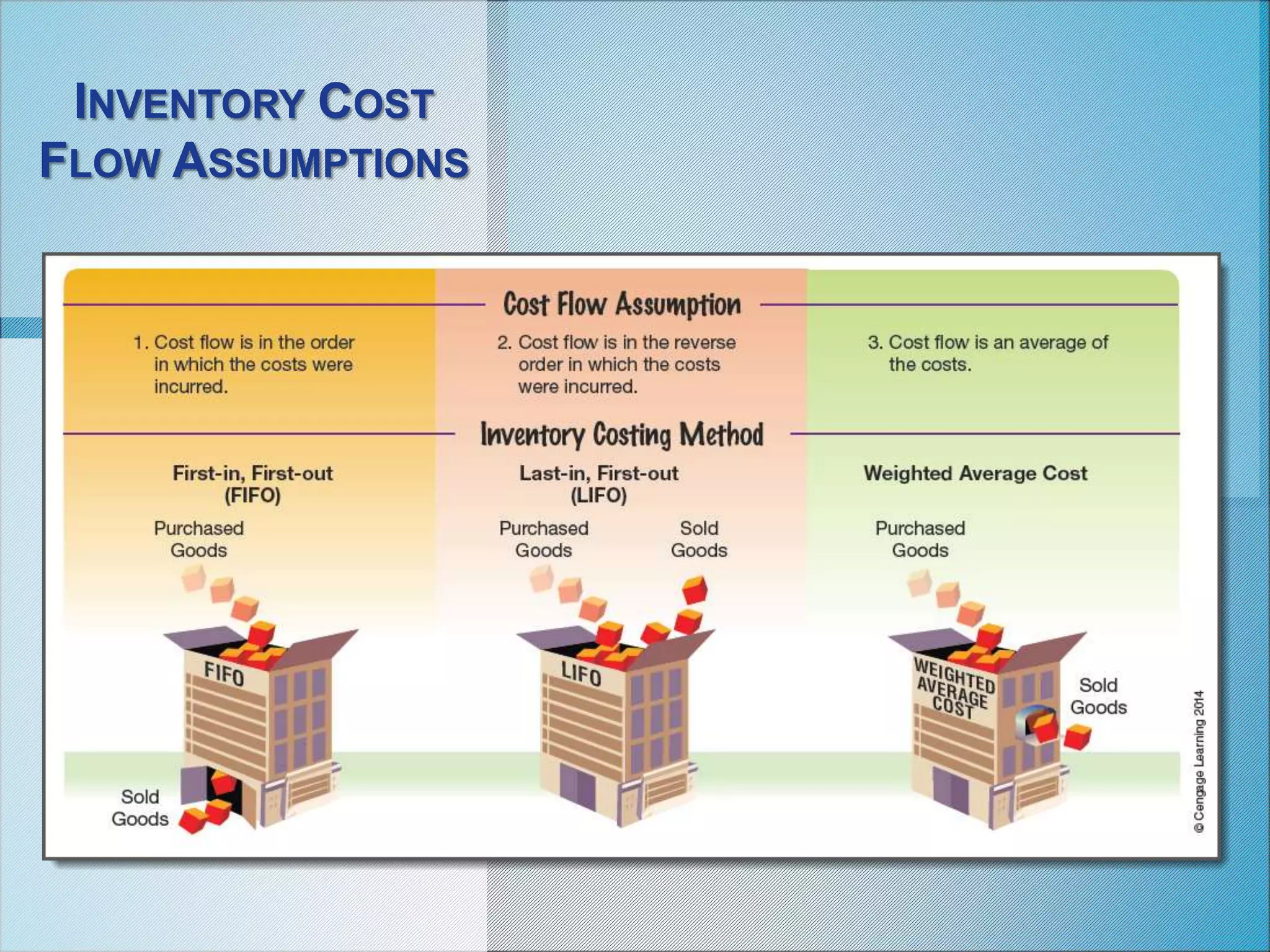

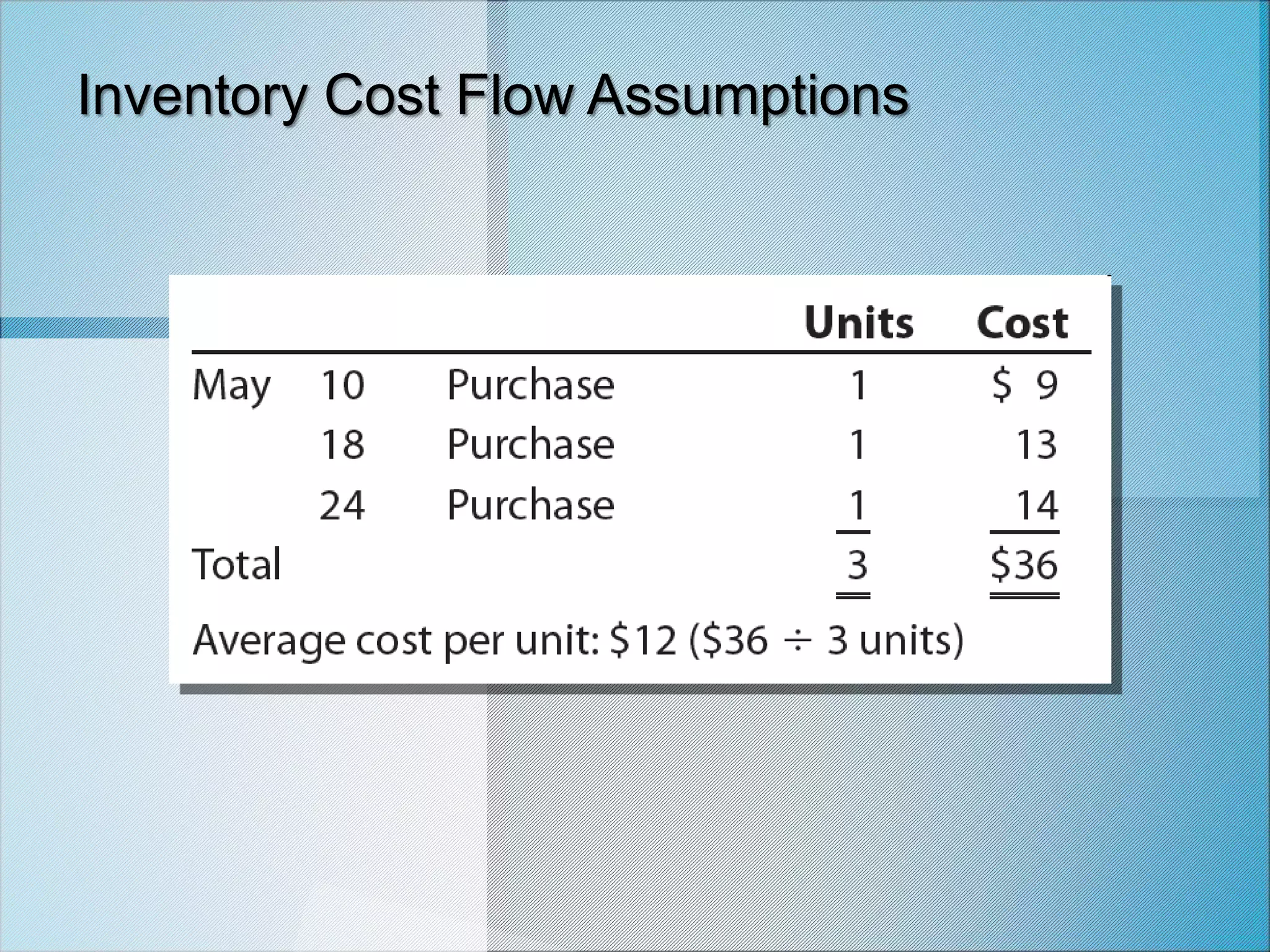

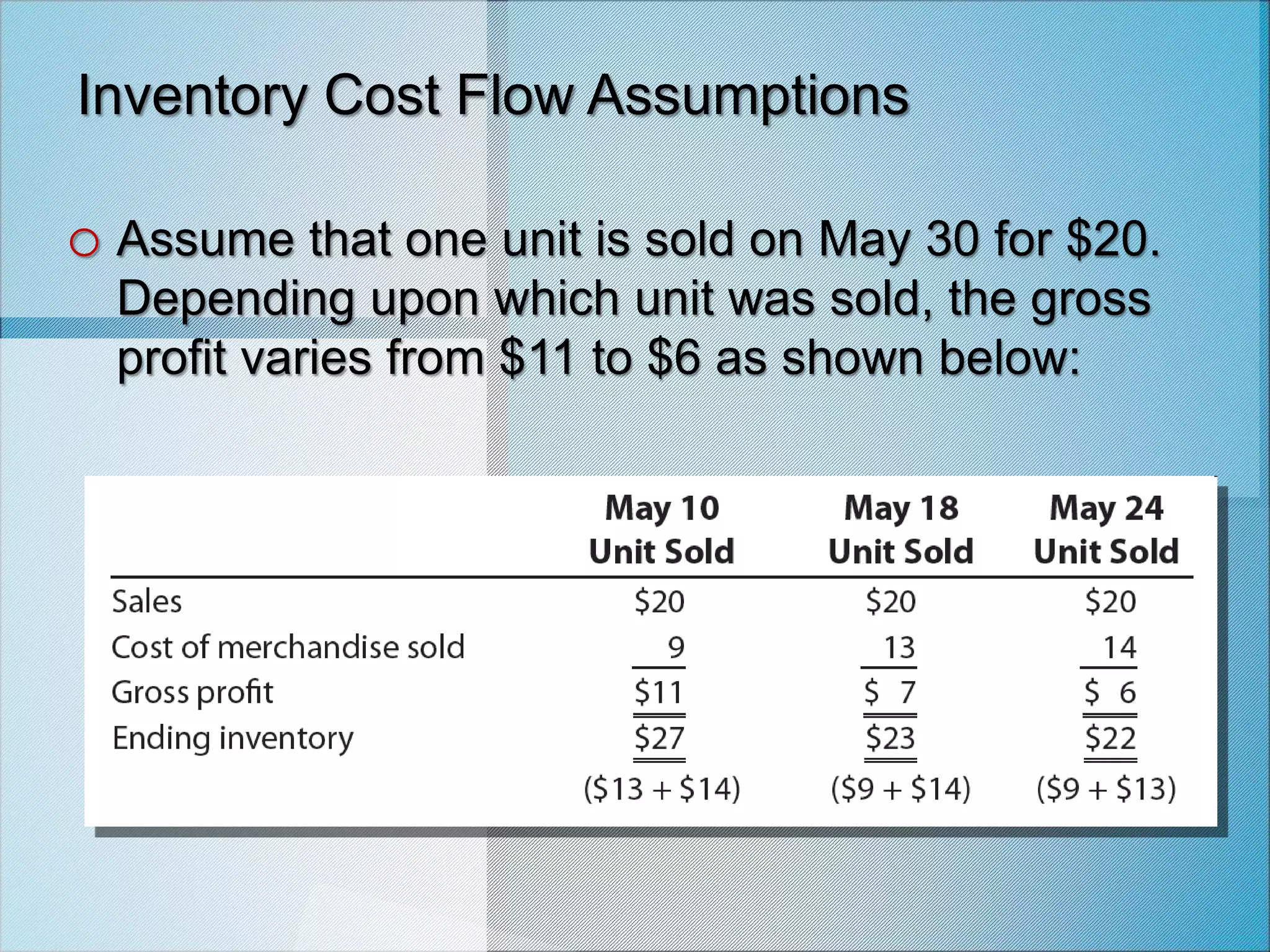

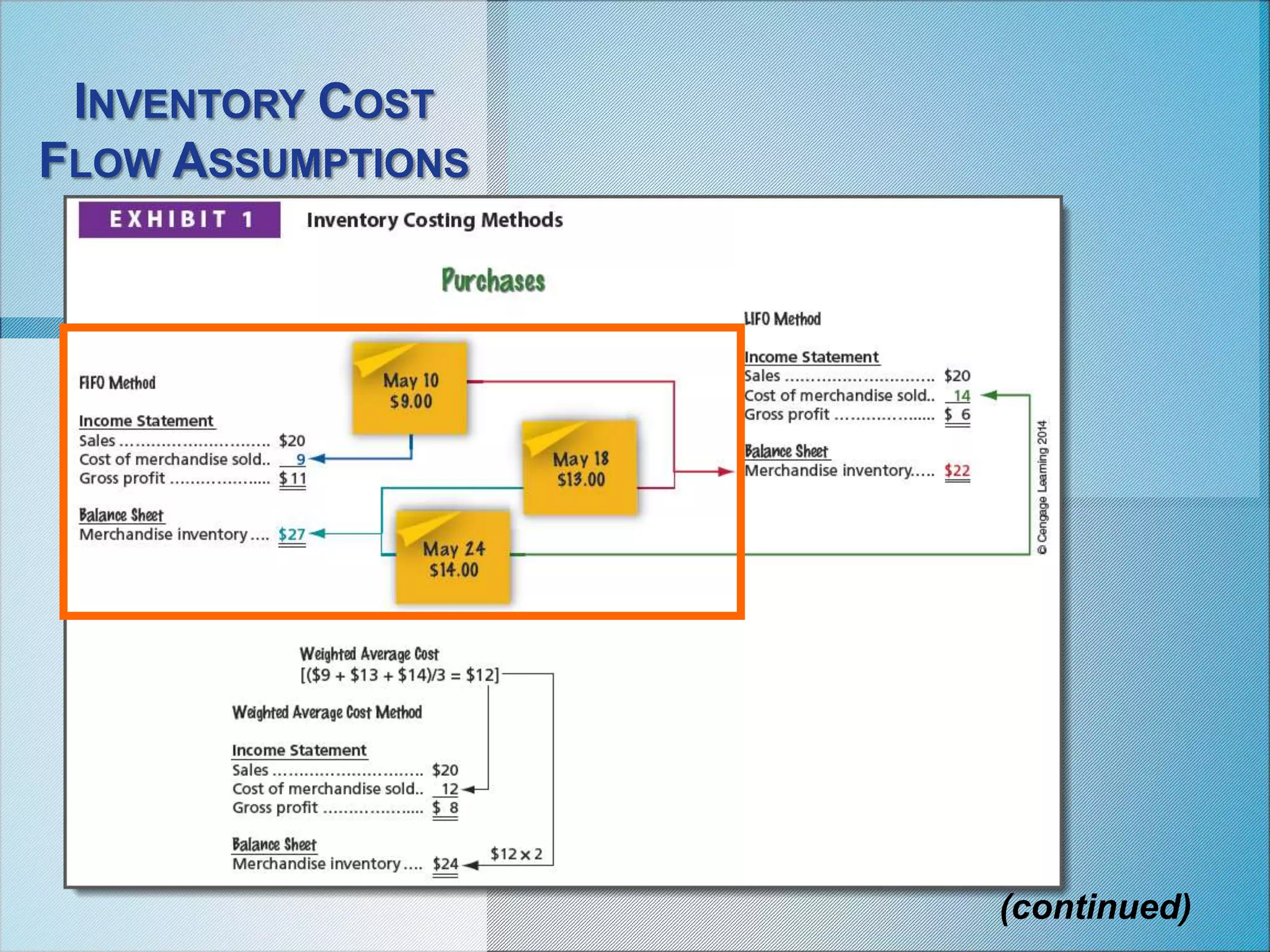

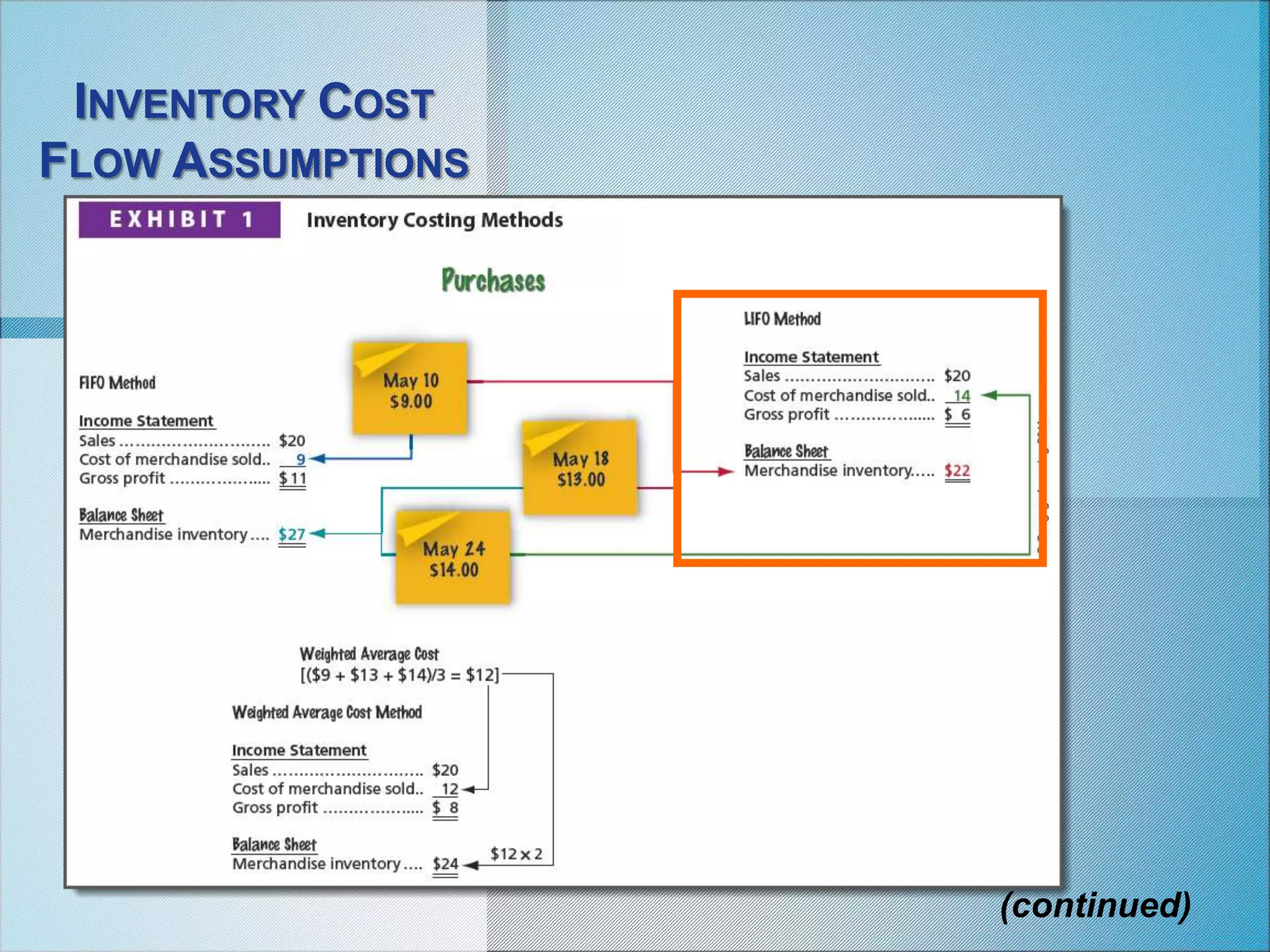

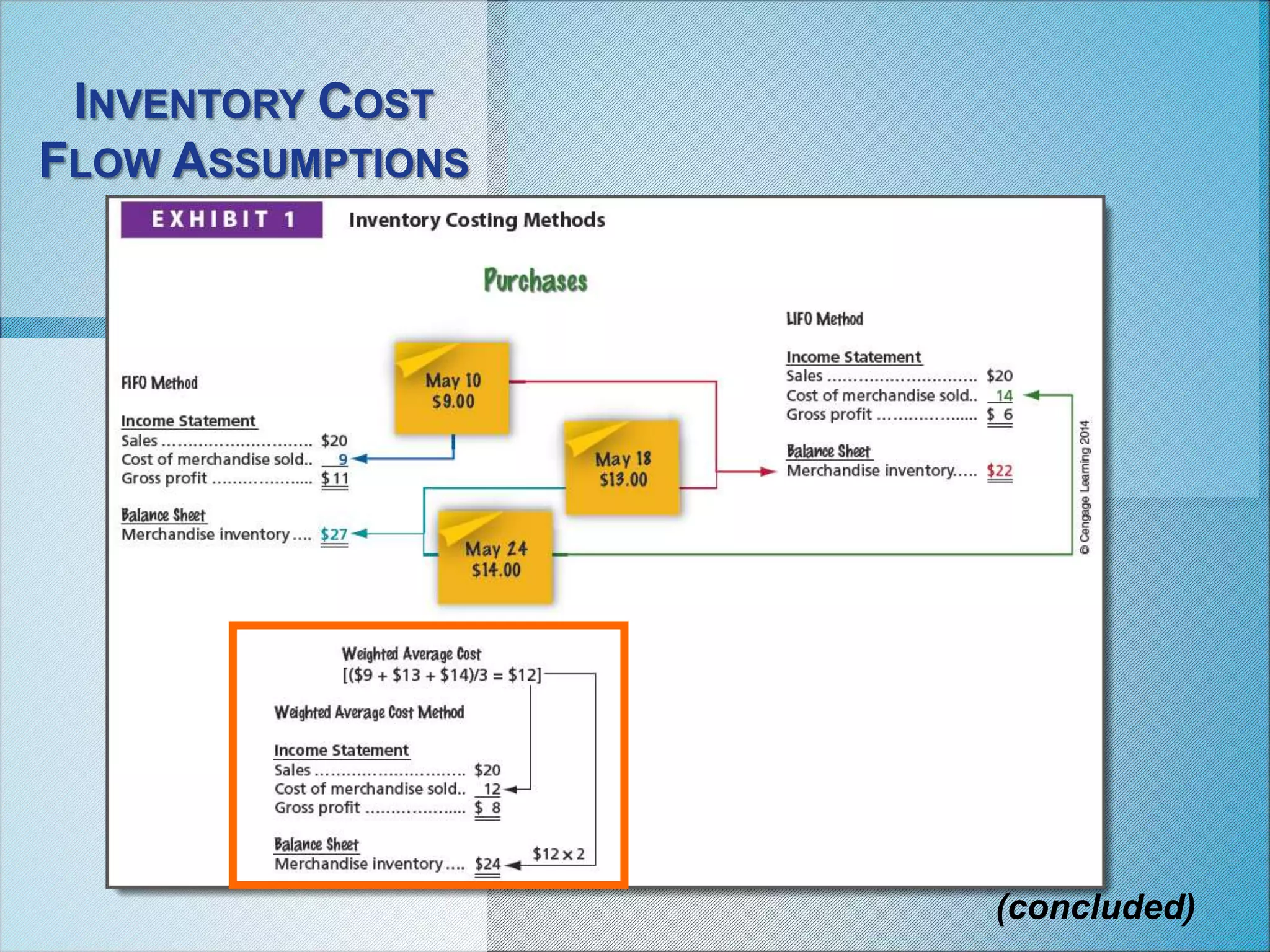

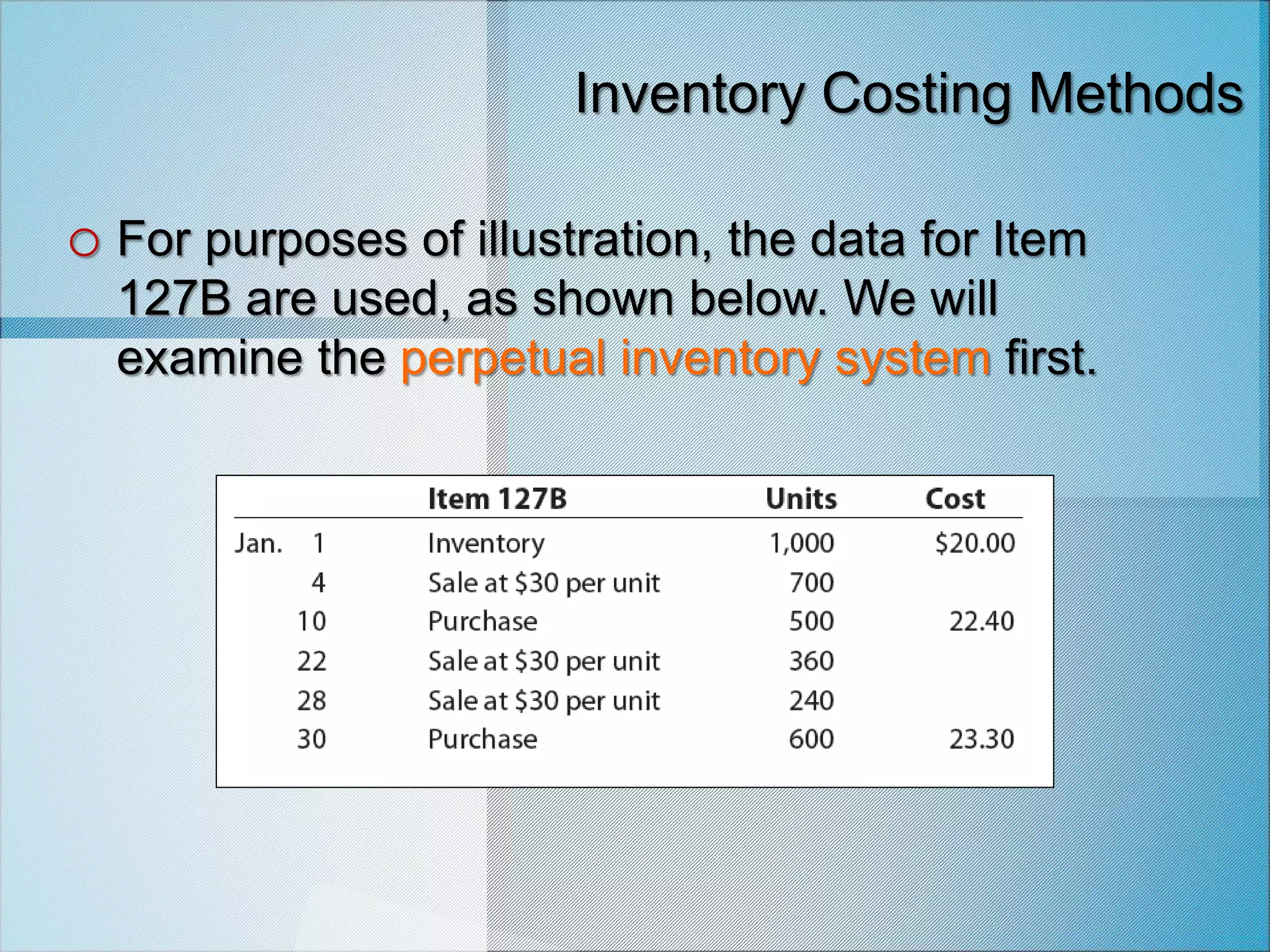

