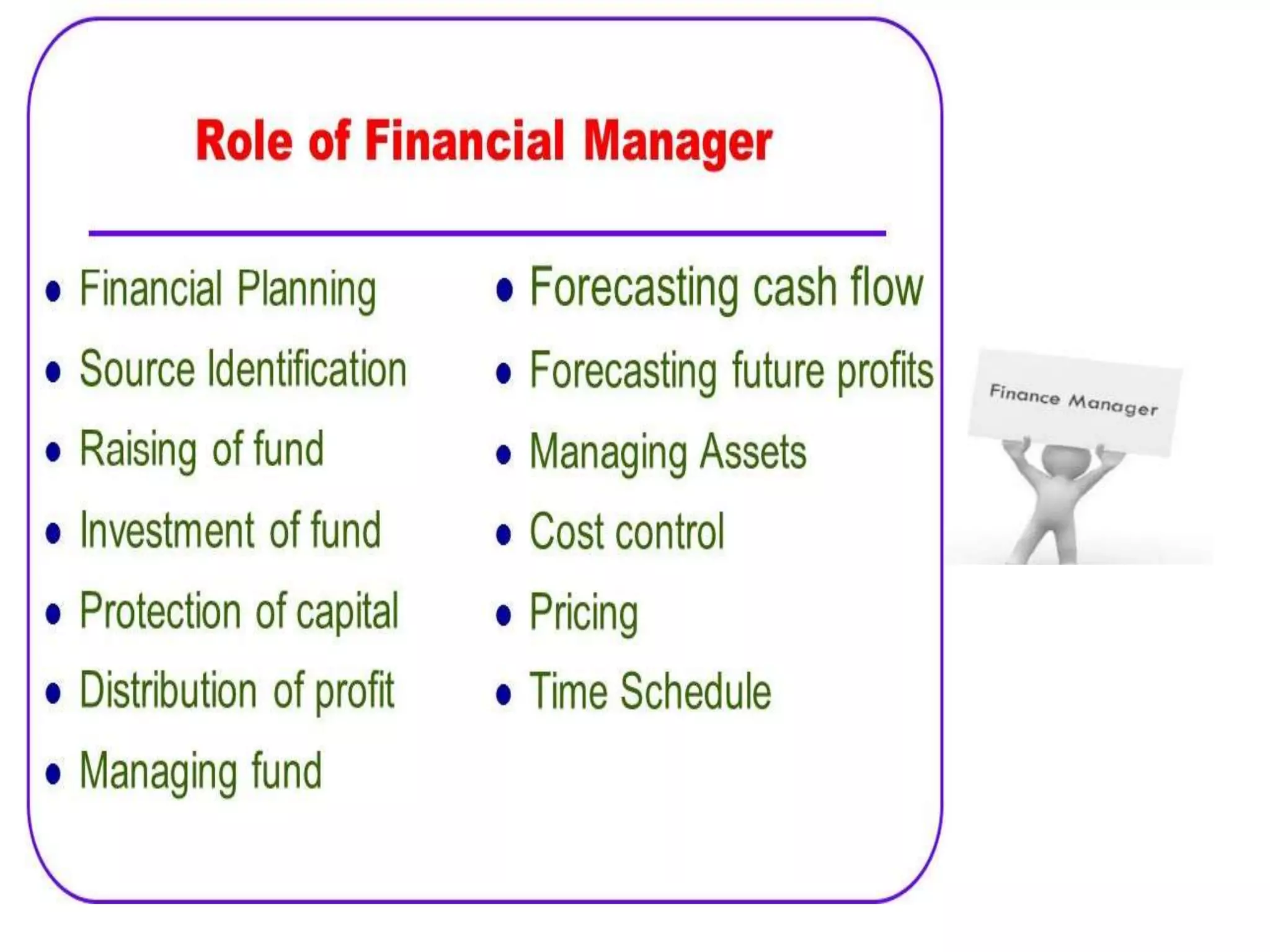

This document provides an overview of finance presented by Ayushi Jain. It defines finance, outlines its key features and scope. It discusses the traditional and modern roles of a finance manager as well as the general organizational structure of the finance function. The document explains the aims of the finance function as anticipating funds needed, acquiring funds, allocating funds efficiently, increasing profitability and maximizing firm value. It highlights the importance of finance for business decision making through an example involving evaluating two investment proposals.