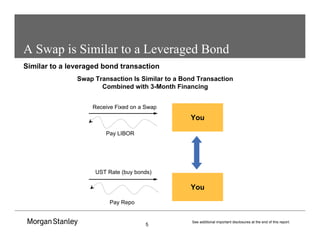

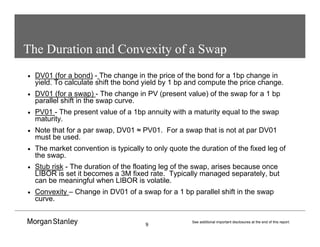

- Interest rate swaps allow parties to exchange interest rate cash flows, with one party paying fixed rates and the other floating rates tied to a reference rate like LIBOR.

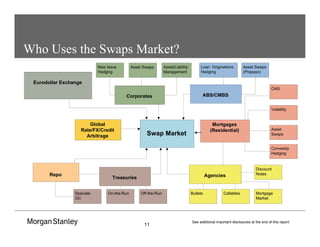

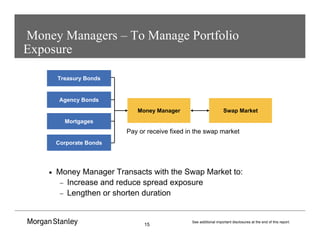

- Corporations, money managers, mortgage holders, and dealers use swaps to hedge interest rate risks and manage portfolio exposures.

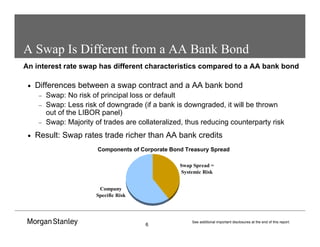

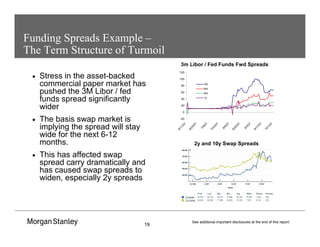

- The swap spread, the difference between Treasury yields and swap fixed rates, is influenced by factors like funding costs and supply/demand dynamics.

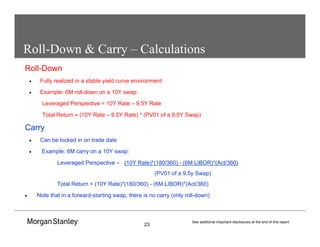

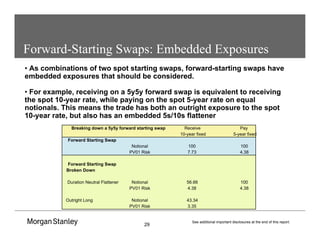

- Forward-starting swaps allow market participants to express views on future interest rate movements over a specific time horizon.

![35

See additional important disclosures at the end of this report.

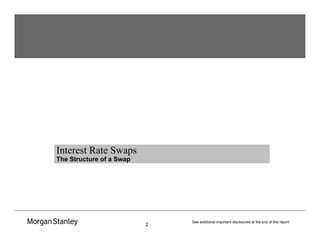

Significance Ratio – Volatility Adjusted Carry

Levels on 3/15/2007

Spot 1s10s -15 bp

1y Fwd 1s10s 35 bp

Rolldown 50 bp

3m Realized Volatility 27.2

Sig Ratio 1.9

Levels on 10/15/2007

Spot 1s10s 35 bp

1y Fwd 1s10s 65 bp

Rolldown 30 bp

3m Realized Volatility 54.2

Sig Ratio 0.5

• Significance Ratio = [Rolldown & Carry] / Volatility

• A metric to find good risk / reward carry trades.](https://image.slidesharecdn.com/49067837-interestrateswaps-ppt-230316160055-f9d1f725/85/InterestRateSwaps-ppt-pdf-35-320.jpg)