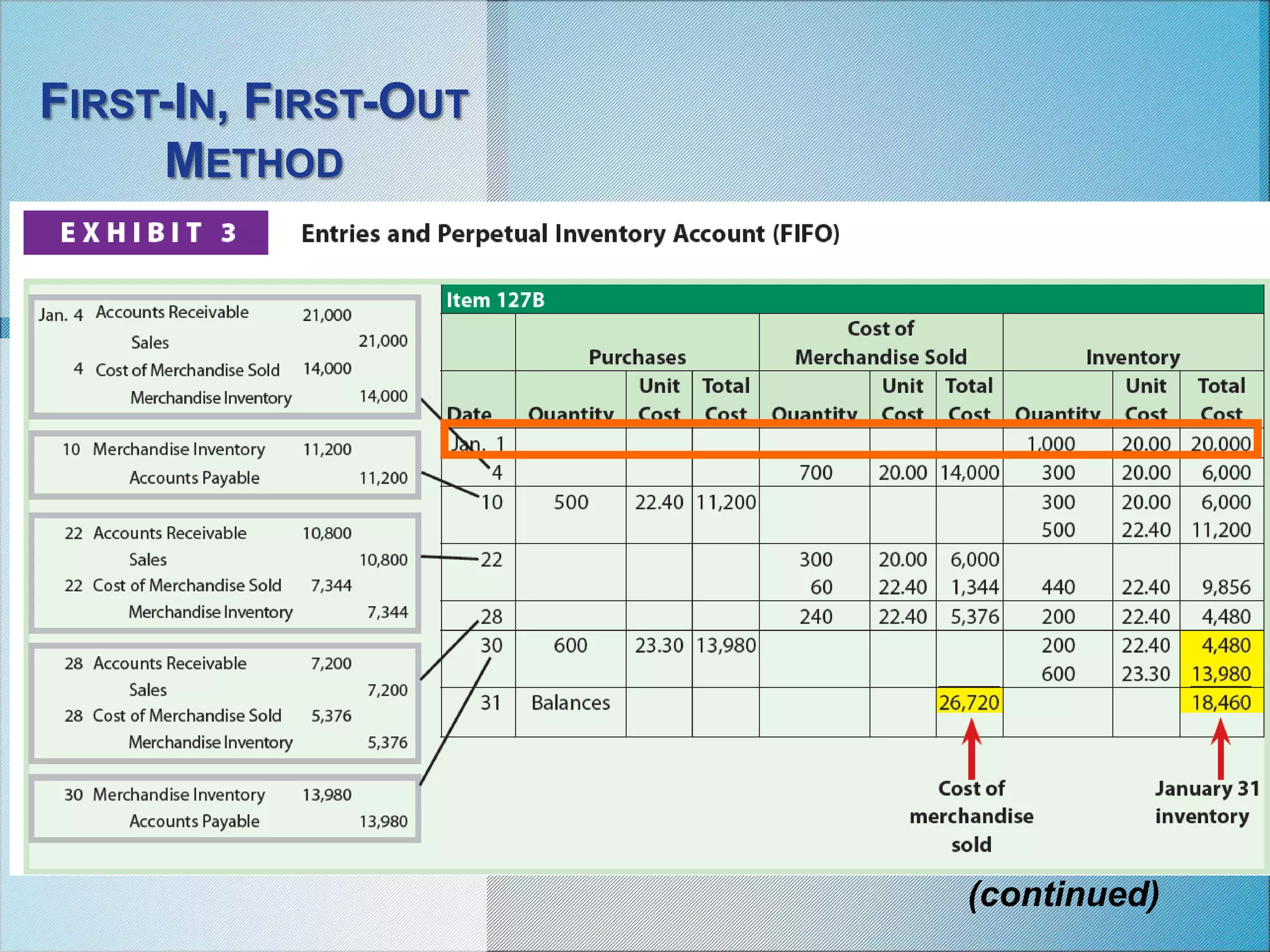

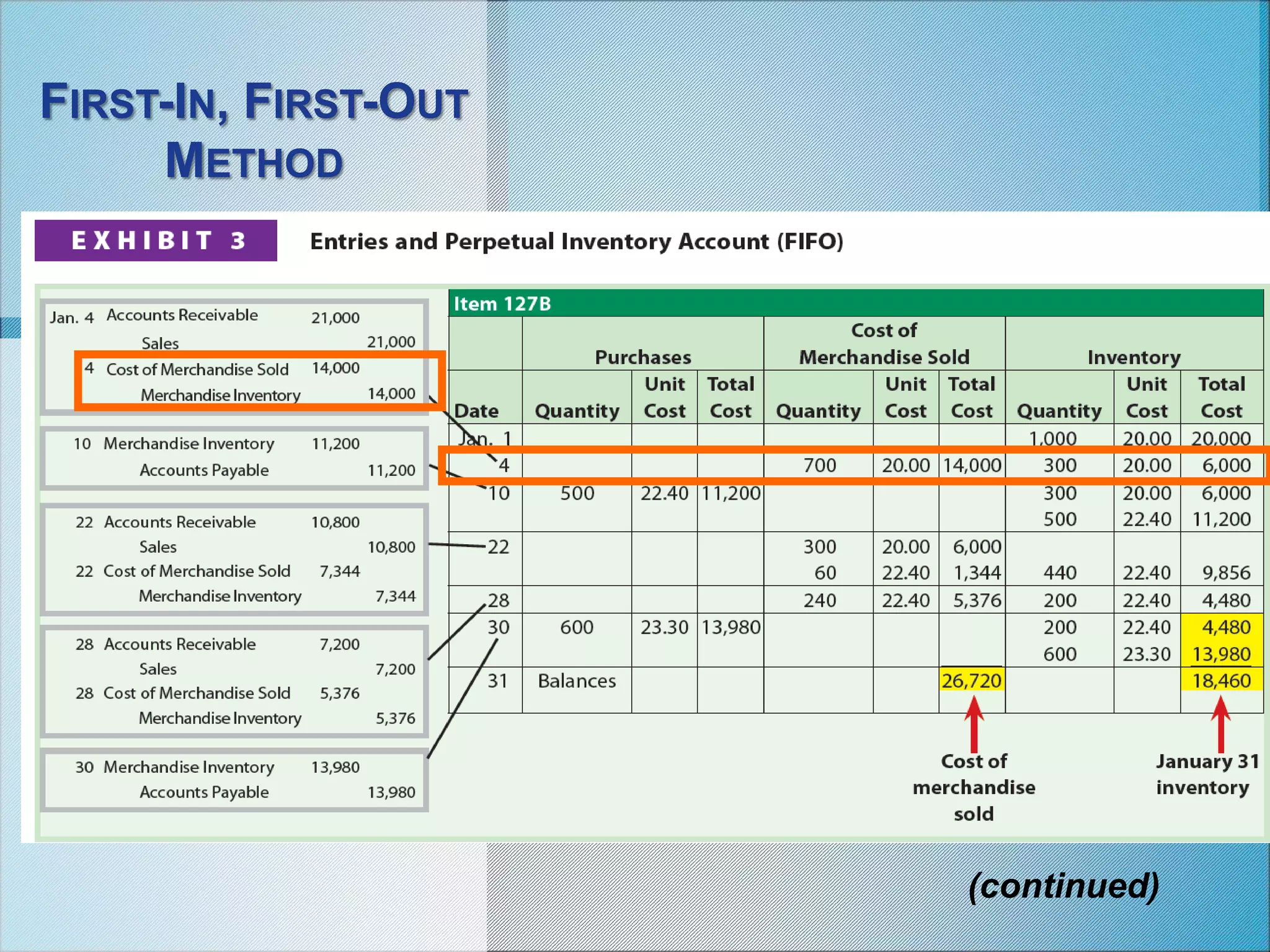

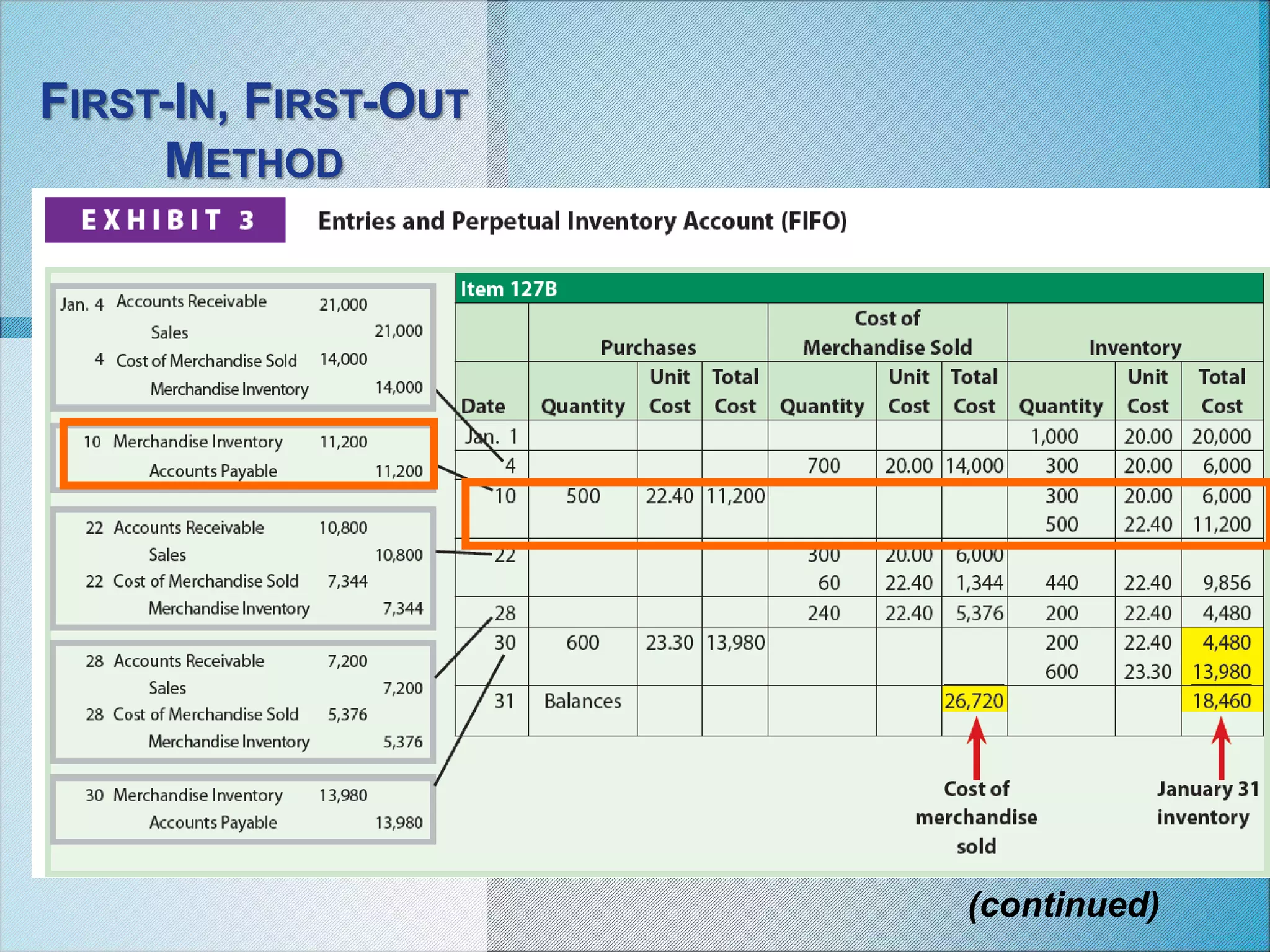

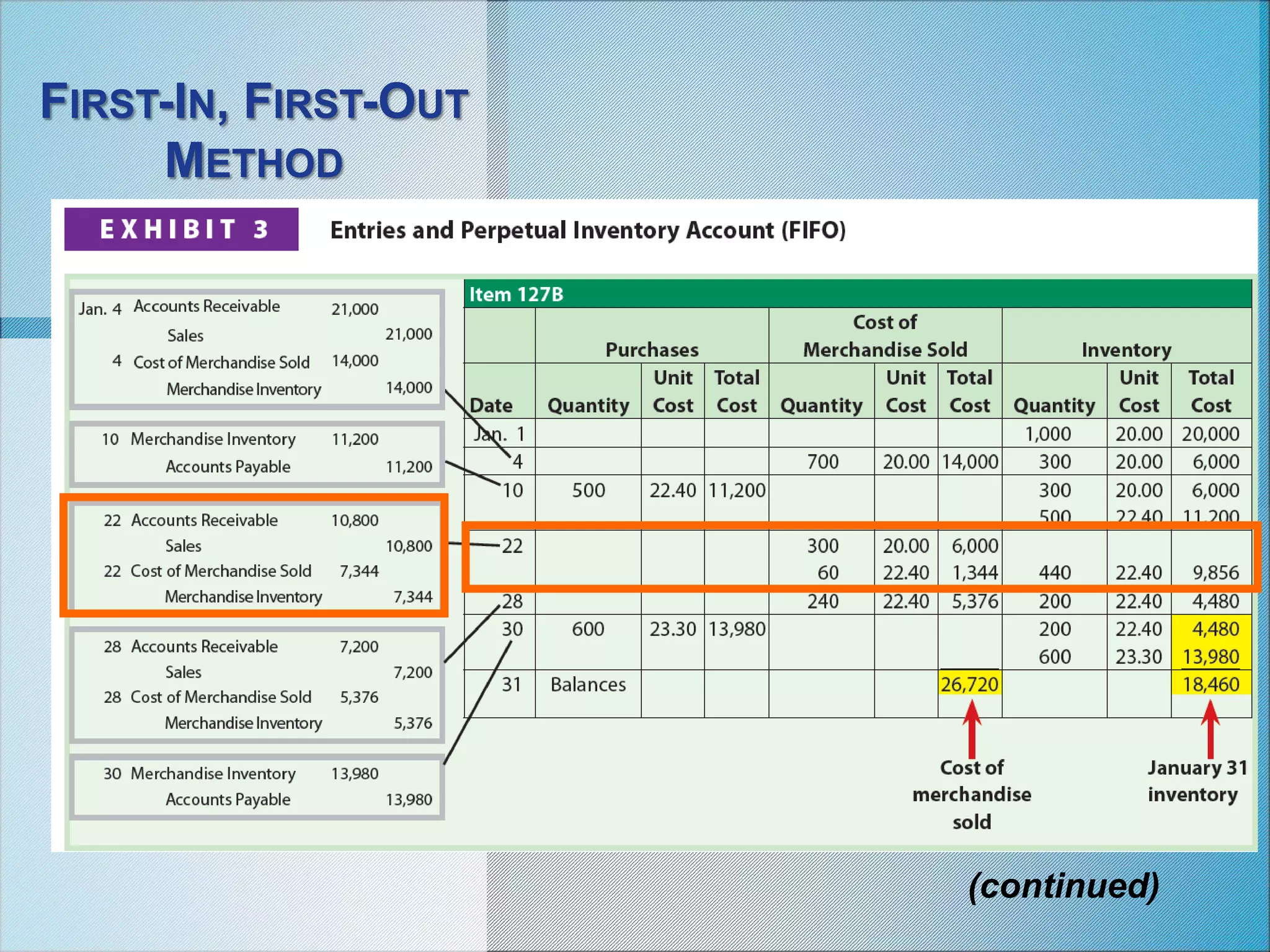

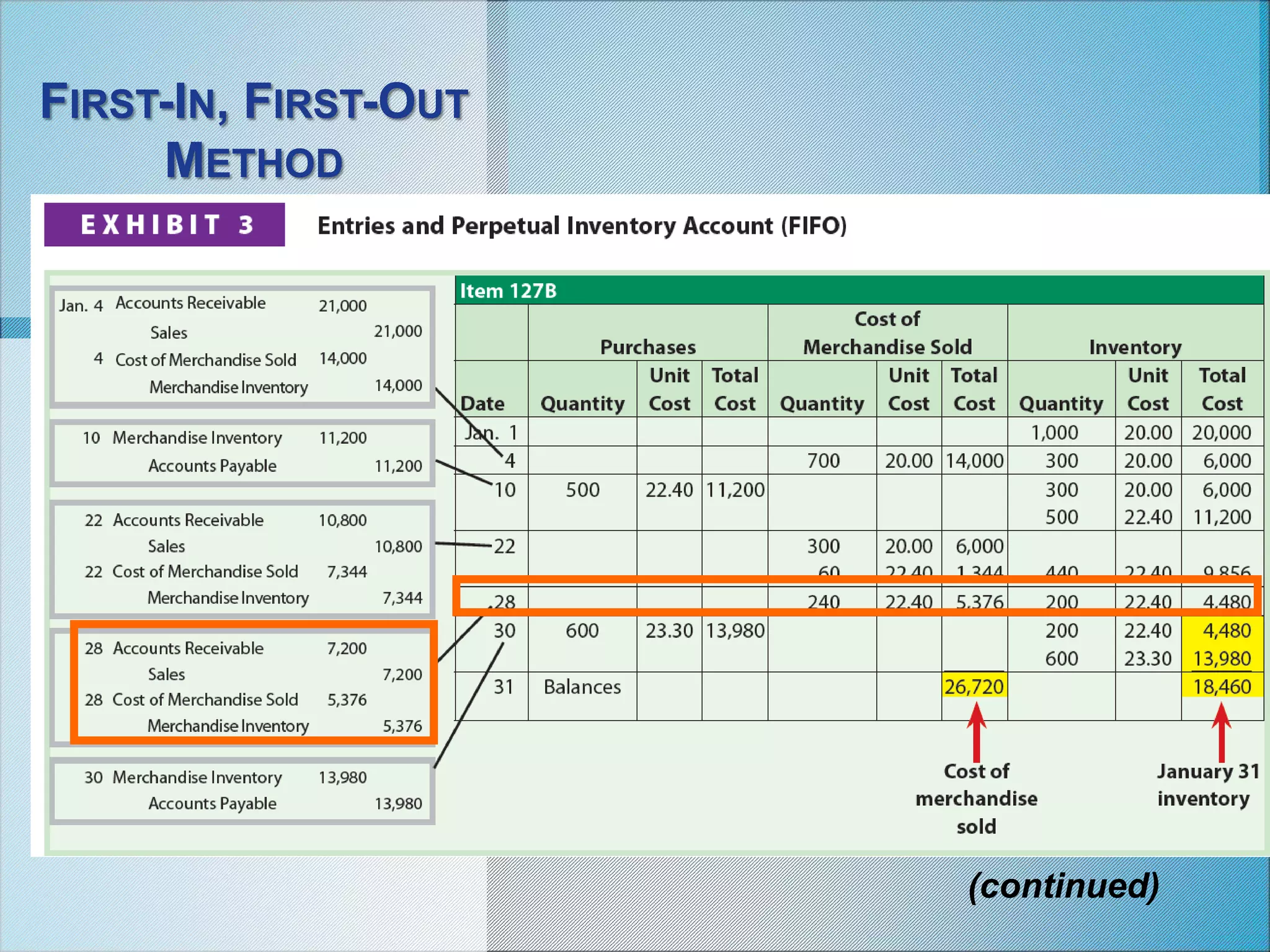

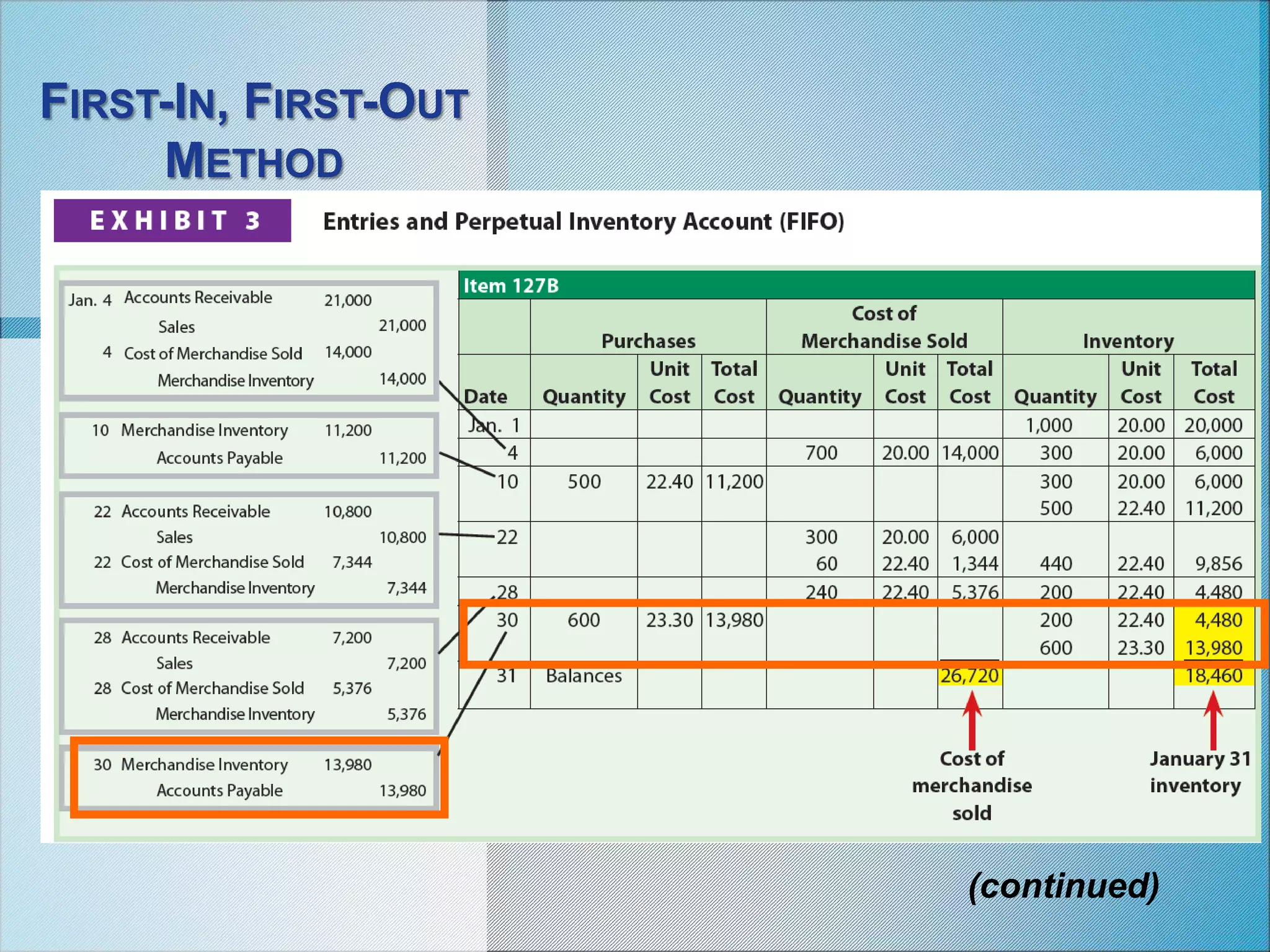

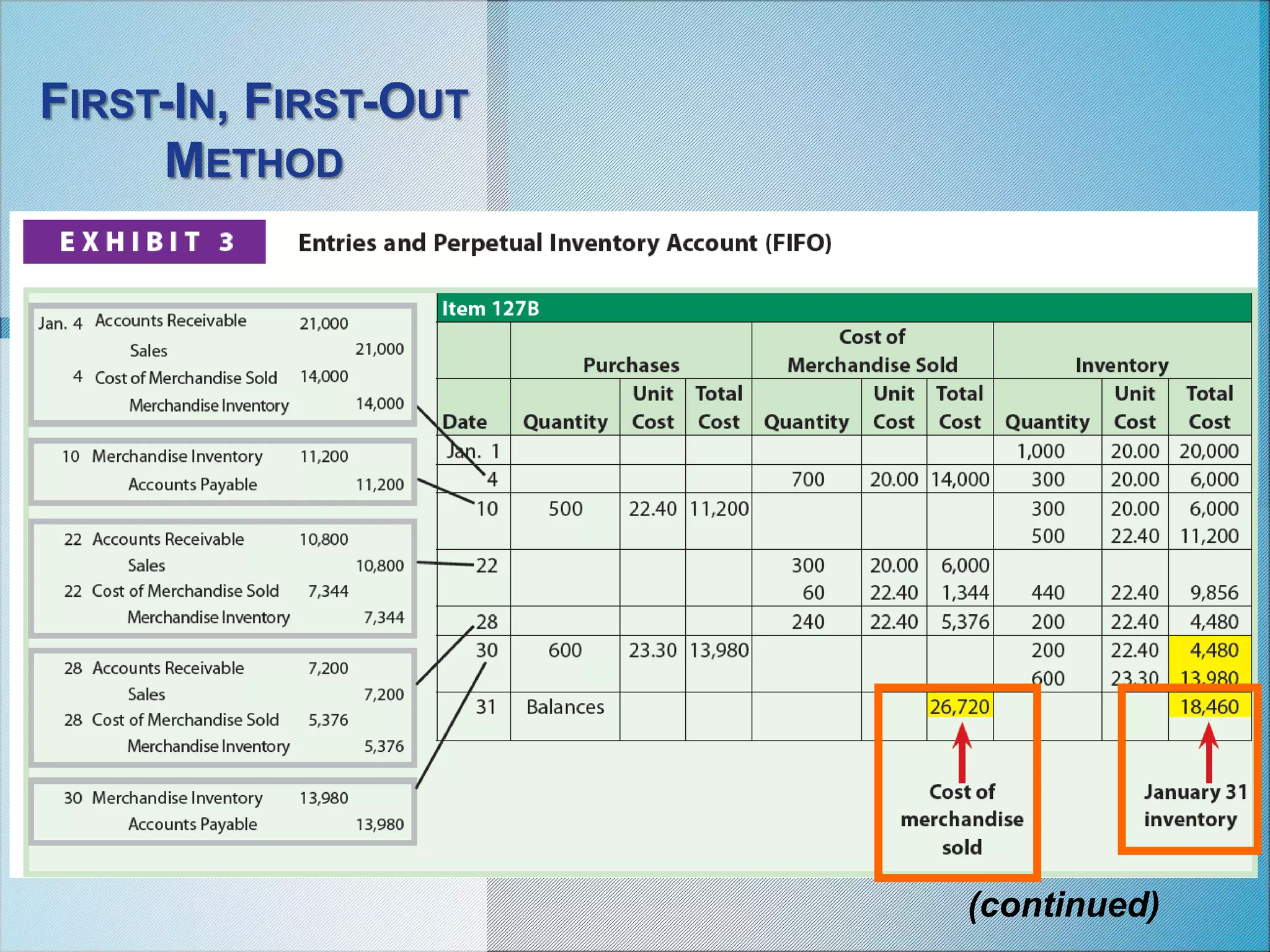

