This document discusses the importance of managing cash flow and working capital for businesses. It provides guidance on developing cash flow forecasts and budgets. Key points include:

- Cash flow and profit can differ, so cash flow forecasts are essential to evaluate a business's liquidity.

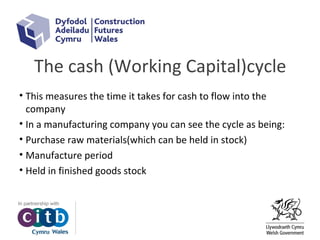

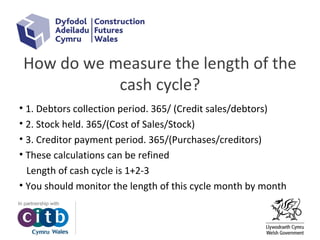

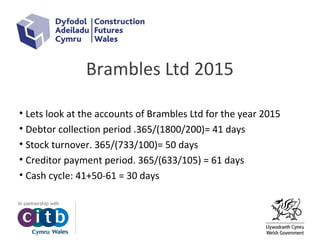

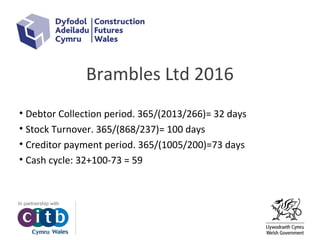

- Working capital management, which involves managing inventory levels, accounts receivable, and accounts payable, is important to ensure sufficient cash flow.

- Cash flow forecasts, along with balance sheets and income statements, allow businesses to anticipate liquidity needs and plan accordingly.

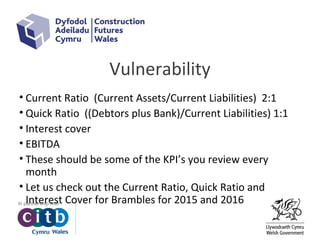

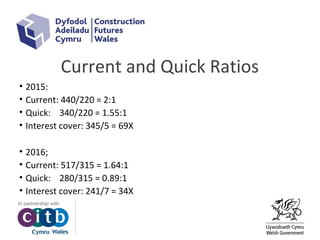

- Metrics like current and quick ratios can help evaluate a business's vulnerability from a cash flow perspective.