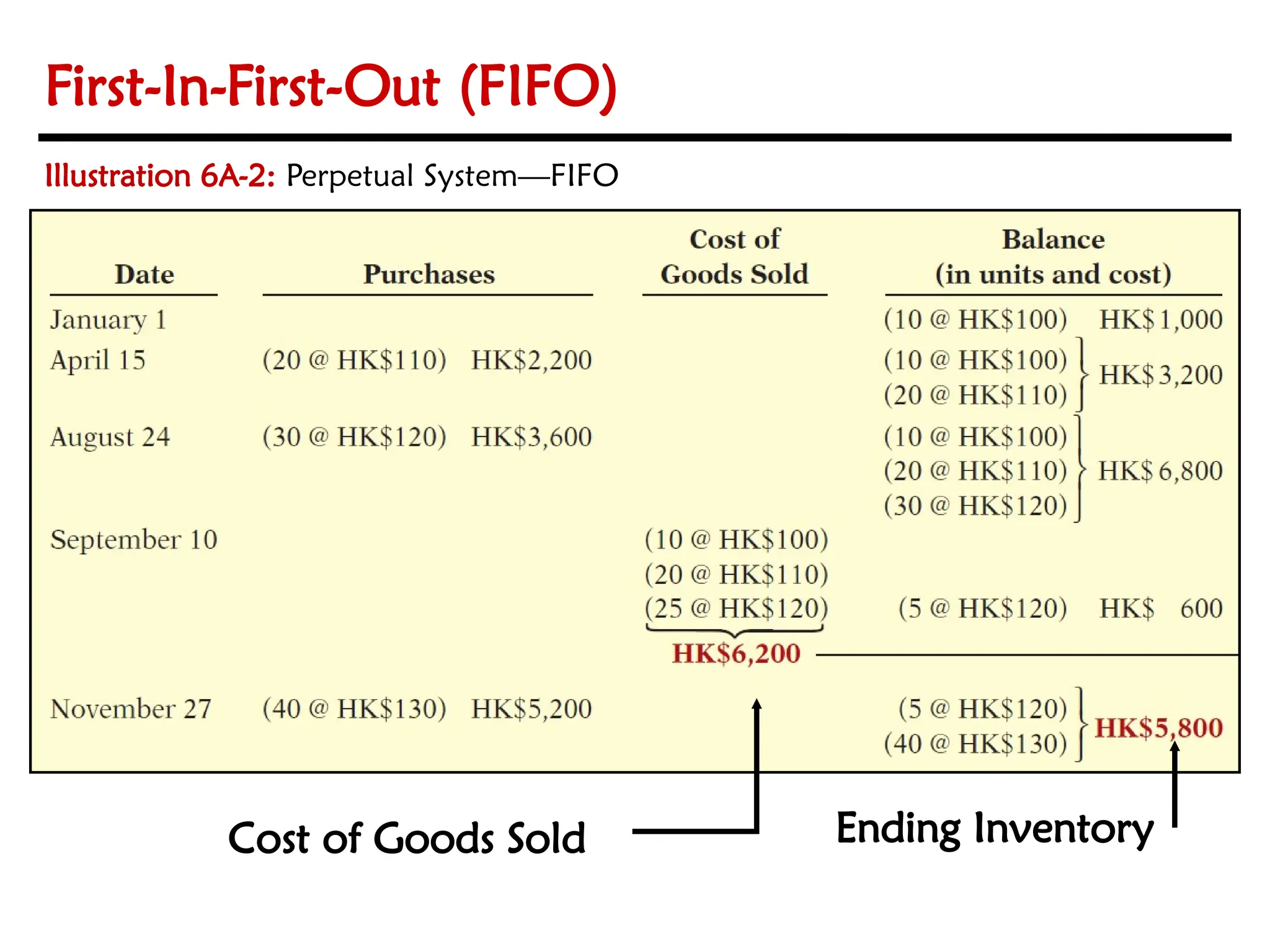

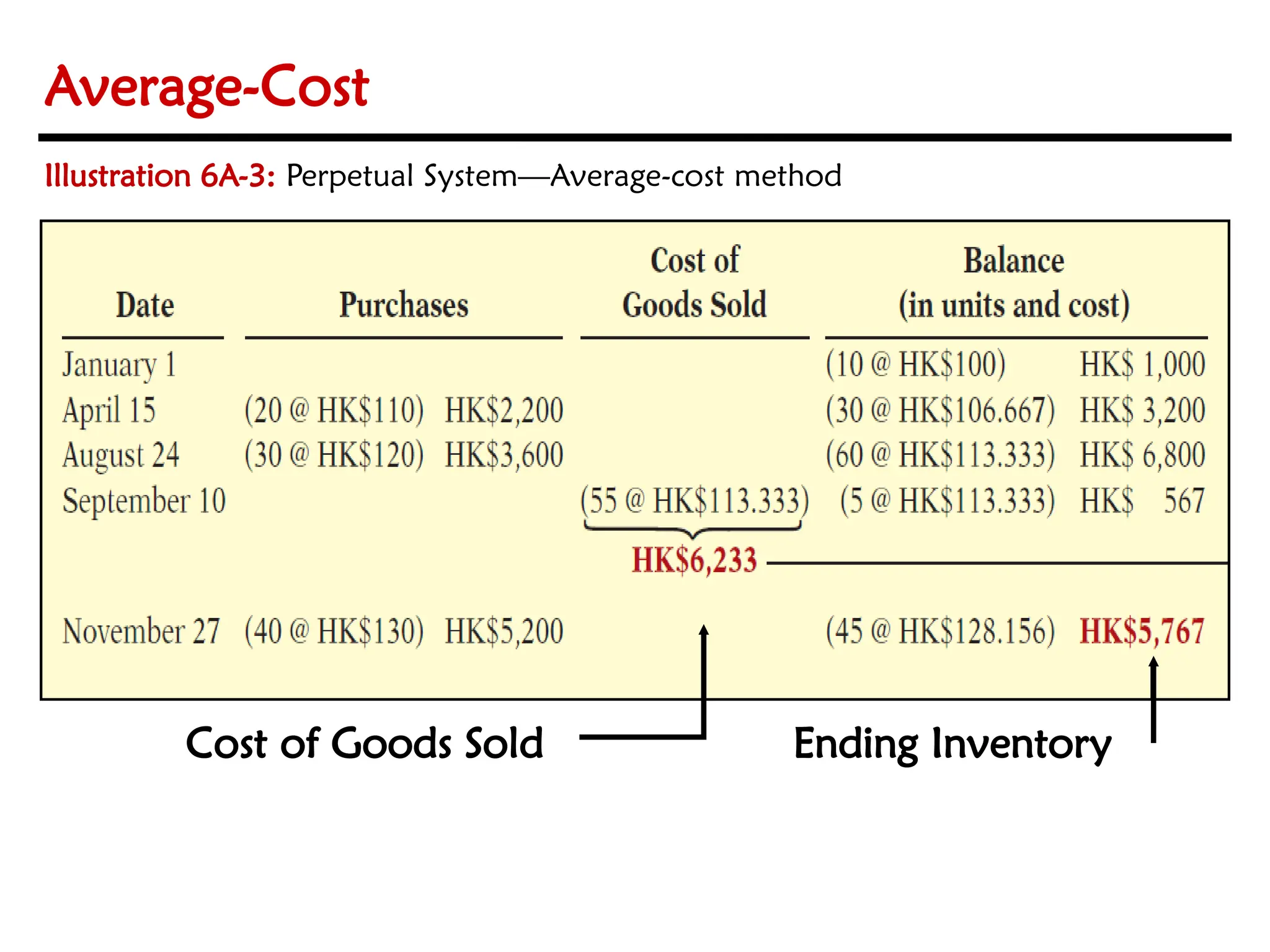

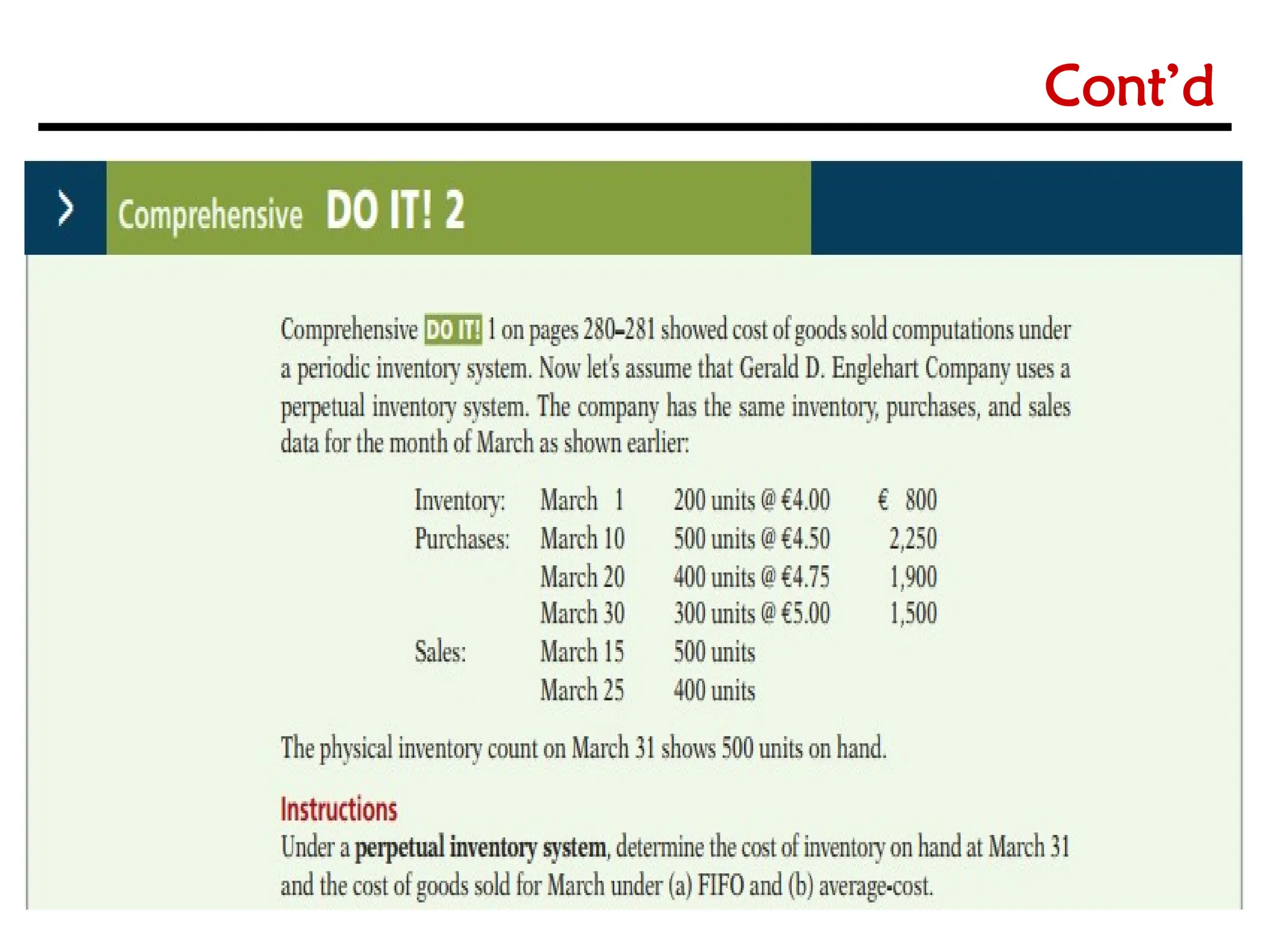