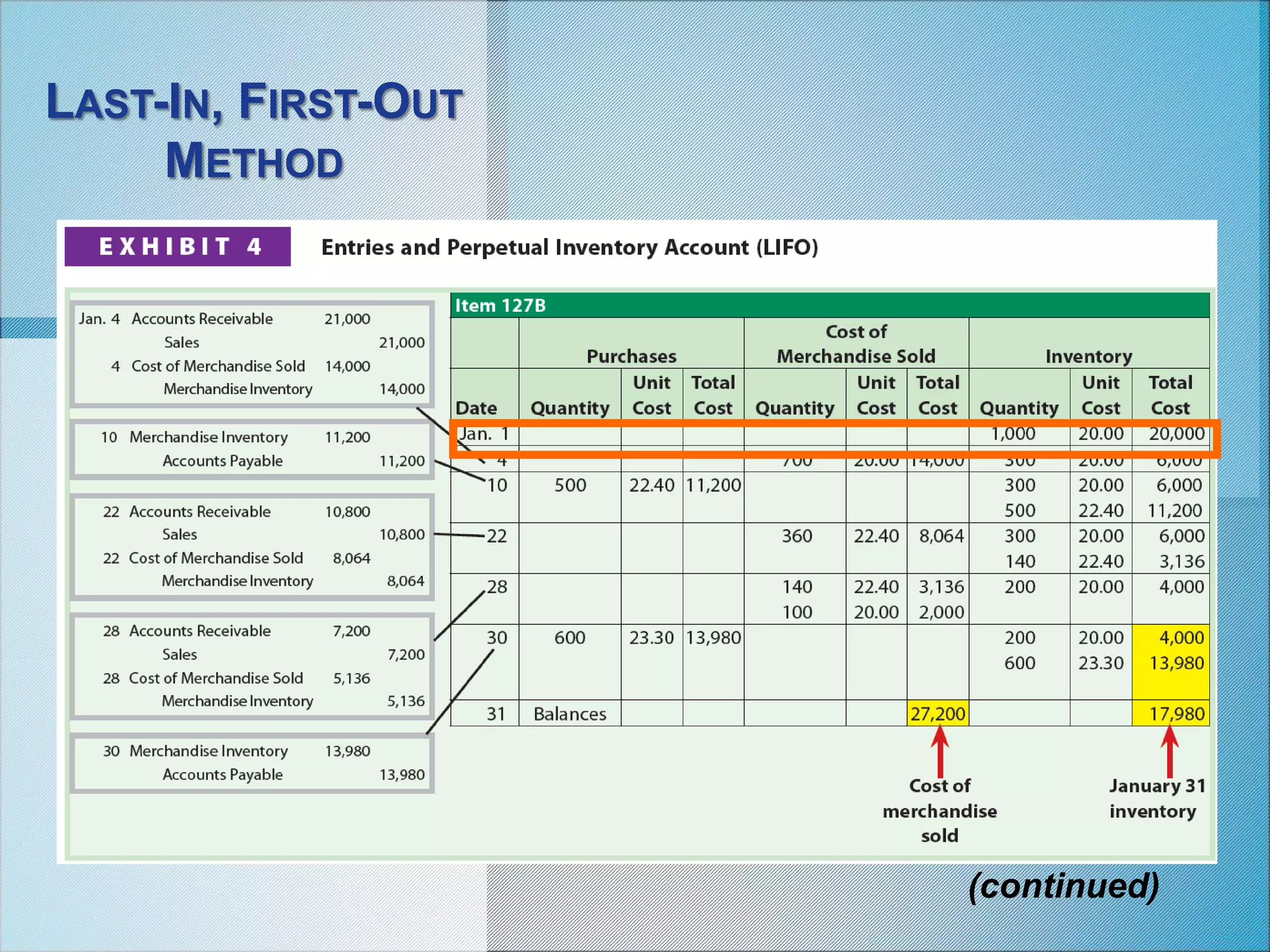

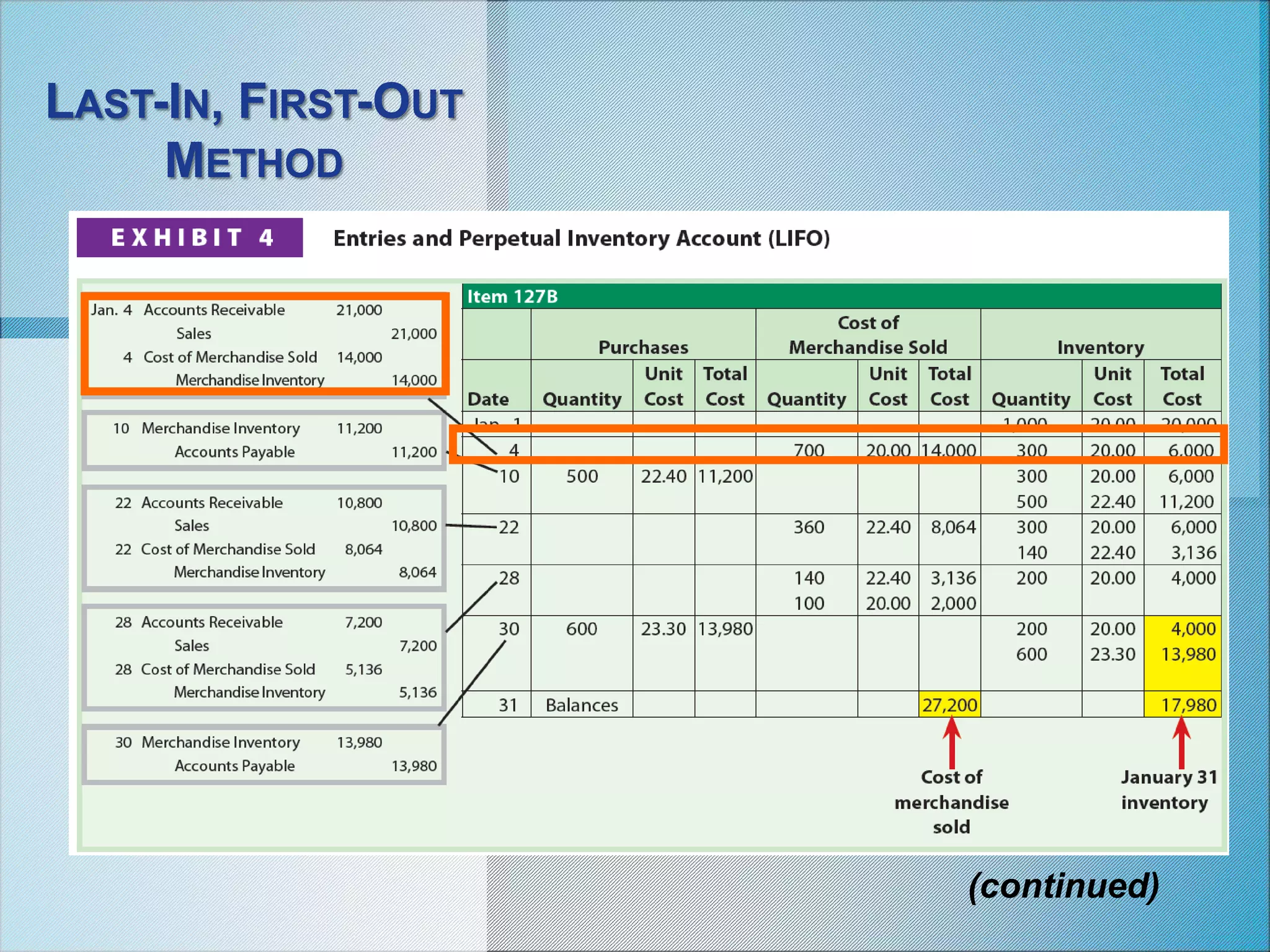

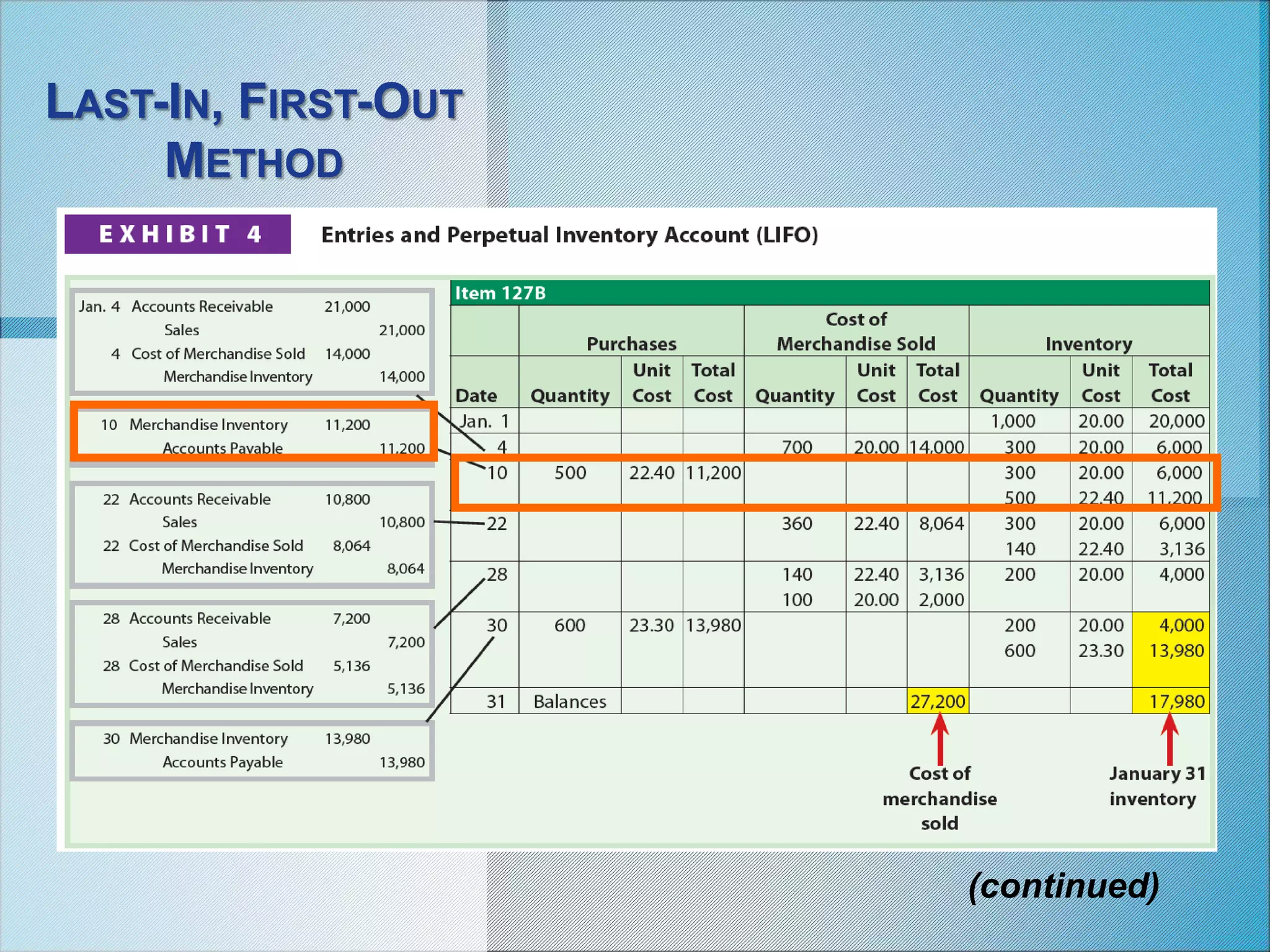

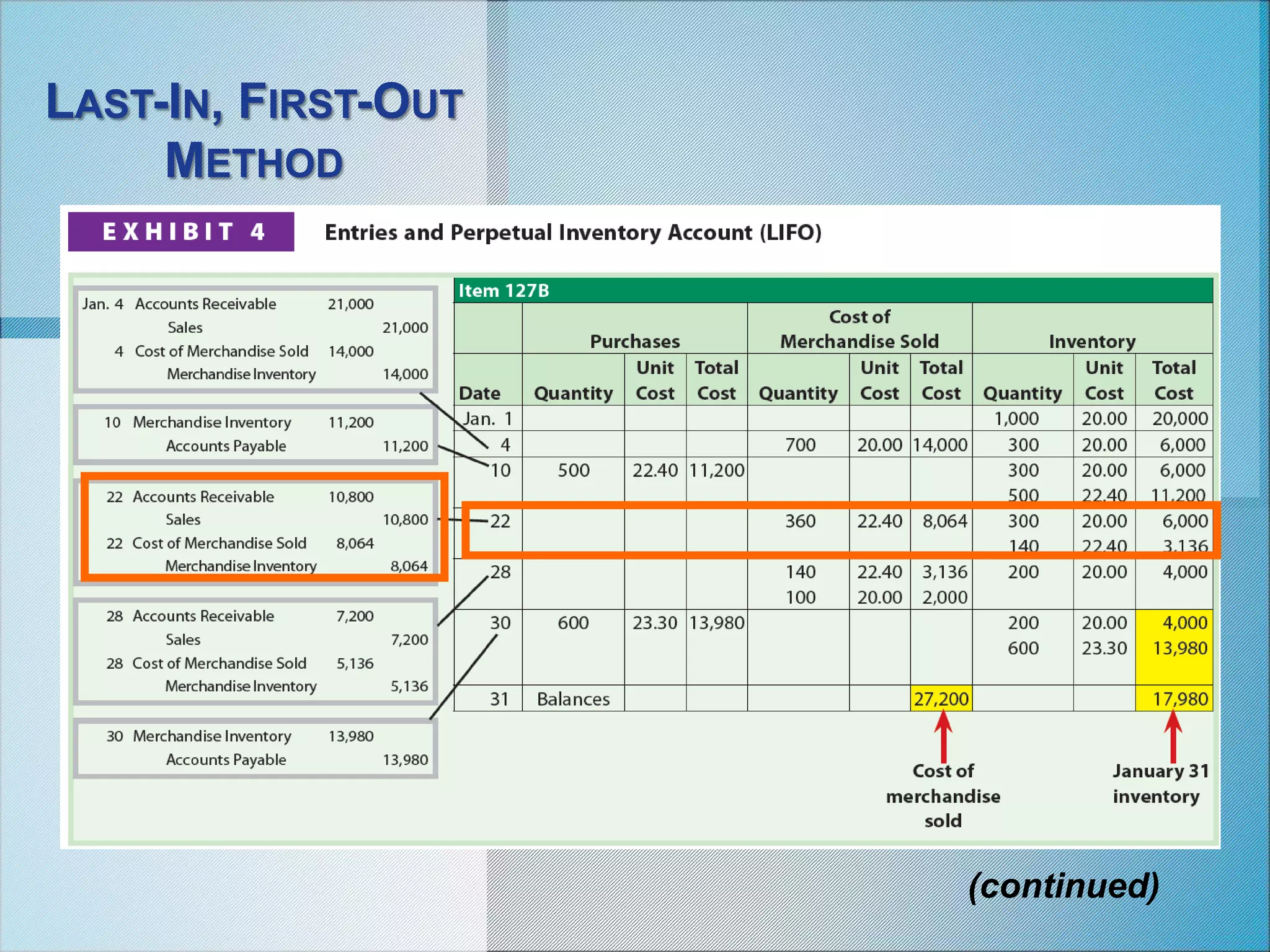

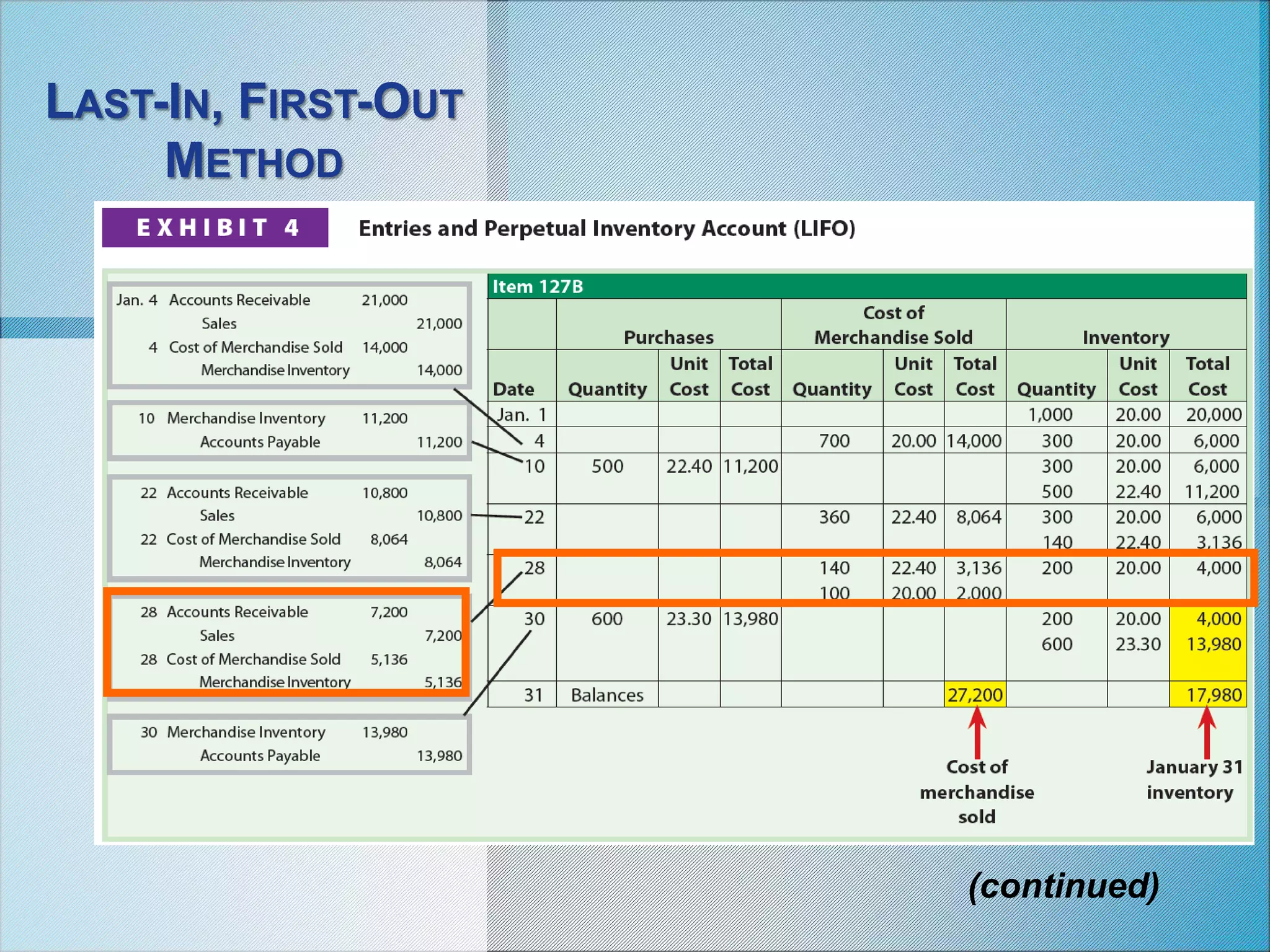

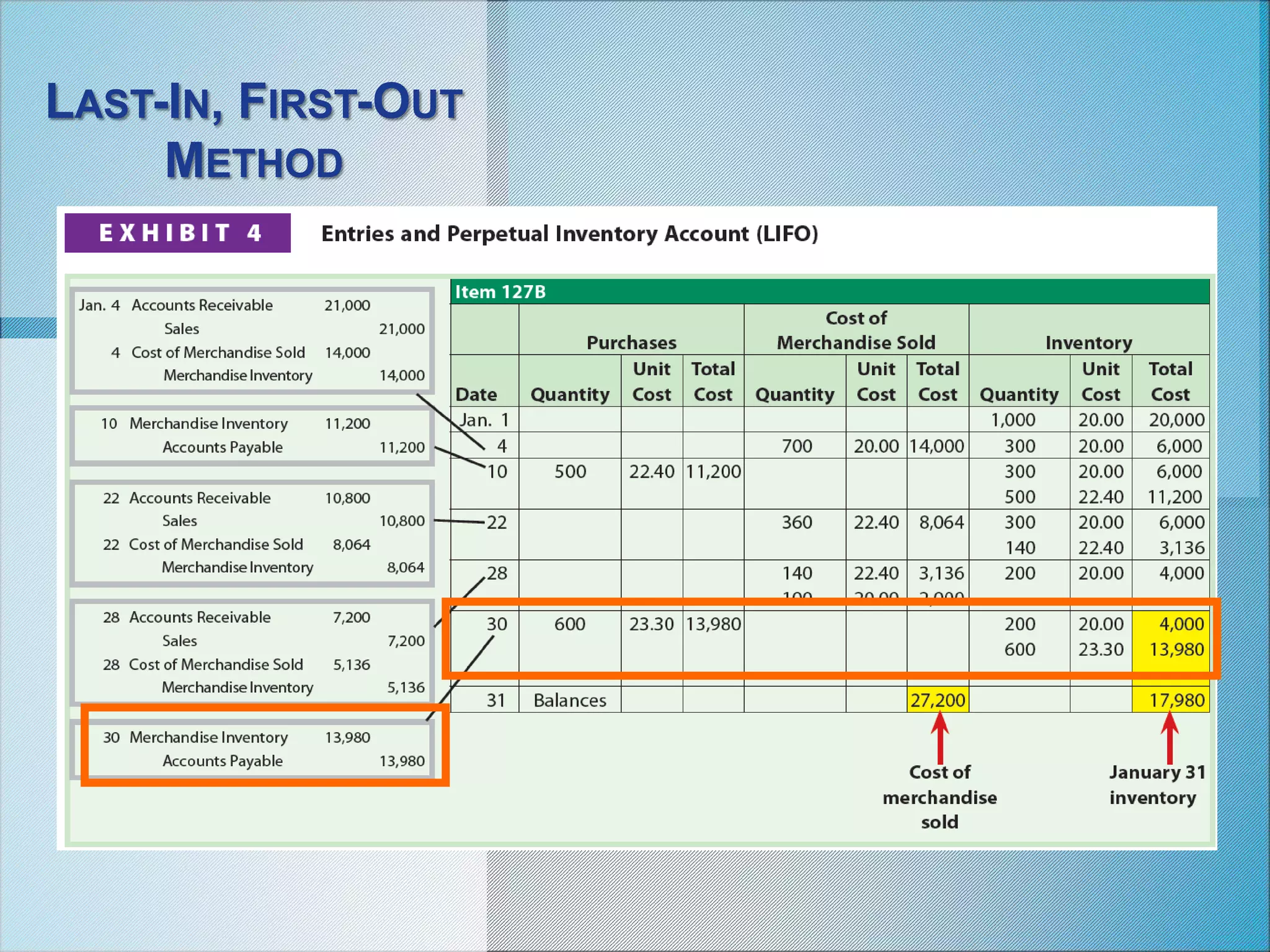

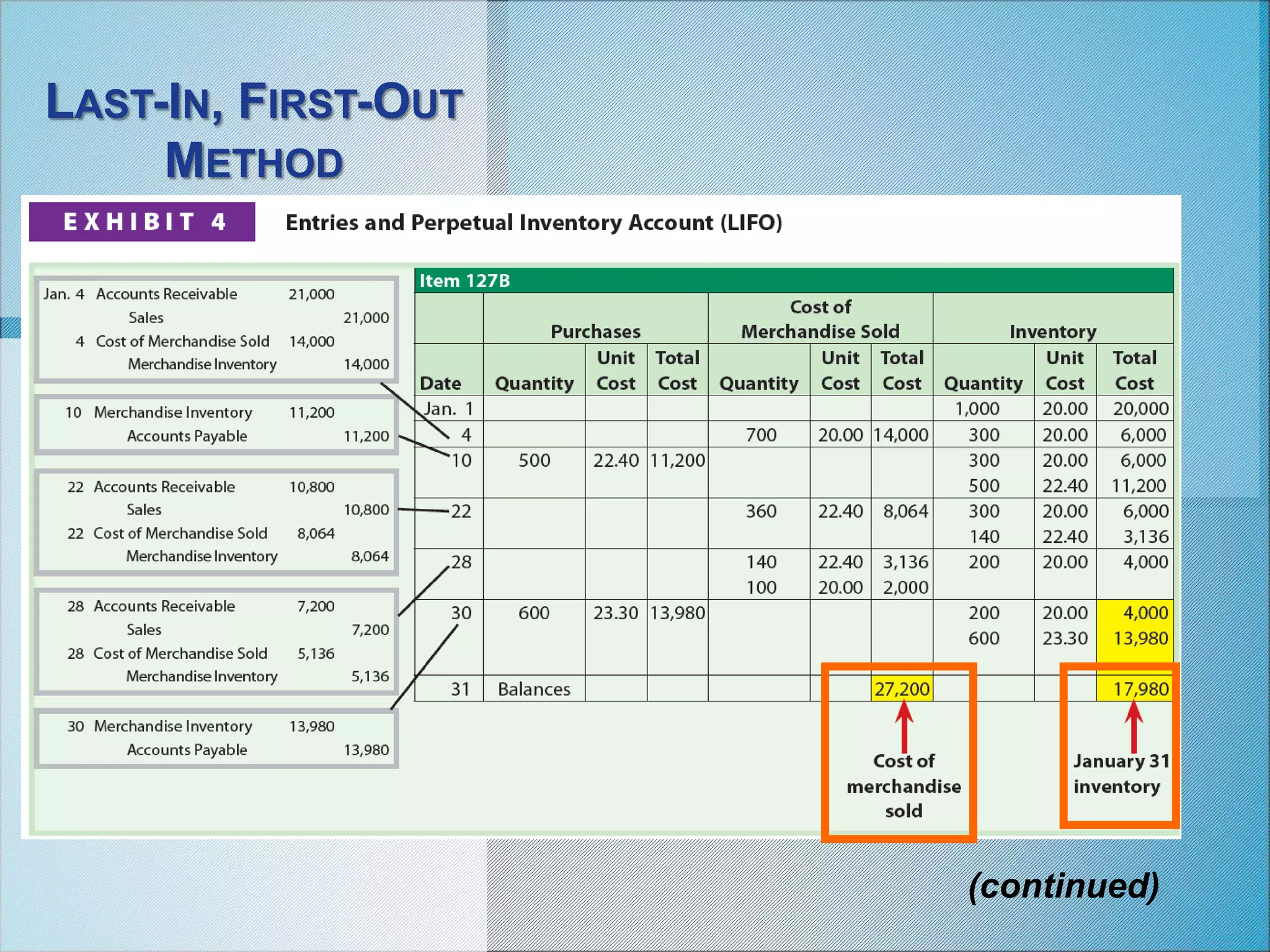

