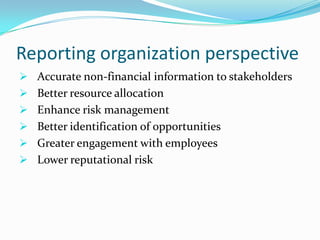

The presentation discusses integrated reporting (IR), which merges financial and non-financial information to communicate business value, emphasizing its importance for various stakeholders. It addresses misconceptions about IR, outlines its objectives, practical steps for implementation, and the benefits for reporting organizations, investors, and regulators. The document also highlights challenges in establishing standards and the need for a shift in reporting practices in India.