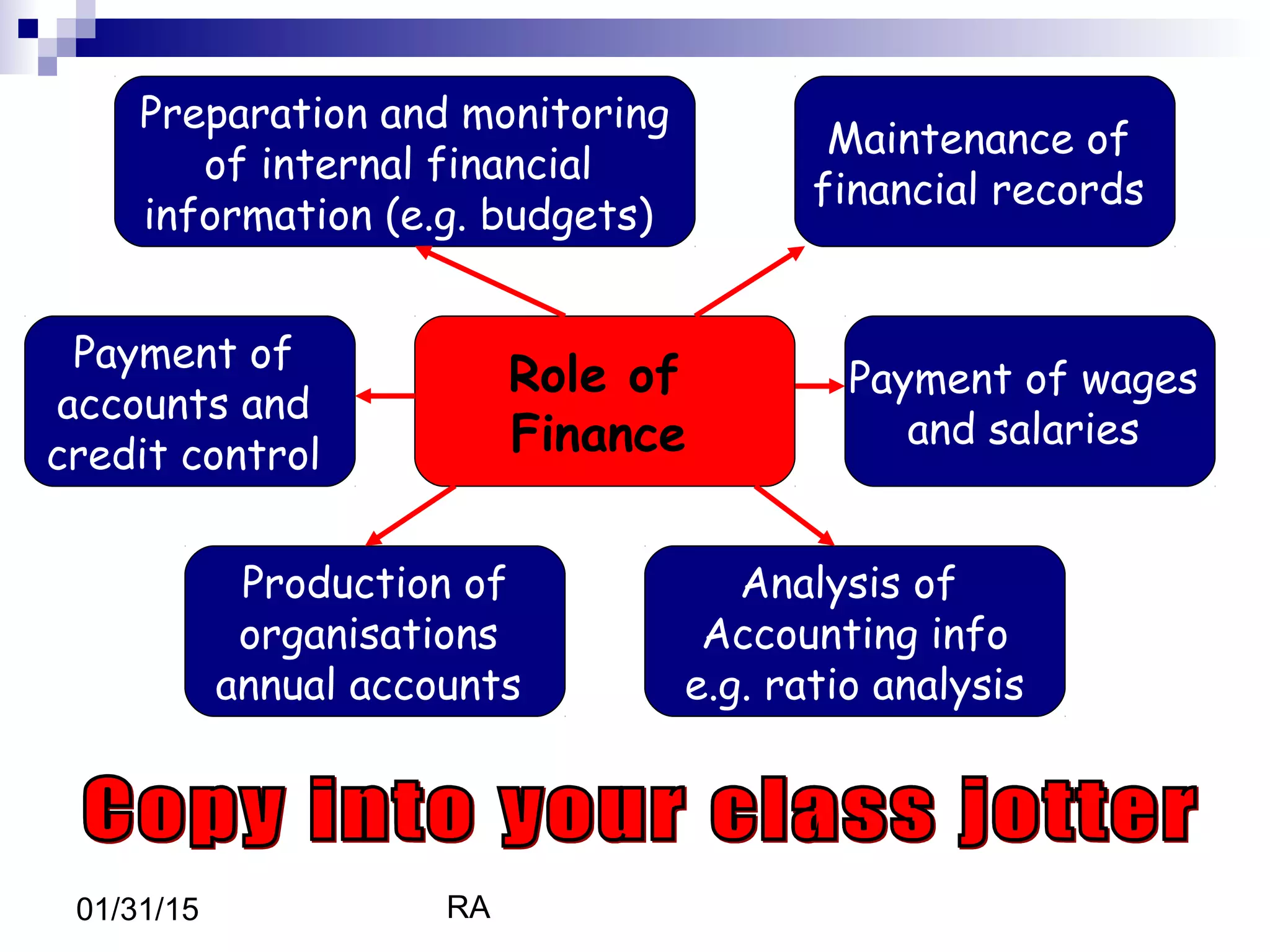

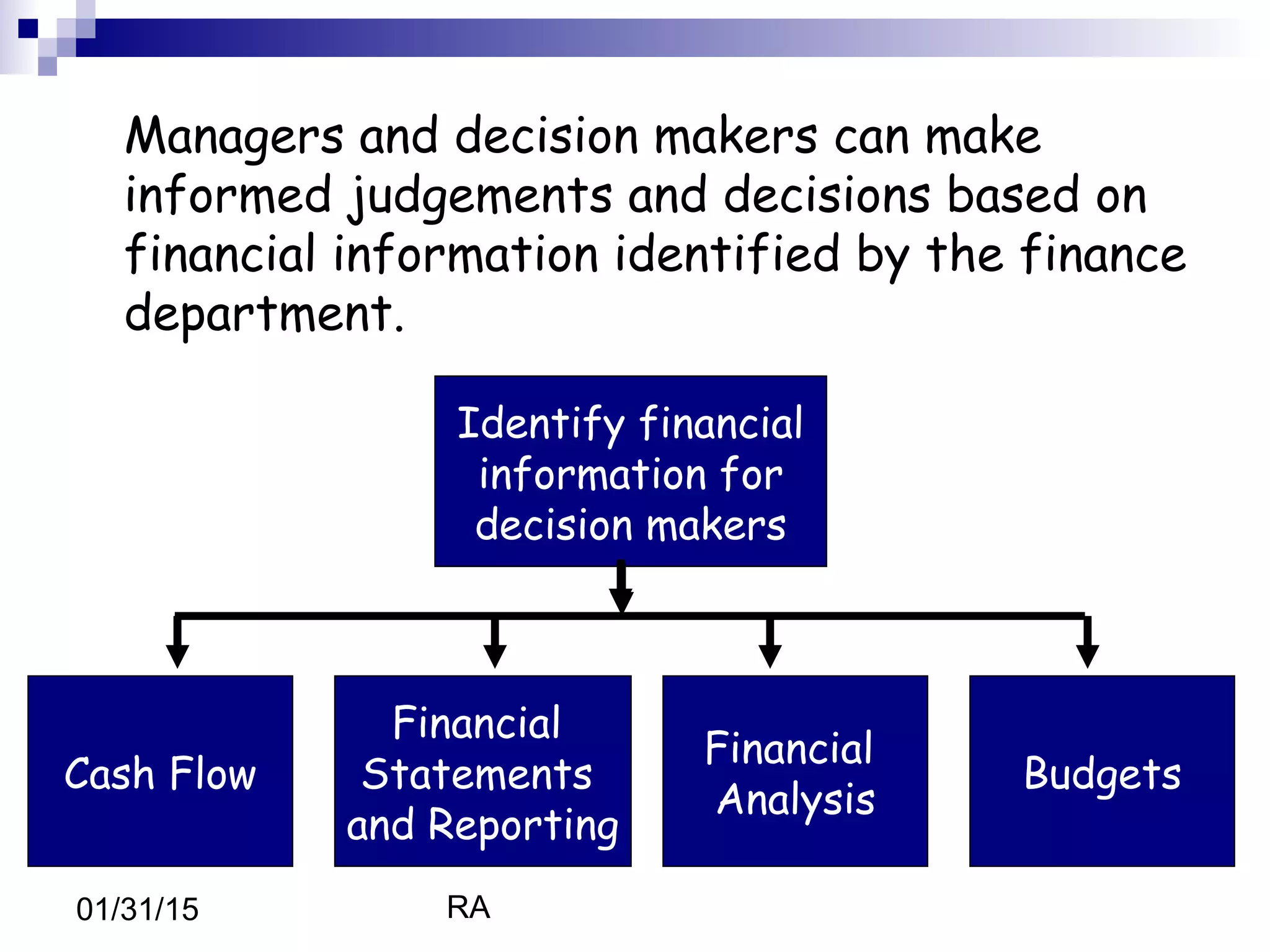

The document discusses the role and importance of financial management. It explains that financial management ensures funds are available to achieve organizational objectives like paying bills, wages, and acquiring resources. It also ensures costs are controlled and adequate cash flow and profitability levels are established. Financial management works closely with other departments and maintains important financial records.