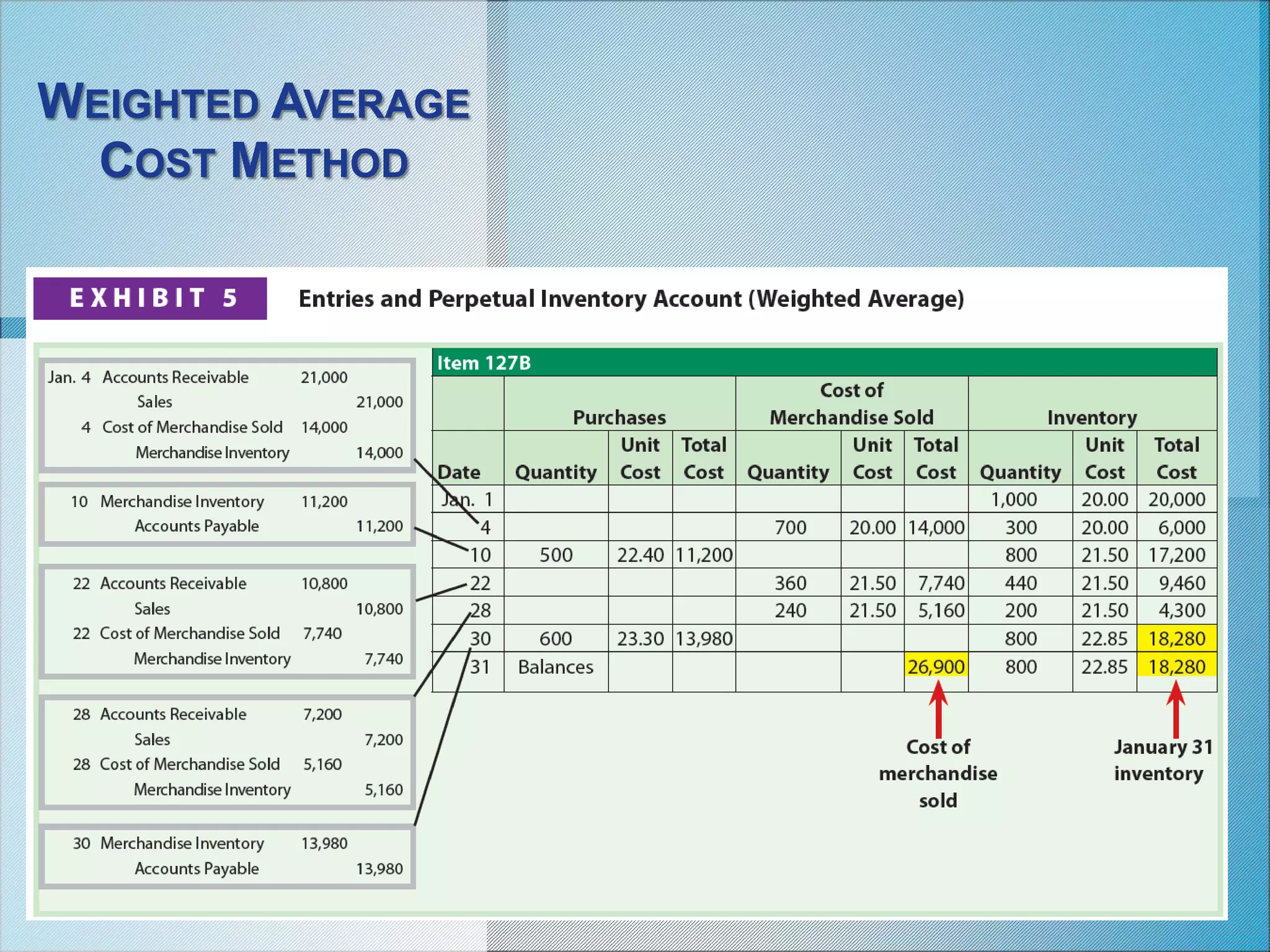

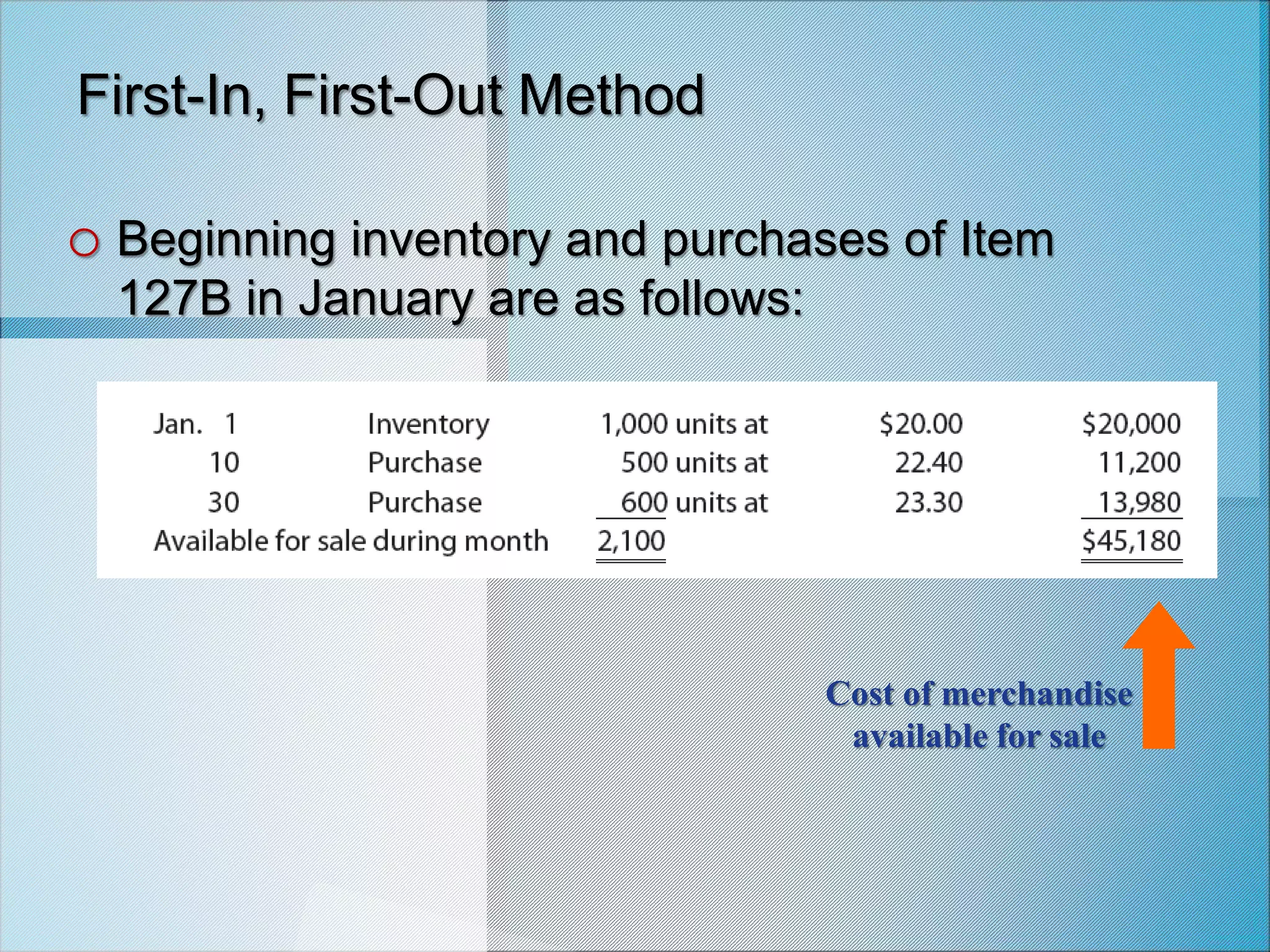

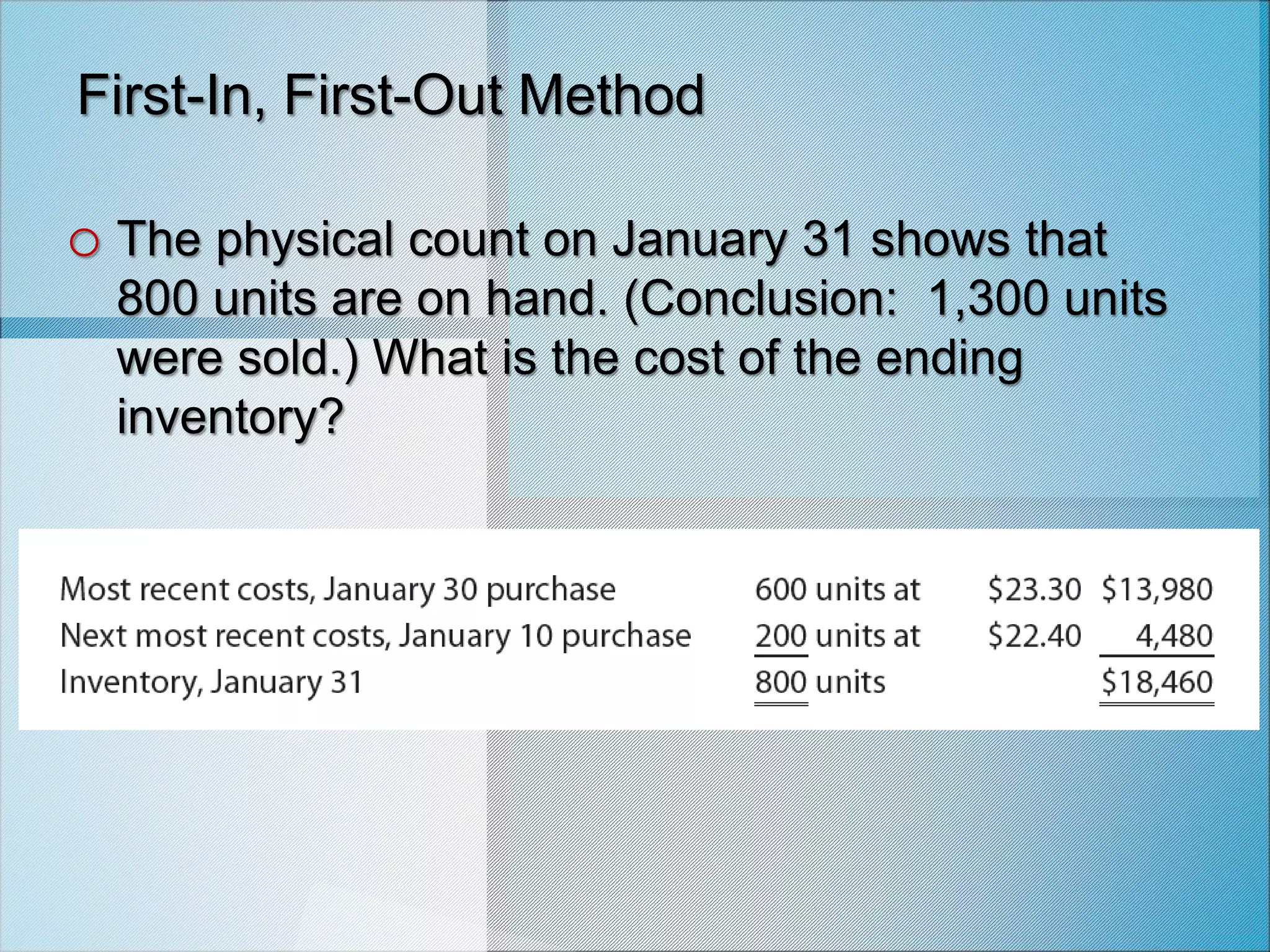

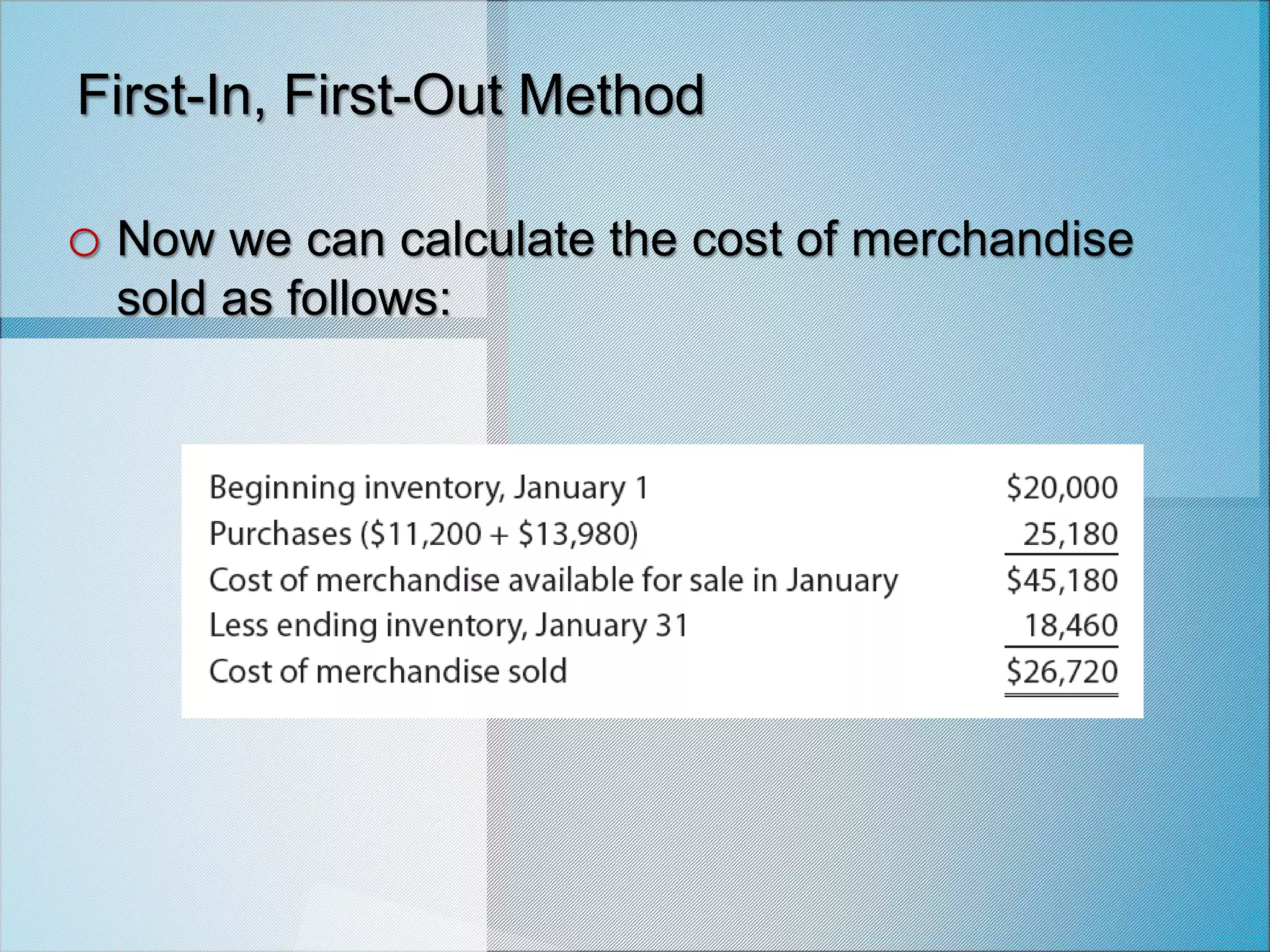

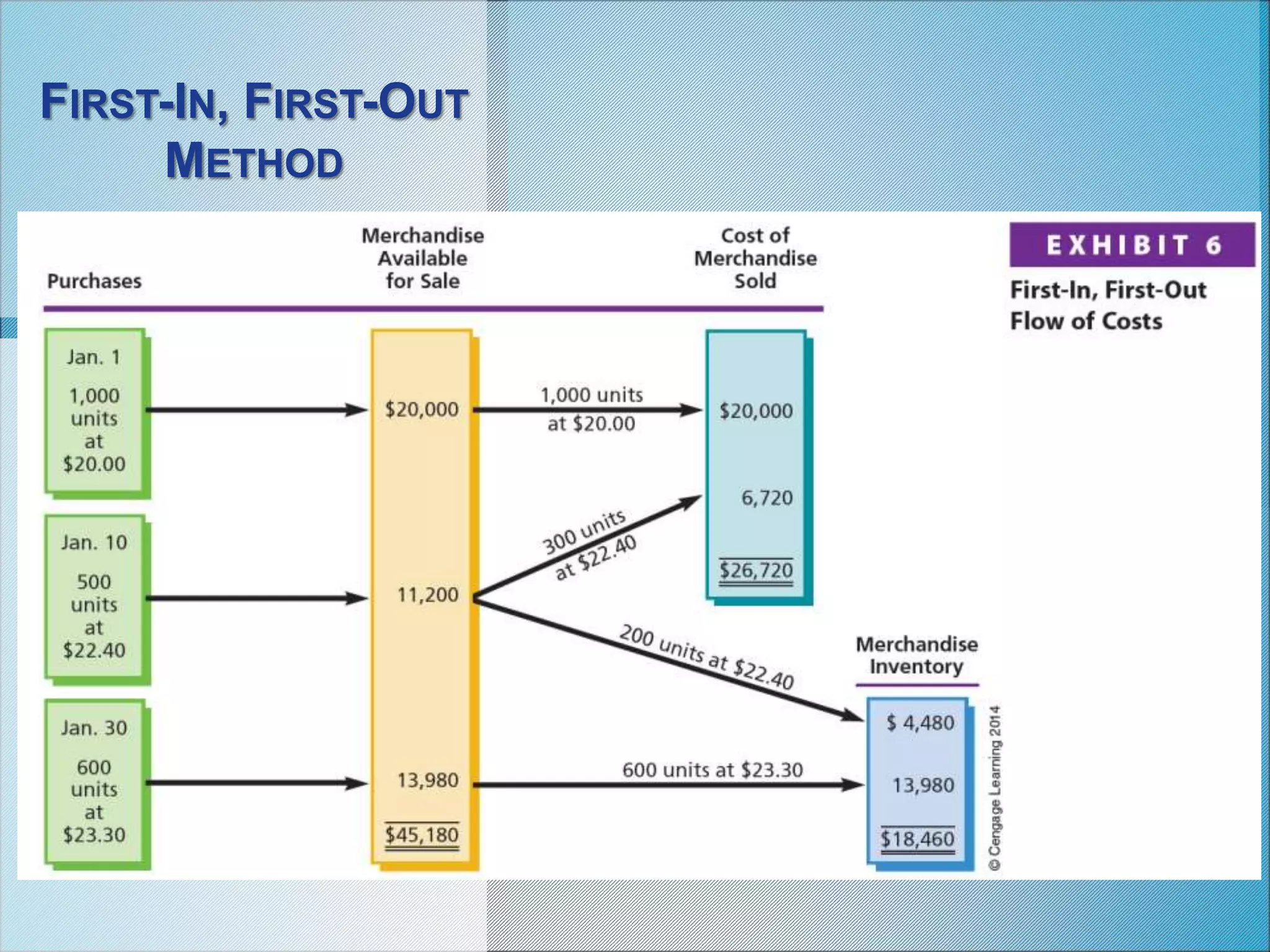

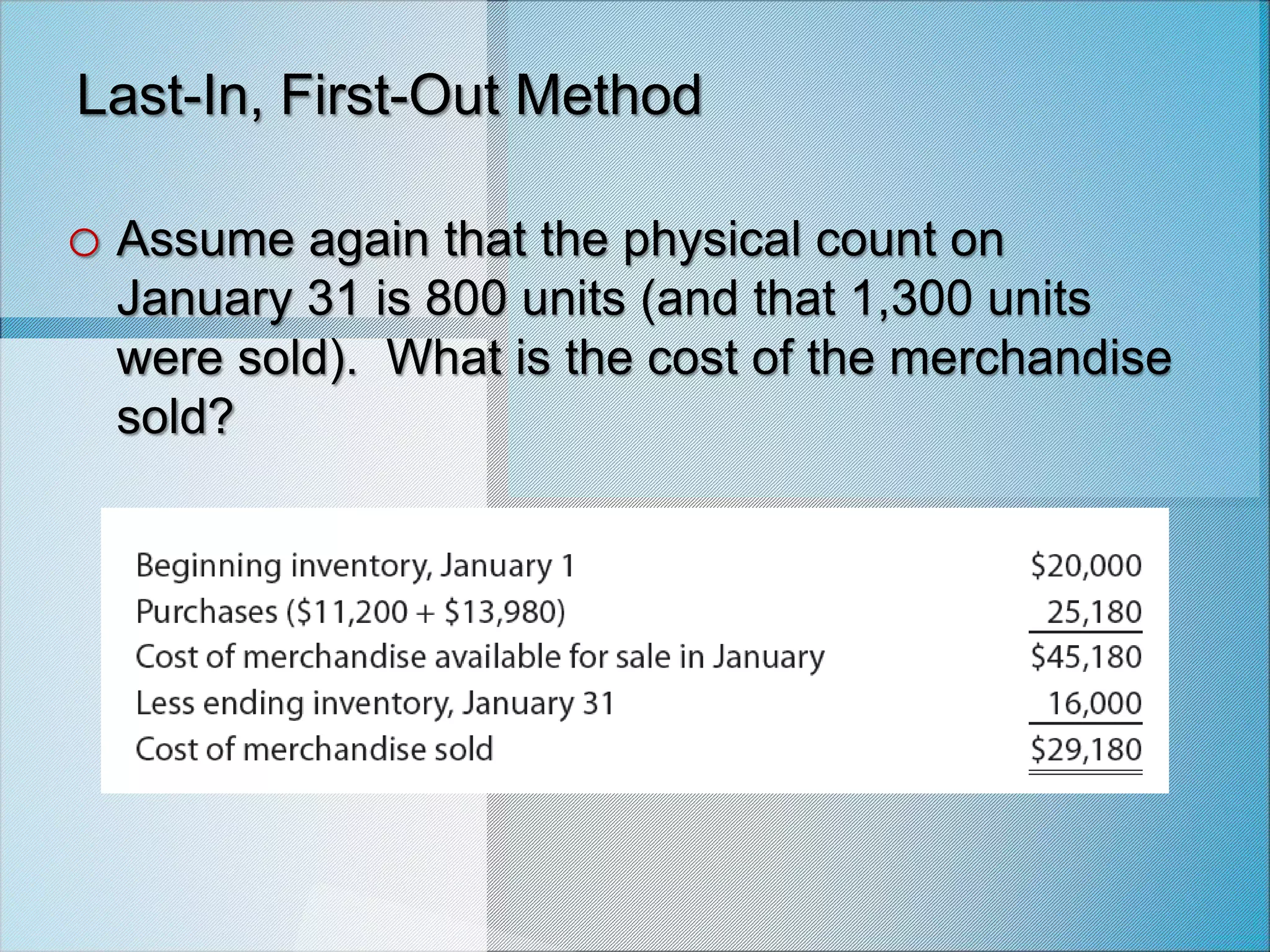

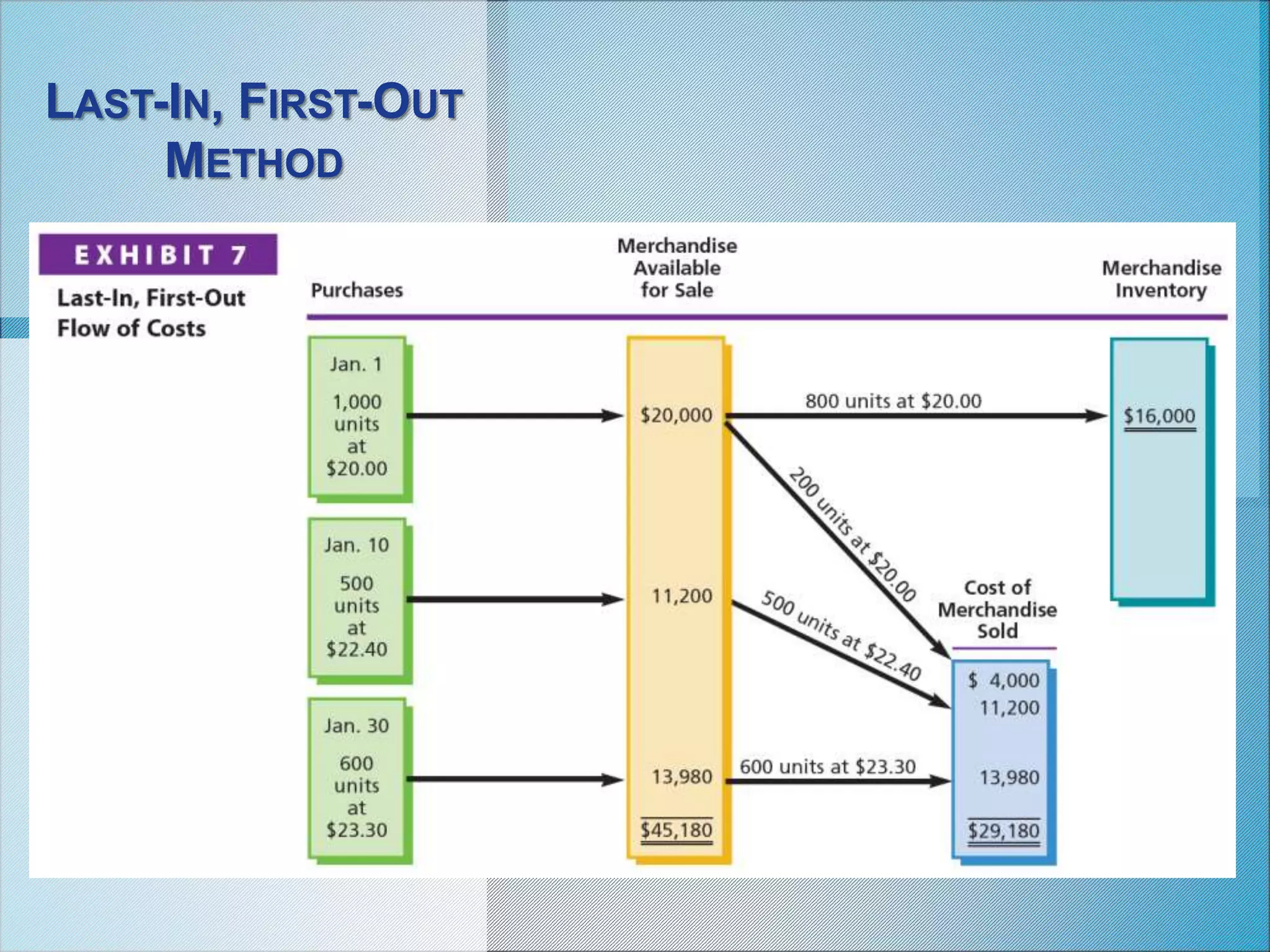

