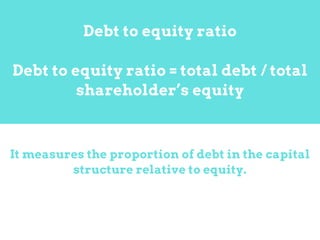

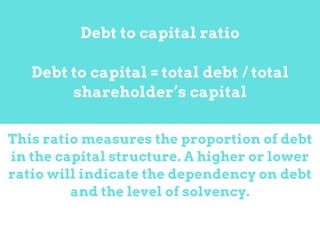

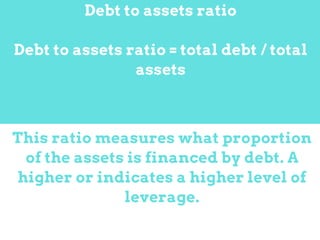

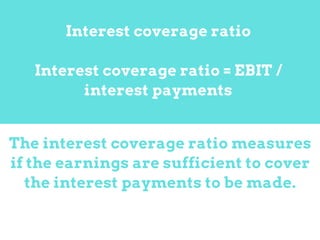

This document discusses solvency ratios, which are financial analysis techniques that measure a firm's ability to meet long-term obligations. It defines several types of solvency ratios, including debt ratios that measure the proportion of debt versus equity or capital in a firm's structure, and coverage ratios that indicate whether a firm's earnings are sufficient to cover interest and fixed payments. The document encourages visiting Aarwin's Guide to CFA for more information on analyzing solvency ratios.