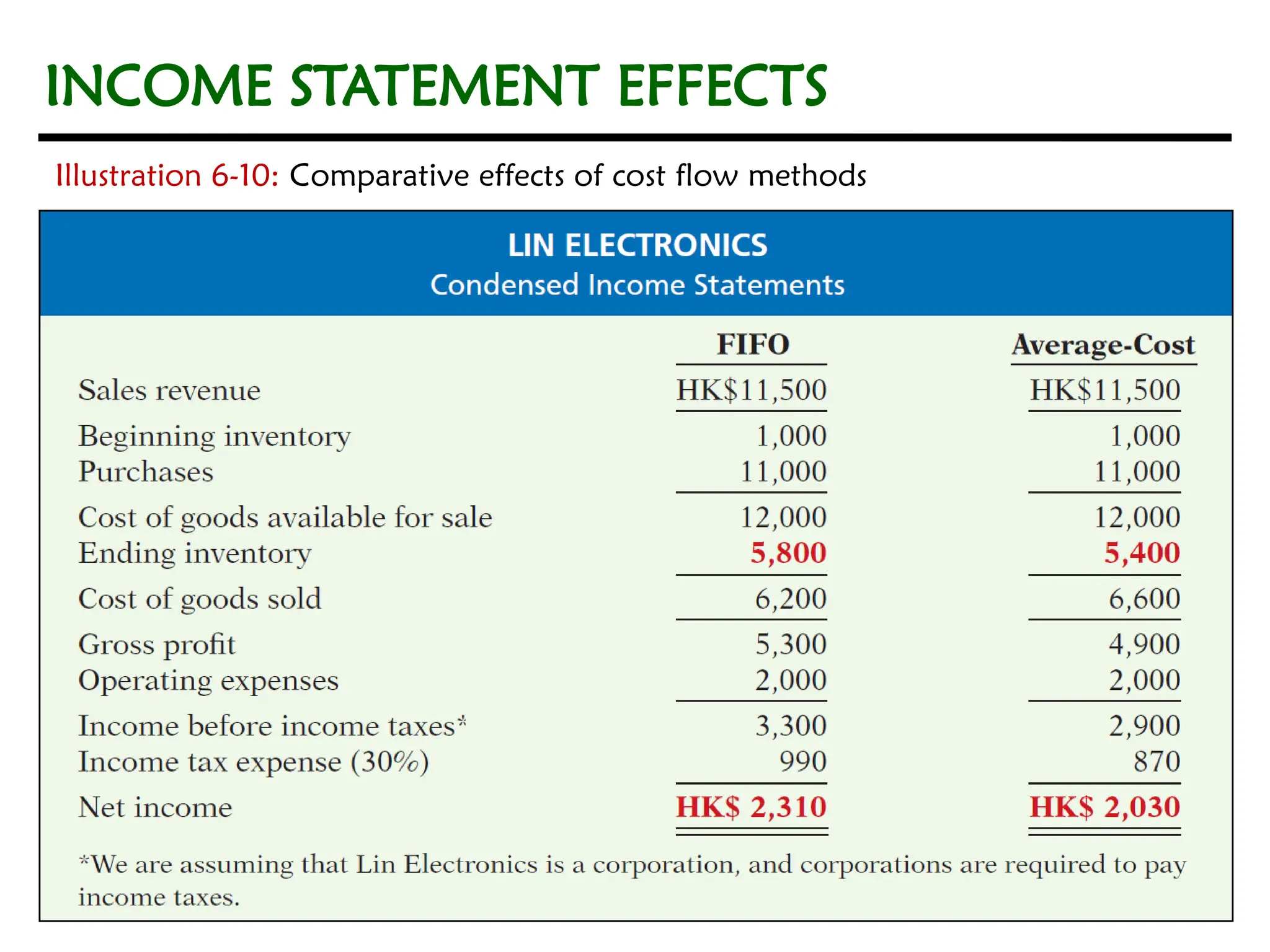

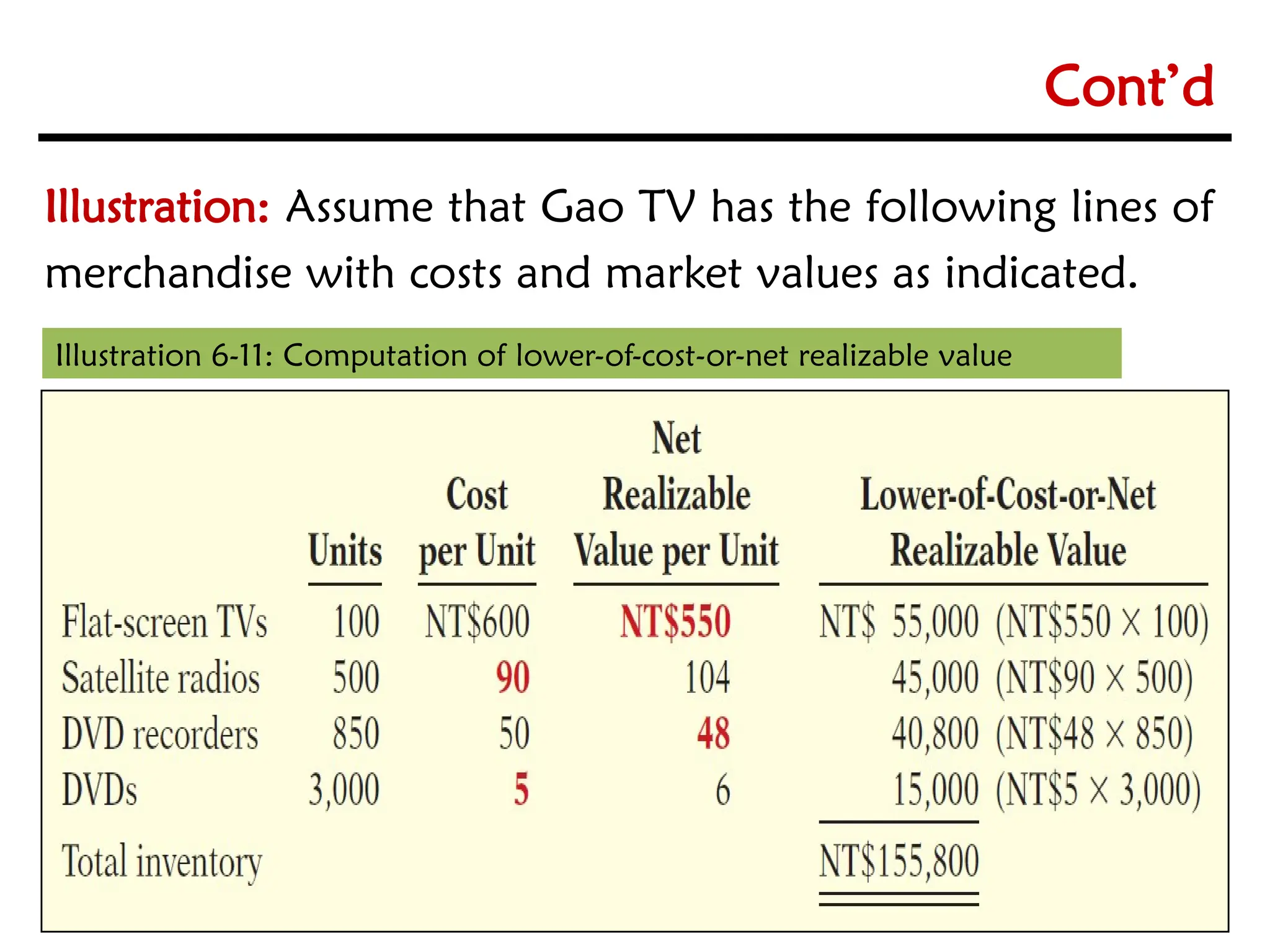

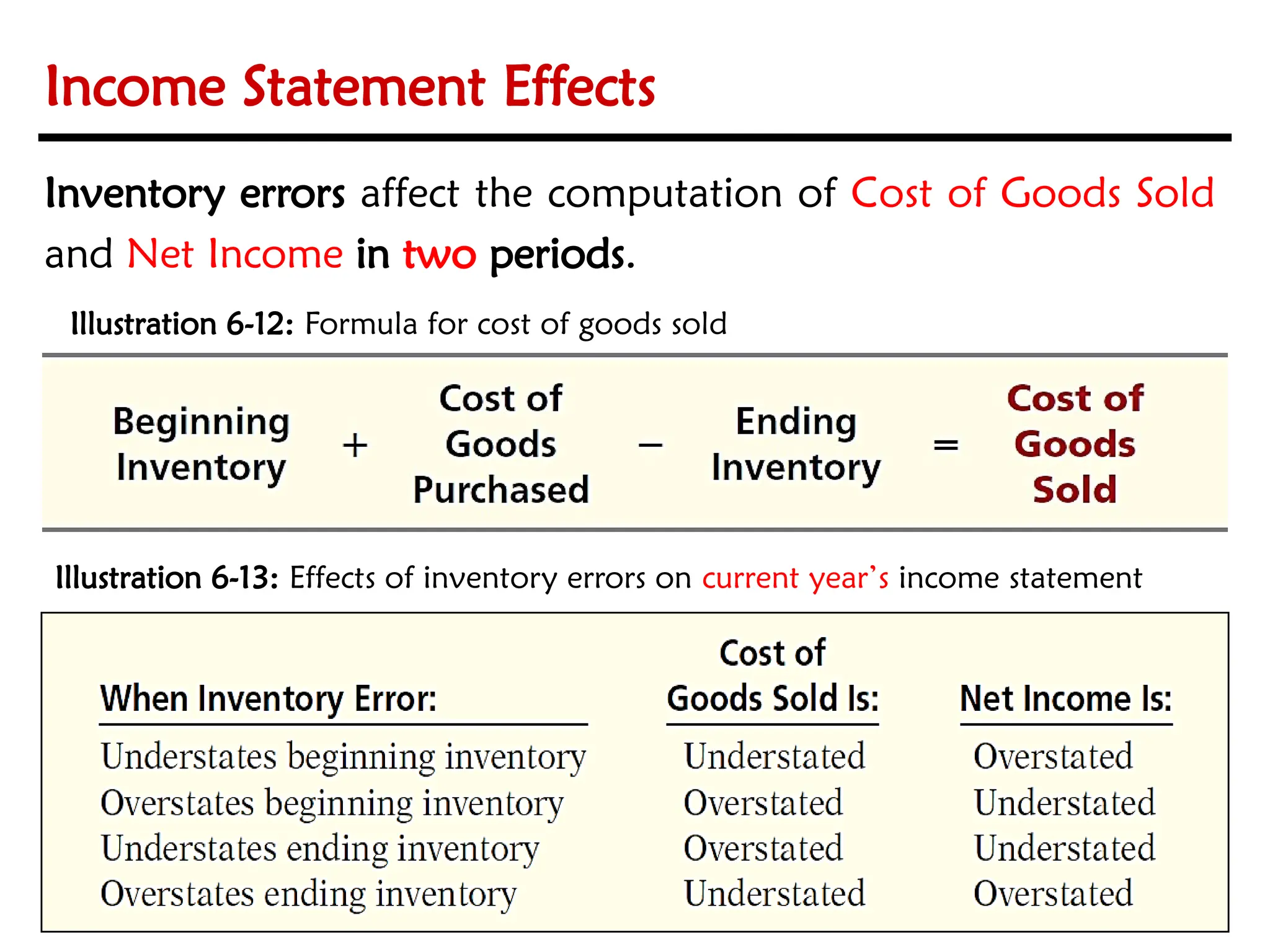