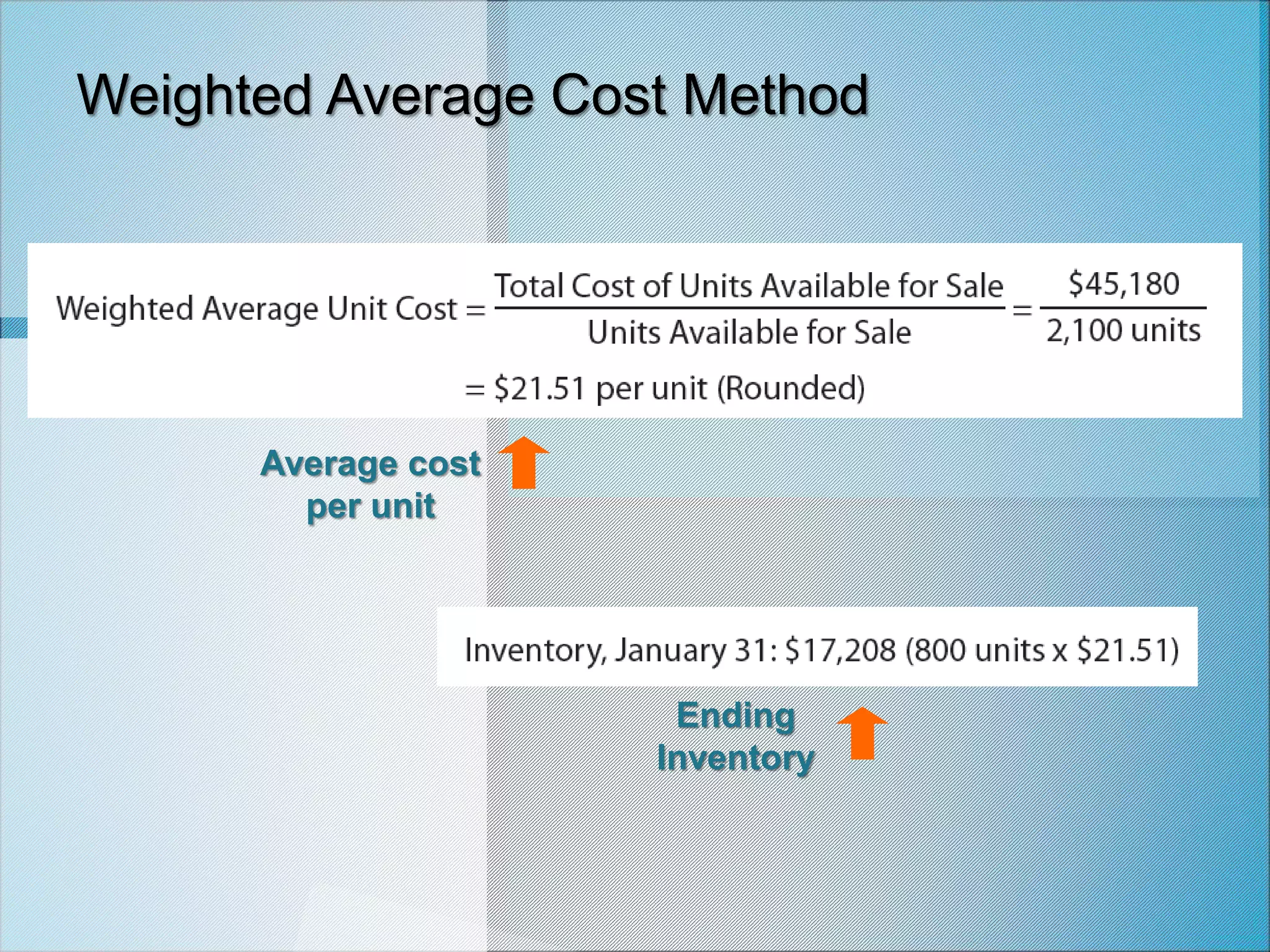

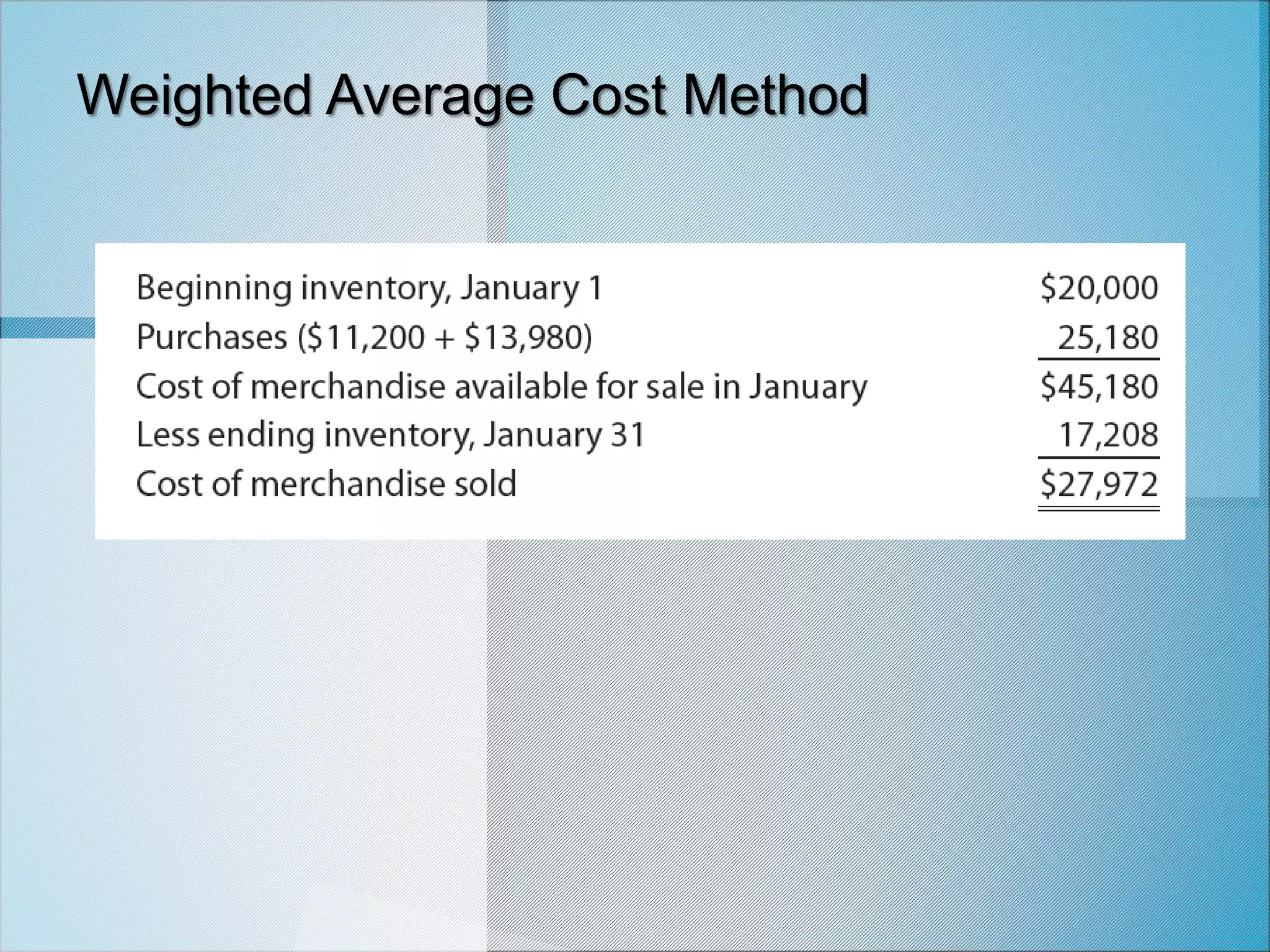

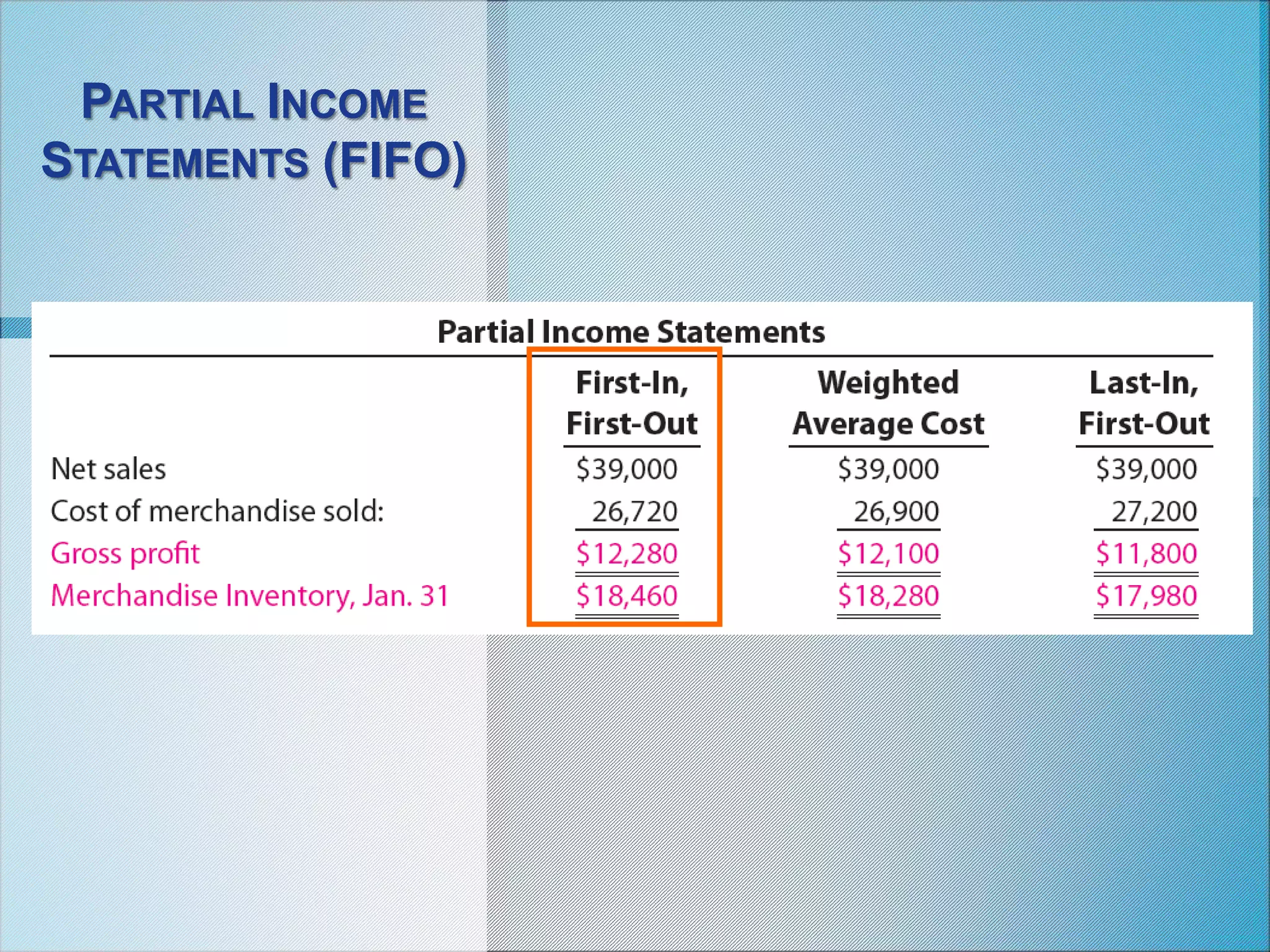

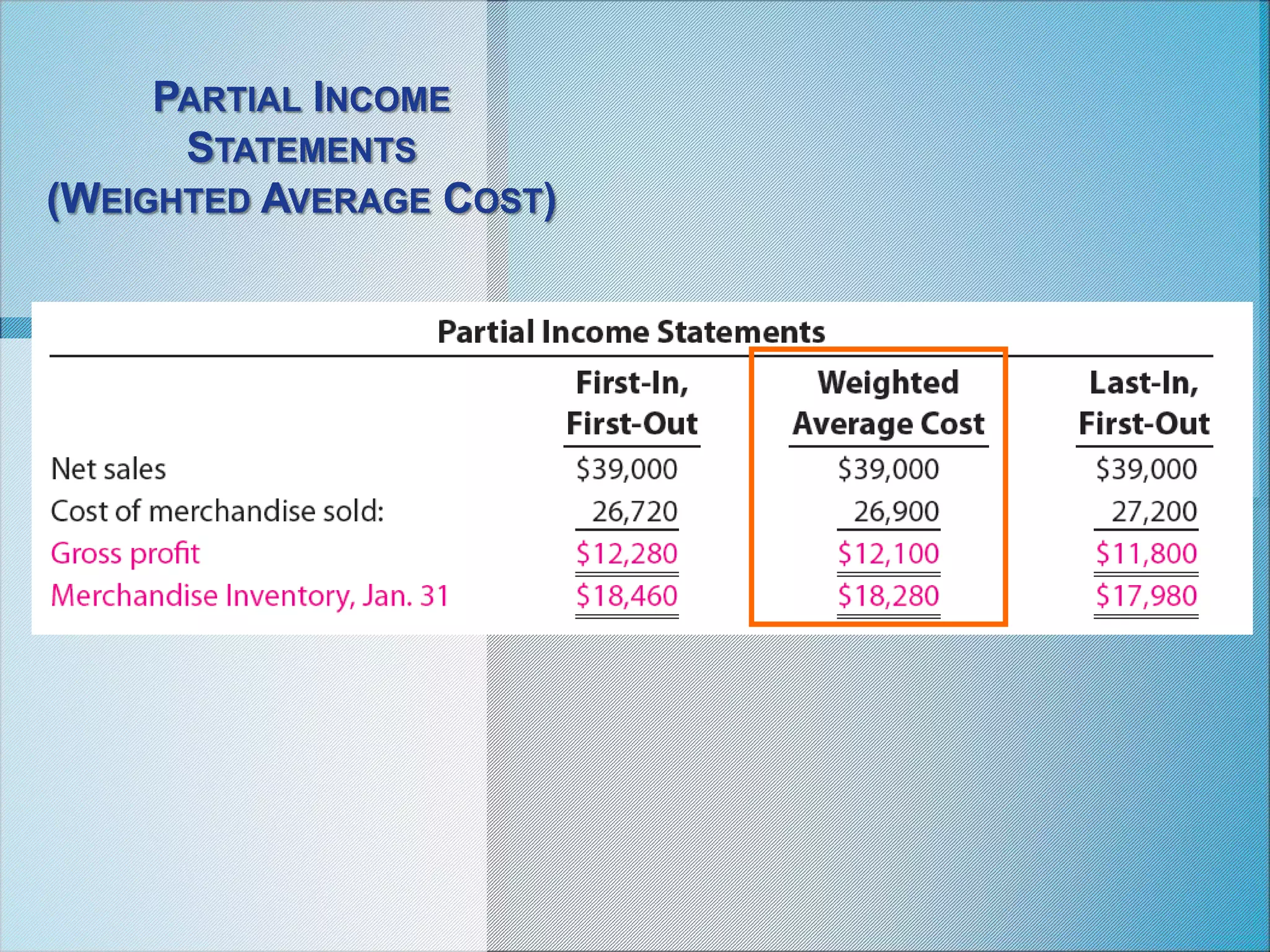

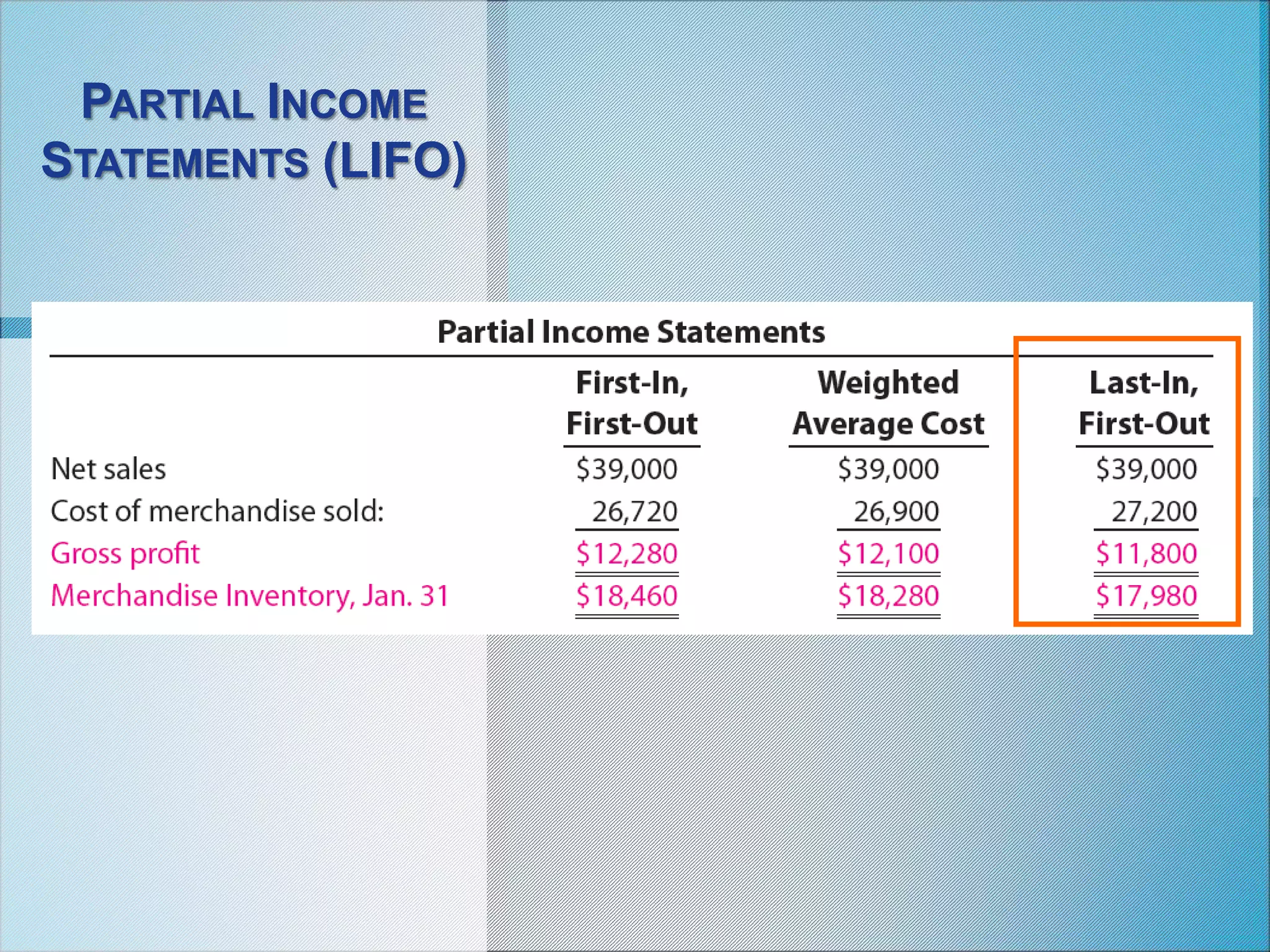

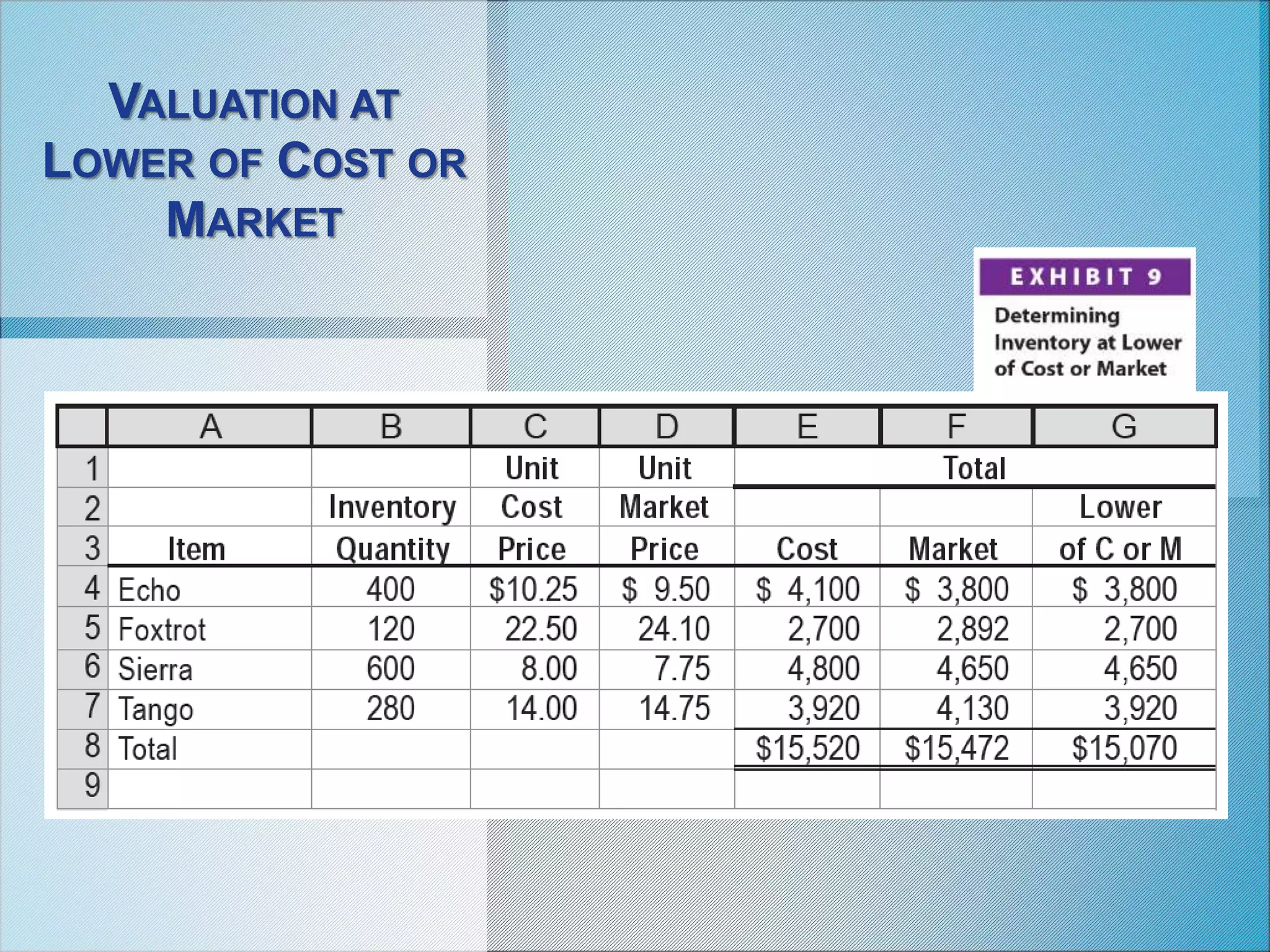

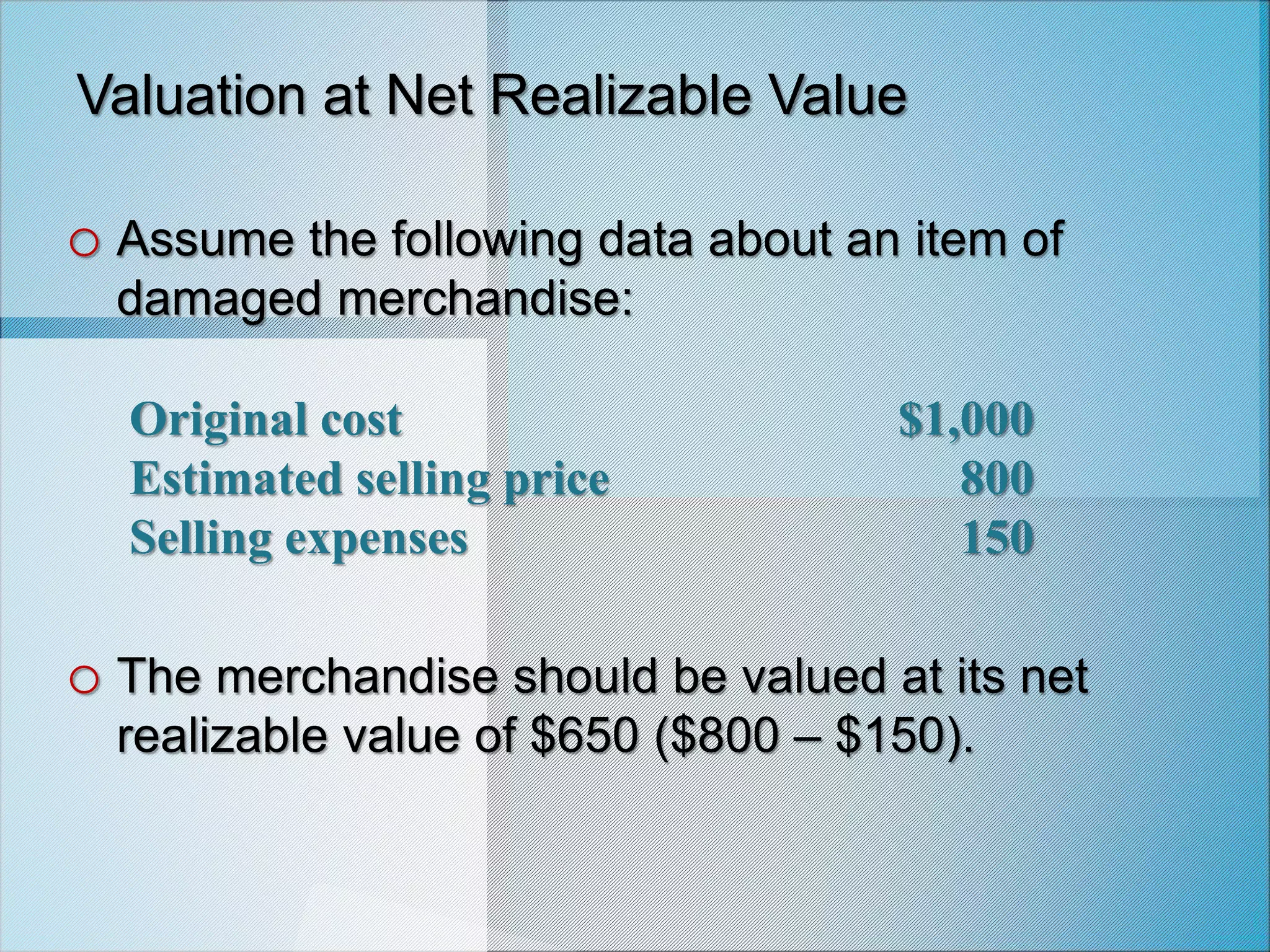

