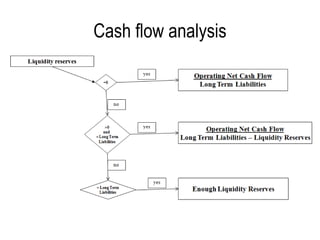

Solvency analysis examines a company's ability to meet its long-term obligations. Key aspects include cash flow analysis using coverage ratios to assess if operating cash flows can cover expenses, debt payments, and taxes. Guarantee analysis compares asset value to liabilities to determine if the company would remain solvent if liquidated. Contingent risks from events like fires or endorsements of other entities must also be considered, as they could impact solvency.