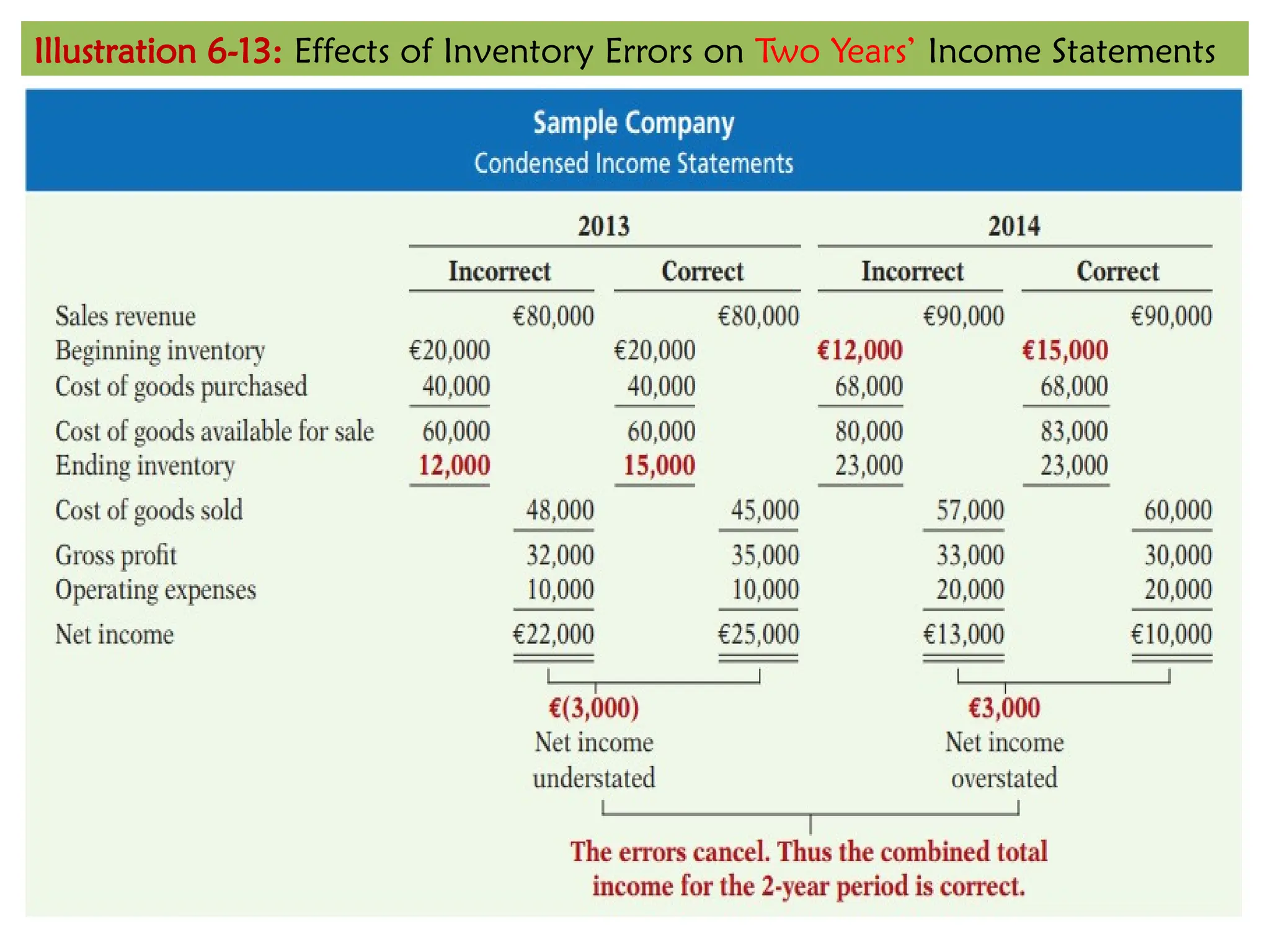

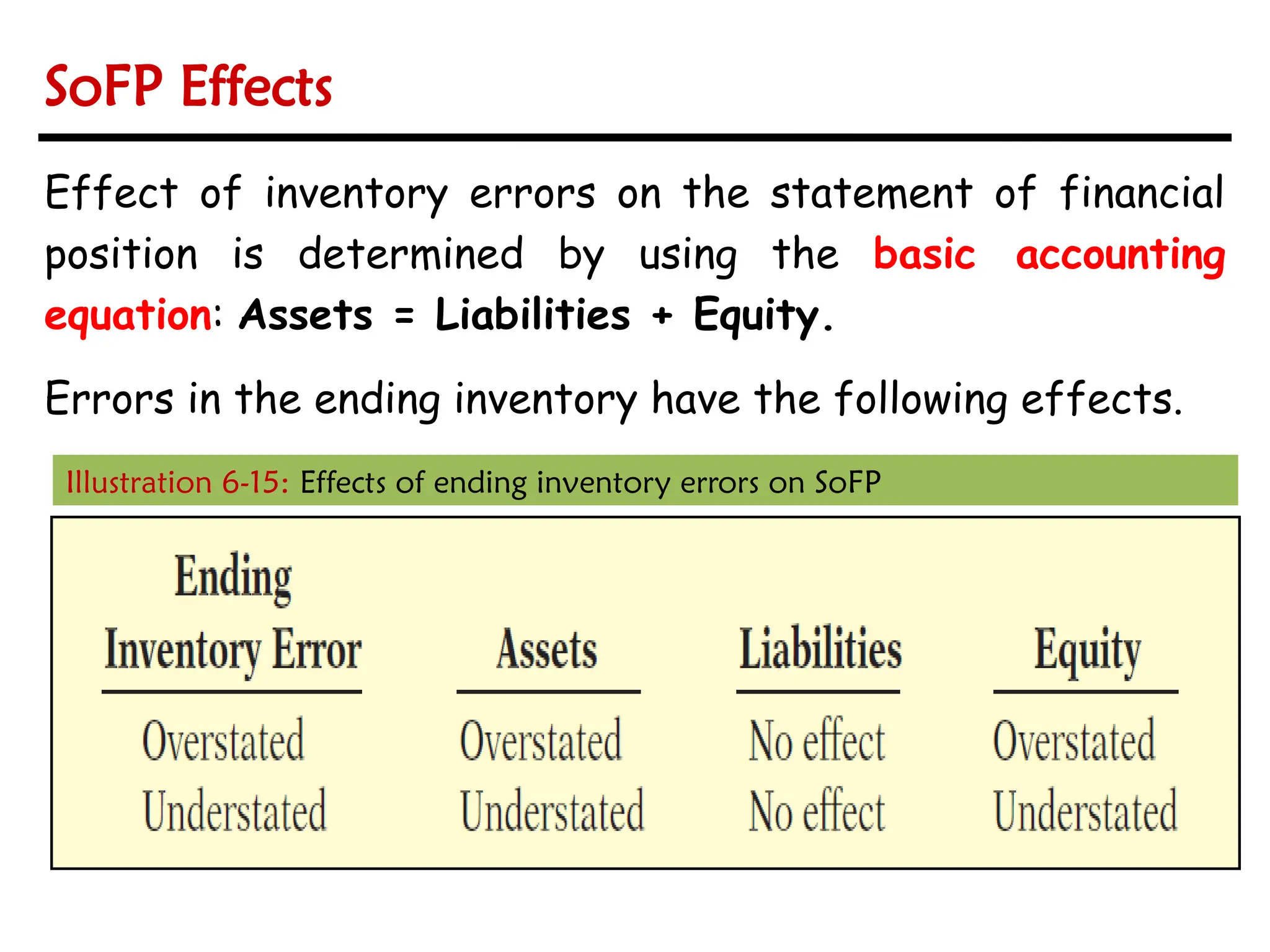

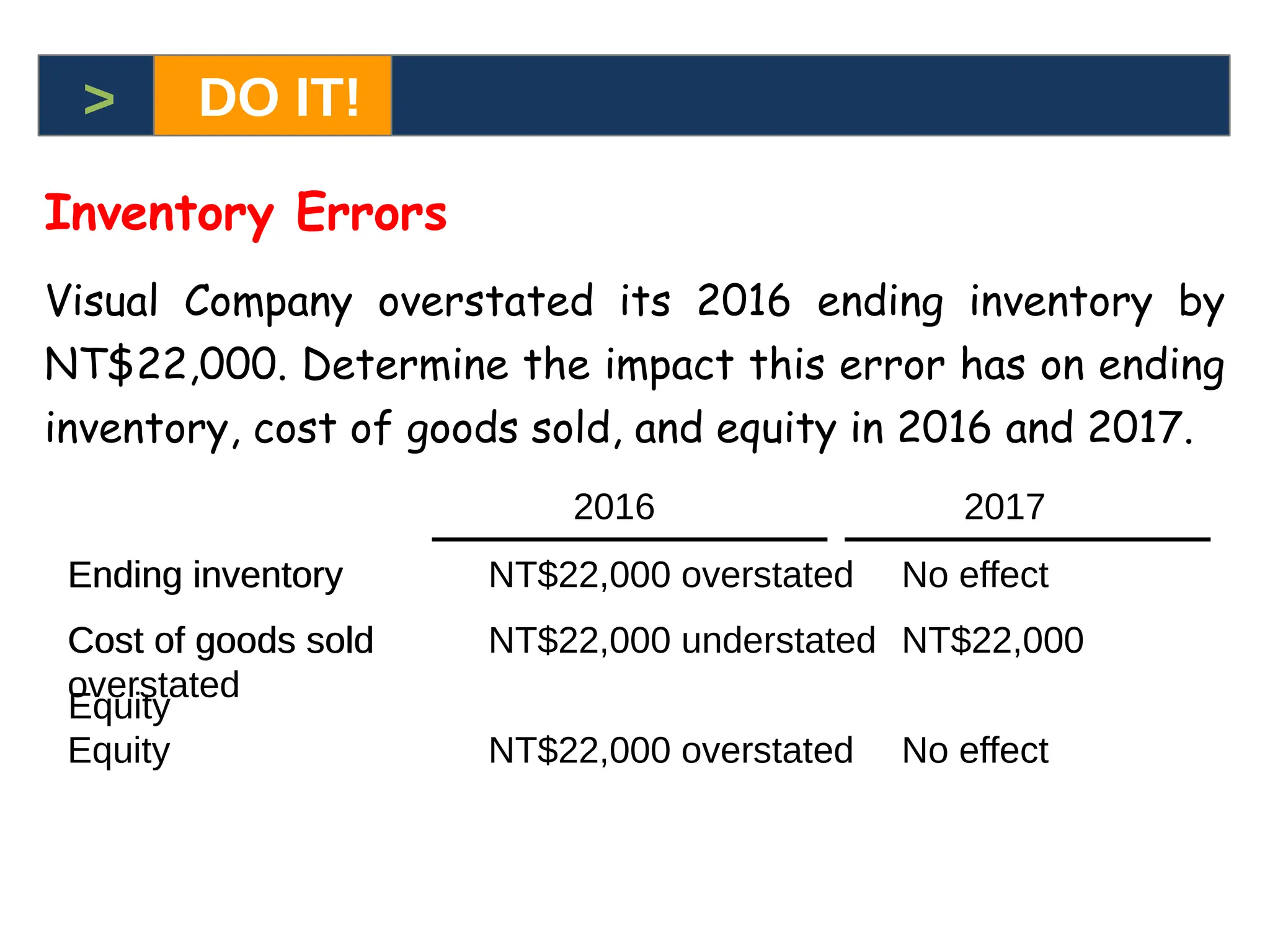

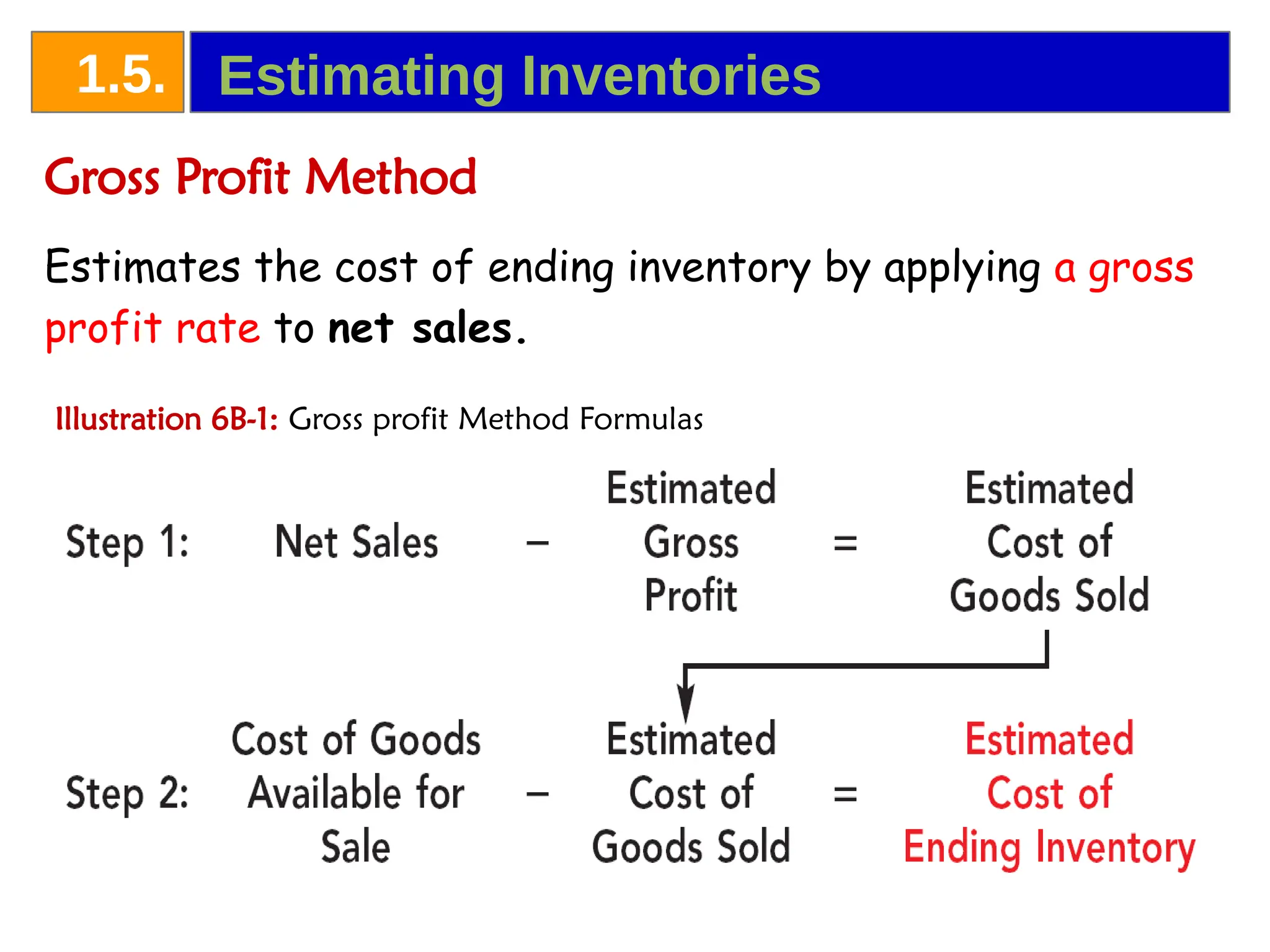