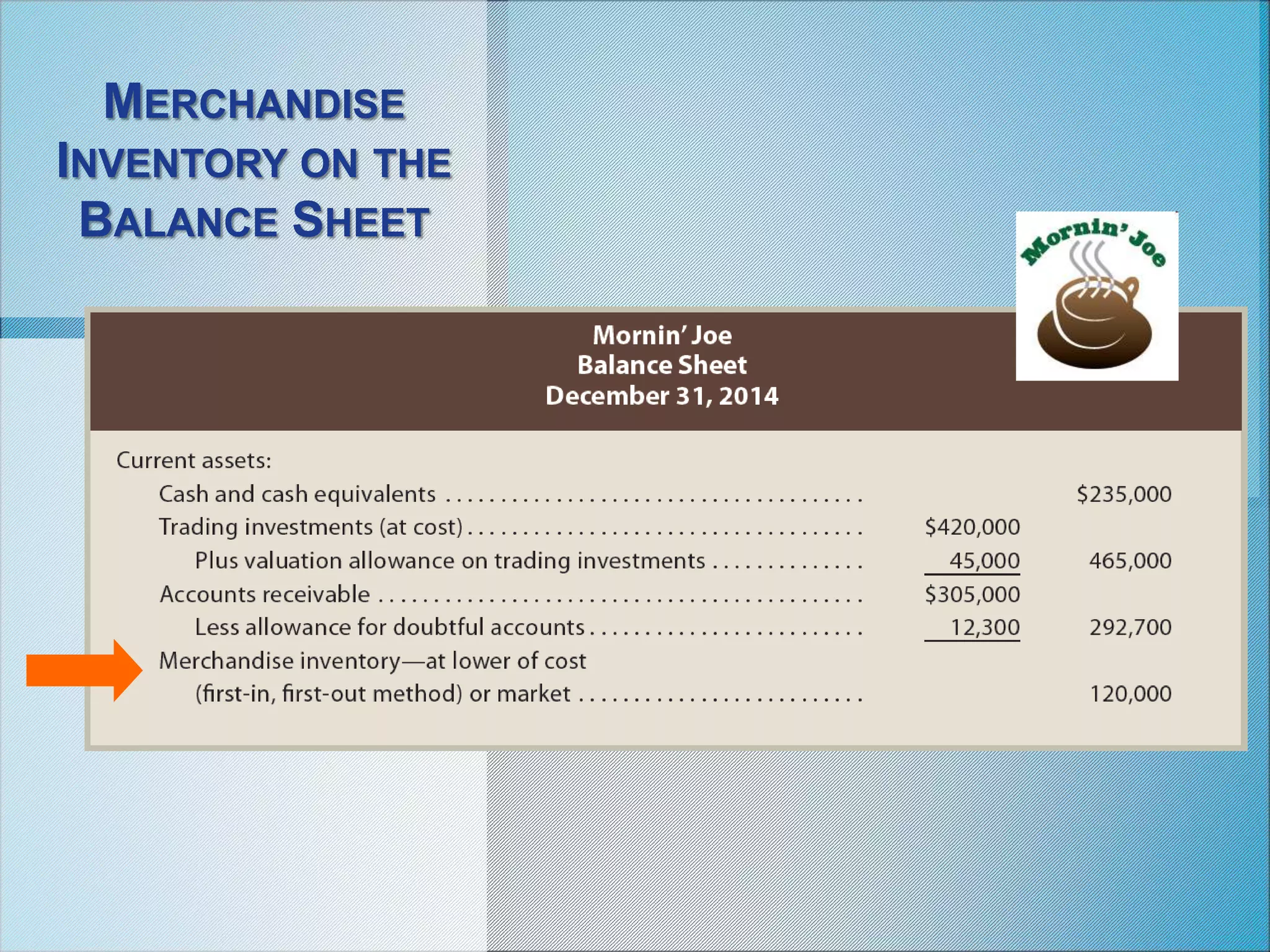

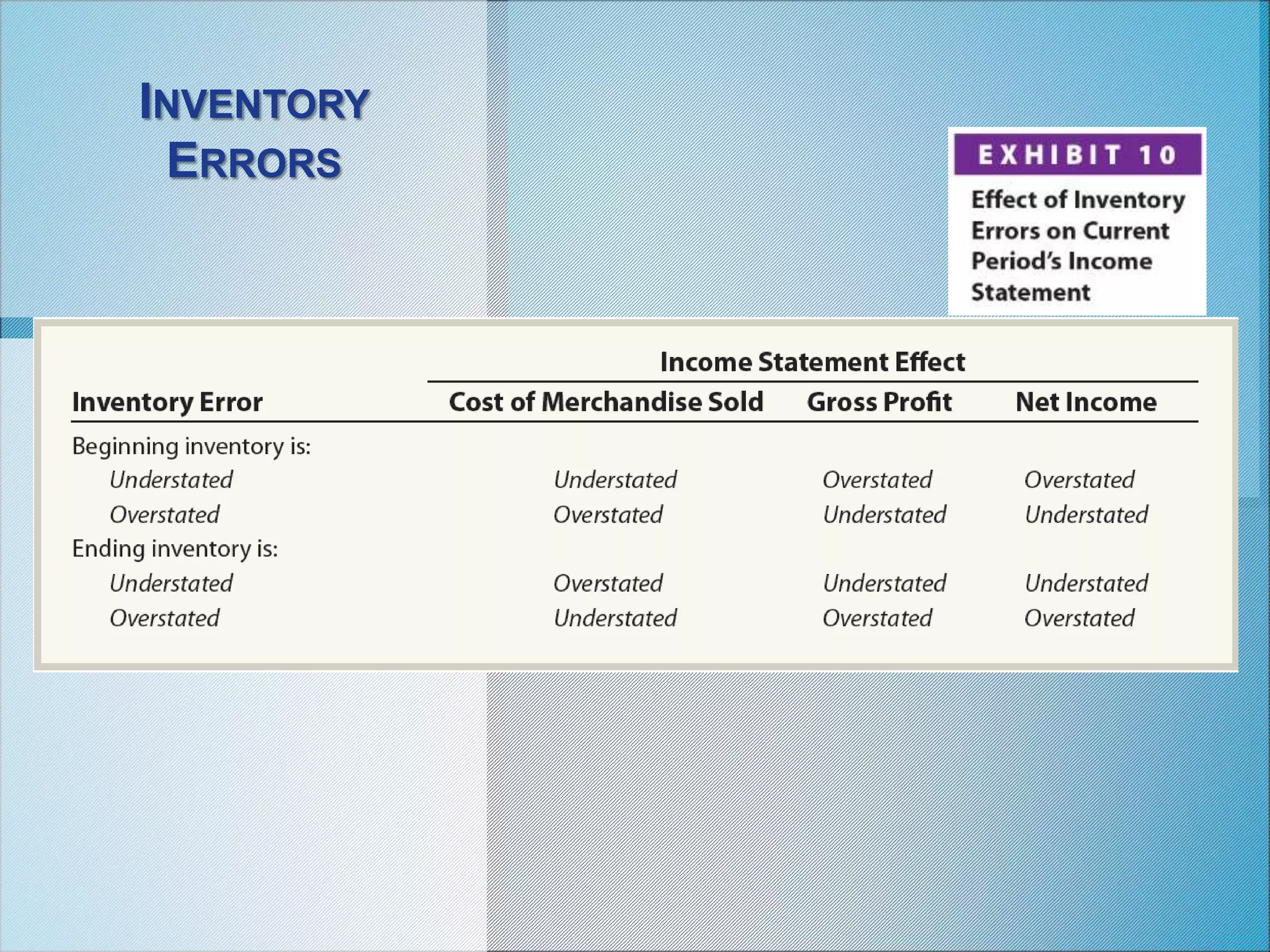

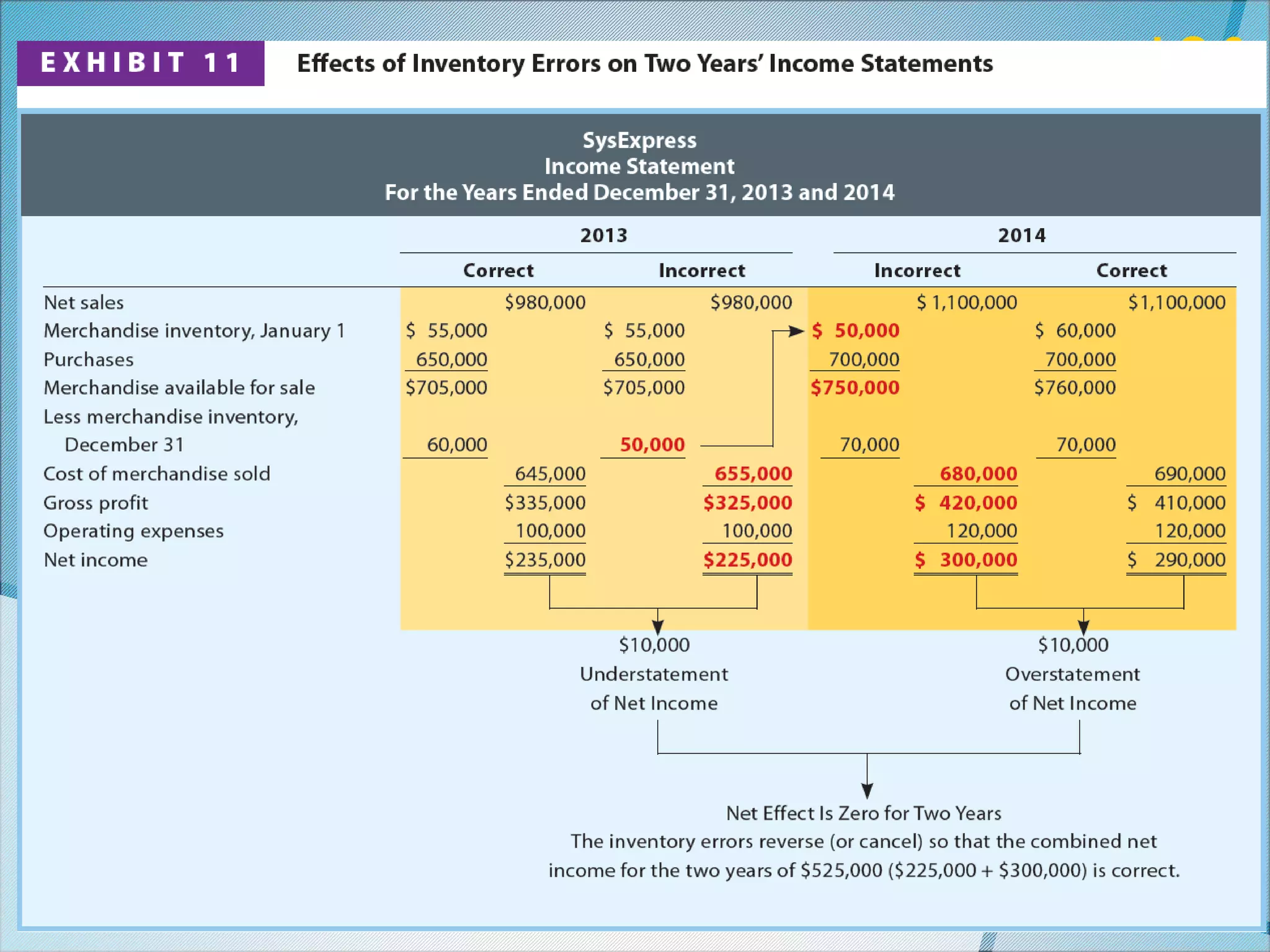

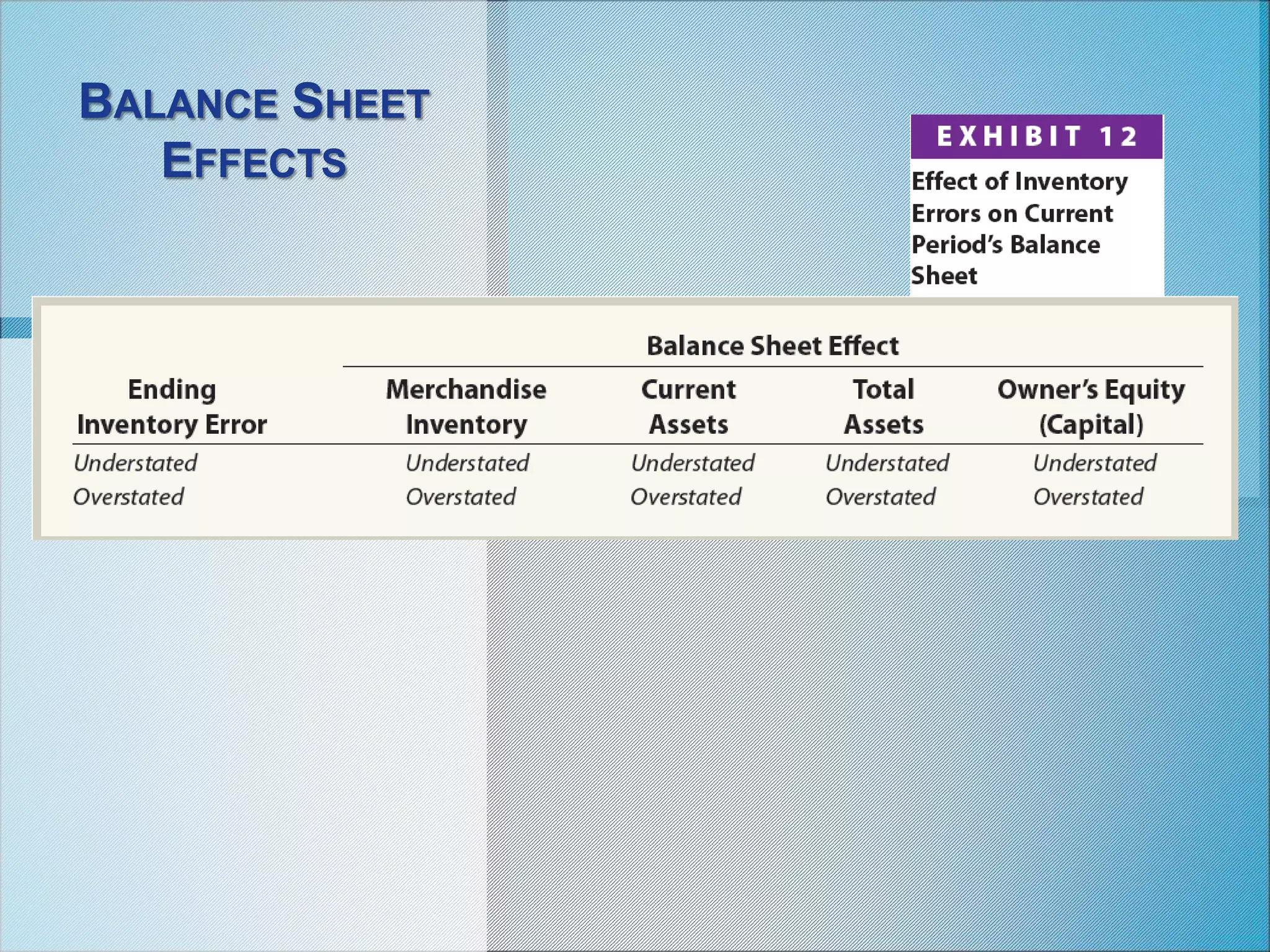

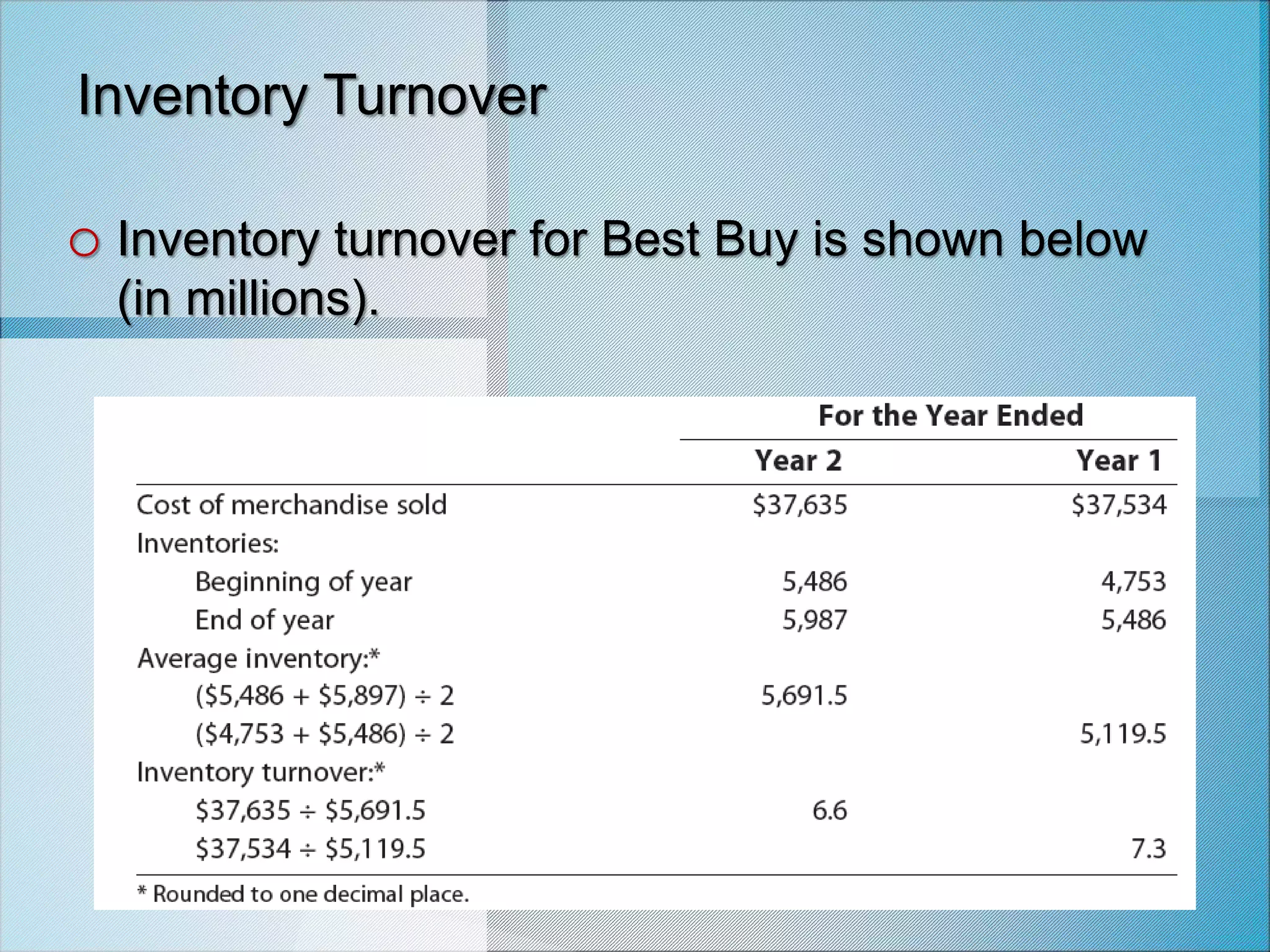

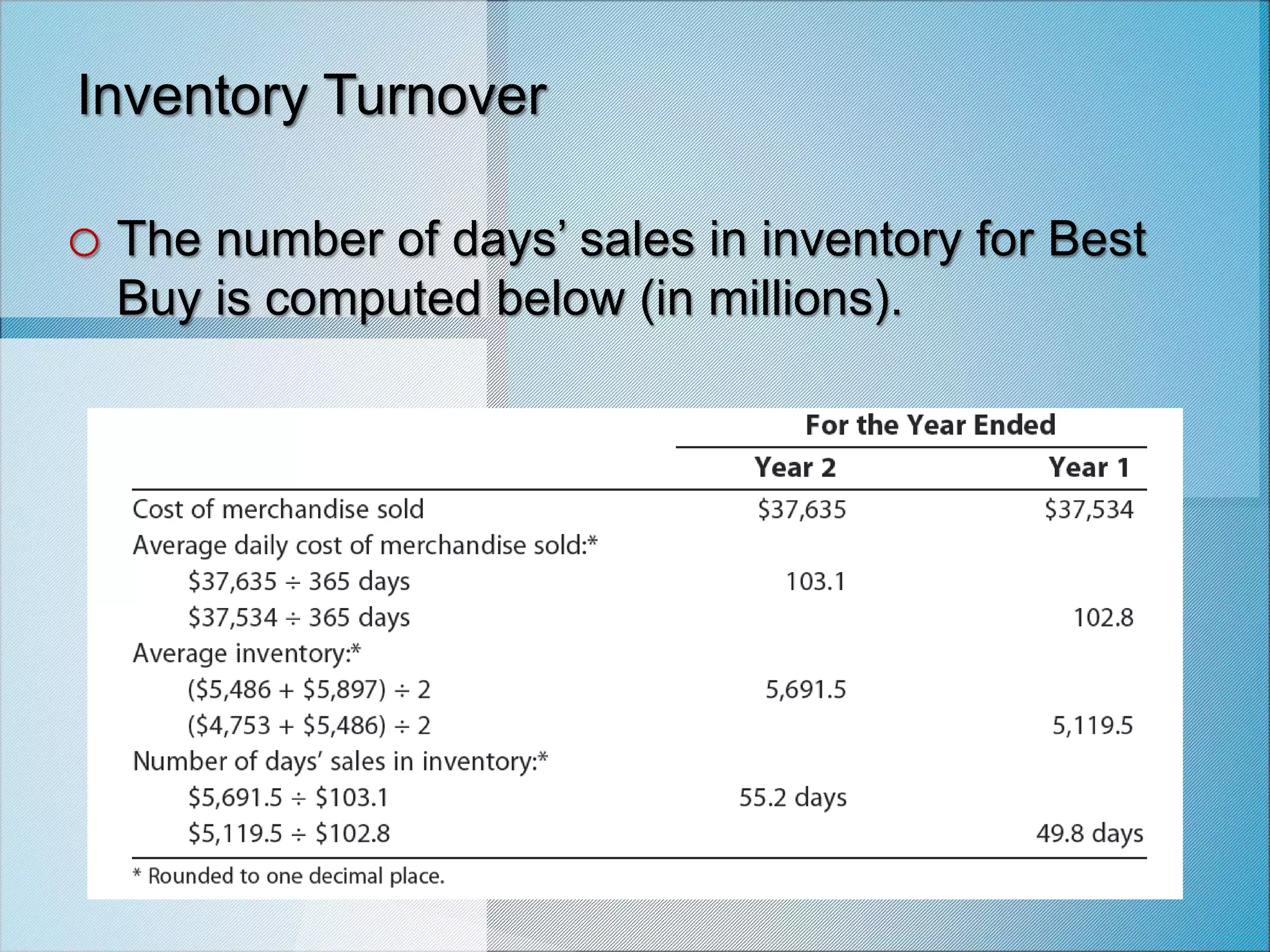

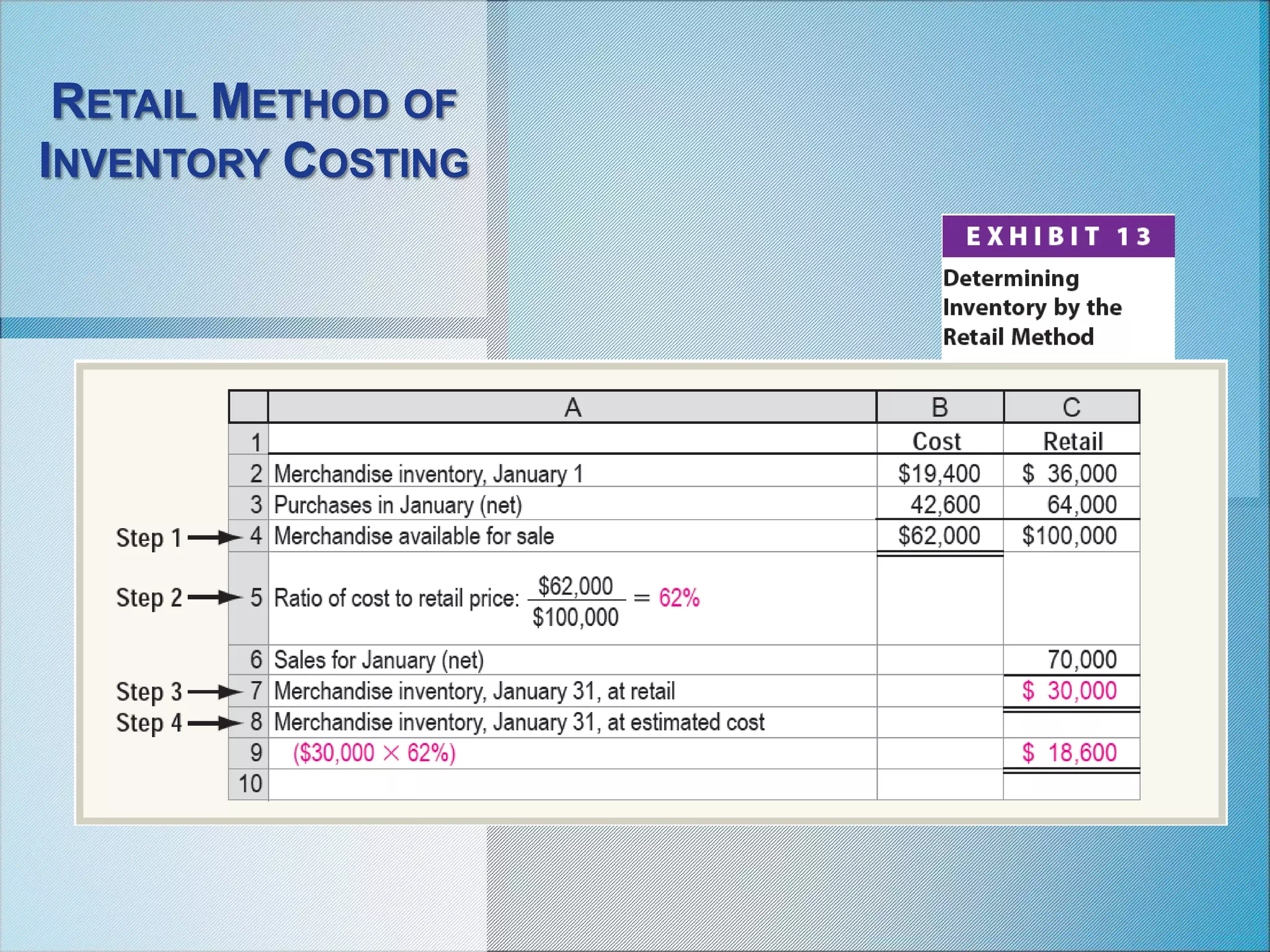

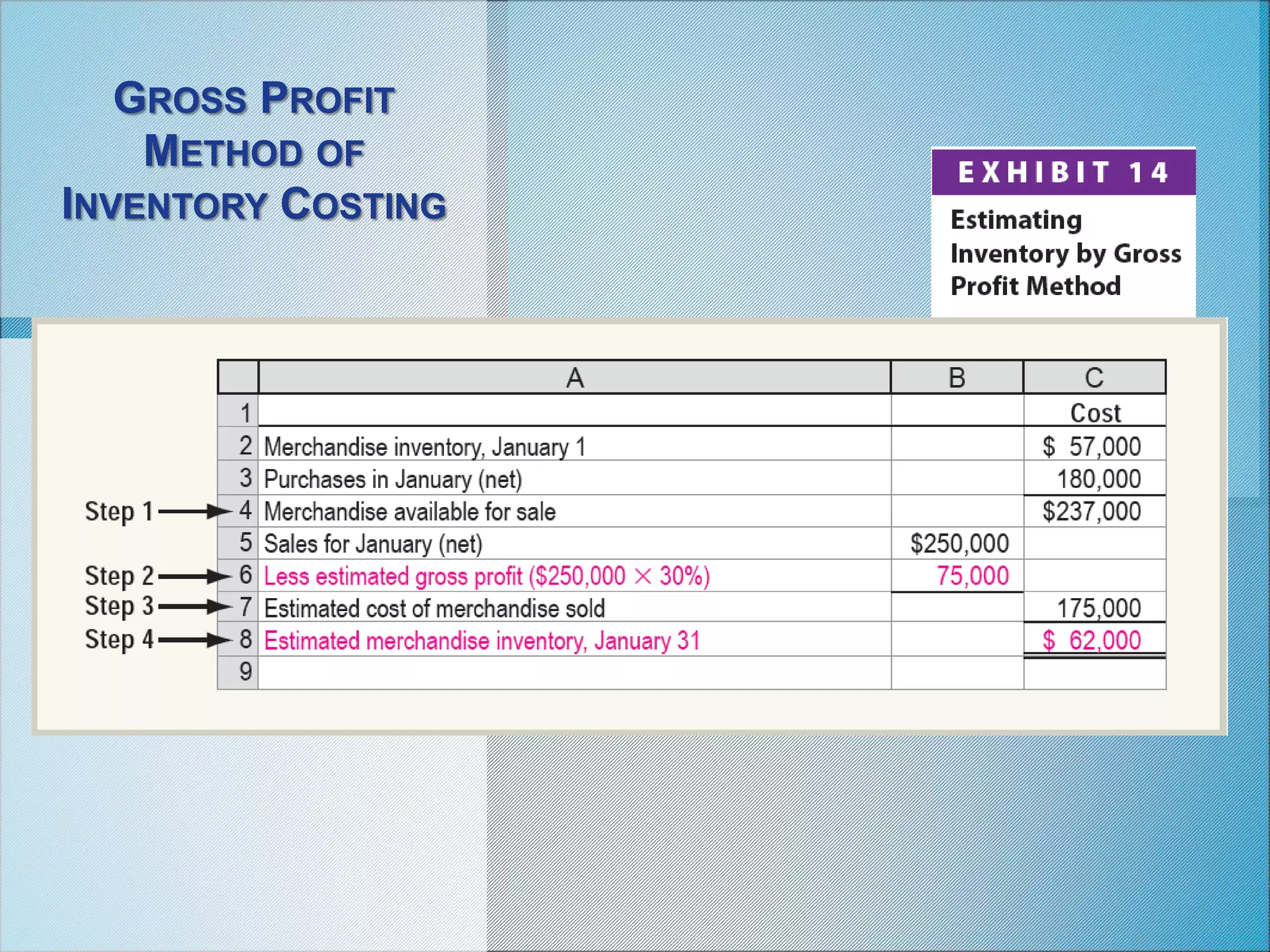

This document discusses inventory costing methods and inventory valuation. It begins by describing the importance of inventory control and three common inventory cost flow assumptions: FIFO, LIFO, and weighted average. It then demonstrates how to calculate inventory costs and valuation under perpetual and periodic inventory systems using the three methods. The document compares the inventory costing methods and their impact on financial statements. It concludes by discussing inventory reporting on the balance sheet and potential causes of inventory errors.