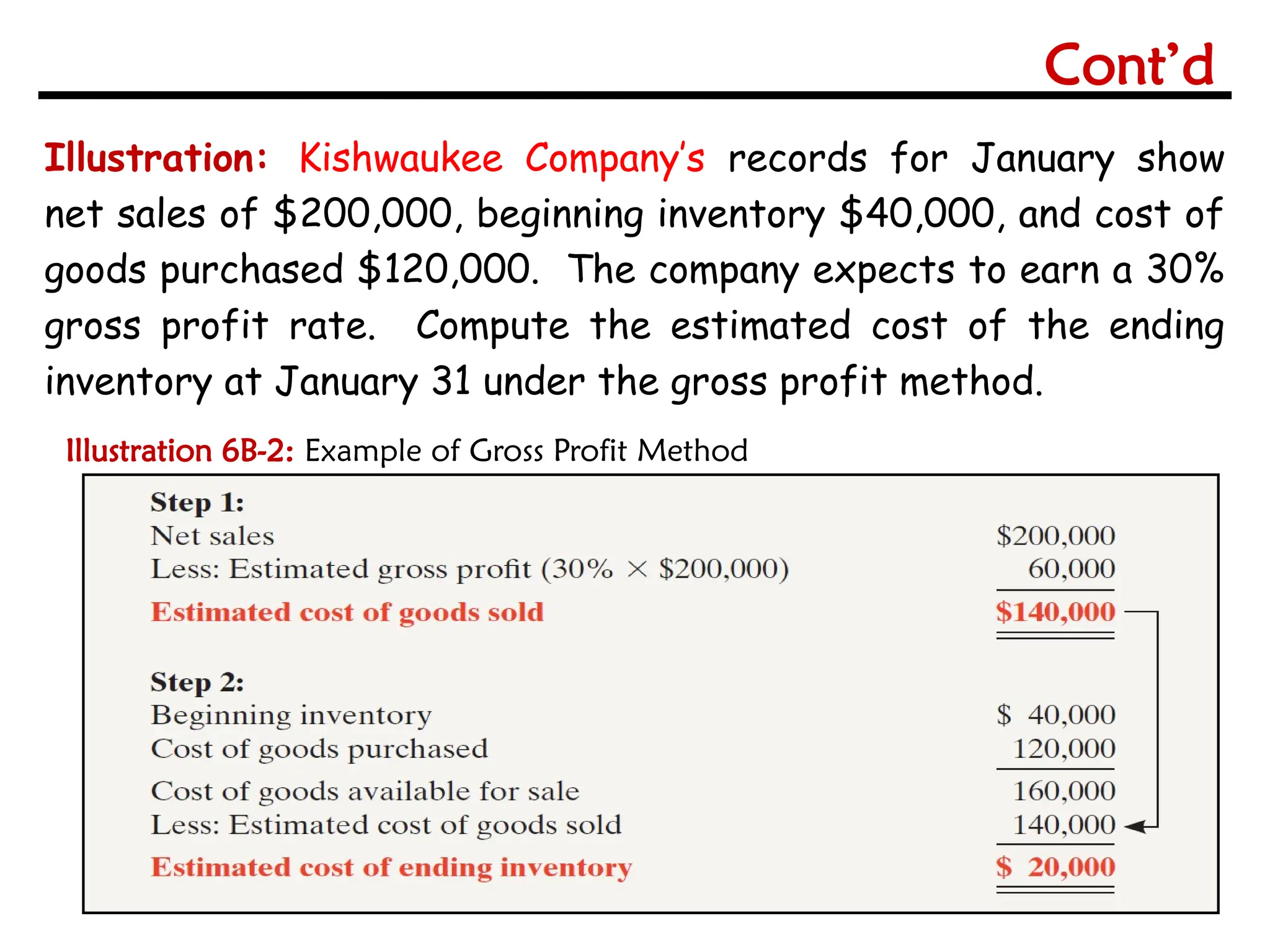

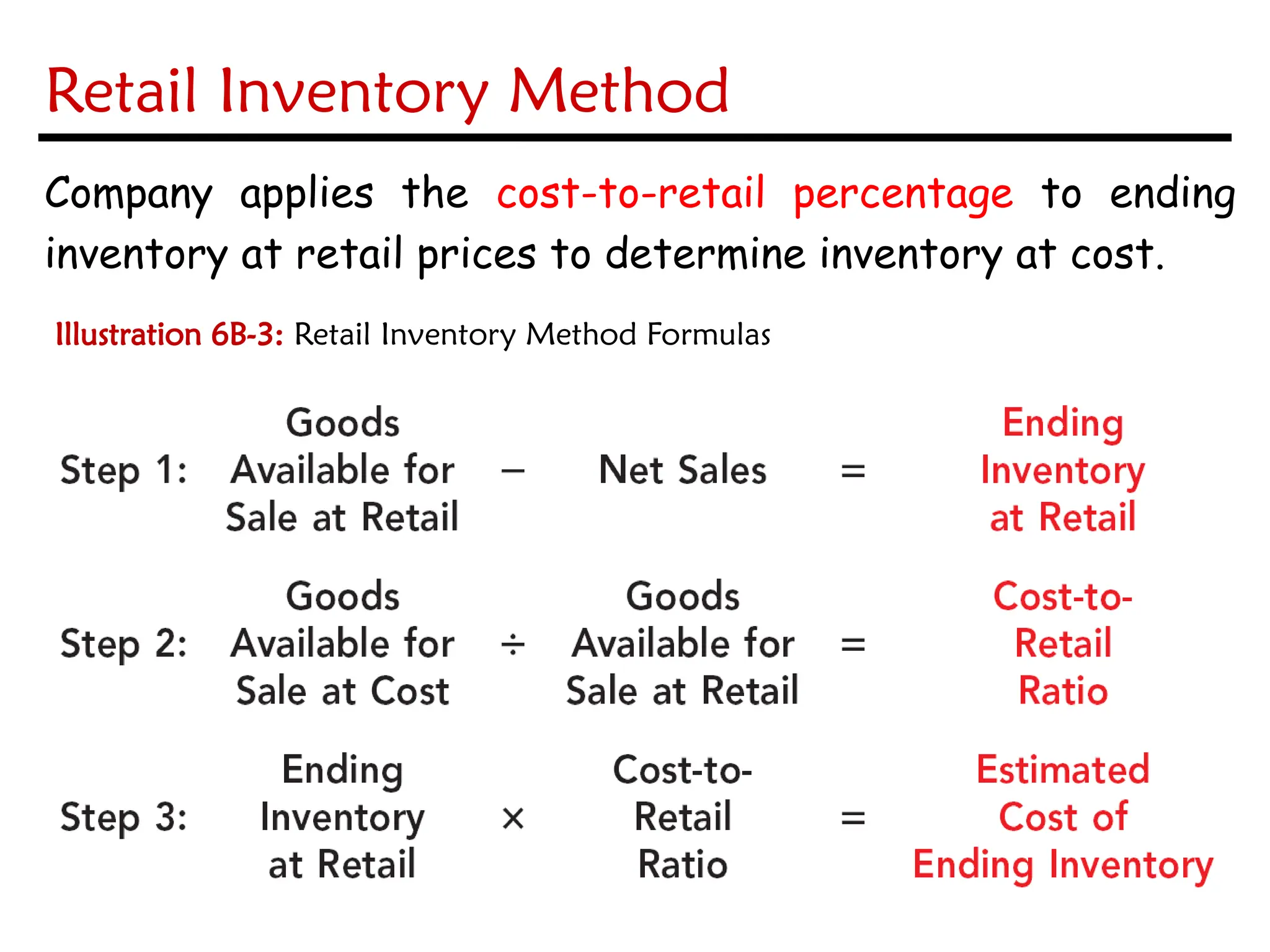

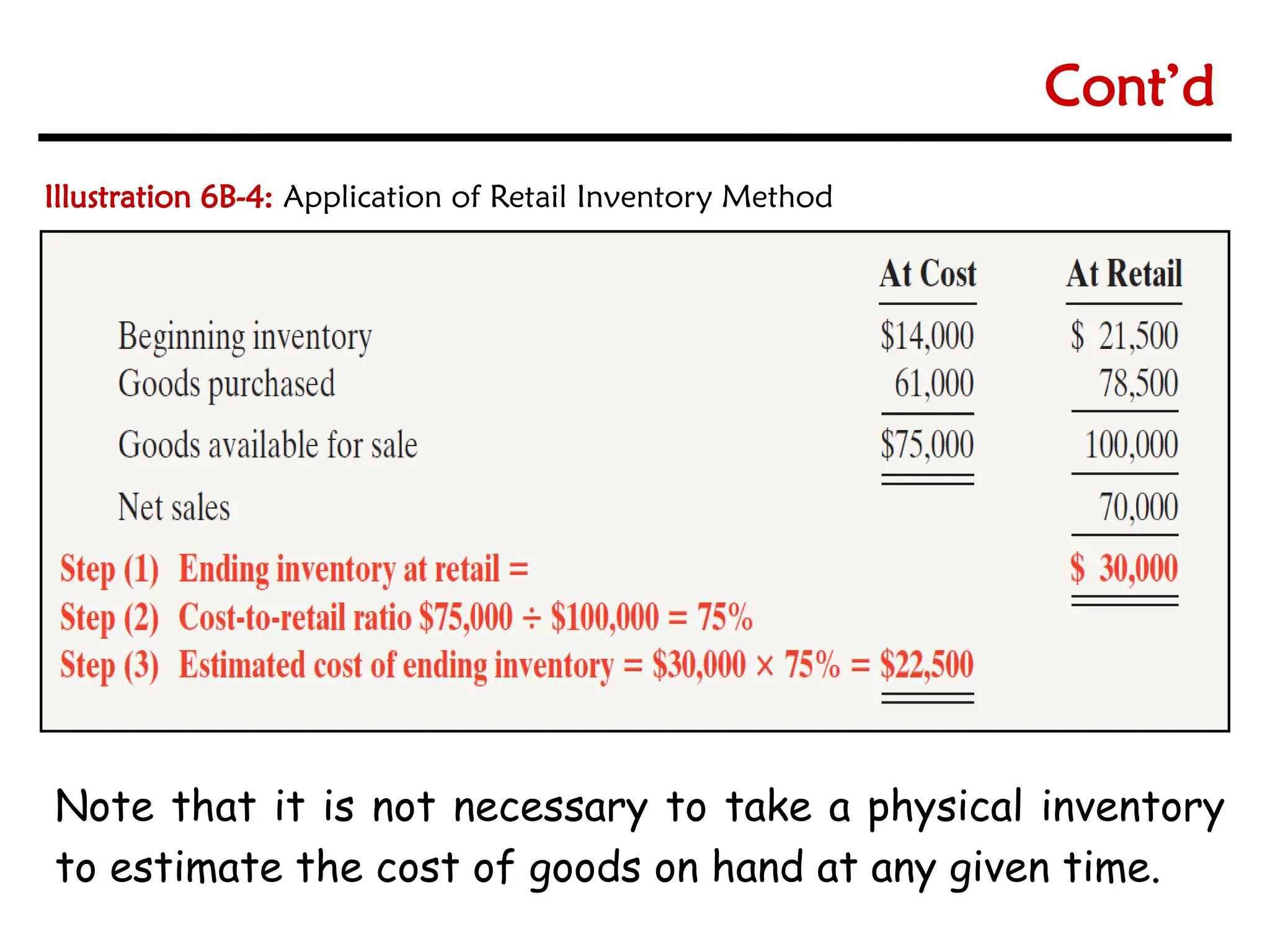

The document discusses inventory classifications for merchandise, raw materials, and finished goods, emphasizing their reporting as current assets. It outlines methods for determining inventory quantities, including perpetual and periodic systems, and explains inventory costing methods such as FIFO and average-cost. Additionally, it covers the effects of inventory errors on financial statements and provides insights into estimating inventory costs through approaches like gross profit and the retail inventory method.